Airport Biometrics Market Analysis and Global Forecast 2021-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

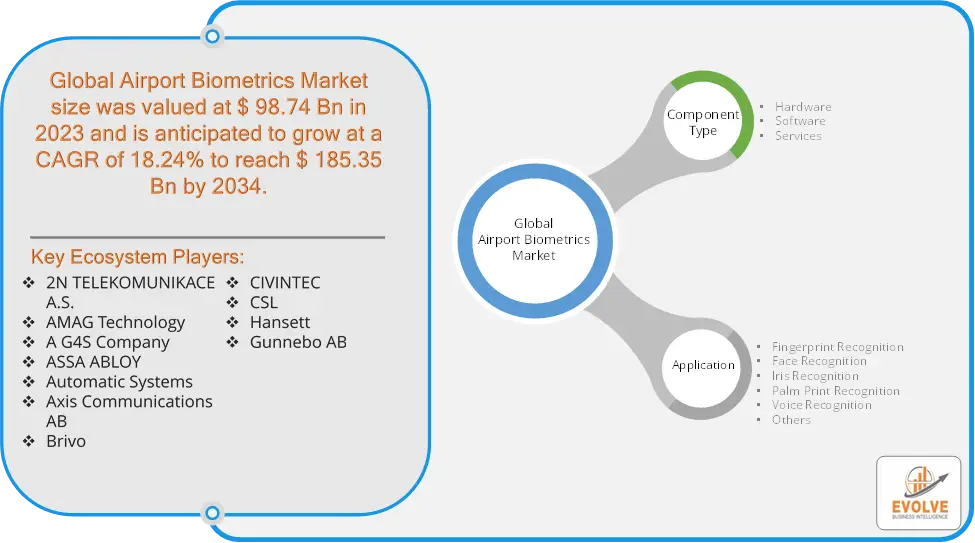

Airport Biometrics Market Research Report: Information By Component Type (Hardware, Software, Services), By Application (Fingerprint Recognition, Face Recognition, Iris Recognition, Palm Print Recognition, Voice Recognition, Others), and by Region — Forecast till 2033

Page: 121

Airport Biometrics Market Overview

The Airport Biometrics Market Size is expected to reach USD 185.35 Billion by 2034. The Airport Biometrics Market industry size accounted for USD 98.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 18.24% from 2021 to 2034. Airport biometrics refers to the application of biometric technologies, such as facial recognition, fingerprint scanning, or iris scanning, to enhance security and efficiency in airport operations. These systems are used to verify the identity of passengers, staff, and other individuals accessing airport facilities.

The Airport Biometrics Market is driven by the need for improved security and efficiency in airport operations, as well as advancements in biometric technology. The airport biometrics market is a rapidly growing industry that is transforming the way airports operate, making them safer, more efficient, and more convenient for passengers.

Global Airport Biometrics Market Synopsis

Airport Biometrics Market Dynamics

Airport Biometrics Market Dynamics

The major factors that have impacted the growth of Airport Biometrics Market are as follows:

Drivers:

Ø Technological Advancements in Biometric Solutions

Advances in biometric technologies, such as facial recognition and iris scanning, provide more reliable and faster processing times, making them more attractive for airport applications. Integration of artificial intelligence (AI) and machine learning into biometric systems enhances accuracy and predictive capabilities, further boosting adoption. Biometrics reduce the need for manual checks by airport staff, lowering labor costs and improving resource allocation. With the adoption of automated biometric systems, airports can handle larger volumes of passengers without a proportional increase in staff, leading to long-term cost savings.

Restraint:

- Perception of Privacy and Data Security Concerns

The collection and storage of sensitive biometric data (e.g., fingerprints, facial scans) raise concerns about potential misuse, hacking, or unauthorized access. Passengers may be reluctant to share their biometric data due to fears of privacy infringement. Strict regulations, such as the General Data Protection Regulation (GDPR) in Europe, mandate how biometric data should be collected, stored, and processed. Complying with these regulations can be challenging and costly for airports. Implementing biometric systems requires significant investment in hardware, software, and supporting infrastructure (e.g., cameras, scanners, and data storage). This high initial cost may deter smaller airports or those with limited budgets from adopting the technology.

Opportunity:

⮚ Growing Demand for Contactless Travel Solutions

The global push for contactless solutions, especially following the COVID-19 pandemic, has increased the demand for biometric systems. Airports can capitalize on this trend by implementing contactless biometric solutions for check-ins, security, and boarding to enhance safety and passenger confidence. With growing emphasis on health screening, biometric technology integrated with digital health passports can streamline health checks at airports, reducing queues and ensuring a seamless travel experience. As global air traffic continues to grow, especially in emerging markets, airports face pressure to improve efficiency and reduce congestion. Biometric systems offer a scalable solution to handle increased passenger volumes without proportionately increasing staff or infrastructure, creating a vast market opportunity.

Airport Biometrics Market Segment Overview

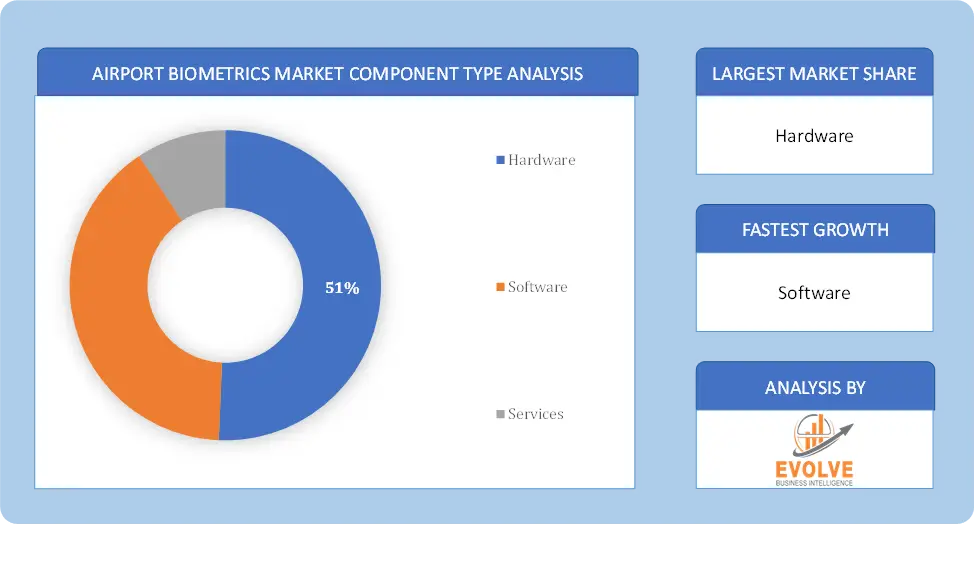

By Component Type

Based on Component Type, the market is segmented based on Hardware, Software and Services. The hardware sub-segment dominates the global market and the growing need for running security systems in several business domains. The demand for hardware in biometric systems is anticipated to increase as other cutting-edge software for various security objectives becomes more and more necessary.

Based on Component Type, the market is segmented based on Hardware, Software and Services. The hardware sub-segment dominates the global market and the growing need for running security systems in several business domains. The demand for hardware in biometric systems is anticipated to increase as other cutting-edge software for various security objectives becomes more and more necessary.

By Application

Based on Application, the market segment has been divided into Fingerprint Recognition, Face Recognition, Iris Recognition, Palm Print Recognition, Voice Recognition and Others. The face recognition segment dominant the worldwide airport biometrics service market. The rapid adoption of advanced technologies and penetration of digital passports at airports across the globe are observed to promote the growth of the segment.

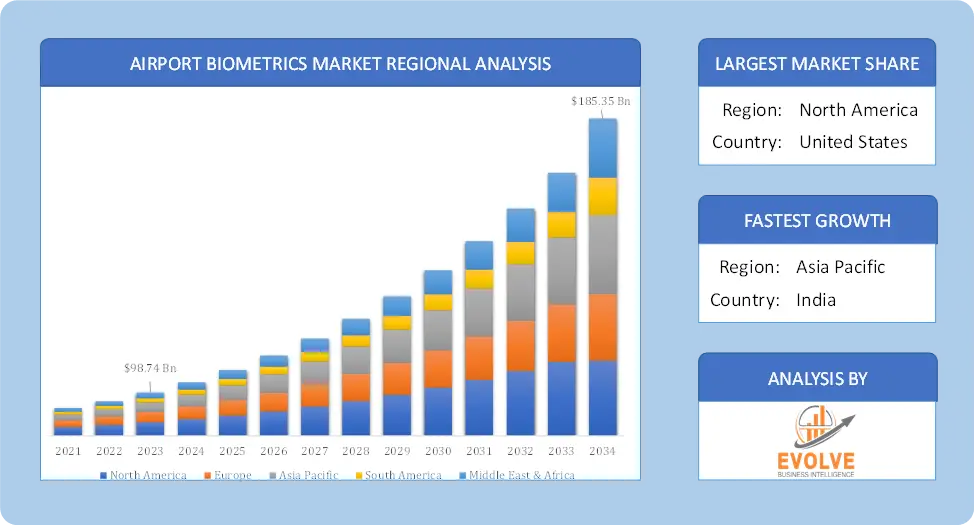

Global Airport Biometrics Market Regional Analysis

Based on region, the global Airport Biometrics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Airport Biometrics Market followed by the Asia-Pacific and Europe regions.

Airport Biometrics North America Market

Airport Biometrics North America Market

North America holds a dominant position in the Airport Biometrics Market. North America holds a significant share of the global Airport Biometrics Market, driven by early adoption of advanced technologies and stringent security regulations. U.S. government initiatives, such as the TSA’s Biometric Entry-Exit Program and U.S. Customs and Border Protection’s (CBP) use of facial recognition at various airports, are driving growth. The U.S. is also leveraging biometrics for border control and customs operations and continued investment in airport infrastructure, particularly in expanding biometrics for security and boarding, is expected to drive future growth.

Airport Biometrics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Airport Biometrics Market industry. It’s driven by increasing air passenger traffic, expanding airport infrastructure, and a growing emphasis on technological innovation. China, Japan, India, and Singapore are key markets in the region. China has been rapidly adopting biometric technologies, such as facial recognition, in airports for security and efficiency purposes. Singapore’s Changi Airport and Japan’s Haneda Airport are also at the forefront of using biometrics and many Asia-Pacific governments are investing heavily in modernizing airport infrastructure and adopting smart technologies to handle increasing passenger volumes.

Competitive Landscape

The global Airport Biometrics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- 2N TELEKOMUNIKACE A.S.

- AMAG Technology, A G4S Company

- ASSA ABLOY

- Automatic Systems

- Axis Communications AB

- Brivo

- CIVINTEC

- CSL

- Hansett

- Gunnebo AB

Key Development

In May 2023, Berlin Brandenburg Airport implemented biometric access control for airports. According to Berlin Brandenburg Airport, digital technology enables visitors to access several airport procedures by biometric facial recognition without presenting any identification. This concept is now in a testing phase with FastID, a technology company, and the Lufthansa Group.

In February 2023, Digi Yatra, a digital boarding and check-in service, was made available at four additional airports, Kolkata, Pune, Vijayawada, and Hyderabad. The Ministry of Civil Aviation has inaugurated the Digi Yatra service, a biometric method of boarding that utilizes facial recognition technology (FRT). To deliver seamless and hassle-free experiences at Indian airports, it is a volunteer service. By eliminating the demand for ID and ticket verification at multiple points of contact and boosting throughput by utilizing the current system and a digital framework, it aims to enhance the passenger experience.

Scope of the Report

Global Airport Biometrics Market, by Component Type

- Hardware

- Software

- Services

Global Airport Biometrics Market, by Application

- Fingerprint Recognition

- Face Recognition

- Iris Recognition

- Palm Print Recognition

- Voice Recognition

- Others

Global Airport Biometrics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $185.35 Billion |

| CAGR | 18.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | 2N TELEKOMUNIKACE A.S., AMAG Technology, A G4S Company, ASSA ABLOY, Automatic Systems, Axis Communications AB, Brivo, CIVINTEC, CSL, Hansett and Gunnebo AB |

| Key Market Opportunities | • Growing Demand for Contactless Travel Solutions • Increasing Global Air Travel |

| Key Market Drivers | • Technological Advancements in Biometric Solutions |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Airport Biometrics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Airport Biometrics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Airport Biometrics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Airport Biometrics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Airport Biometrics Market is 2021- 2033

What is the growth rate of the global Airport Biometrics Market?

The global Airport Biometrics Market is growing at a CAGR of 18.24% over the next 10 years

Which region has the highest growth rate in the market of Airport Biometrics Market?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the global Airport Biometrics Market?

North America holds the largest share in 2022

Who are the key players in the global Airport Biometrics Market?

2N TELEKOMUNIKACE A.S., AMAG Technology, A G4S Company, ASSA ABLOY, Automatic Systems, Axis Communications AB, Brivo, CIVINTEC, CSL, Hansett and Gunnebo AB are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Airport Biometrics Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Airport Biometrics Market, By Component Type 6.1. Introduction 6.2. Hardware 6.3. Software 6.4. Services Chapter 7. Global Airport Biometrics Market, By Application 7.1. Introduction 7.2. Fingerprint Recognition 7.3. Face Recognition 7.4. Iris Recognition 7.5. Palm Print Recognition 7.6. Voice Recognition 7.7. Others Chapter 8. Global Airport Biometrics Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Component Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2026 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2026 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Component Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. 2N TELEKOMUNIKACE A.S. 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Component Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. AMAG Technology, A G4S Company 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Component Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. ASSA ABLOY 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Component Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Automatic Systems 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Component Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Axis Communications AB 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Component Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Brivo 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Component Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. CIVINTEC 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Component Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. CSL 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Component Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Hansett 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Component Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Gunnebo AB 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Component Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology