Biopolymers & Bioplastics market Analysis and Global Forecast 2021-2028

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

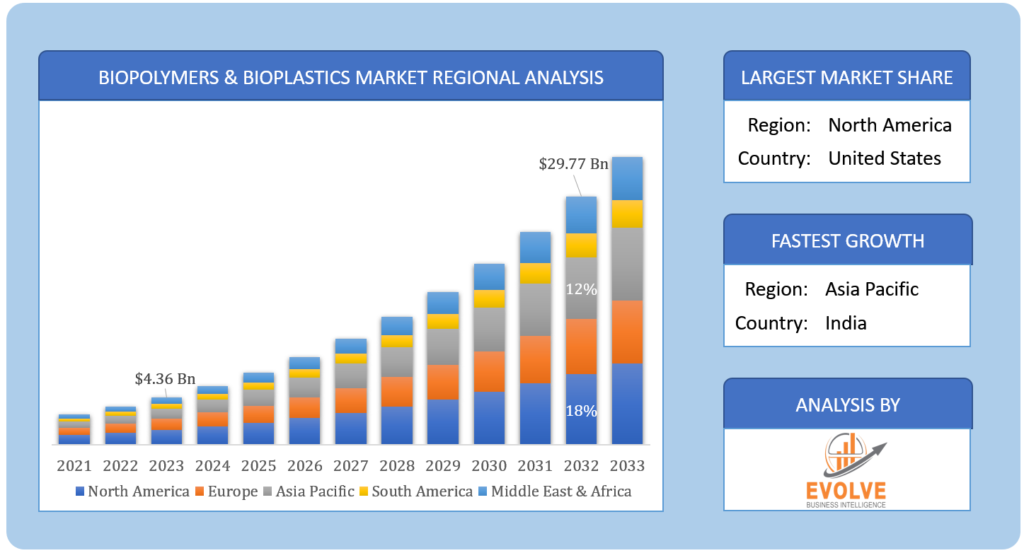

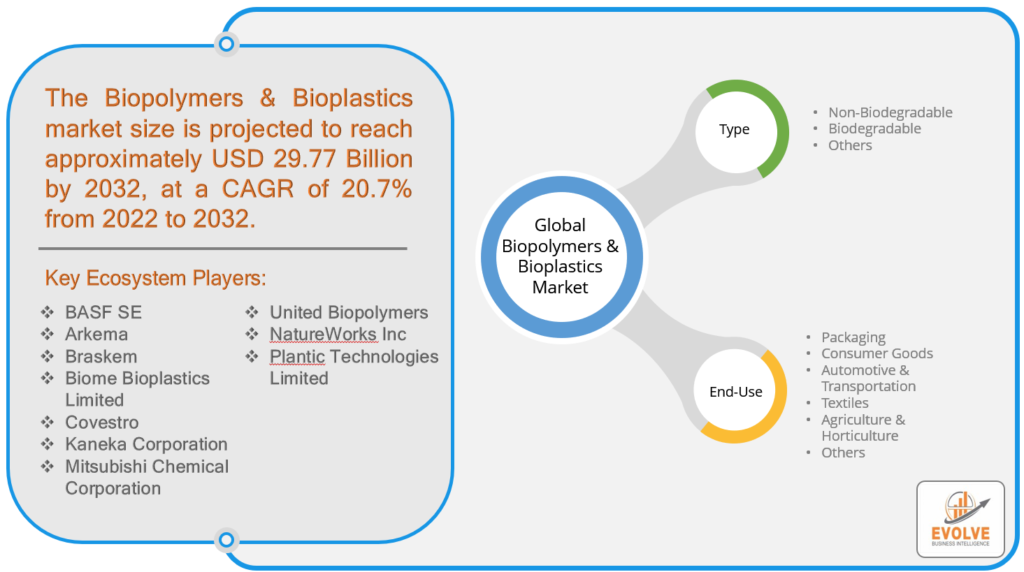

Report Published on: October 19, 2024The global Biopolymers & Bioplastics market size is projected to reach approximately USD 29.77 Billion by 2032, at a CAGR of 20.7% from 2022 to 2032. Plastic may be molded and created from chemical compounds produced by or derived from microorganisms, such as bacteria or genetically altered plants. Thermoplastics derived from bio-based substances including sugar, starch, and seaweed are known as bioplastics. Biopolymers and bioplastics are widely used in the packaging sector. As a result, bio-based raw materials including starch and vegetable crop waste byproducts are employed to adhere to strict governmental environmental standards. So, compared to typical plastic product manufacturing businesses, product quality is inferior in this sector. Food items may be kept for extended periods without refrigeration and yet retain their chemical qualities when stored in bio-plastics.

COVID-18 Impact Analysis

The COVID-19 pandemic had resulted in strict border controls, and a temporary lockdown, forcing big businesses, governments, and the plastics industry to replenish supply chains. The COVID-19 pandemic is having a significant impact on the social and financial sectors across the world, and all major businesses are suffering difficulties. The coronavirus pandemic has had an uneven effect on the bio-based industry. While some businesses are helping with technical solutions to stop the epidemic, others seem to be witnessing an increase in demand for biodegradable takeout containers.

Biopolymers & Bioplastics market Dynamics

The market for bioplastics and biopolymers is primarily driven by increasing consumer demand for plastic convenience and quality food products, rising urban population, which increases food adoption, rising processed or stored food and packaged food consumption for consumers, growing disposable income of eatable food, and multifunctionality of packaging.

The market for bioplastics and biopolymers is primarily driven by increasing consumer demand for plastic convenience and quality food products, rising urban population, which increases food adoption, rising processed or stored food and packaged food consumption for consumers, growing disposable income of eatable food, and multifunctionality of packaging.

Drivers:

⮚ Growing consumer demand for plastic convenience products

The increasing consumer demand for plastic convenience products is the primary driver of market growth. The advantages of biopolymers and bioplastics over traditional plastics, such as their renewable nature and biodegradability, are also expected to contribute to market growth. In addition, the growing awareness of the environmental impacts of traditional plastics is expected to drive consumer preference for biopolymers and bioplastics.

Restraint:

- The high cost of bioplastics in comparison to traditional plastic

Bioplastics are made from renewable resources, such as corn starch, and are therefore more environmentally friendly than traditional plastics, which are made from fossil fuels. However, bioplastics are generally more expensive than traditional plastics, which hinders the growth of the bioplastics market.

Opportunity:

⮚ The introduction of new bioplastics and biopolymers product developments

The introduction of new bioplastics and biopolymers product developments creates a prodigious opportunity to market. With the help of new technology, these product developments can be used in many industries and sectors. They are not only eco-friendly but also have the potential to replace traditional plastics and polymers. This can help in reducing the overall environmental impact of the manufacturing process.

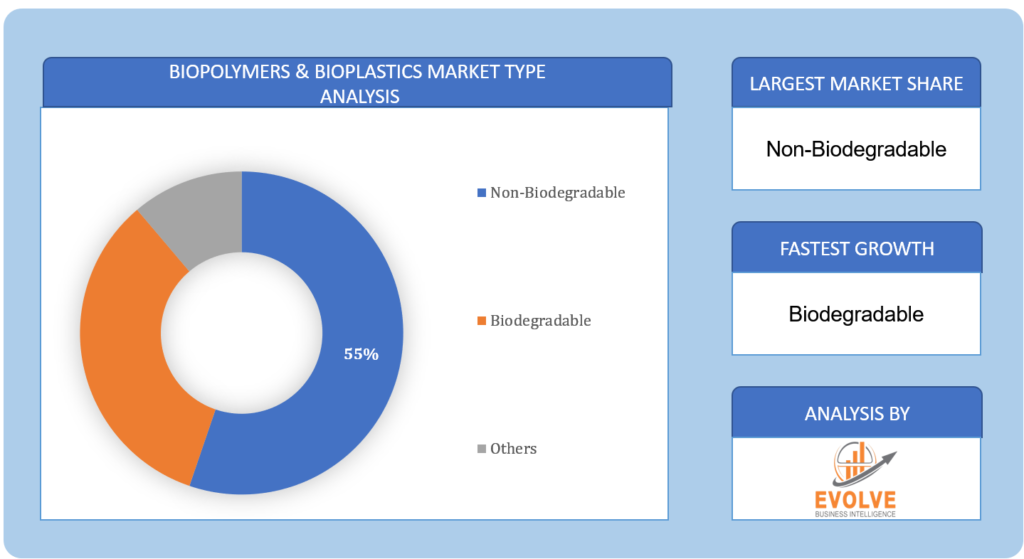

Biopolymers & Bioplastics market Segment Overview

Based on the Component, the Biopolymers & Bioplastics market is segmented based on Non-Biodegradable/Bio-Based, Biodegradable, and Others. The biodegradable market is expected to increase rapidly in the next years due to enterprises’ and customers’ reliance on environmentally friendly solutions to suit their everyday demands.

By End-Use

Based on the End-Use, the global Biopolymers & Bioplastics market has been divided into Packaging, Consumer Goods, Automotive & Transportation, Textiles, Agriculture & Horticulture, and Others. The Automotive & Transportation segment is expected to be the fastest-growing market share. This is attributed to the increasing demand for cars and other vehicles, as the need for efficient transportation solutions. This growth will be driven by the increasing demand for cars and other vehicles, as well as the need for efficient transportation solutions.

Global Biopolymers & Bioplastics Market Share, by Segmentation

Biopolymers & Bioplastics market Regional Analysis

Biopolymers & Bioplastics market Regional Analysis

Based on region, the global Biopolymers & Bioplastics market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. Asia Pacific is projected to dominate the use of the Biopolymers & Bioplastics market followed by North America.

Asia-Pacific Market

Asia Pacific is the largest market for Biopolymers & Bioplastics, due to the high demand from countries such as China, Japan, and India. In China, the government is promoting the use of bioplastics, as they are considered to be environmentally friendly. In Japan, bioplastics are being used in a wide range of applications, such as food packaging, agriculture, and medical devices. India is also a major market for bioplastics, due to the growing awareness about the environmental benefits of these materials.

North America Market

North America is estimated to rise at the fastest CAGR of the Biopolymers & Bioplastics market. The growth in this region is attributed to the rising demand for bio-based and degradable plastics from the packaging industry. In addition, the growing preference for sustainable and eco-friendly products is another major factor driving the growth of the Biopolymers & Bioplastics market in North America.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. As for their strategic innovations and broad regional presence, companies such as BASF, Kaneka Corporation, Mitsubishi Chemical Corporation, and United Biopolymers lead the global Biopolymers & Bioplastics business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- BASF SE

- Arkema

- Braskem

- Biome Bioplastics Limited

- Covestro

- Kaneka Corporation

- Mitsubishi Chemical Corporation

- United Biopolymers

- NatureWorks Inc

- Plantic Technologies Limited

Scope of the Report

Global Biopolymers & Bioplastics Market, by Type

- Non-Biodegradable/Bio-Based

- Biodegradable

- Others

Global Biopolymers & Bioplastics Market, by End-User

- Packaging

- Consumer Goods

- Automotive & Transportation

- Textiles

- Agriculture & Horticulture

- Others

Global Biopolymers & Bioplastics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

|---|---|

| Market Size | 2032: $ 29.77 Billion |

| CAGR | 20.7% CAGR (2022-2032) |

| Base year | 2021 |

| Forecast Period | 2020-2032 |

| Historical Data | 2020 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF SE, Arkema, Braskem, Biome Bioplastics Limited, Covestro, Kaneka Corporation, Mitsubishi Chemical Corporation, United Biopolymers, NatureWorks Inc, Plantic Technologies Limited |

| Key Market Opportunities | The introduction of new bioplastics and biopolymers product developments |

| Key Market Drivers | Growing consumer demand for plastic convenience products |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biopolymers & Bioplastics market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Biopolymers & Bioplastics market historical market size for the year 2020, and forecast from 2021 to 2032

- Biopolymers & Bioplastics market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Biopolymers & Bioplastics market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Biopolymers & Bioplastics market is 2022 - 2032

What is the growth rate of the global Biopolymers & Bioplastics market?

The global Biopolymers & Bioplastics market is growing at a CAGR of ~ 7% over the next 7 years

Which region has the highest growth rate in the global Biopolymers & Bioplastics market?

North America is expected to register the highest CAGR during 2022-2032

Which region has the largest share in the global Biopolymers & Bioplastics market?

Asia Pacific holds the largest share in 2021

Who are the key players in the global Biopolymers & Bioplastics market?

BASF, Kaneka Corporation, Mitsubishi Chemical Corporation, and United Biopolymers are the major companies operating in the global Biopolymers & Bioplastics

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Table of Contents Chapter 1. Executive Summary Chapter 2. Scope Of Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Distribution channel Providers 4.1.2. Manufacturing Distribution channel 4.1.3. Distributors/Retailers 4.1.4. Forms 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-18 on the Biopolymers & Bioplastics Market 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Product Type Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Biopolymers & Bioplastics Market 4.8. Import Analysis of the Biopolymers & Bioplastics Market 4.8. Export Analysis of the Biopolymers & Bioplastics Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Biopolymers & Bioplastics Market, By Type 6.1. Introduction 6.2. Non-Biodegradable/Bio-Based 6.3. Biodegradable 6.4. Others Chapter 7. Global Biopolymers & Bioplastics Market, By End-Use 7.1. Introduction 7.2. Packaging 7.3. Consumer Goods 7.4. Automotive & Transportation 7.5. Textiles 7.6. Agriculture & Horticulture 7.7. Others Chapter 8. Global Biopolymers & Bioplastics Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2022 - 2032 8.2.4. Market Size and Forecast, By Type, 2022 - 2032 8.2.5. Market Size and Forecast, By End-Use, 2022 - 2032 8.2.7. US 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Type, 2022 - 2032 8.2.7.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.2.8. Canada 8.2.8.1. Introduction 8.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.8.4. Market Size and Forecast, By Type, 2022 - 2032 8.2.8.5. Market Size and Forecast, By End-Use, 2022 - 2032 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2022 - 2032 8.3.4. Market Size and Forecast, By Type, 2022 - 2032 8.3.5. Market Size and Forecast, By End-Use, 2022 - 2032 8.3.7. Germany 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2022 - 2032 8.3.7.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.3.8. France 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2022 - 2032 8.3.8.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.3.9. UK 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2022 - 2032 8.3.9.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.3.10. Italy 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Type, 2022 - 2032 8.3.10.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2022 - 2032 8.3.11.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2022 - 2032 8.4.4. Market Size and Forecast, By Type, 2022 - 2032 8.4.5. Market Size and Forecast, By End-Use, 2022 - 2032 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2022 - 2032 8.4.6.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2022 - 2032 8.4.7.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2022 - 2032 8.4.8.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2022 - 2032 8.4.9.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2022 - 2032 8.4.10.4. Market Size and Forecast, By End-Use, 2022 - 2032 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Type, 2022 - 2032 8.5.4. Market Size and Forecast, By End-Use, 2022 - 2032 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. BASF SE 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Arkema 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Braskem 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Biome Bioplastics Limited 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Covestro 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Kaneka Corporation 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Mitsubishi Chemical Corporation 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. United Biopolymers 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. NatureWorks Inc 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Plantic Technologies Limited 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology