Blockchain in Insurance Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

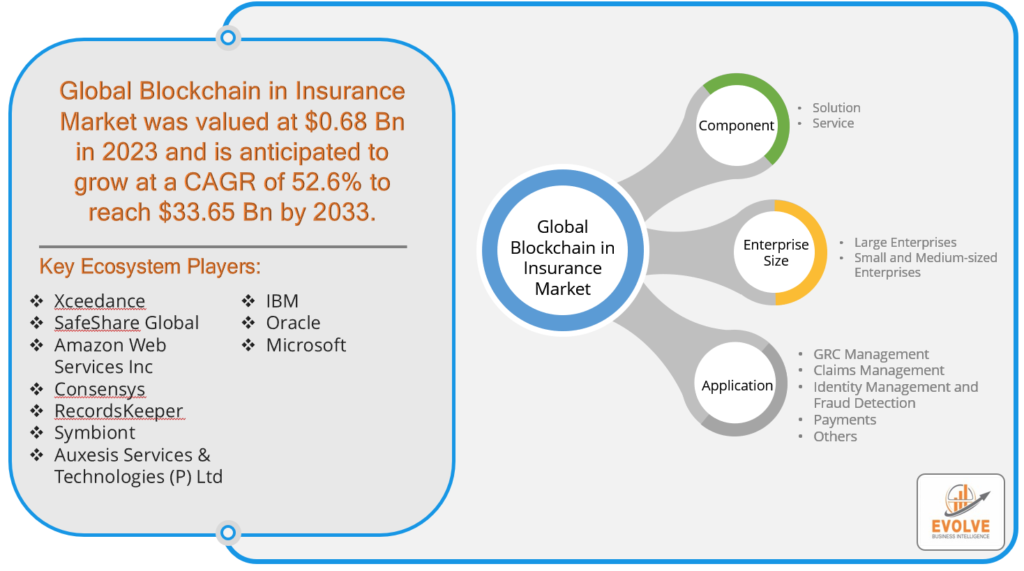

Blockchain in Insurance Market Research Report: By Component (Solution, Service), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises). By Application (GRC Management, Claims Management, Identity Management and Fraud Detection, Payments, Others), and by Region — Forecast till 2033

Blockchain in Insurance Market Overview

The Blockchain in Insurance Market Size is expected to reach USD 33.65 Billion by 2033. The Blockchain in Insurance industry size accounted for USD 0.68 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 52.6% from 2023 to 2033. Blockchain in insurance is the application of blockchain technology to revolutionize the insurance industry by creating a secure, transparent, and efficient ecosystem. Through decentralized ledgers and smart contracts, blockchain streamlines policy management automates claims processing, enhances identity verification, and facilitates data sharing among stakeholders. It also improves risk assessment, aids in fraud prevention, and simplifies reinsurance processes, ultimately increasing trust, reducing costs, and enhancing the overall customer experience in the insurance sector.

Global Blockchain in Insurance Market Synopsis

The COVID-19 pandemic unexpectedly bolstered the Blockchain in Insurance market as it underscored the need for greater efficiency, transparency, and trust within the insurance industry. The crisis prompted insurers to reevaluate their operations and embrace blockchain’s capabilities to streamline processes such as claims handling and policy management, which became even more critical in a remote work environment. Blockchain’s immutable ledger and smart contract functionalities proved valuable in automating and securing various insurance processes, while also improving fraud detection and risk assessment. Consequently, the pandemic accelerated the adoption of blockchain technology in insurance, driving innovation and resilience in the face of unprecedented challenges.

Global Blockchain in Insurance Market Dynamics

The major factors that have impacted the growth of Blockchain in Insurance are as follows:

Drivers:

⮚ Enhanced Efficiency and Reduced Costs

One of the key drivers for the adoption of blockchain in the insurance market is the potential for enhanced efficiency and cost reduction. Blockchain’s ability to automate and streamline processes such as claims processing, policy management, and data sharing can significantly reduce administrative overhead, minimize errors, and eliminate intermediaries. This efficiency gain can lead to cost savings for insurers and, in turn, offer customers more competitive premiums.

Restraint:

- Regulatory Challenges and Compliance

A major restraint in the blockchain insurance market is the complex regulatory landscape that insurers must navigate. The adoption of blockchain technology involves compliance with various regulations related to data privacy, smart contracts, and financial services. Ensuring that blockchain solutions align with these regulations and obtaining the necessary approvals can be a time-consuming and costly process. Additionally, evolving regulatory frameworks can create uncertainty, making it challenging for insurers to integrate blockchain into their operations.

Opportunity:

⮚ Improved Transparency and Trust

An opportunity presented by blockchain in insurance is the potential to enhance transparency and trust within the industry. Blockchain’s immutable ledger ensures that all transactions and data are securely recorded and can be audited, reducing the risk of fraud and increasing transparency for both insurers and policyholders. This improved trust can help insurers attract more customers and foster stronger relationships with existing ones, ultimately leading to business growth and customer loyalty.

Blockchain in Insurance Market Segment Overview

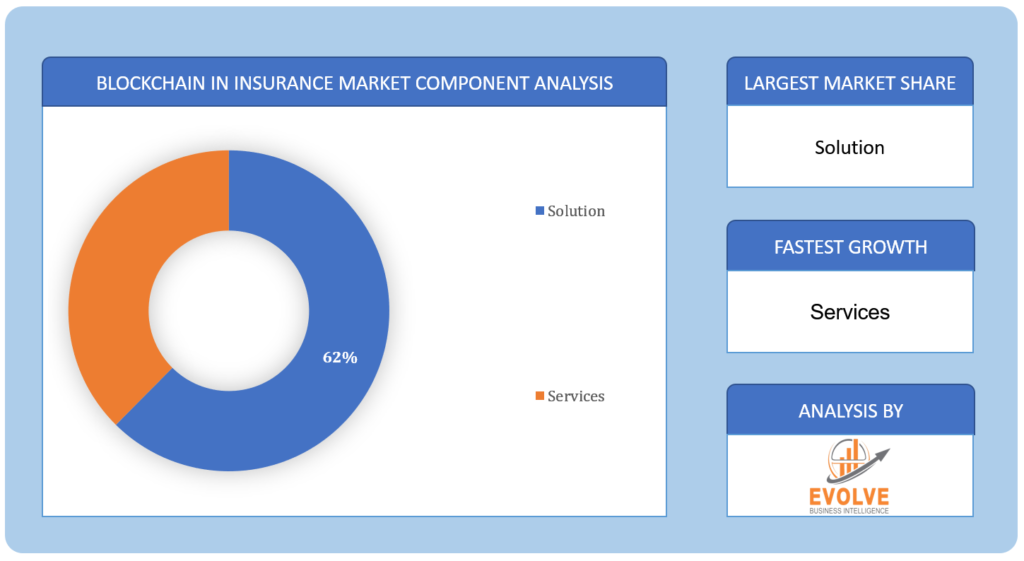

By Component

Based on the Component, the market is segmented based on Solutions and services. The Solution segment was projected to hold the largest market share in the Blockchain in Insurance market due to the increasing adoption of blockchain-based insurance solutions for policy management, claims processing, and fraud prevention.

Based on the Component, the market is segmented based on Solutions and services. The Solution segment was projected to hold the largest market share in the Blockchain in Insurance market due to the increasing adoption of blockchain-based insurance solutions for policy management, claims processing, and fraud prevention.

By Enterprise Size

Based on the Enterprise Size, the market has been divided into Large Enterprises, Small and Medium-sized Enterprises. The Solution segment was projected to hold the largest market share in the Blockchain in Insurance market due to the increasing adoption of blockchain-based insurance solutions for policy management, claims processing, and fraud prevention.

By Application

Based on Application, the market has been divided into GRC Management, Claims Management, Identity Management and Fraud Detection, Payments, and Others. The Large Enterprises segment is expected to hold the largest market share in the Blockchain in Insurance market due to their greater resources and capacity to invest in and implement blockchain solutions for complex insurance processes and operations.

Global Blockchain in Insurance Market Regional Analysis

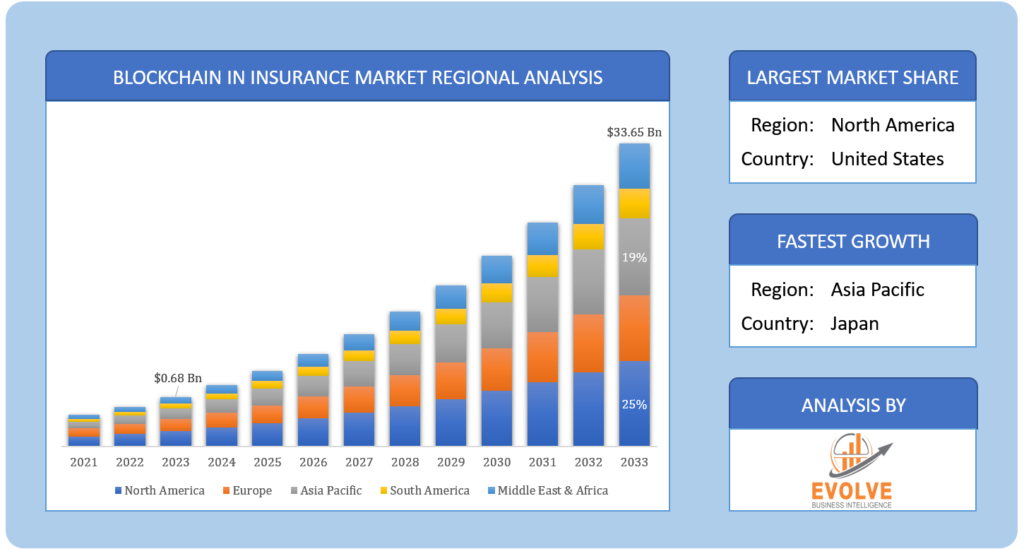

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Blockchain in Insurance, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America stands at the forefront of the Blockchain in Insurance market, driven by a combination of factors such as a robust insurance industry, advanced technological infrastructure, and a strong focus on innovation. The region has witnessed significant adoption of blockchain in insurance, with insurance companies leveraging the technology to streamline operations, enhance customer experiences, and improve risk management. Additionally, regulatory bodies in North America have shown a willingness to engage with blockchain-related developments, providing a favorable environment for growth. The presence of several key blockchain solution providers and a tech-savvy customer base further cements North America’s leading position in the blockchain-powered insurance landscape, with the region poised for continued growth and innovation in this space.

Asia Pacific Market

The Asia-Pacific region is experiencing remarkable growth in the Blockchain in Insurance market, driven by several factors. Rapid economic development, a burgeoning middle class, and increasing awareness of insurance products have created a fertile ground for innovation in the insurance sector. In response to this, insurers across the region are embracing blockchain technology to streamline traditionally complex insurance processes, reduce fraud, and enhance customer trust. Additionally, government initiatives in countries like China and India to promote blockchain adoption and digital transformation are further accelerating the technology’s penetration in the insurance sector. With a large and digitally native population, the Asia-Pacific region is poised for continued expansion and transformation in the blockchain-powered insurance market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Xceedance, SafeShare Global, Amazon Web Services, Inc., Consensys, and RecordsKeeper are some of the leading players in the global Blockchain in Insurance Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Xceedance

- SafeShare Global

- Amazon Web Services Inc

- Consensys

- RecordsKeeper

- Symbiont

- Auxesis Services & Technologies (P) Ltd

- IBM

- Oracle

- Microsoft

Key development:

March 2023, Xceedance announced a Series A equity investment in Vitraya Technologies, an India-based technology platform that enables automated claims decision-making for insurers and real-time payouts to providers. Xceedance, together with a consortium of investors, invested a total of $4.1 million into Vitraya at this stage.

Scope of the Report

Global Blockchain in Insurance Market, by Component

- Solution

- Services

Global Blockchain in Insurance Market, by Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

Global Blockchain in Insurance Market, by Application

- GRC Management

- Claims Management

- Identity Management and Fraud Detection

- Payments

- Others

Global Blockchain in Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $33.65 Billion |

| CAGR | 52.6% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Enterprise Size, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Xceedance, SafeShare Global, Amazon Web Services, Inc, Consensys, RecordsKeeper, Symbiont, Auxesis Services & Technologies (P) Ltd, IBM, Oracle, Microsoft |

| Key Market Opportunities | • Enhanced Transparency and Trust |

| Key Market Drivers | • Efficiency and Cost Reduction |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Blockchain in Insurance Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Blockchain in Insurance market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Blockchain in Insurance market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Blockchain in Insurance Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Blockchain in Insurance market is 2022- 2033

What is the 10-year CAGR (2023 to 2033) of the global Blockchain in Insurance market?

The global Blockchain in Insurance market is growing at a CAGR of ~6% over the next 10 years

Which region has the highest growth rate in the market of Blockchain in Insurance?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Blockchain in Insurance?

North America holds the largest share in 2022

Major Key Players in the Market of Blockchain in Insurance Manufacturers?

Xceedance, SafeShare Global, Amazon Web Services, Inc, Consensys, RecordsKeeper, Symbiont, Auxesis Services & Technologies (P) Ltd, IBM, Oracle, Microsoft.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Segement – Market Opportunity Score 4.1.2. Enterprise Size Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Blockchain in Insurance Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Blockchain in Insurance Market, By Component 7.1. Introduction 7.1.1. Solution 7.1.2. Services CHAPTER 8. Global Blockchain in Insurance Market, By Enterprise Size 8.1. Introduction 8.1.1. Large Enterprises 8.1.2. Small and Medium-sized Enterprises CHAPTER 9. Global Blockchain in Insurance Market, By Application 9.1. Introduction 9.1.1. GRC Management 9.1.2. Claims Management 9.1.3. Identity Management and Fraud Detection 9.1.4. Payments 9.1.5. Others CHAPTER 10. Global Blockchain in Insurance Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Xceedance 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. SafeShare Global 13.3. Amazon Web Services 13.4. Consensys 13.5. RecordsKeeper 13.6. Symbiont 13.7. Auxesis Services & Technologies (P) Ltd 13.8. IBM Corporation 13.9. Oracle 13.10. Microsoft

Connect to Analyst

Research Methodology