Automotive RFID Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Automotive RFID Market Research Report: Information By Type (Active RFID, Passive RFID), By Vehicles (Passenger vehicles, Commercial vehicles), By Frequency (Low frequency, High frequency), and by Region — Forecast till 2033

Page: 160

Automotive RFID Market Overview

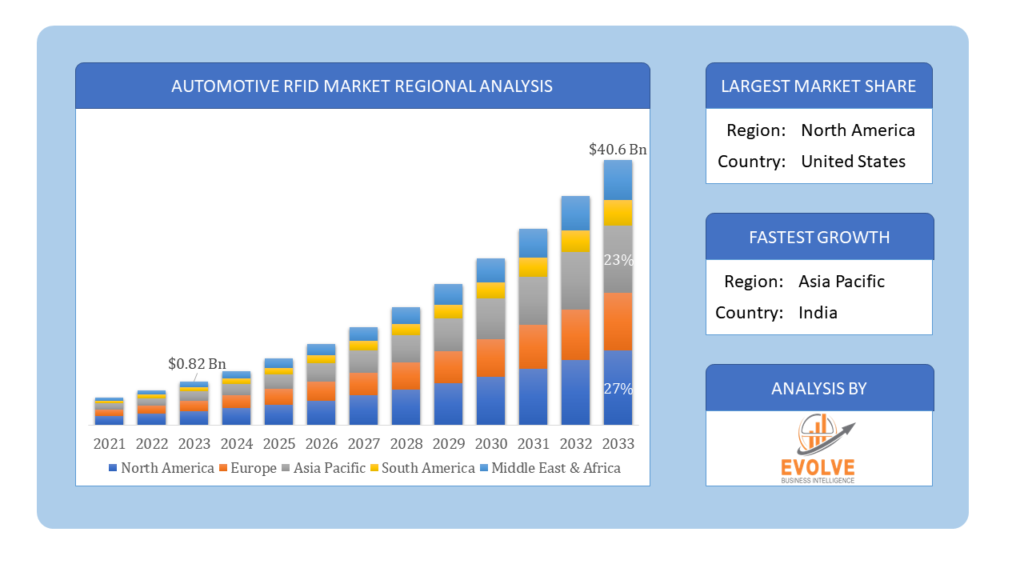

The Automotive RFID Market Size is expected to reach USD 40.65 Billion by 2033. The Automotive RFID Market industry size accounted for USD 0.82 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 13.97% from 2023 to 2033. The Automotive RFID (Radio-Frequency Identification) Market involves the use of RFID technology in the automotive industry. RFID is a wireless system that uses radio waves to identify and track objects.

The Automotive RFID Market is driven by the increasing demand for improved vehicle tracking and management systems, enhanced security features, and efficient inventory management in the automotive industry. Advancements in RFID technology, such as longer read ranges and increased data storage capacity, are also contributing to the growth of this market.

Global Automotive RFID Market Synopsis

The COVID-19 pandemic had a significant impact on the Automotive RFID Market. The pandemic led to the temporary shutdown of manufacturing plants, causing delays in the production of RFID components and automotive vehicles. Restrictions on transportation and international trade affected the timely delivery of RFID components and raw materials. The need for contactless solutions grew during the pandemic, leading to increased interest in RFID technology for applications such as keyless entry, toll collection, and automated parking systems. Automotive companies sought ways to improve efficiency and reduce costs, driving the adoption of RFID for inventory management and vehicle tracking. The pandemic accelerated the digital transformation in the automotive industry, leading to a greater emphasis on technologies that can enhance efficiency and reduce human intervention.

Automotive RFID Market Dynamics

The major factors that have impacted the growth of Automotive RFID Market are as follows:

Drivers:

Ø Enhanced Vehicle Security

RFID technology is used in keyless entry systems and vehicle immobilizers, enhancing vehicle security and reducing theft rates. sRFID allows for secure access control in vehicles, ensuring only authorized individuals can start or access the vehicle. The COVID-19 pandemic has accelerated the demand for contactless technologies, including RFID, for applications such as keyless entry, toll collection, and automated parking systems. Advancements in RFID technology, such as increased read range, higher data storage capacity, and enhanced durability, make RFID systems more reliable and efficient. As RFID technology matures, the cost of RFID tags and readers continues to decrease, making it more affordable for widespread adoption in the automotive industry.

Restraint:

- Perception of High Initial Costs

The initial cost of implementing RFID systems, including purchasing tags, readers, and software, can be high, particularly for small and medium-sized enterprises (SMEs). Upgrading existing infrastructure to support RFID technology can require significant investment, which may be a barrier for some companies. RFID systems can experience interference from metal objects, liquids, and other electronic devices, which can affect the accuracy and reliability of data transmission. Depending on the type of RFID technology used (e.g., low-frequency, high-frequency, ultra-high-frequency), there may be limitations in the read range, impacting the effectiveness of the system.

Opportunity:

⮚ Growing Demand for Electric Vehicles (EVs)

As the demand for electric vehicles increases, there is a growing need for efficient supply chain management. RFID can help track and manage the inventory of EV components, batteries, and raw materials. RFID can be used in EV charging stations for user authentication, payment processing, and tracking charging sessions, enhancing the user experience. RFID technology can support the communication and data exchange needed for autonomous and connected vehicles, contributing to vehicle-to-everything (V2X) communication. RFID can be used to enhance safety features in autonomous vehicles, such as obstacle detection, traffic signal communication, and pedestrian tracking.

Automotive RFID Market Segment Overview

By Type

Based on Type, the market is segmented based on Active RFID and Passive RFID. The Active RFID segment dominant the market. In automotive manufacturing, active RFID is used to track work-in-progress (WIP) components, tools, and finished vehicles as they move through the assembly line. Active RFID tags are increasingly used in the automotive aftermarket for tracking inventory, managing spare parts, and providing faster service and maintenance operations.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into the Passenger vehicles and Commercial vehicles. Passenger car’s maximum contribution stemming from APAC. The increasing demand for passenger cars from developed and developing economies has made the segment important for the vehicle radio-frequency identification tag market.

By Frequency

Based on Frequency, the market segment has been divided into the Low frequency and High frequency. The high frequency segment held the largest share of the market. Ultrahigh-frequency RFID tags can be attached to metal products and materials, enabling real-time visibility and automated inventory management. It helps reduce human error, improve inventory, accuracy, and enhance supply chain efficiency.

Global Automotive RFID Market Regional Analysis

Based on region, the global Automotive RFID Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Automotive RFID Market followed by the Asia-Pacific and Europe regions.

Automotive RFID North America Market

Automotive RFID North America Market

North America holds a dominant position in the Automotive RFID Market. North America, particularly the United States, is a leader in adopting advanced RFID technologies due to a strong emphasis on innovation and early adoption of new technologies. The region has a robust automotive industry, with major manufacturers and suppliers investing in RFID for vehicle tracking, inventory management, and security. Government regulations and initiatives promoting vehicle safety and emissions standards drive the adoption of RFID technology. High demand for connected and autonomous vehicles, as well as electric vehicles, creates opportunities for RFID applications in these segments.

Automotive RFID Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Automotive RFID Market industry. The Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing rapid industrialization and growth in the automotive sector, leading to increased adoption of RFID technology. China and India are significant manufacturing bases for automotive components and vehicles, where RFID is used to enhance production efficiency and inventory management. Japan and South Korea are known for their technological advancements and innovation in the automotive industry, driving the integration of RFID in connected and autonomous vehicles.

Competitive Landscape

The global Automotive RFID Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Impinj

- NXP Semiconductors

- Avery Dennison Corporation

- Confidex Ltd.

- SMARTRAC N.V

- Alien Technology

- Nedap N.V.

- Zebra Technologies

- Invengo Technology Pte. Ltd

Key Development

In March 2023, September 2023 – The AD Pure line launches with, AD Belt U9 Pure inlays and tags which are ideally suited for global apparel, retail, industry and supply-chain applications. They are compact in size and offer excellent performance on difficult-to-tag or low-detuning materials such as cardboard and plastic. Source: https://www.mordorintelligence.com/industry-reports/global-rfid-market

Scope of the Report

Global Automotive RFID Market, by Type

- Active RFID

- Passive RFID

Global Automotive RFID Market, by Vehicle Type

- Passenger vehicles

- Commercial vehicles

Global Automotive RFID Market, by Frequency

- Low frequency

- High frequency

Global Automotive RFID Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $40.65 Billion/strong> |

| CAGR | 13.97% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Vehicle Type, Frequency |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Impinj, NXP Semiconductors, Avery Dennison Corporation, Confidex Ltd., SMARTRAC N.V, Alien Technology, Nedap N.V., Zebra Technologies and Invengo Technology Pte. Ltd.. |

| Key Market Opportunities | • Growing Demand for Electric Vehicles (EVs) |

| Key Market Drivers | • Enhanced Vehicle Security • Advancements in RFID Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive RFID Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Automotive RFID Market historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive RFID Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Automotive RFID Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Automotive RFID Market is 2021- 2033

2.What is the growth rate of the global Automotive RFID Market?

- The global Automotive RFID Market is growing at a CAGR of 13.97% over the next 10 years

3.Which region has the highest growth rate in the market of Automotive RFID Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Automotive RFID Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Automotive RFID Market?

Impinj, NXP Semiconductors, Avery Dennison Corporation, Confidex Ltd., SMARTRAC N.V, Alien Technology, Nedap N.V., Zebra Technologies and Invengo Technology Pte. Ltd. are the major companies operating in the market

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Vehicle Type Segment – Market Opportunity Score 4.1.3. Frequency Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive RFID Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Automotive RFID Market, By Type 7.1. Introduction 7.1.1. Active RFID 7.1.2. Passive RFID CHAPTER 8 Automotive RFID Market, By Vehicle Type 8.1. Introduction 8.1.1. Passenger vehicles 8.1.2. Commercial vehicles CHAPTER 9. Automotive RFID Market, By Frequency 9.1. Introduction 9.1.1. Low frequency 9.1.2 High frequency CHAPTER 10. Automotive RFID Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.9.3.________ Rest of Middle East & Africa: Market Size and Forecast, By Frequency, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Impinj 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. NXP Semiconductors 13.3. Avery Dennison Corporation 13.4. Confidex Ltd. 13.5. SMARTRAC N.V 13.6. Alien Technology 13.7. Nedap N.V. 13.8. Zebra Technologies 13.9 Invengo Technology Pte. Ltd

Connect to Analyst

Research Methodology