Alcoholic Soft Drinks Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Alcoholic Soft Drinks Market Research Report: Information By Product Type (Beer-Based Soft Drinks, Cider-Based Soft Drinks, Spirit-Based Soft Drinks), By Distribution Channel (Bars, Pubs And Restaurants, Retail Stores, Online Platforms), and by Region — Forecast till 2033

Page: 218

Alcoholic Soft Drinks Market Overview

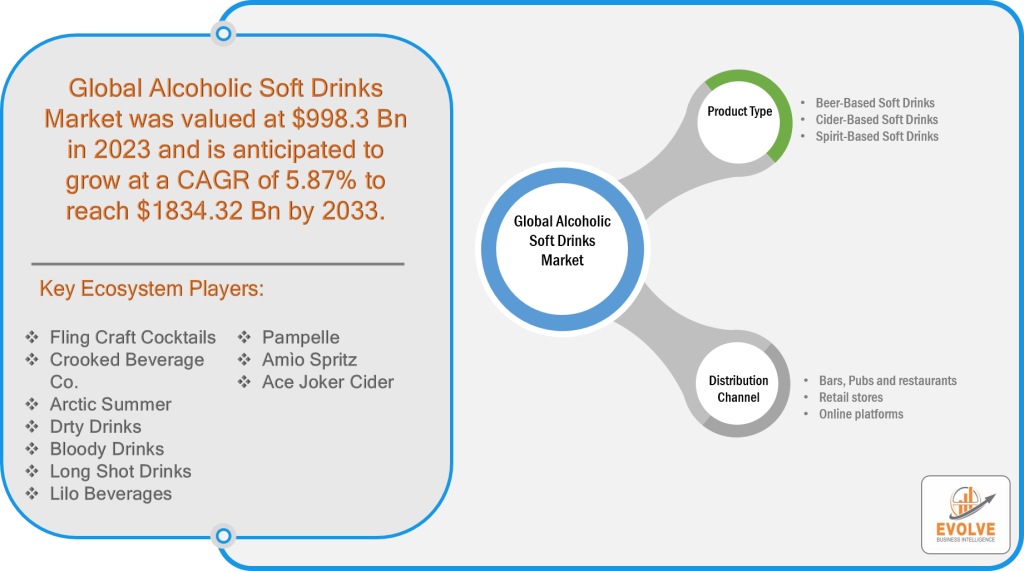

The Alcoholic Soft Drinks Market Size is expected to reach USD 1834.32 Billion by 2033. The Alcoholic Soft Drinks industry size accounted for USD 998.3 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.87% from 2023 to 2033. “Alcoholic soft drinks” refer to a category of beverages that blend elements of traditional soft drinks with alcoholic content, resulting in a product that combines the refreshing characteristics of non-alcoholic beverages with the inclusion of alcohol. These drinks typically contain a lower alcohol content compared to traditional alcoholic beverages such as spirits, wines, or beers, and are often designed to provide a milder and more approachable drinking experience. Alcoholic soft drinks may incorporate a range of flavors, carbonation, and sweeteners to enhance the overall taste and appeal to a broader consumer base.

Global Alcoholic Soft Drinks Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had substantial implications for the Alcoholic Soft Drinks market. The industry experienced significant disruptions due to various factors, including widespread lockdown measures, restrictions on social gatherings and entertainment venues, and changes in consumer behavior. With bars, restaurants, and nightlife establishments forced to close or operate at reduced capacity, the demand for Alcoholic Soft Drinks declined significantly. Additionally, the shift towards remote work, social distancing, and health concerns prompted individuals to prioritize health-conscious choices and reduce alcohol consumption. This led to decreased sales and production volumes, financial challenges for businesses in the sector, and a slowdown in innovation and product launches. The Alcoholic Soft Drinks market had to adapt to changing market dynamics, explore online sales channels, and introduce new offerings to cater to evolving consumer preferences.

Alcoholic Soft Drinks Market Dynamics

The major factors that have impacted the growth of Alcoholic Soft Drinks are as follows:

Drivers:

Changing Consumer Preferences

One of the key drivers for the Alcoholic Soft Drinks market is the evolving consumer preferences towards beverages that offer a milder and more approachable drinking experience. Consumers are increasingly seeking alternatives to traditional alcoholic beverages that provide unique flavors, lower alcohol content, and innovative formulations. Alcoholic Soft Drinks fulfill this demand by offering a wide range of flavors, carbonation, and sweetness, appealing to those looking for a more refreshing and enjoyable drinking experience.

Restraint:

Stringent Regulations

The Alcoholic Soft Drinks market faces restraints due to the regulatory environment governing the production, distribution, and marketing of alcoholic beverages. The sector is subject to strict regulations and policies regarding alcohol content, labeling, advertising, and age restrictions, which can pose challenges for market players. Compliance with these regulations adds complexity and costs to the development and sale of Alcoholic Soft Drinks, potentially limiting the market’s growth and expansion.

Opportunity:

Increasing Health Consciousness

The growing trend of health consciousness among consumers presents a significant opportunity for the Alcoholic Soft Drinks market. As individuals become more mindful of their alcohol consumption and seek healthier beverage options, Alcoholic Soft Drinks can position themselves as a viable choice. By offering lower alcohol content, natural ingredients, and reduced sugar levels, these drinks cater to health-conscious consumers who still want to indulge in a social drinking experience. The ability to tap into this market segment can lead to increased sales and market share for Alcoholic Soft Drinks manufacturers.

Alcoholic Soft Drinks Segment Overview

By Product Type

Based on Product Type, the market is segmented based on Beer-Based Soft Drinks, Cider-Based Soft Drinks, and Spirit-Based Soft Drinks. The Spirit-Based Soft Drinks segment is poised for substantial growth in the Alcoholic Soft Drinks market during the forecast period. This segment combines the flavors and characteristics of spirits with the refreshing attributes of soft drinks, providing consumers with a unique and enticing drinking experience. Spirit-Based Soft Drinks offer a diverse range of options, including premixed cocktails, spirit-infused sodas, and flavored alcoholic beverages, catering to different taste preferences and occasions. The convenience and ready-to-drink nature of these products appeals to consumers seeking convenience and novelty in their beverage choices.

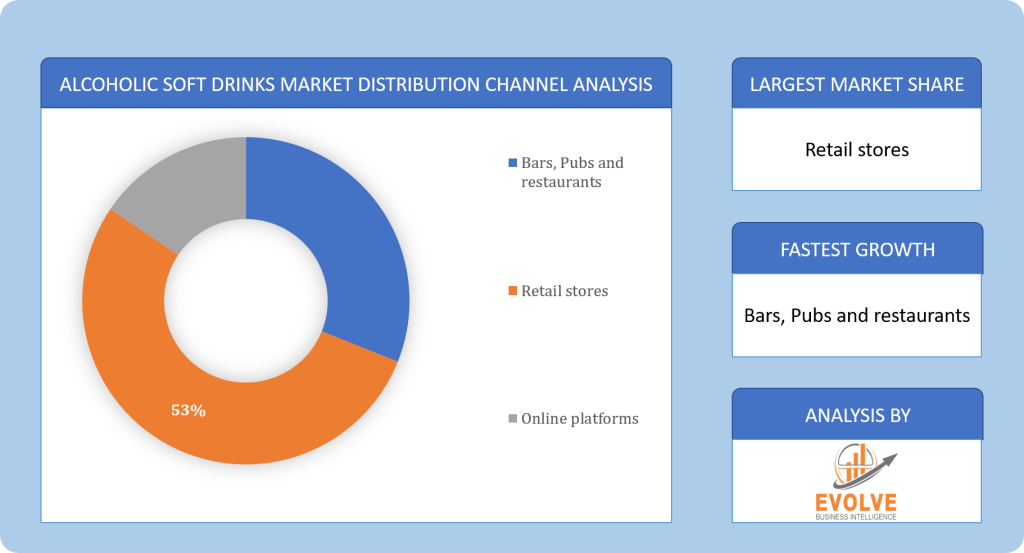

By Distribution Channel

Based on Distribution Channel, the market has been divided into Bars, Pubs and restaurants, Retail stores, and Online platforms. Retail stores dominate the Alcoholic Soft Drinks Market. Retail stores, including supermarkets, convenience stores, and liquor stores, have traditionally been the primary avenue for consumers to purchase Alcoholic Soft Drinks. These stores offer a wide range of products, including various brands, flavors, and packaging options, providing consumers with convenience and choice.

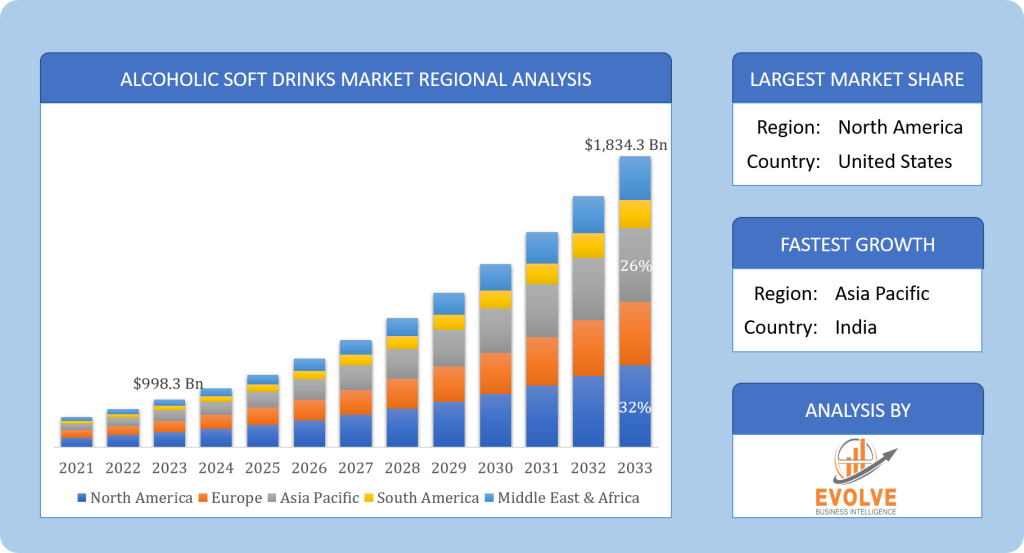

Global Alcoholic Soft Drinks Market Regional Analysis

Based on region, the global Alcoholic Soft Drinks market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Alcoholic Soft Drinks market followed by the Asia-Pacific and Europe regions.

North America Market

North America is a thriving market for Alcoholic Soft Drinks products, driven by factors such as changing consumer preferences, a desire for innovative beverage options, and well-established distribution networks. The region’s consumers are increasingly seeking unique and refreshing alcoholic beverages that provide a distinct drinking experience. Alcoholic Soft Drinks cater to this demand by offering a wide range of flavors, lower alcohol content, and creative formulations. The presence of a strong consumer base, coupled with the influence of social trends like home entertaining and mixology, has contributed to the market’s growth. Additionally, North America benefits from a well-developed infrastructure for retail and e-commerce, providing convenient access to Alcoholic Soft Drinks for consumers. As a result, the region continues to offer significant opportunities for manufacturers and retailers operating in the Alcoholic Soft Drinks market.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Alcoholic Soft Drinks market. This can be attributed to several factors that have contributed to the region’s rapid growth in recent years. First and foremost, there has been a significant shift in consumer preferences and an increasing acceptance of alcoholic beverages that offer a milder and more approachable drinking experience. Alcoholic Soft Drinks cater to this demand by providing a variety of flavors, lower alcohol content, and unique formulations that resonate with Asian consumers. Additionally, rising disposable incomes, urbanization, and changing lifestyles have led to an increase in socializing and a growing demand for innovative and premium alcoholic beverages. The region’s large population, particularly in countries such as China and India, presents a vast consumer base, further fueling the market’s growth potential.

Competitive Landscape

The global Alcoholic Soft Drinks market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Fling Craft Cocktails

- Crooked Beverage Co.

- Arctic Summer

- Drty Drinks

- Bloody Drinks

- Long Shot Drinks

- Lilo Beverages

- Pampelle

- Amìo Spritz

- Ace Joker Cider

Key Development

In April 2023, Crooked Beverage Company entered into a partnership with Capitol Beverage Sales, a prominent beverage distributor in Minnesota. This collaboration aims to support the company’s widespread market adoption. Capitol Beverage Sales, known for its extensive sales and distribution network, represents some of the most well-known brands in the country. The agreement with Capitol Beverage Sales will provide Crooked Beverage Company with enhanced opportunities to expand its presence in the mainstream market.

Scope of the Report

Global Alcoholic Soft Drinks Market, by Product Type

- Beer-Based Soft Drinks

- Cider-Based Soft Drinks

- Spirit-Based Soft Drinks

Global Alcoholic Soft Drinks Market, by Distribution Channel

- Bars, Pubs, and restaurants

- Retail stores

- Online platforms

Global Alcoholic Soft Drinks Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 1,834.2 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 5.87% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Distribution Channel |

| Key Market Opportunities | Growing Middle-Class and Urbanization |

| Key Market Drivers | Shifting Consumer Preferences |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Fling Craft Cocktails, Crooked Beverage Co, Arctic Summer, Drty Drinks, Bloody Drinks, Long Shot Drinks, Lilo Beverages, Pampelle, Amìo Spritz, Ace Joker Cider |

Report Content Brief:

- High-level analysis of the current and future Alcoholic Soft Drinks market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Alcoholic Soft Drinks market historical market size for the year 2021, and forecast from 2023 to 2033

- Alcoholic Soft Drinks market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Alcoholic Soft Drinks market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Alcoholic Soft Drinks market is 2021- 2033

What is the growth rate of the global Alcoholic Soft Drinks market?

The global Alcoholic Soft Drinks market is growing at a CAGR of 5.87% over the next 10 years

Which region has the highest growth rate in the market of Alcoholic Soft Drinks?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Alcoholic Soft Drinks market?

North America holds the largest share in 2022

Who are the key players in the global Alcoholic Soft Drinks market?

Fling Craft Cocktails, Crooked Beverage Co, Arctic Summer, Drty Drinks, Bloody Drinks, Long Shot Drinks, Lilo Beverages, Pampelle, Amìo Spritz, Ace Joker Cider are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Alcoholic Soft Drinks Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Alcoholic Soft Drinks Market 4.8. Import Analysis of the Alcoholic Soft Drinks Market 4.9. Export Analysis of the Alcoholic Soft Drinks Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Alcoholic Soft Drinks Market, By Product Type 6.1. Introduction 6.2. Beer-Based Soft Drinks 6.3. Cider-Based Soft Drinks 6.4. Spirit-Based Soft Drinks Chapter 7. Global Alcoholic Soft Drinks Market, By Distribution Channel 7.1. Introduction 7.2. Bars, Pubs and restaurants 7.3. Retail stores 7.4. Online platforms Chapter 8. Global Alcoholic Soft Drinks Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Fling Craft Cocktails, 2023-2033 8.2.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Distribution Channel, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Fling Craft Cocktails 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Crooked Beverage Co. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Arctic Summer 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Drty Drinks 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Bloody Drinks 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Long Shot Drinks 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Lilo Beverages 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Pampelle 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Amìo Spritz 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Ace Joker Cider 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology