Analog IC Market Overview

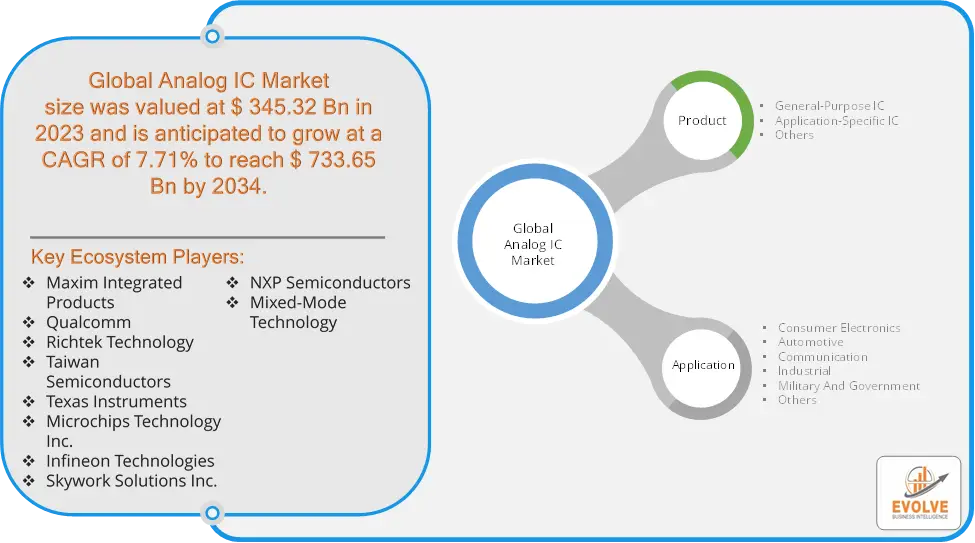

The Analog IC Market size accounted for USD 345.32 Billion in 2023 and is estimated to account for 365.20 Billion in 2024. The Market is expected to reach USD 733.65 Billion by 2034 growing at a compound annual growth rate (CAGR) of 7.71% from 2024 to 2034. The Analog IC (Integrated Circuit) Market refers to the global industry involved in the design, production, and sales of analog integrated circuits, which process continuous signals (as opposed to digital ICs that process discrete signals). Analog ICs are crucial components in many electronic devices, as they handle real-world data like sound, light, temperature, and pressure, converting these signals into digital data for processing.

The analog IC market is expected to continue growing, driven by technological advancements and increasing demand across various industries. These circuits are used across industries such as consumer electronics, automotive, telecommunications, healthcare, and industrial automation. With the growing adoption of IoT, 5G, electric vehicles, and smart devices, demand for Analog ICs has been rising.

Global Analog IC Market Synopsis

Analog IC Market Dynamics

Analog IC Market Dynamics

The major factors that have impacted the growth of Analog IC Market are as follows:

Drivers:

Ø 5G and Telecommunications Growth

The rollout of 5G technology demands more sophisticated analog ICs for radio frequency (RF) front-end components, signal processing, and power amplifiers in base stations and mobile devices. Analog ICs are used in solar panels, wind turbines, and energy storage systems for monitoring and managing energy conversion and distribution, driving demand in the renewable energy sector. Analog ICs play a crucial role in sensor interfaces, motor control, and power management in factories, automated systems, and robotics, which are experiencing rapid growth due to Industry 4.0 initiatives.

Restraint:

- Perception of High Competition and Price Pressure

Intense competition among major players like Texas Instruments, Analog Devices, and Infineon Technologies creates significant price pressure. To remain competitive, companies may be forced to lower prices, which can affect profit margins and slow down investment in research and development (R&D). As digital IC technologies (like microcontrollers and FPGAs) continue to advance, some functions traditionally performed by analog ICs are being integrated into digital components. This shift could reduce the demand for standalone analog ICs in certain applications.

Opportunity:

⮚ Growing Internet of Things (IoT) Ecosystem

The expansion of IoT across industries, including smart homes, cities, agriculture, healthcare, and manufacturing, drives demand for analog ICs in sensors, communication modules, and power management systems. With billions of connected devices expected in the coming years, this represents a large growth opportunity. The development of autonomous driving technology and advanced driver-assistance systems (ADAS) creates a strong demand for analog ICs that manage data from cameras, radars, LiDAR, and other sensors used in vehicle control and safety systems.

Analog IC Market Segment Overview

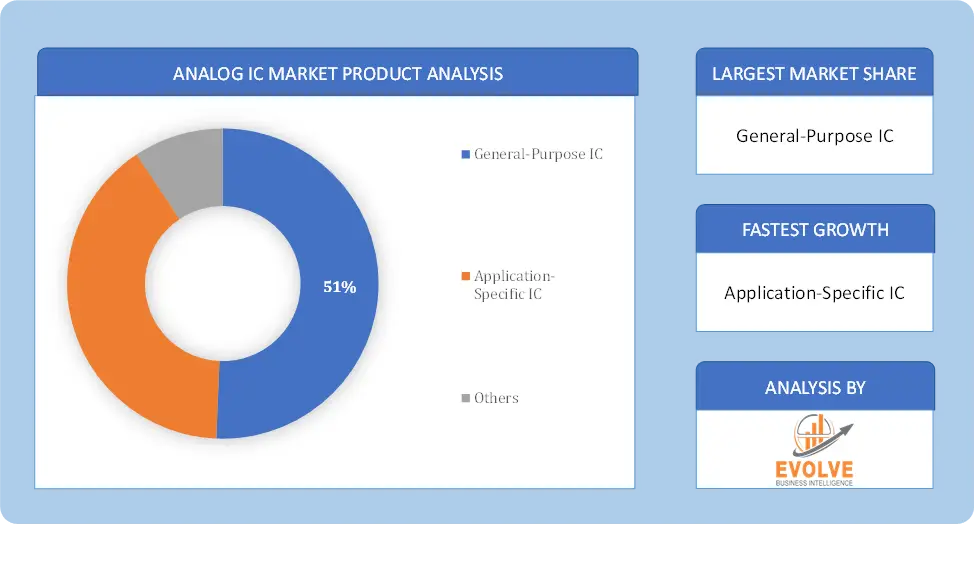

By Product Type

Based on Product Type, the market is segmented based on General-Purpose IC, Application-Specific IC and Others. The Application-Specific IC segment dominant the market. This is the larger segment of the Analog Integrated Circuit Market expected to experience steady growth due to the increasing demand for customized functionalities in various applications, especially in the automotive and industrial sectors.

Based on Product Type, the market is segmented based on General-Purpose IC, Application-Specific IC and Others. The Application-Specific IC segment dominant the market. This is the larger segment of the Analog Integrated Circuit Market expected to experience steady growth due to the increasing demand for customized functionalities in various applications, especially in the automotive and industrial sectors.

By Application

Based on Application, the market segment has been divided into Consumer Electronics, Automotive, Communication, Industrial, Military And Government and Others. The consumer electronics segment dominant the market. These products include smartphones, televisions, laptops, and other consumer electronics devices, which have led to the rapid growth of this segment.

Global Analog IC Market Regional Analysis

Based on region, the global Analog IC Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Analog IC Market followed by the Asia-Pacific and Europe regions.

Analog IC North America Market

North America holds a dominant position in the Analog IC Market. North America, particularly the U.S., is a major market for analog ICs due to its strong presence in industries like automotive, consumer electronics, aerospace, and telecommunications. The region is also a leader in 5G infrastructure development and IoT adoption, both of which are key growth drivers for analog ICs and increasing demand for electric vehicles (EVs) and renewable energy systems further boosts the need for power management ICs and data converters.

Analog IC Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Analog IC Market industry. Countries like China, Japan, South Korea, and Taiwan being major hubs for consumer electronics manufacturing and automotive production. The region also has a high concentration of semiconductor foundries and manufacturing facilities and the rapid adoption of 5G, IoT, industrial automation, and smart devices in APAC countries creates significant demand for analog ICs. Additionally, the growing middle class in countries like India and Southeast Asia is driving demand for consumer electronics and home automation products.

Competitive Landscape

The global Analog IC Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Maxim Integrated Products

- Qualcomm

- Richtek Technology

- Taiwan Semiconductors

- Texas Instruments

- Microchips Technology Inc.

- Infineon Technologies

- Skywork Solutions Inc.

- NXP Semiconductors

- Mixed-Mode Technology

Key Development

In November 2021, Nuvoton Technology Corporation Japan released third-generation enhanced functional safety battery monitoring ICs (BM-ICs) for automotive battery management systems (BMS). With copies of the battery cell input terminal, multiplexer, and AD converter in a single IC, their novel BM-ICs can detect a variety of battery cell irregularities and BMS failures.

Scope of the Report

Global Analog IC Market, by Product Type

- General-Purpose IC

- Application-Specific IC

- Others

Global Analog IC Market, by Application

- Consumer Electronics

- Automotive

- Communication

- Industrial

- Military And Government

- Others

Global Analog IC Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $733.65 Billion |

| CAGR | 7.71% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Maxim Integrated Products, Qualcomm, Richtek Technology, Taiwan Semiconductors, Texas Instruments, Microchips Technology Inc., Infineon Technologies, Skywork Solutions Inc., NXP Semiconductors and Mixed-Mode Technology. |

| Key Market Opportunities | • Growing Internet of Things (IoT) Ecosystem • Autonomous Vehicles and ADAS Systems |

| Key Market Drivers | • 5G and Telecommunications Growth • Rising Adoption of Renewable Energy Systems |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Analog IC Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Analog IC Market historical market size for the year 2021, and forecast from 2023 to 2033

- Analog IC Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Analog IC Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.