Automotive Powertrain Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

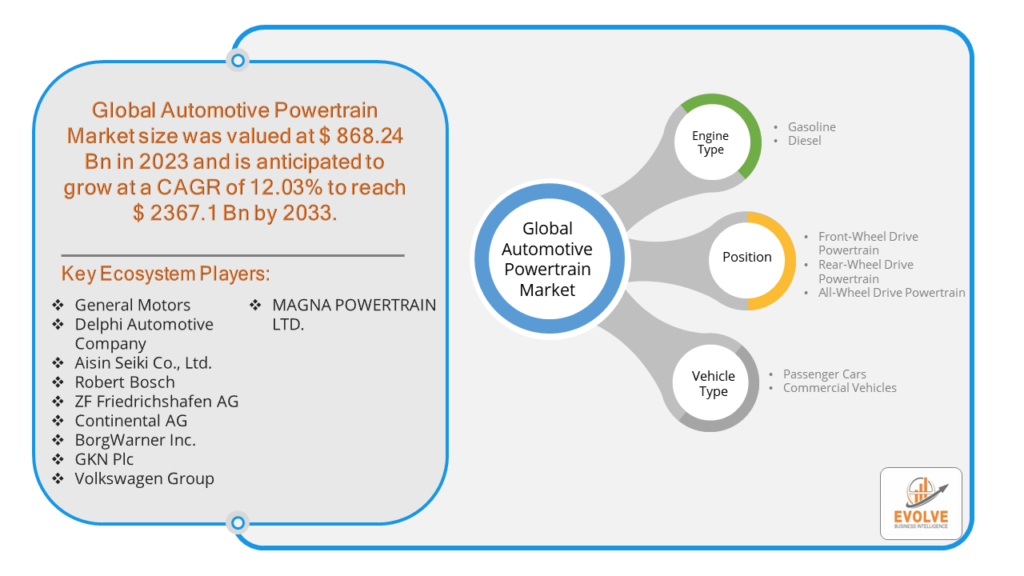

Automotive Powertrain Market Research Report: Information By Engine Type (Gasoline and Diesel), By Position (Front-Wheel Drive Powertrain, Rear-Wheel Drive Powertrain and All-Wheel Drive Powertrain), By Vehicle Type (Passenger Cars, and Commercial Vehicles), and by Region — Forecast till 2033

Page: 134

Automotive Powertrain Market Overview

The Automotive Powertrain Market Size is expected to reach USD 2367.1 Billion by 2033. The Automotive Powertrain industry size accounted for USD 868.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.03% from 2023 to 2033. The automotive powertrain refers to the integrated system within a vehicle responsible for generating and transmitting power to the wheels, enabling propulsion. It typically encompasses components such as the engine, transmission, driveshaft, differential, and wheels, working in tandem to deliver mechanical energy for vehicle movement. The powertrain plays a fundamental role in determining a vehicle’s performance, efficiency, and drivability, making it a crucial focus area for automotive engineering and development.

Global Automotive Powertrain Market Synopsis

The Automotive Powertrain market experienced a profound and transformative shift as a result of the COVID-19 pandemic. Initially, disruptions in global supply chains and manufacturing operations led to significant production slowdowns and supply shortages across the automotive industry. Additionally, decreased consumer demand and economic uncertainty resulted in a notable decline in vehicle sales, prompting automakers to reevaluate their production strategies and investment priorities. However, amidst these challenges, the pandemic accelerated existing trends such as the transition towards electric and hybrid powertrains. Governments and automotive manufacturers intensified efforts to meet sustainability goals, leading to increased investments in alternative propulsion technologies. This paradigm shift not only reshaped the Automotive Powertrain market but also underscored the importance of adaptability and resilience in the face of unforeseen disruptions.

Automotive Powertrain Market Dynamics

The major factors that have impacted the growth of Automotive Powertrain are as follows:

Drivers:

Ø Regulatory pressures and emission reduction goals

Increasingly stringent emissions regulations worldwide are driving the Automotive Powertrain market towards more efficient and environmentally friendly technologies. Automakers are incentivized to develop powertrains that produce lower emissions and consume less fuel, leading to innovation in hybrid, electric, and alternative fuel powertrain systems.

Restraint:

- High development and production costs

The Automotive Powertrain market is the high cost associated with the development and production of advanced powertrain technologies. Research and development expenses for new propulsion systems, as well as the investment required to retool manufacturing facilities, can pose significant financial challenges for automakers, especially during economic downturns or periods of uncertainty.

Opportunity:

⮚ Shift towards electric and hybrid vehicles

The growing consumer demand for electric and hybrid vehicles presents a significant opportunity for the Automotive Powertrain market. As concerns about climate change and air pollution rise, more consumers are seeking vehicles with lower emissions and greater fuel efficiency. This trend creates opportunities for automakers to invest in electric powertrains, battery technology, and hybrid systems to meet market demand and gain a competitive edge.

Automotive Powertrain Segment Overview

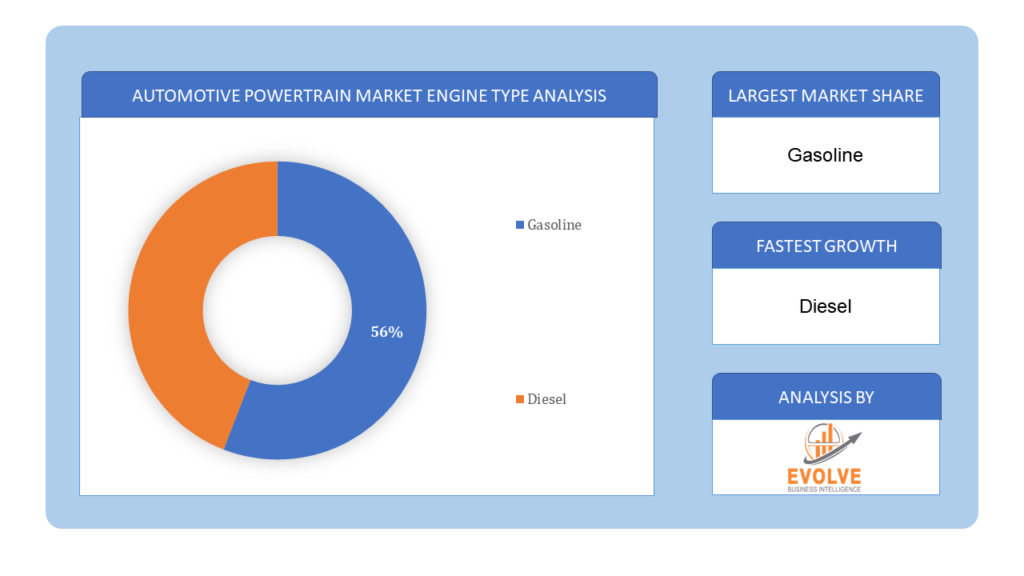

By Engine Type

Based on Engine Type, the market is segmented based on Gasoline and Diesel. The Gasoline segment is positioned for notable expansion, fueling growth in the Automotive Powertrain market due to ongoing demand for internal combustion engine vehicles and advancements in gasoline engine technology, enhancing performance and efficiency to meet regulatory standards and consumer preferences.

Based on Engine Type, the market is segmented based on Gasoline and Diesel. The Gasoline segment is positioned for notable expansion, fueling growth in the Automotive Powertrain market due to ongoing demand for internal combustion engine vehicles and advancements in gasoline engine technology, enhancing performance and efficiency to meet regulatory standards and consumer preferences.

By Position

Based on Position, the market has been divided into Front-Wheel Drive Powertrain, Rear-Wheel Drive Powertrain and All-Wheel Drive Powertrain. Front-wheel drive (FWD) powertrains are emerging as the predominant force in the Automotive Powertrain Market, driven by their widespread adoption in passenger vehicles worldwide. FWD systems offer advantages such as efficient packaging, improved fuel economy, and enhanced traction in various driving conditions, making them increasingly popular among automakers and consumers alike.

By Vehicle Type

Based on Vehicle Type, the market has been divided into Passenger Cars, and Commercial Vehicles. The dominance of passenger cars in the Automotive Powertrain Market is evident due to their widespread use and demand globally. Passenger cars represent a significant portion of vehicle sales, driving the adoption of various powertrain technologies. With consumers increasingly prioritizing factors such as fuel efficiency, performance, and environmental impact, automakers are focused on developing powertrains that meet these demands.

Global Automotive Powertrain Market Regional Analysis

Based on region, the global Automotive Powertrain market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Automotive Powertrain market followed by the Asia-Pacific and Europe regions.

Automotive Powertrain North America Market

Automotive Powertrain North America Market

North America has consistently maintained a dominant position in the Automotive Powertrain market, owing to its robust automotive manufacturing infrastructure, technological innovation, and strong consumer demand for vehicles. The region’s leading role in automotive production and engineering allows it to drive advancements in powertrain technologies, including hybrid and electric propulsion systems, to meet regulatory standards and consumer preferences. Additionally, North America’s large market size and diverse automotive landscape contribute to its sustained prominence in the global Automotive Powertrain market.

Automotive Powertrain Asia-Pacific Market

The Asia-Pacific region has emerged as a rapidly growing market for the Automotive Powertrain industry, fueled by several factors including increasing vehicle production, rising consumer demand, and government initiatives promoting sustainable mobility solutions. Countries such as China, Japan, South Korea, and India are leading the way in automotive manufacturing and innovation, driving the adoption of advanced powertrain technologies. Additionally, the region’s expanding middle class and urbanization trends are driving demand for passenger vehicles, further boosting the Automotive Powertrain market. With a growing emphasis on environmental sustainability and fuel efficiency, the Asia-Pacific region presents significant growth opportunities for powertrain manufacturers and suppliers.

Competitive Landscape

The Global Automotive Powertrain market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- General Motors

- Delphi Automotive Company

- Aisin Seiki Co., Ltd.

- Robert Bosch

- ZF Friedrichshafen AG

- Continental AG

- BorgWarner Inc.

- GKN Plc

- Volkswagen Group

- MAGNA POWERTRAIN LTD.

Key Development

In July 2021, Valeo and Omega Seiki Mobility (OSM) signed a Memorandum of Understanding (MoU), with Valeo set to provide electric powertrains for OSM’s lineup of vehicles, focusing on a three-wheeler commercial vehicle range in India.

Also in July 2021, Volvo Cars and Geely Automotive formed a strategic partnership, establishing a joint venture named “Aurobay,” aimed at the development and supply of powertrains.

Scope of the Report

Global Automotive Powertrain Market, by Engine Type

- Gasoline

- Diesel

Global Automotive Powertrain Market, by Position

- Front-Wheel Drive Powertrain

- Rear-Wheel Drive Powertrain

- All-Wheel Drive Powertrain

Global Automotive Powertrain Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Powertrain Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2367.1 Billion |

| CAGR | 12.03% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Engine Type, Position, Vehicle Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | General Motors, Delphi Automotive Company, Aisin Seiki Co., Ltd., Robert Bosch, ZF Friedrichshafen AG, Continental AG, BorgWarner Inc., GKN Plc, Volkswagen Group, MAGNA POWERTRAIN LTD |

| Key Market Opportunities | • Growing market for electric and hybrid vehicles, spurred by increasing environmental awareness and government incentives. • Technological innovation presenting opportunities for the development of more efficient and high-performance powertrains |

| Key Market Drivers | • Regulatory requirements and emission standards driving demand for cleaner and more fuel-efficient powertrain technologies. • Advancements in technology, such as electric and hybrid propulsion systems, responding to consumer preferences for environmentally friendly vehicles. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Powertrain market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Automotive Powertrain market historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Powertrain market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Automotive Powertrain market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive Powertrain Market?

The study period for the Automotive Powertrain Market is from 2023 to 2033.

What is the growth rate of the Automotive Powertrain Market?

The Automotive Powertrain Market is expected to grow at a compound annual growth rate (CAGR) of 12.03% from 2023 to 2033.

Which region has the highest growth rate in the Automotive Powertrain Market?

The Asia-Pacific region has the highest growth rate in the Automotive Powertrain Market.

Which region has the largest share of the Automotive Powertrain Market?

North America holds the largest share of the Automotive Powertrain Market.

Who are the key players in the Automotive Powertrain Market?

Key players in the Automotive Powertrain Market include General Motors, Delphi Automotive Company, Aisin Seiki Co., Ltd., Robert Bosch, and ZF Friedrichshafen AG.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Engine Type Segement – Market Opportunity Score 4.1.2. Position Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Powertrain Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Powertrain Market, By Engine Type 7.1. Introduction 7.1.1. Gasoline 7.1.2. Diesel CHAPTER 8. Global Automotive Powertrain Market, By Position 8.1. Introduction 8.1.1. Front-Wheel Drive Powertrain 8.1.2. Wheel Drive Powertrain 8.1.3. All-Wheel Drive Powertrain CHAPTER 9. Global Automotive Powertrain Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Automotive Powertrain Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. General Motors 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Delphi Automotive Company 13.3. Aisin Seiki Co., Ltd. 13.4. Robert Bosch 13.5. ZF Friedrichshafen AG 13.6. Continental AG 13.7. BorgWarner Inc. 13.8. GKN Plc 13.9. Volkswagen Group 13.10. MAGNA POWERTRAIN LTD.

Connect to Analyst

Research Methodology

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Engine Type Segement – Market Opportunity Score 4.1.2. Position Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Powertrain Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Powertrain Market, By Engine Type 7.1. Introduction 7.1.1. Gasoline 7.1.2. Diesel CHAPTER 8. Global Automotive Powertrain Market, By Position 8.1. Introduction 8.1.1. Front-Wheel Drive Powertrain 8.1.2. Wheel Drive Powertrain 8.1.3. All-Wheel Drive Powertrain CHAPTER 9. Global Automotive Powertrain Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Automotive Powertrain Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Engine Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Position, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. General Motors 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Delphi Automotive Company 13.3. Aisin Seiki Co., Ltd. 13.4. Robert Bosch 13.5. ZF Friedrichshafen AG 13.6. Continental AG 13.7. BorgWarner Inc. 13.8. GKN Plc 13.9. Volkswagen Group 13.10. MAGNA POWERTRAIN LTD.