Biological seed treatment Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Biological Seed Treatment Market By Type (Microbials, Botanical and others), By crop type (Corn, Wheat, Soybean, Others), By Function (Seed enhancement, Seed protection) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2023 to 2033

Page: 158

Biological seed treatment Market Overview

The Biological seed treatment Market Size is expected to reach USD 2.78 Billion by 2033. The Biological seed treatment industry size accounted for USD 1.23 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.47% from 2023 to 2033. The Biological Seed Treatment Market involves the use of microorganisms to protect seeds against diseases, offering a more effective and environmentally friendly alternative to chemical treatments. It is a rapidly growing market, with projections to reach USD 9.2 billion by 2027 and USD 2.01 billion by 2029, driven by the adoption of sustainable agricultural practices and investments in research and development. Major players like Bayer AG and Syngenta AG are investing in innovative biological products to enhance crop productivity and align with environmental sustainability goals. The market encompasses seed protection and seed enhancement functions, catering to high-value industrial crops and promoting organic farming practices

Global Biological seed treatment Market Synopsis COVID-19 Impact Analysis

COVID-19 Impact Analysis

The Biological seed treatment market experienced a positive impact due to the COVID-19 pandemic. The COVID-19 pandemic has caused supply chain hiccups that have reduced demand or created shortages in the market for biological seed treatments. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, prompting manufacturers, developers, and service providers to implement diverse tactics aimed at stabilizing their businesses.

Global Biological seed treatment Market Dynamics

The major factors that have impacted the growth of Biological seed treatment are as follows:

Drivers:

⮚ Advancements in Biotechnology

Ongoing advancements in biotechnology are leading to the development of more effective and targeted biological seed treatments. Researchers are discovering and engineering novel microorganisms and bioactive compounds that offer superior pest and disease control, as well as other agronomic benefits.

Restraint:

- Limited Efficacy and Consistency

One challenge with biological seed treatments is ensuring consistent efficacy across different environmental conditions and crop varieties. The effectiveness of biological agents can vary, leading to unpredictable results and potentially disappointing outcomes for farmers.

Opportunity:

⮚ Technological Advancements

Bi Continued advancements in biotechnology and microbiology offer opportunities to develop more effective and targeted biological seed treatments. Research into novel microorganisms, genetic engineering, and formulation technologies can lead to the creation of innovative products with improved efficacy and environmental sustainability

Biological seed treatment Market Segment Overview

By Type

Based on the Type, the market is segmented based on Microbials, Botanical and others. In 2022, the microbial biological seed treatment segment accounted for approximately 75-77% of the revenue generated by the biological seed treatment market, holding the dominant share. Microbial therapy employs fungi such as mycorrhizae, Penicillium bilaii, and Trichoderma harzianum, as well as bacteria such as Rhizobia, Bacillus, Pseudomonas, and Streptomyces, to eradicate the pathogens and improve the health of the seeds. They effectively protect crops from insects, pests, plant illnesses, and dryness.

Based on the Type, the market is segmented based on Microbials, Botanical and others. In 2022, the microbial biological seed treatment segment accounted for approximately 75-77% of the revenue generated by the biological seed treatment market, holding the dominant share. Microbial therapy employs fungi such as mycorrhizae, Penicillium bilaii, and Trichoderma harzianum, as well as bacteria such as Rhizobia, Bacillus, Pseudomonas, and Streptomyces, to eradicate the pathogens and improve the health of the seeds. They effectively protect crops from insects, pests, plant illnesses, and dryness.

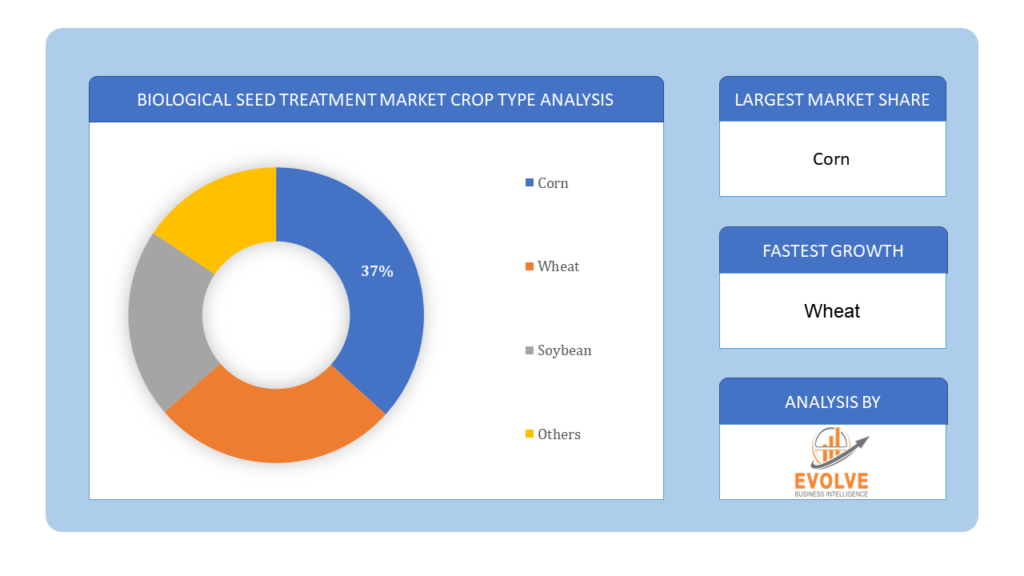

By Crop type

Based on the Crop type, the market has been divided into Corn, Wheat, Soybean, Others. For corn, treatments focus on enhancing germination rates, nutrient uptake, and resistance to pests and diseases. Wheat treatments aim to improve seedling vigor, disease resistance, and overall crop yield. In soybeans, biological treatments target nitrogen fixation, root development, and protection against soil-borne pathogens, contributing to higher yields and improved plant health.

By Function

Based on Function, the market has been divided into Seed enhancement, Seed protection. In 2021, the category that accounted for the most percentage was seed protection. Increased crop loss from factors including contaminated seeds and biotic and abiotic stress is expected to fuel industry expansion in the upcoming years.

Global Biological seed treatment Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Biological seed treatment, followed by those in Asia-Pacific and Europe.

Biological seed treatment North America Market

Biological seed treatment North America Market

North America dominates the Biological seed treatment market due to several factors. The market for biological seed treatment in North America, which was valued at USD 2.6 billion in 2022, is anticipated to increase at a substantial CAGR during the course of the study. The organic agricultural sector is expected to grow due to the growing popularity of this practice in nations including the United States, Mexico, and Canada. The two main exporters of grains worldwide are Canada and Mexico.

Biological seed treatment Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. A faster compound annual growth rate (CAGR) is anticipated in the Asia-Pacific Biological Seed Treatment Market between 2022 and 2030. The strong growth of the agricultural sector in countries like Bangladesh, China, India, Sri Lanka, and the former Soviet Union is expected to propel future product demand.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF, Bayer, NOVOZYMES, Syngenta Group, and Corteva Agriscience are some of the leading players in the global Biological seed treatment Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF

- Bayer

- NOVOZYMES

- Syngenta Group

- Corteva Agriscience

- Rhizobacter

- ValentBioSciences

- Verdesian Lifescience

- Plant Health Care

Key development:

In September 2022, BASF focused on enhancing plant performance sustainably through innovative biological seed treatments, combining biologicals and chemistry to protect young crops from damaging pests during critical early development. Their diverse seed treatment portfolio aims to support growers with challenges they face today and in the future, emphasizing the balance between efficacy and sustainability.

Scope of the Report

Global Biological seed treatment Market, by Type

- Microbials

- Botanical and others

Global Biological seed treatment Market, by Crop type

- Corn

- Wheat

- Soybean

- Others

Global Biological seed treatment Market, by Function

- Seed enhancement

- Seed protection

Global Biological seed treatment Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.78 Billion |

| CAGR | 10.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Crop type, Function |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF, Bayer, NOVOZYMES, Syngenta Group, Corteva Agriscience, Rhizobacter, ValentBioSciences, Verdesian Lifescience, Plant Health Care, Italpollina |

| Key Market Opportunities | • Growing Global Population |

| Key Market Drivers | • Dependency of the General Population on Agriculture Increasing Consumption of Crops |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biological seed treatment Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Biological seed treatment market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Biological seed treatment market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Biological seed treatment Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Biological seed treatment Market?

The study period encompasses historical data from 2021 and forecasts for the years 2023 to 2033.

What is the growth rate of the Biological seed treatment Market?

The Biological seed treatment Market is expected to expand at a compound annual growth rate (CAGR) of 10.47% from 2023 to 2033.

Which region has the highest growth rate in the Biological seed treatment Market?

The Asia Pacific region is anticipated to have the highest growth rate in the Biological seed treatment Market, driven by factors such as the strong growth of the agricultural sector in countries like Bangladesh, China, India, Sri Lanka, and the former Soviet Union.

Which region has the largest share of the Biological seed treatment Market?

Currently, North America dominates the Biological seed treatment Market, with a substantial market size and significant adoption of biological seed treatments, especially in nations like the United States, Mexico, and Canada.

Who are the key players in the Biological seed treatment Market?

Key players in the Biological seed treatment Market include BASF, Bayer, NOVOZYMES, Syngenta Group, Corteva Agriscience, Rhizobacter, ValentBioSciences, Verdesian Lifescience, and Plant Health Care, among others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Crop type Segment – Market Opportunity Score 4.1.3. Function Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Biological seed treatment Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Biological seed treatment Market, By Type 7.1. Introduction 7.1.1. Microbials 7.1.2. Botanical and others CHAPTER 8. Global Biological seed treatment Market, By Crop type 8.1. Introduction 8.1.1. Corn 8.1.2. Wheat 8.1.3. Soybean 8.1.4. Others CHAPTER 9. Global Biological seed treatment Market, By Function 9.1. Introduction 9.1.1. Seed enhancement 9.1.2. Seed protection CHAPTER 10. Global Biological seed treatment Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Crop type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Bayer 13.3. NOVOZYMES 13.4. Syngenta Group 13.5. Corteva Agriscience 13.6. Rhizobacter 13.7. ValentBioSciences 13.8. Verdesian Lifescience 13.9. Plant Health Care 13.10. Italpollina

Connect to Analyst

Research Methodology