Animal Feed Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Animal Feed Market Research Report: By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Amino Acids, Vitamins, Minerals, Others), By Form (Pellets, Crumbles, Mash, Others), By Species (Swine, Ruminants, Poultry, Aquaculture, Others), and by Region — Forecast till 2033

Animal Feed Market Overview

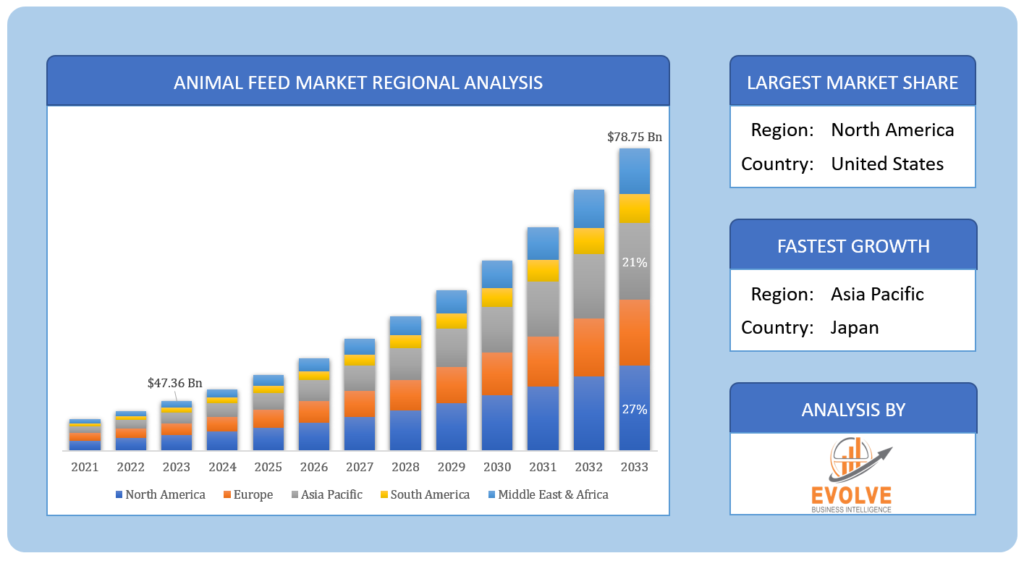

The Animal Feed Market Size is expected to reach USD 47.36 Billion by 2033. The Animal Feed industry size accounted for USD 78.75 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.86% from 2023 to 2033. Animal feed refers to a nutritionally balanced mixture of various ingredients, such as grains, protein sources, vitamins, minerals, and additives, formulated to provide essential nutrients for domesticated animals and livestock. It serves as a primary source of sustenance, supporting their growth, health, and productivity. Animal feed comes in various forms, including pellets, powders, and granules, tailored to meet the specific dietary requirements of different animal species and production stages. Properly designed and regulated animal feed plays a critical role in ensuring the well-being and optimal performance of animals, enhancing their ability to produce meat, milk, eggs, or other animal-derived products efficiently and sustainably.

Global Animal Feed Market Synopsis

The COVID-19 pandemic had a profound and lasting impact on the Animal Feed market. The disruption caused by the pandemic in global supply chains, transportation, and labor availability led to fluctuations in feed ingredient prices and availability. Lockdowns and restrictions affected feed production and distribution, causing challenges in maintaining the supply chain for livestock and poultry farmers. Additionally, changes in consumer behavior and food demand patterns during the pandemic influenced the composition and demand for animal feed, with some sectors experiencing increased demand (e.g., pet food) while others faced reduced consumption (e.g., feed for animals in the hospitality industry). Despite these challenges, the pandemic also highlighted the importance of resilient and sustainable supply chains, accelerating investments in advanced technologies and innovations in the animal feed industry to enhance production efficiency and adaptability for future disruptions.

Global Animal Feed Market Dynamics

The major factors that have impacted the growth of Animal Feed are as follows:

Drivers:

⮚ Growing Global Population and Rising Demand for Animal Protein

As the global population continues to grow, so does the demand for animal protein, such as meat, dairy, and eggs. This increasing demand for animal-based products drives the need for high-quality and nutritionally balanced animal feed to support livestock and poultry production, creating a significant driver for the Animal Feed market.

Restraint:

- Fluctuating Prices of Feed Ingredients

The Animal Feed market faces the restraint of fluctuating prices of feed ingredients, such as grains, oilseeds, and other essential nutrients. Market volatility, climate-related factors, and geopolitical events can impact the availability and cost of feed ingredients, leading to unpredictable expenses for feed manufacturers and livestock farmers.

Opportunity:

⮚ Rising Focus on Sustainable and Healthy Feed Solutions

There is a growing opportunity in the Animal Feed market for sustainable and healthy feed solutions. Consumers’ increasing awareness of animal welfare, environmental sustainability, and food safety has encouraged the development and adoption of feed formulations that reduce the environmental footprint, incorporate alternative protein sources, and enhance animal health and performance, aligning with the principles of responsible and ethical farming practices.

Animal Feed Market Segment Overview

By Type

Based on the Type, the market is segmented based on Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Amino Acids, Vitamins, Minerals, and Others. The Acidifiers segment was projected to hold the largest market share in the Animal Feed market due to their potential to improve feed efficiency, promote growth, and support animal health by maintaining a balanced gastrointestinal pH and preventing the growth of harmful bacteria in the digestive tract.

By Form

Based on the Form, the market has been divided into Pellets, Crumbles, Mash, and Others. The Pellets segment is expected to hold the largest market share in the Animal Feed market due to their convenience, better feed conversion rate, reduced feed wastage, and improved storage and handling properties making them a preferred choice for efficient and cost-effective animal feeding.

By Species

Based on Species, the market has been divided into Swine, Ruminants, Poultry, Aquaculture, and Others. The Swine segment is expected to hold the largest market share in the Animal Feed market due to the high demand for specialized and nutritionally balanced feed formulations to support the growth and productivity of swine in the global pork industry.

Based on Species, the market has been divided into Swine, Ruminants, Poultry, Aquaculture, and Others. The Swine segment is expected to hold the largest market share in the Animal Feed market due to the high demand for specialized and nutritionally balanced feed formulations to support the growth and productivity of swine in the global pork industry.

Global Animal Feed Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Animal Feed, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America has consistently maintained a significant market share in the Animal Feed market due to several factors. Firstly, the region’s large and well-developed livestock and poultry industries drive substantial demand for animal feed to support the production of meat, dairy, and other animal-based products. Secondly, the region’s advanced agricultural practices and high adoption of technological innovations have led to increased productivity and efficiency in feed production. Additionally, a growing focus on animal health, welfare, and nutrition has spurred the demand for premium and specialized feed formulations. Furthermore, North America’s stable and well-regulated food safety standards have encouraged the use of high-quality and safe feed ingredients, further boosting the market’s growth. Overall, the region’s dynamic and diverse agricultural landscape, coupled with a strong commitment to sustainable and responsible farming practices, continues to position North America as a key player in the global Animal Feed market.

Asia Pacific Market

The Animal Feed industry in the Asia-Pacific region has been witnessing remarkable growth in recent years. The region’s increasing population, rising income levels, and shifting dietary preferences towards animal-based protein have fueled the demand for livestock and poultry products. As a result, there is a growing need for nutritionally balanced and cost-effective animal feed to support the expansion of the livestock industry. Additionally, rapid urbanization and industrialization have led to advancements in animal husbandry practices, driving the adoption of modern feed technologies and management systems. Moreover, favorable government policies, foreign investments, and collaborations with global feed manufacturers have further contributed to the industry’s growth in the Asia-Pacific region. With a strong focus on sustainable and efficient animal production, the region’s Animal Feed market is expected to continue its upward trajectory, catering to the increasing demand for safe and high-quality animal-derived products.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Adisseo, Ajinomoto Co Inc, ADM, BASF SE, and BIOMIN Holding GmbH are some of the leading players in the global Animal Feed Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Adisseo

- Ajinomoto Co Inc

- ADM

- BASF SE

- BIOMIN Holding GmbH

- Cargill, Incorporated

- Hansen Holding A/S

- DuPont

- DSM

- Elanco

Key development:

In January 2022, ADM launched an Aquaculture Innovation Lab at the Animal Nutrition Technology Centre (ANTC) based in Decatur, Illinois. This addition complements ADM’s existing aquaculture research facilities in Brazil, Mexico, and Vietnam, extending the company’s global research and development capabilities to a new domain. The newly established lab aims to enhance efforts in developing state-of-the-art nutrition solutions on a global level, further reinforcing ADM’s commitment to innovation in the aquaculture industry.

Scope of the Report

Global Animal Feed Market, by Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Amino Acids

- Vitamins

- Minerals

- Others

Global Animal Feed Market, by Form

- Pellets

- Crumbles

- Mash

- Others

Global Animal Feed Market, by Species

- Swine

- Ruminants

- Poultry

- Aquaculture

- Others

Global Animal Feed Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $47.36 Billion |

| CAGR | 4.86% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Form, Species |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Adisseo, Ajinomoto Co Inc, ADM, BASF SE, BIOMIN Holding GmbH, Cargill, Incorporated, Chr. Hansen Holding A/S, DuPont, DSM, Elanco |

| Key Market Opportunities | • Growing focus on sustainable and healthy feed solutions to meet consumer demand for responsible and ethical farming practices. |

| Key Market Drivers | • Increasing global demand for animal-based protein products leads to a rising need for high-quality and nutritionally balanced animal feed. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Animal Feed Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Animal Feed market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Animal Feed market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Animal Feed Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Animal Feed market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Animal Feed market?

The global Animal Feed market is growing at a CAGR of ~86% over the next 10 years

Which region has the highest growth rate in the market of Animal Feed?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Animal Feed?

North America holds the largest share in 2022

Major Key Players in the Market of Animal Feed Manufacturers?

Adisseo, Ajinomoto Co Inc, ADM, BASF SE, BIOMIN Holding GmbH, Cargill, Incorporated, Chr. Hansen Holding A/S, DuPont, DSM, Elanco.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Form Segment – Market Opportunity Score 4.1.3. Species Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Animal Feed Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Animal Feed Market, By Type 7.1. Introduction 7.1.1. Acidifiers 7.1.2. Probiotics 7.1.3. Enzyme 7.1.4. Antioxidants 7.1.5. Antibiotics 7.1.6. Amino Acids 7.1.7. Vitamins 7.1.8. Minerals 7.1.9. Others CHAPTER 8. Global Animal Feed Market, By Form 8.1. Introduction 8.1.1. Pellets 8.1.2. Crumbles 8.1.3. Mash 8.1.4. Others CHAPTER 9. Global Animal Feed Market, By Species 9.1. Introduction 9.1.1. Swine 9.1.2. Ruminants 9.1.3. Poultry 9.1.4. Aquaculture 9.1.5. Others CHAPTER 10. Global Animal Feed Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Adisseo 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Ajinomoto Co Inc 13.3. ADM 13.4. BASF SE 13.5. BIOMIN Holding GmbH 13.6. Cargill Incorporated 13.7. Chr. Hansen Holding A/S 13.8. DuPont 13.9. DSM 13.10. Elanco

Connect to Analyst

Research Methodology