ASIC Chip Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

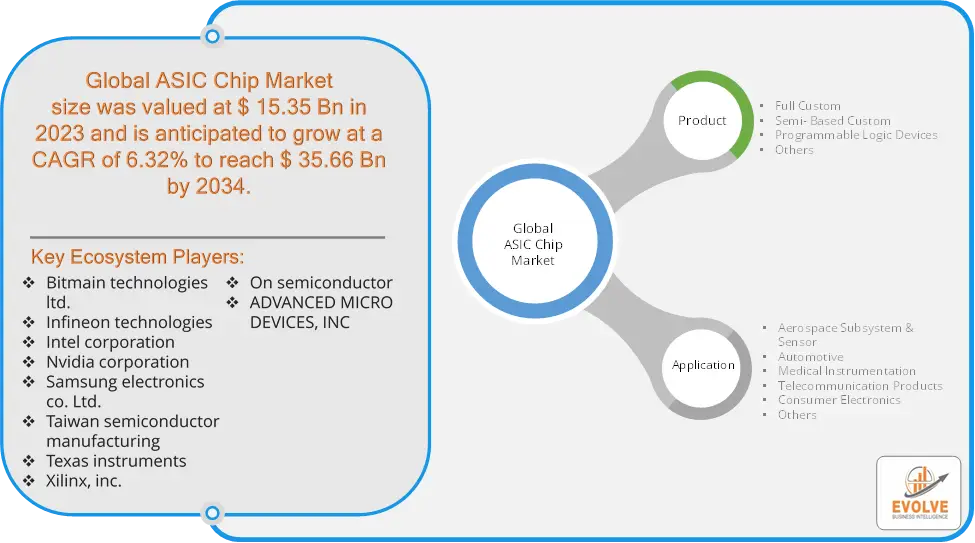

ASIC Chip Market Research Report: Information By Product Type (Full Custom, Semi- Based Custom, Programmable Logic Devices, Others), By Application (Aerospace Subsystem & Sensor, Automotive, Medical Instrumentation, Telecommunication Products, Consumer Electronics, Others), and by Region — Forecast till 2034

Page: 163

ASIC Chip Market Overview

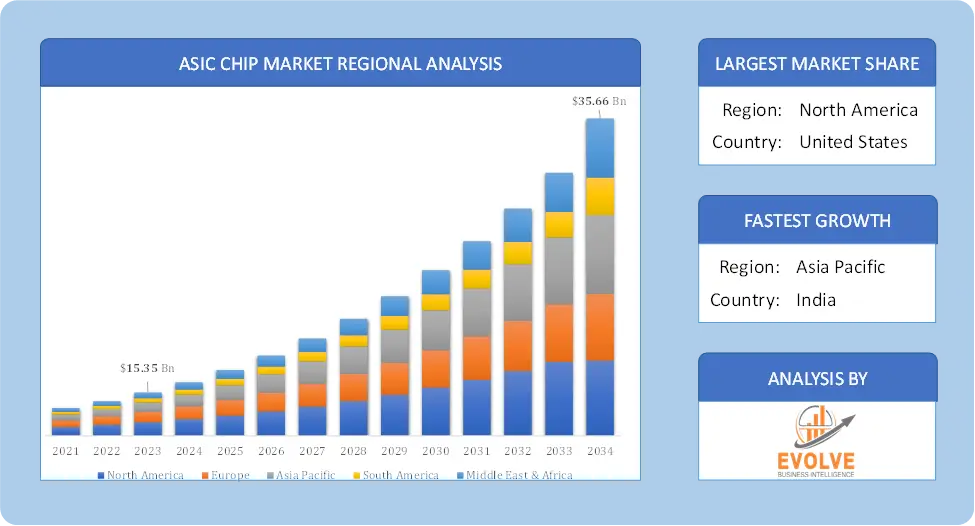

The ASIC Chip Market size accounted for USD 15.35 Billion in 2023 and is estimated to account for 16.96 Billion in 2024. The Market is expected to reach USD 35.66 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.32% from 2024 to 2034. Custom-built integrated circuits meant for particular applications rather than general-purpose use are the focus of the ASIC (Application-Specific Integrated Circuit) chip market. These chips are designed to do specific functions such consumer electronics, telecommunications, AI processing, and cryptography. When manufactured in large quantities, ASICs provide better performance, lower power consumption, and cheaper unit costs than general-purpose processors like CPUs or GPUs. They are frequently utilized in data centers, the automobile industry, and the healthcare sector. The market is expanding because to the rising demand for IoT devices, 5G technologies, and AI/ML applications.

Global ASIC Chip Market Synopsis

ASIC Chip Market Dynamics

ASIC Chip Market Dynamics

The major factors that have impacted the growth of ASIC Chip are as follows:

Drivers:

Ø Growing Demand for AI and Machine Learning (ML) Applications

The need for specialized hardware to handle the enormous volumes of data and intricate algorithms has increased with the growth of artificial intelligence (AI) and machine learning. Large-scale data centers and edge computing devices require higher data processing rates, lower latency, and greater power efficiency, which ASICs, which are specifically developed for AI/ML activities, offer over general-purpose processors.

Restraint:

- High Risk of Obsolescence

The semiconductor industry is seeing significant technological breakthroughs, which raises the possibility of ASIC obsolescence. An ASIC design cannot be readily modified or altered once it has been finalized. ASICs may go out of date before they ever reach full production in areas like consumer electronics or telecommunications that experience rapid innovation, particularly if new standards, protocols, or features are introduced. This high risk of obsolescence acts as a major disincentive to businesses that require adaptability to change in the ever evolving technology landscape.

Opportunity:

⮚ Expansion in AI and Machine Learning (ML) Applications

Significant prospects exist for ASICs due to the need for specialized hardware to handle AI and machine learning workloads. Certain AI workloads, such neural network processing, picture recognition, and natural language processing, can be expedited by optimizing ASICs. They function faster and more energy-efficiently than general-purpose processors, which makes them indispensable for large-scale AI deployments in autonomous systems, data centers, and cloud computing platforms. The need for ASICs designed specifically for AI workloads will increase as AI continues to spread into industries like healthcare, finance, retail, and automotive, offering a sizable market opportunity.

ASIC Chip Segment Overview

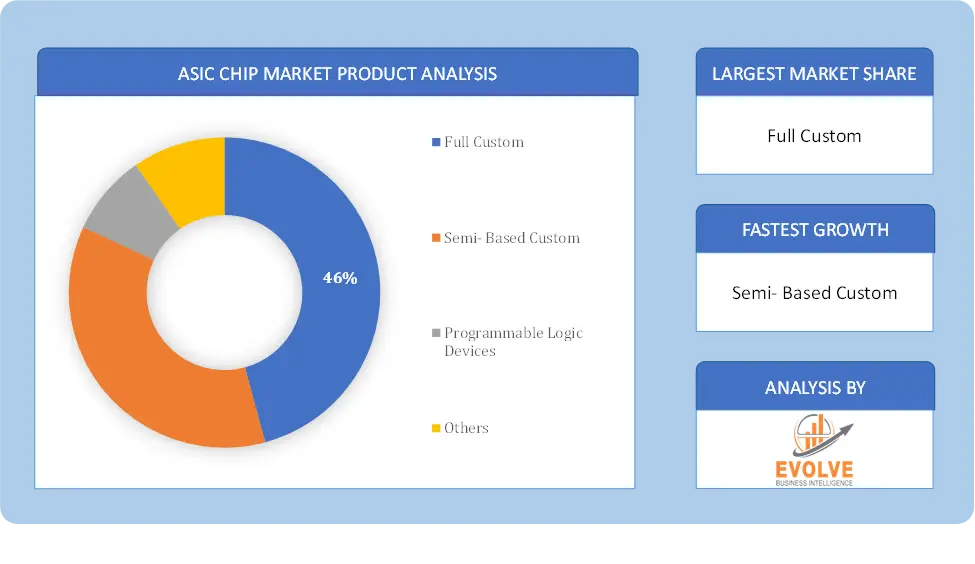

By Product Type

Based on Product Type, the market is segmented based on Full Custom, Semi- Based Custom, Programmable Logic Devices, Others. the semi-custom segment dominates as it offers a balance between customization and cost-efficiency, allowing for faster design cycles and lower development costs compared to full custom ASICs while still offering tailored performance.

Based on Product Type, the market is segmented based on Full Custom, Semi- Based Custom, Programmable Logic Devices, Others. the semi-custom segment dominates as it offers a balance between customization and cost-efficiency, allowing for faster design cycles and lower development costs compared to full custom ASICs while still offering tailored performance.

By Application

Based on Applications, the market has been divided into the Aerospace Subsystem & Sensor, Automotive, Medical Instrumentation, Telecommunication Products, Consumer Electronics, Others. the consumer electronics segment dominates due to the high demand for custom chips in devices such as smartphones, tablets, and gaming consoles, driven by the need for energy efficiency and enhanced performance in compact devices.

Global ASIC Chip Market Regional Analysis

Based on region, the global ASIC Chip market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the ASIC Chip market followed by the Asia-Pacific and Europe regions.

ASIC Chip North America Market

ASIC Chip North America Market

North America holds a dominant position in the ASIC Chip Market. Due to the rapidly growing demand for energy-efficient devices and the increasing ubiquity of smartphones in the region, the Asia Pacific application-specific integrated circuit market is expected to dominate. This will accelerate the expansion of the market in this area. Furthermore, in the Asia-Pacific area, the application-specific integrated circuit market with the most market share belonged to China, while the one with the quickest growth was India.

ASIC Chip Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the ASIC Chip industry. The market for application-specific integrated circuits is anticipated to expand at the quickest rate in North America between 2024 and 2032. The substantial presence of well-known companies in the region, including as Texas Instruments Inc., Qualcomm Inc., Intel Corporation, and Maxim Integrated Products Inc., is credited with the rise.

Competitive Landscape

The global ASIC Chip market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bitmain technologies ltd.

- Infineon technologies

- Intel corporation

- Nvidia corporation

- Samsung electronics co. Ltd.

- Taiwan semiconductor manufacturing

- Texas instruments

- Xilinx, inc.

- On semiconductor

- ADVANCED MICRO DEVICES, INC.

Key Development

In June 2021, According to Taiwan-based IC design houses, the impending release of new 5G-enabled models, especially by Chinese brands, has given them hope for their smartphone application shipments in the third quarter of 2021. Given that bids for 5G chips are often higher than those for 4G applications, the majority of IC vendors anticipate that their order volumes will rise by more than 10% sequentially in the third quarter. Related vendors’ revenues will also see notable increases. Additionally, the analog integrated circuit suppliers stressed that their 2021 5G chip shipping targets stay the same because they anticipate an exponential increase in the number of 5G phones shipped globally in 2021 and 2022.

Scope of the Report

Global ASIC Chip Market, by Product

- Full Custom

- Semi- Based Custom

- Programmable Logic Devices

- Others

Global ASIC Chip Market, by Application

- Aerospace Subsystem & Sensor

- Automotive

- Medical Instrumentation

- Telecommunication Products

- Consumer Electronics

- Others

Global ASIC Chip Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $35.66 Billion |

| CAGR | 6.32% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Bitmain technologies ltd., Infineon technologies, Intel corporation, Nvidia corporation, Samsung electronics co. Ltd., Taiwan semiconductor manufacturing, Texas instruments, Xilinx, inc., On semiconductor, ADVANCED MICRO DEVICES, INC |

| Key Market Opportunities | • The growing demand for healthier food options • The rise of e-commerce and online food delivery platforms |

| Key Market Drivers | • Technological Advancements • Increasing Urbanization |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future ASIC Chip market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- ASIC Chip market historical market size for the year 2022, and forecast from 2021 to 2034

- ASIC Chip market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global ASIC Chip market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global ASIC Chip market is 2021- 2034

What is the growth rate of the global ASIC Chip market?

The global ASIC Chip market is growing at a CAGR of 6.32% over the next 10 years

Which region has the highest growth rate in the market of ASIC Chip?

North America is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the global ASIC Chip market?

Asia Pacific holds the largest share in 2023

Who are the key players in the global ASIC Chip market?

Bitmain technologies ltd., Infineon technologies, Intel corporation, Nvidia corporation, Samsung electronics co. Ltd., Taiwan semiconductor manufacturing, Texas instruments, Xilinx, inc., On semiconductor, and ADVANCED MICRO DEVICES, INC. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on ASIC Chip Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global ASIC Chip Market, By Product Type 6.1. Introduction 6.2. Full Custom 6.3. Semi- Based Custom 6.3. Programmable Logic Devices 6.4. Others Chapter 7. Global ASIC Chip Market, By Application 7.1. Introduction 7.2. Aerospace Subsystem & Sensor 7.3. Automotive 7.4. Medical Instrumentation 7.5. Telecommunication Products 7.6. Consumer Electronics 7.7. Others Chapter 8. Global ASIC Chip Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Bitmain technologies ltd. 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Infineon technologies 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Intel corporation 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Nvidia corporation 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Samsung electronics co. Ltd. 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Taiwan semiconductor manufacturing 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Texas instruments 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Xilinx, inc. 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. On semiconductor 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Advanced Micro Devices, Inc. 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology