Biofertilizers market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

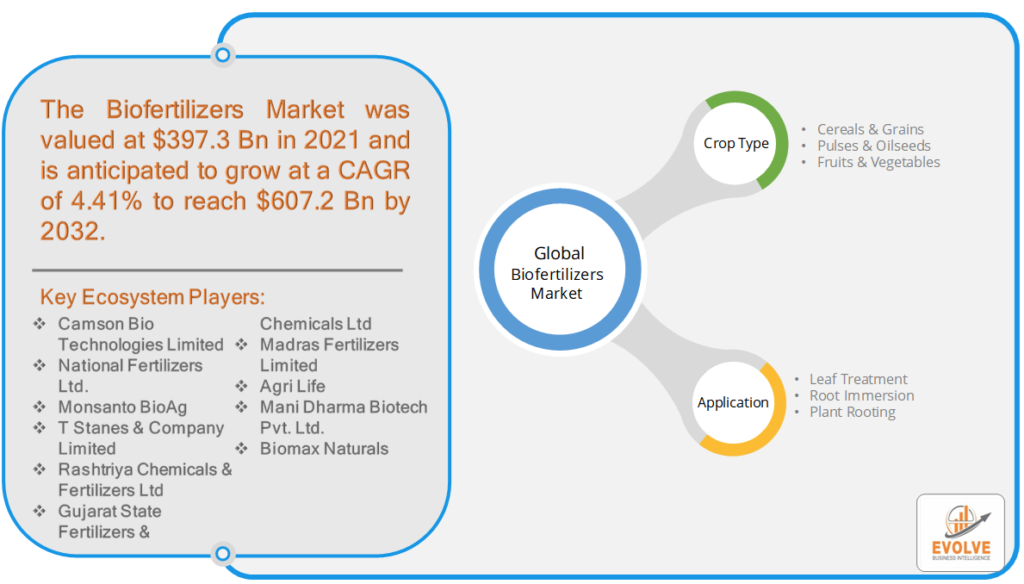

Biofertilizers market Research Report: Information By Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables), By Application (Leaf Treatment, Root Immersion, Plant Rooting), and by Region — Forecast till 2033

Biofertilizers Market Overview

The Biofertilizers market Size is expected to reach USD 607.2 Billion by 2033. The Biofertilizers market industry size accounted for USD 397.3 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.41% from 2023 to 2033. Biofertilizers market refers to the market segment dedicated to the production, distribution, and sale of biofertilizers. Biofertilizers are natural fertilizers derived from living organisms, such as bacteria, fungi, and algae that enhance plant growth and improve soil fertility through various biological processes. The demand for biofertilizers has been steadily increasing due to their eco-friendly nature and ability to enhance soil health and crop productivity sustainably. They are considered a viable alternative to chemical fertilizers, which can have negative environmental impacts when overused. The Biofertilizers market is influenced by factors such as government initiatives promoting sustainable agriculture, rising awareness about environmental issues, and the adoption of organic farming practices. The market players include manufacturers, distributors, agricultural organizations, and research institutions involved in the production and commercialization of biofertilizers.

Global Biofertilizers market Synopsis

During the initial stages of the pandemic, many countries implemented lockdowns and travel restrictions to contain the spread of the virus. These measures disrupted supply chains, affecting the production and distribution of biofertilizers. With lockdowns and restrictions in place, agricultural activities, including farming and gardening, were affected. As a result, the demand for agricultural inputs like biofertilizers declined in certain regions. The pandemic forced farmers and agricultural businesses to focus on essentials and critical supplies, diverting attention and resources away from investing in new agricultural inputs like biofertilizers. The economic downturn caused by the pandemic impacted farmers’ and growers’ incomes, leading to reduced spending on agricultural inputs, including biofertilizers.

Frozen Food Market Dynamics

The major factors that have impacted the growth of Biofertilizers market are as follows:

Drivers:

Ø Increasing awareness among farmers

Growing concerns about environmental degradation, soil health, and water pollution have led to a shift towards sustainable agricultural practices. Biofertilizers offer an eco-friendly alternative to chemical fertilizers, as they promote soil fertility, reduce chemical runoff, and minimize environmental impacts. The rising demand for organic produce has been a significant driver for the Biofertilizers market. Biofertilizers are an integral part of organic farming, as they help meet the nutrient needs of crops without using synthetic chemicals. Biofertilizers play a vital role in enhancing soil fertility and microbial activity, leading to improved soil structure, nutrient availability, and water-holding capacity. The growing demand for organic food products, driven by health-conscious consumers, has increased the need for organic farming practices and, consequently, the demand for biofertilizers.

Restraint:

- Quality control and standardization

Despite increasing awareness about biofertilizers, there is still a lack of widespread knowledge and understanding among farmers and growers. Many farmers may be hesitant to switch from conventional chemical fertilizers to biofertilizers due to a lack of information about their benefits and proper application methods. The performance of biofertilizers can vary depending on several factors, including soil type, climate, and crop species. Some biofertilizers may not show consistent results across different agricultural conditions, leading to uncertainties among farmers. The biofertilizers market faces competition from chemical fertilizers, which have been widely used for decades and are readily available. Chemical fertilizers often provide quick and predictable results, making it challenging for biofertilizers to gain market share. Some biofertilizers may require higher initial investments compared to chemical fertilizers. While biofertilizers may offer long-term benefits, farmers may be reluctant to invest in a new agricultural input if the short-term financial benefits are not apparent.

Opportunity

:

⮚ Increasing demand for sustainable agriculture

Growing awareness about environmental sustainability and the adverse impacts of chemical fertilizers has led to a rising demand for sustainable agricultural practices. Biofertilizers, being eco-friendly and capable of improving soil health, are well-positioned to cater to this demand. The global organic food market has been experiencing significant growth due to increased consumer awareness about health and environmental concerns. As organic farming practices require the use of biofertilizers, the expanding organic food market offers a substantial opportunity for the biofertilizers industry.Partnerships between biofertilizer manufacturers, agricultural organizations, and research institutions can lead to the development of innovative products and solutions tailored to specific crops and regional needs. With a growing recognition of the importance of soil health in sustainable agriculture, there is an increased emphasis on practices that promote soil fertility and microbial activity. Biofertilizers play a crucial role in soil health management, creating opportunities for market growth.

Biofertilizers market Segment Overview

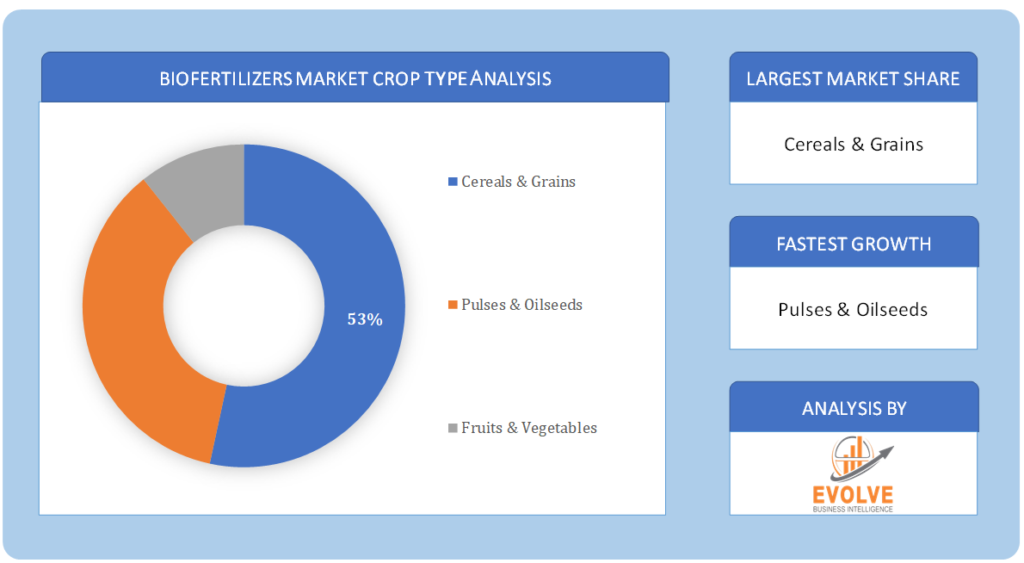

By Crop Type

Based on Crop Type, the market is segmented based on Cereals & Grains, Pulses & Oilseeds and Fruits & Vegetables. Biofertilizers play a crucial role in enhancing the growth and productivity of cereal crops, as they promote soil fertility and nutrient availability. Nitrogen-fixing biofertilizers are particularly important for cereal crops because they help fix atmospheric nitrogen and convert it into plant-available forms, ensuring optimal nitrogen levels for crop growth.Fruits and vegetables are high-value crops, and their quality and yield are vital for economic success. Biofertilizers are used to enhance fruiting, flowering, and overall crop health, leading to improved yield and quality. Oilseeds include crops like soybean, sunflower, and canola, while pulses encompass crops like lentils, chickpeas, and beans. Nitrogen-fixing biofertilizers are particularly valuable for oilseeds and pulses, as they enhance protein content and improve oil yield in oilseed crops.

Based on Crop Type, the market is segmented based on Cereals & Grains, Pulses & Oilseeds and Fruits & Vegetables. Biofertilizers play a crucial role in enhancing the growth and productivity of cereal crops, as they promote soil fertility and nutrient availability. Nitrogen-fixing biofertilizers are particularly important for cereal crops because they help fix atmospheric nitrogen and convert it into plant-available forms, ensuring optimal nitrogen levels for crop growth.Fruits and vegetables are high-value crops, and their quality and yield are vital for economic success. Biofertilizers are used to enhance fruiting, flowering, and overall crop health, leading to improved yield and quality. Oilseeds include crops like soybean, sunflower, and canola, while pulses encompass crops like lentils, chickpeas, and beans. Nitrogen-fixing biofertilizers are particularly valuable for oilseeds and pulses, as they enhance protein content and improve oil yield in oilseed crops.

By Application

Based on Application, the market has been divided into Leaf Treatment, Root Immersion and Plant Rooting. Leaf treatment involves applying biofertilizers directly to the leaves of plants in the form of a foliar spray. This method allows for quick and efficient nutrient absorption through the leaves, bypassing the soil and root system. Root immersion, also known as root dipping or root soaking, involves immersing the plant roots in a solution containing biofertilizers before transplanting or planting them in the field. This method ensures direct contact between the biofertilizer solution and the root system, promoting early root colonization by beneficial microorganisms. Plant rooting, also called root inoculation, involves applying biofertilizers directly to the root zone of established plants. This method can be achieved through root drenching, soil injection, or through application in planting holes.

Global Biofertilizers market Regional Analysis

Based on region, the global Biofertilizers market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Biofertilizers market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Biofertilizers market. The United States and Canada are major players in the North American biofertilizers market. The demand for organic and sustainable agriculture has been increasing in this region, driven by consumer preferences and government support for environmentally friendly practices. Strong emphasis on research and development in the agricultural sector contributes to advancements in biofertilizer technologies.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Biofertilizers market industry. The Asia-Pacific region is home to some of the world’s most populous countries with extensive agricultural activities. The demand for biofertilizers in this region is driven by the need to improve soil fertility, increase crop yields, and adopt sustainable agricultural practices to support a large and growing population.The increasing awareness of health and environmental concerns has led to a surge in demand for organic food products in the Asia-Pacific region. Biofertilizers are a critical component of organic farming practices, contributing to the region’s growing biofertilizers market. Countries like India have invested significantly in research and development in the agricultural sector, including biofertilizers. Advancements in biotechnology and microbial research have led to the development of more efficient and targeted biofertilizer products.

Competitive Landscape

The global Biofertilizers market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Camson Bio Technologies Limited

- National Fertilizers Ltd.

- Monsanto BioAg

- T Stanes & Company Limited

- Rashtriya Chemicals & Fertilizers Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Madras Fertilizers Limited

- Agri Life

- Mani Dharma Biotech Pvt. Ltd.

- Biomax Naturals

Key Development

In September 2021, In order to address the major issues facing North American producers, Novozymes launched five biological solutions, which included inoculants. The company also established a new sales staff to assist clients directly in the United States. Inoculants that address concerns with nutritional effectiveness, nodulation, and nitrogen fixation are among the new products.

Scope of the Report

Global Biofertilizers market, by Crop Type

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

Global Biofertilizers market, by Application

- Leaf Treatment

- Root Immersion

- Plant Rooting

Global Biofertilizers market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $607.2Billion |

| CAGR | 4.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Crop Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Camson Bio Technologies Limited, National Fertilizers Ltd., Monsanto BioAg, T Stanes & Company Limited, Rashtriya Chemicals & Fertilizers Ltd, Gujarat State Fertilizers & Chemicals Ltd, Madras Fertilizers Limited, Agri Life, Mani Dharma Biotech Pvt. Ltd. |

| Key Market Opportunities | • Increasing demand for sustainable agriculture |

| Key Market Drivers | • Increasing awareness among farmers |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biofertilizers market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Biofertilizers market historical market size for the year 2021, and forecast from 2023 to 2033

- Biofertilizers market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Biofertilizers market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Biofertilizers market is 2021- 2033

What is the growth rate of the global Biofertilizers market?

The global Biofertilizers market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Biofertilizers market?

North America holds the largest share in 2022

Who are the key players in the global Biofertilizers market?

Conagra Camson Bio Technologies Limited, National Fertilizers Ltd., Monsanto BioAg, T Stanes & Company Limited, Rashtriya Chemicals & Fertilizers Ltd, Gujarat State Fertilizers & Chemicals Ltd, Madras Fertilizers Limited, Agri Life, Mani Dharma Biotech Pvt. Ltd. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Biofertilizers market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Biofertilizers market 4.8.Import Analysis of the Biofertilizers market 4.9.Export Analysis of the Biofertilizers market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Biofertilizers market, By Crop Type 6.1. Introduction 6.2. Cereals & Grains 6.3. Pulses & Oilseeds 6.4. Fruits & Vegetables Chapter 7. Global Biofertilizers market, By Application 7.1. Introduction 7.2. Leaf Treatment 7.3. Root Immersion 7.4 Plant Rooting Chapter 8. Global Biofertilizers market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Conagra Camson Bio Technologies Limited 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. National Fertilizers Ltd. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Monsanto BioAg 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. T Stanes & Company Limited 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Rashtriya Chemicals & Fertilizers Ltd 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Gujarat State Fertilizers & Chemicals Ltd 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Madras Fertilizers Limited 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Agri Life 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Mani Dharma Biotech Pvt. Ltd. 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis

Connect to Analyst

Research Methodology