Aircraft Cabin Lighting Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Aircraft Cabin Lighting Market Research Report: Information By Aircraft Type (Narrow Body Aircraft, Wide-Body Aircraft, Very Large Aircraft, Regional Transport Aircraft, Others), By End User (OEM, Aftermarket), and by Region — Forecast till 2033

Page: 159

Aircraft Cabin Lighting Market Overview

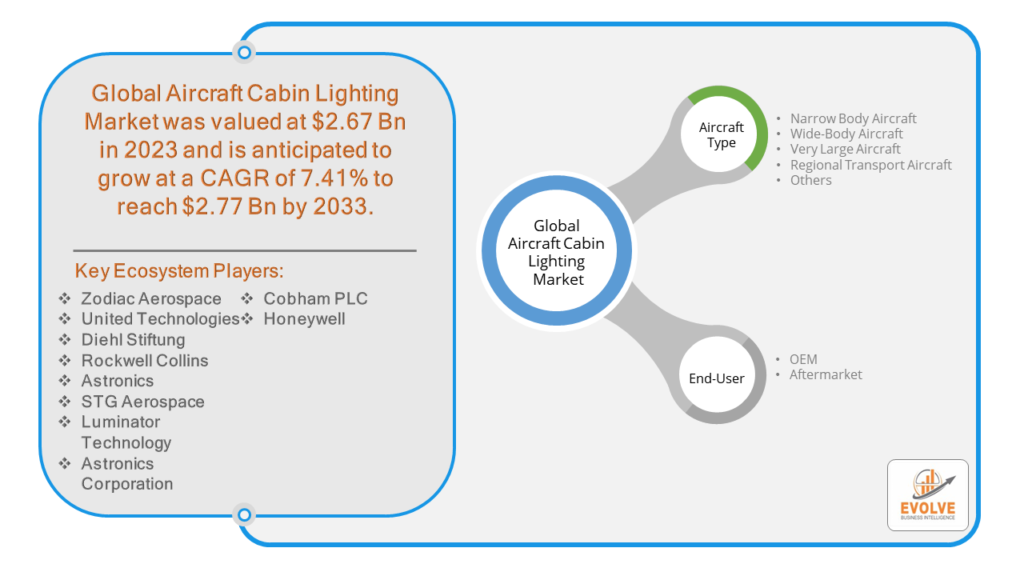

The Aircraft Cabin Lighting Market Size is expected to reach USD 2.77 Billion by 2033. The Aircraft Cabin Lighting Market industry size accounted for USD 2.67 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.41% from 2023 to 2033. The Aircraft Cabin Lighting Market refers to the segment of the aviation industry focused on the design, manufacturing, and distribution of lighting systems specifically tailored for aircraft cabins. These lighting systems play a crucial role in enhancing the passenger experience, ensuring safety, and creating a comfortable environment during flights.

The market encompasses various stakeholders, including aircraft manufacturers, lighting system suppliers, airlines, and maintenance, repair, and overhaul (MRO) service providers. It is influenced by factors such as technological advancements, regulatory requirements, airline preferences, and passenger expectations. As air travel continues to grow, driven by increasing passenger demand and the expansion of airline fleets, the aircraft cabin lighting market is expected to witness further growth and innovation. Moreover, cabin lighting also plays a role in enhancing safety by providing visibility during emergency situations and facilitating evacuation procedures.

Global Aircraft Cabin Lighting Market Synopsis

The COVID-19 pandemic had a significant impact on the Aircraft Cabin Lighting Market. With travel restrictions, lockdowns, and a general decline in passenger demand, airlines have been operating fewer flights, leading to decreased demand for new aircraft and retrofitting of existing aircraft with upgraded cabin lighting systems. Many airlines have deferred or canceled orders for new aircraft or postponed cabin upgrade projects to conserve cash and adapt to the reduced demand for air travel. This has directly impacted the orders and deliveries of cabin lighting systems. The pandemic has heightened concerns about passenger safety and hygiene. Airlines have prioritized implementing measures to enhance cleanliness and sanitation in aircraft cabins, which may include changes or upgrades to cabin lighting systems to support these efforts. The pandemic has altered passenger preferences and expectations regarding air travel. There may be increased demand for features that promote health, wellness, and comfort in the cabin environment, which could influence the design and selection of cabin lighting systems.

Aircraft Cabin Lighting Market Dynamics

The major factors that have impacted the growth of Aircraft Cabin Lighting Market are as follows:

Drivers:

Ø Technological Advancements

Airlines are increasingly focused on enhancing the passenger experience to differentiate themselves in a competitive market. Cabin lighting plays a vital role in creating a comfortable and pleasant environment for passengers, contributing to overall satisfaction and loyalty. Ongoing advancements in lighting technology, such as LED and OLED systems, offer significant benefits in terms of energy efficiency, durability, flexibility, and customization options. These technologies enable airlines to create innovative lighting designs that enhance the ambiance of the cabin and improve the passenger experience. Airlines invest in modernizing their fleets to improve operational efficiency, reduce operating costs, and enhance passenger comfort. Retrofitting older aircraft with new cabin lighting systems allows airlines to update their interiors to meet current standards and provide a more attractive cabin environment for passengers.

Restraint:

- Perception of Stringent Regulations

Aviation safety regulations are paramount in the aviation industry. New cabin lighting systems need to undergo rigorous testing and certification processes to ensure they meet all safety standards. This can be a lengthy and expensive process, hindering the adoption of innovative lighting solutions. As cabin lighting systems become more sophisticated and potentially connected to aircraft networks, cybersecurity becomes a growing concern. Airlines need to be confident that these systems are secure from hacking or malfunctions that could disrupt operations.

Opportunity:

⮚ Rising Demand for Enhanced Passenger Experience

Airlines are increasingly focusing on improving passenger comfort and satisfaction throughout the flying experience. Advanced cabin lighting systems with features like mood lighting and dynamic color control can create a more relaxing and enjoyable atmosphere for flyers, leading to greater demand for these technologies. Imagine in-flight entertainment integrated with the cabin lighting! Imagine lighting that reacts to movies or music, creating a more immersive entertainment experience. Airlines are increasingly focused on sustainability. Developing eco-friendly lighting systems made from recycled materials or powered by renewable energy sources could be a major selling point.

Aircraft Cabin Lighting Market Segment Overview

By Aircraft Type

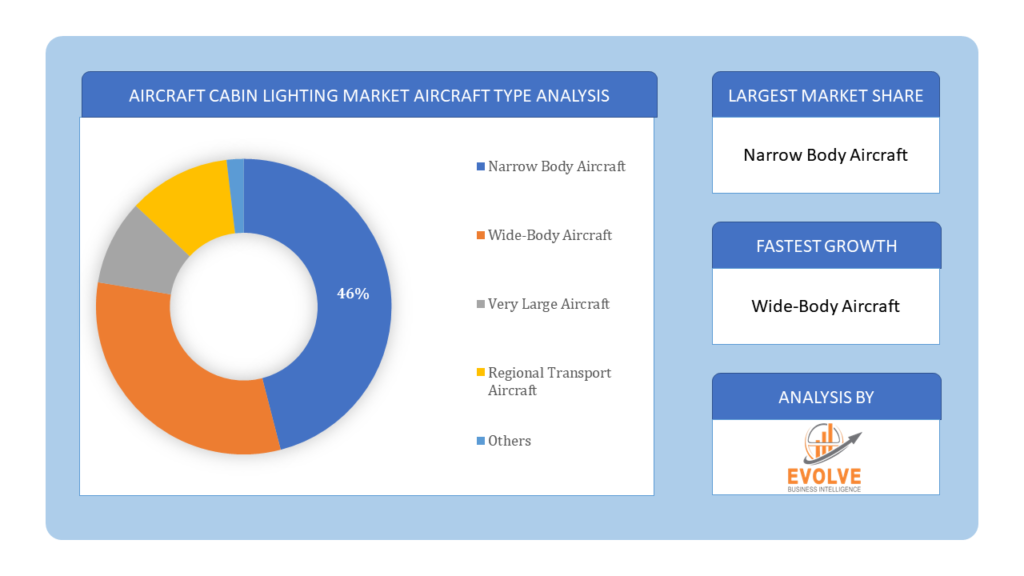

Based on Aircraft Type, the market is segmented based on Narrow Body Aircraft, Wide-Body Aircraft, Very Large Aircraft, Regional Transport Aircraft and Others. The narrow body category generated the most income. Narrow-body aircraft enable rapid adoption as they add flexibility to fleet management and help reduce airlines’ operational costs. Increasing demand for low-cost AI-based interior lighting technology in the aviation industry is fueling the market.

Based on Aircraft Type, the market is segmented based on Narrow Body Aircraft, Wide-Body Aircraft, Very Large Aircraft, Regional Transport Aircraft and Others. The narrow body category generated the most income. Narrow-body aircraft enable rapid adoption as they add flexibility to fleet management and help reduce airlines’ operational costs. Increasing demand for low-cost AI-based interior lighting technology in the aviation industry is fueling the market.

By End User

Based on End User, the market segment has been divided into OEM and Aftermarket. The OEM segment dominated the market. The flight lighting is essential for safety in all phases of flight. It is used to illuminate the cabin during boarding and disembarking, to ensure visibility during takeoff and landing, and to guide passengers to emergency exits in the event of an emergency. Regulatory authorities also require exterior lighting, such as navigation and anti-collision lights, to ensure the safe operation of the aircraft.

Global Aircraft Cabin Lighting Market Regional Analysis

Based on region, the global Aircraft Cabin Lighting Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Aircraft Cabin Lighting Market followed by the Asia-Pacific and Europe regions.

Aircraft Cabin Lighting North America Market

North America holds a dominant position in the Aircraft Cabin Lighting Market. North America boasts a significant share of the global aviation industry, with prominent aircraft manufacturers and airlines. The region witnesses continuous demand for new aircraft deliveries and retrofitting projects, driving the demand for cabin lighting systems. The presence of major aircraft manufacturers like Boeing and a robust MRO industry contribute to the region’s vibrant cabin lighting market. Technological innovation and a focus on passenger experience drive demand for advanced lighting solutions.

Aircraft Cabin Lighting Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Aircraft Cabin Lighting Market industry. Asia-Pacific is the fastest-growing aviation market globally, driven by rising disposable incomes and increasing air travel demand. The region sees substantial orders for new aircraft and retrofitting projects, creating opportunities for cabin lighting providers. Rapid fleet expansion by airlines in countries like China and India fuels demand for cabin lighting systems. Additionally, cultural preferences and passenger expectations for premium cabin experiences contribute to the adoption of advanced lighting technologies and customizable designs.

Competitive Landscape

The global Aircraft Cabin Lighting Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Zodiac Aerospace

- United Technologies

- Diehl Stiftung

- Rockwell Collins

- Astronics

- STG Aerospace

- Luminator Technology

- Astronics Corporation,

- Cobham PLC

- Honeywell

Key Development

In January 2022, Diehl Stiftung & Co. KG has entered into a contract with Boeing to supply interior components for Boeing aircraft. Under this contract, Diehl Aviation provided cabin installation services such as monuments and light bars on Boeing aircraft.

In March 2021, Astronics Corporation launched the new Nuancia RGBW light strips to provide energy-efficient lighting options for commercial aircraft seats and cabins. Nuancia RGBW light strips can provide aircraft manufacturers and airlines with over 16 million colors.

Scope of the Report

Global Aircraft Cabin Lighting Market, by Aircraft Type

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Others

Global Aircraft Cabin Lighting Market, by End User

- OEM

- Aftermarket

Global Aircraft Cabin Lighting Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.77 Billion |

| CAGR | 7.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Aircraft Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Zodiac Aerospace, United Technologies, Diehl Stiftung, Rockwell Collins, Astronics, STG Aerospace, Luminator Technology, Astronics Corporation, Cobham PLC and Honeywell. |

| Key Market Opportunities | • Rising Demand for Enhanced Passenger Experience • Interactive Lighting Experiences |

| Key Market Drivers | • Technological Advancements • Passenger Experience Enhancement |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Aircraft Cabin Lighting Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Aircraft Cabin Lighting Market historical market size for the year 2021, and forecast from 2023 to 2033

- Aircraft Cabin Lighting Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Aircraft Cabin Lighting Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of the Aircraft Cabin Lighting Market?

The study period for the Aircraft Cabin Lighting Market spans from 2021 to the projected years of 2023 to 2033, offering insights into long-term trends and forecasts in aviation lighting solutions.

What is the growth rate of the Aircraft Cabin Lighting Market?

The Aircraft Cabin Lighting Market is expected to expand at a compound annual growth rate (CAGR) of 7.41% from 2023 to 2033, indicating significant growth opportunities in the aviation lighting industry.

Which region has the highest growth rate in the Aircraft Cabin Lighting Market?

The Asia-Pacific region is poised to experience the highest growth rate in the Aircraft Cabin Lighting Market, driven by rising disposable incomes, increasing air travel demand, and substantial orders for new aircraft and retrofitting projects.

Which region has the largest share of the Aircraft Cabin Lighting Market?

North America dominates the Aircraft Cabin Lighting Market, with a significant share attributed to prominent aircraft manufacturers, robust MRO industries, and continuous demand for new aircraft deliveries and retrofitting projects.

Who are the key players in the Aircraft Cabin Lighting Market?

Key players in the Aircraft Cabin Lighting Market include Zodiac Aerospace, United Technologies, Diehl Stiftung, Rockwell Collins, Astronics, STG Aerospace, Luminator Technology, Astronics Corporation, Cobham PLC, and Honeywell, driving innovation and competition in aviation lighting solutions.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Aircraft Cabin Lighting Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Aircraft Cabin Lighting Market 4.8.Import Analysis of the Aircraft Cabin Lighting Market 4.9.Export Analysis of the Aircraft Cabin Lighting Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Aircraft Cabin Lighting Market, By Aircraft Type 6.1. Introduction 6.2. Narrow Body Aircraft 6.3. Wide-Body Aircraft 6.4. Very Large Aircraft 6.5. Regional Transport Aircraft 6.6. Others Chapter 7. Global Aircraft Cabin Lighting Market, By End User 7.1. Introduction 7.2. OEM 7.3. Aftermarket Chapter 8. Global Aircraft Cabin Lighting Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Aircraft Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Aircraft Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Aircraft Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Aircraft Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Zodiac Aerospace 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. United Technologies 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Diehl Stiftung 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Rockwell Collins 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Luminator Technology 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Astronics Corporation 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Cobham PLC 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Honeywell 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Astronics 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. STG Aerospace 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology