Automated Parking Systems Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

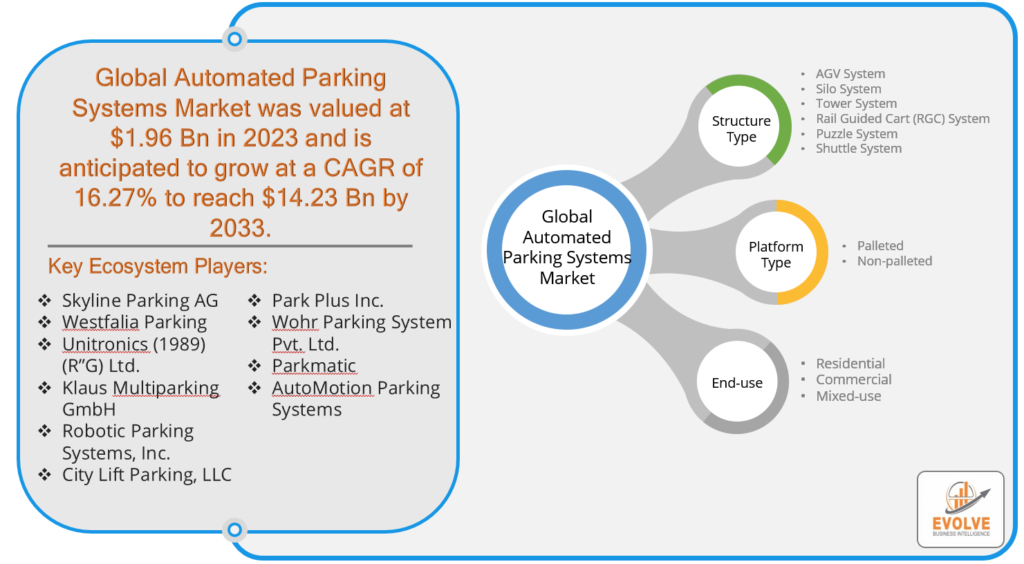

Automated Parking Systems Market Research Report: By Structure Type (AGV System, Silo System, Tower System, Rail Guided Cart (RGC) System, Puzzle System, Shuttle System), By Platform Type (Palleted, Non-palleted), By End-use (Residential, Commercial, Mixed-use), and by Region — Forecast till 2033

Automated Parking Systems Market Overview

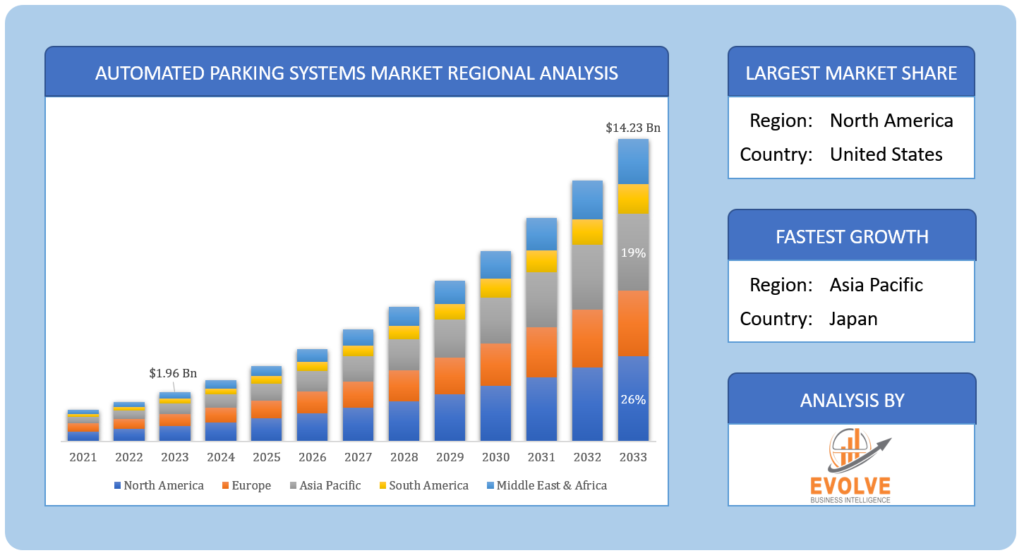

The Automated Parking Systems Market Size is expected to reach USD 14.23 Billion by 2033. The Automated Parking Systems industry size accounted for USD 1.96 Billion in 2023 and is expected to expand at a CAGR of 16.27% from 2023 to 2033. Automated Parking Systems (APS), often referred to as automated or robotic parking, are advanced vehicular storage and retrieval systems that employ a combination of mechanical, electronic, and software-based technologies to automatically transport vehicles to designated parking spaces within enclosed or semi-enclosed structures. These systems minimize the need for human intervention and traditional parking infrastructure, such as ramps and driveways, by utilizing lifts, conveyors, shuttles, and robotics. APS is designed to maximize space utilization and enhance parking efficiency, making them particularly suitable for urban environments with limited space and high parking demand. They improve the overall parking experience by reducing the time and effort required for both vehicle parking and retrieval, offering an innovative solution to address urban congestion and parking challenges.

Global Automated Parking Systems Market Synopsis

The Automated Parking Systems (APS) market experienced a moderate impact from the COVID-19 pandemic. In the early stages of the pandemic, as lockdowns and restrictions reduced vehicular activity and construction projects faced delays, the demand for APS systems temporarily slowed down. However, the industry displayed resilience and adaptability as the pandemic continued. A growing emphasis on contactless and touchless parking solutions to enhance safety and reduce human interaction led to a gradual recovery in demand for APS. Urban areas still faced the persistent challenge of efficient parking, and this drove interest in smart and automated solutions. The long-term outlook for the APS market remained positive, with the pandemic accelerating the adoption of these systems to meet evolving urban needs.

Global Automated Parking Systems Market Dynamics

The major factors that have impacted the growth of Automated Parking Systems are as follows:

Drivers:

⮚ Urbanization and Space Constraints

Urbanization is an ongoing global trend, with an increasing number of people moving to cities in search of better opportunities and lifestyles. This urban migration has led to a surge in the demand for parking spaces in already densely populated urban areas. Traditional parking facilities, which often rely on surface parking lots and multi-story parking garages, struggle to keep up with the demand, resulting in congestion and wasted space. Automated Parking Systems (APS) address this issue by making more efficient use of available space, reducing the need for large surface lots, and eliminating the need for space-consuming ramps, driveways, and walkways.

Restraint:

- High Initial Investment Costs

The APS market is the significant upfront investment required for the planning, design, construction, and installation of automated parking systems. These costs encompass the purchase of specialized equipment, construction of the robotic parking structure, and implementation of the software and control systems. While APS can lead to long-term operational savings, the high initial capital outlay can deter property developers, municipalities, or businesses from adopting these systems. Finding the necessary funding and convincing stakeholders of the long-term benefits can be challenging, particularly in regions with limited financial resources or competing infrastructure priorities.

Opportunity:

⮚ Technological Advancements and Sustainability

The advancement of technology, particularly in the fields of Artificial Intelligence (AI), the Internet of Things (IoT), and sustainable materials and practices, offers exciting opportunities for the APS market. These technological advancements can enhance the overall efficiency and user experience of automated parking systems. AI and IoT can improve system reliability, vehicle identification, and customer interface, reducing errors and wait times. Moreover, energy-efficient components and sustainable construction practices can make APS more environmentally friendly, aligning with the increasing focus on sustainability and green urban planning. These opportunities make APS more attractive for property developers and cities looking to invest in state-of-the-art parking solutions that benefit both their residents and the environment.

Automated Parking Systems Market Segment Overview

By Structure Type

Based on the Structure Type, the market is segmented based on AGV System, Silo System, Tower System, Rail Guided Cart (RGC) System, Puzzle System, and Shuttle System. The AGV System segment was projected to hold the largest market share in the Automated Parking Systems market due to its efficiency in navigating and transporting vehicles within confined spaces, enhancing overall system performance.

Based on the Structure Type, the market is segmented based on AGV System, Silo System, Tower System, Rail Guided Cart (RGC) System, Puzzle System, and Shuttle System. The AGV System segment was projected to hold the largest market share in the Automated Parking Systems market due to its efficiency in navigating and transporting vehicles within confined spaces, enhancing overall system performance.

By Platform Type

Based on the Platform Type, the market has been divided into Palleted and non-palleted. I’m sorry, but there seems to be a misunderstanding in your request. Elbow sleeves and pallets are unrelated products. Elbow sleeves are typically related to sports or medical equipment, while pallets are used for material handling and storage. Please clarify your request, and I’d be happy to provide relevant information.

By End-use

Based on End-use, the market has been divided into Residential, Commercial, and Mixed-use. The Residential segment is expected to hold the largest market share in the Automated Parking Systems market due to the rising need for efficient and space-saving parking solutions in urban residential developments.

Global Automated Parking Systems Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Automated Parking Systems, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America exerts significant dominance in the Automated Parking Systems (APS) market. This supremacy is attributed to several factors, including the region’s high population density, especially in major urban centers, which has driven a strong demand for innovative parking solutions. North America has also been at the forefront of technological advancements, with a robust automotive industry and a well-developed ecosystem for smart city initiatives. Moreover, an increasing emphasis on sustainability and reducing urban congestion has prompted many North American cities to explore APS as a viable solution. With a mature market, established infrastructure, and a growing focus on efficiency and convenience in parking, North America continues to lead in the adoption and deployment of automated parking systems.

Asia Pacific Market

The Asia-Pacific region has been experiencing remarkable growth in the Automated Parking Systems (APS) market. This expansion can be attributed to several factors, including rapid urbanization, a burgeoning middle class, and a surge in vehicle ownership across the region. As urban areas become increasingly congested, there is a pressing need for space-efficient parking solutions. APS, with its ability to maximize parking capacity and reduce land usage, has gained traction as a solution to address these challenges. Additionally, governments and city planners in Asia-Pacific countries are increasingly recognizing the benefits of smart and automated parking systems in terms of reducing traffic congestion and pollution, making them an integral part of their urban development strategies. With a growing focus on technological innovation and urban sustainability, the Asia-Pacific APS market is expected to continue its remarkable growth trajectory.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Skyline Parking AG, Westfalia Parking, Unitronics Ltd, Klaus Multiparking GmbH, and Robotic Parking Systems, Inc. are some of the leading players in the global Automated Parking Systems Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Skyline Parking AG

- Westfalia Parking

- Unitronics Ltd.

- Klaus Multiparking GmbH

- Robotic Parking Systems, Inc.

- City Lift Parking, LLC

- Park Plus Inc.

- Wohr Parking System Pvt. Ltd.

- Parkmatic

- AutoMotion Parking Systems

Key development:

In February of 2022, a collaboration between Nvidia and Jaguar Land Rover was unveiled, aimed at jointly creating software-defined functionalities to enhance autonomous driving capabilities in their vehicles starting in 2025. This strategic alliance places a strong focus on AI-driven features, encompassing advanced visualization and comprehensive monitoring of drivers and occupants through the utilization of Drive IX software.

In January 2022, Fauceria announced its acquisition of a significant 79.5% stake in Hella Electronics. This acquisition serves as part of their strategy to broaden their product range within the automotive technology sector, which includes advanced driver assistance systems (ADAS), radar technologies, electronic power steering solutions, and automated parking systems.

Scope of the Report

Global Automated Parking Systems Market, by Structure Type

- AGV System

- Silo System

- Tower System

- Rail Guided Cart (RGC) System

- Puzzle System

- Shuttle System

Global Automated Parking Systems Market, by Platform Type

- Glassmaking Palleted

- Non-palleted

Global Automated Parking Systems Market, by End-use

- Residential

- Commercial

- Mixed-use

Global Automated Parking Systems Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $14.23 Billion |

| CAGR | 16.27% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Structure Type, Platform Type, End-use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Skyline Parking AG, Westfalia Parking, Unitronics Ltd, Klaus Multiparking GmbH, Robotic Parking Systems, Inc., City Lift Parking, LLC, Park Plus Inc., Wohr Parking System Pvt. Ltd, Parkmatic, AutoMotion Parking Systems |

| Key Market Opportunities | • Technological advancements in AI, IoT, and energy-efficient components. • Growing focus on sustainability and green urban planning. • Adoption of contactless and touchless parking solutions post-COVID-19. |

| Key Market Drivers | • Urbanization and population growth in major cities. • Escalating demand for efficient parking solutions in congested urban areas. • Need to optimize land usage in space-constrained locations. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automated Parking Systems Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automated Parking Systems market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automated Parking Systems market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM)

- for the Global Automated Parking Systems Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Automated Parking Systems market is 2022- 2033

What is the 10-year CAGR (2023 to 2033) of the global Automated Parking Systems market?

The global Automated Parking Systems market is growing at a CAGR of ~27% over the next 10 years

Which region has the highest growth rate in the market of Automated Parking Systems?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Automated Parking Systems?

North America holds the largest share in 2022

Major Key Players in the Market of Automated Parking Systems Manufacturers?

Skyline Parking AG, Westfalia Parking, Unitronics Ltd, Klaus Multiparking GmbH, Robotic Parking Systems, Inc., City Lift Parking, LLC, Park Plus Inc., Wohr Parking System Pvt. Ltd, Parkmatic, AutoMotion Parking Systems.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Structure Type Segement – Market Opportunity Score 4.1.2. Platform Type Segment – Market Opportunity Score 4.1.3. End-use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automated Parking Systems Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automated Parking Systems Market, By Structure Type 7.1. Introduction 7.1.1. AGV System 7.1.2. Silo System 7.1.3. Tower System 7.1.4. Rail Guided Cart (RGC) System 7.1.5. Puzzle System 7.1.6. Shuttle System CHAPTER 8. Global Automated Parking Systems Market, By Platform Type 8.1. Introduction 8.1.1. Palleted 8.1.2. Non-palleted CHAPTER 9. Global Automated Parking Systems Market, By End-use 9.1. Introduction 9.1.1. Residential 9.1.2. Commercial 9.1.3. Mixed-use CHAPTER 10. Global Automated Parking Systems Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Structure Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Platform Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-use, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Skyline Parking AG 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Westfalia Parking 13.3. Unitronics Ltd. 13.4. Klaus Multiparking GmbH 13.5. Robotic Parking Systems, Inc. 13.6. City Lift Parking, LLC 13.7. Park Plus Inc. 13.8. Wohr Parking System Pvt. Ltd. 13.9. Parkmatic 13.10. AutoMotion Parking Systems

Connect to Analyst

Research Methodology