Global Agriculture Crop Insurance Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

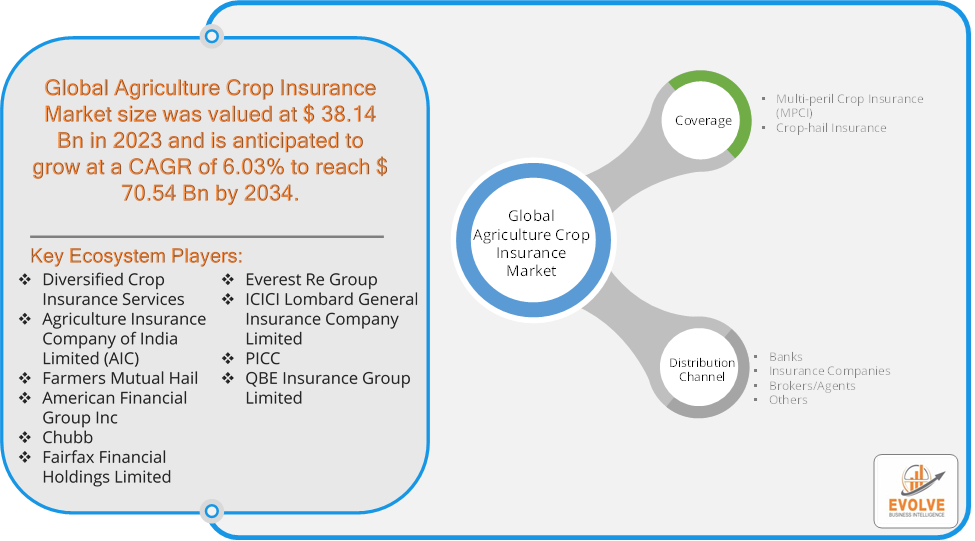

Global Agriculture Crop Insurance Market Research Report: Information By Coverage (Multi-peril Crop Insurance (MPCI), Crop-hail Insurance) By Distribution Channel (Banks, Insurance Companies, Brokers/Agents, Others), and by Region — Forecast till 2034

Page: 160

Global Agriculture Crop Insurance Market Overview

The Global Agriculture Crop Insurance Market size accounted for USD 38.14 Billion in 2023 and is estimated to account for 39.21 Billion in 2024. The Market is expected to reach USD 70.54 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.03% from 2024 to 2034. The Global Agriculture Crop Insurance Market refers to the market that provides insurance coverage to farmers and agricultural producers to protect against losses due to natural disasters, weather-related events (like drought, floods, or storms), pests, diseases, or other unforeseen incidents that can affect crop yields. Crop insurance helps to mitigate the financial risks that farmers face by offering them a safety net, ensuring income stability, and encouraging investment in agriculture.

The market’s growth is influenced by factors such as the increasing frequency of extreme weather events, government support and subsidies for crop insurance, and growing awareness among farmers about the benefits of such protection. The Global Agriculture Crop Insurance Market plays a vital role in supporting the agricultural sector and ensuring food security.

Global Agriculture Crop Insurance Market Synopsis

Global Agriculture Crop Insurance Market Dynamics

Global Agriculture Crop Insurance Market Dynamics

The major factors that have impacted the growth of Global Agriculture Crop Insurance Market are as follows:

Drivers:

Ø Technological Advancements

The integration of advanced technologies, such as satellite imagery, drones, artificial intelligence (AI), and data analytics, is improving risk assessment, monitoring, and claims processing. These innovations make crop insurance more efficient, accurate, and scalable, driving further market adoption. As the global population continues to grow, food security becomes a more pressing issue. Crop insurance plays a critical role in stabilizing agricultural output by protecting farmers from financial ruin due to crop loss, thus contributing to stable food supplies.

Restraint:

- Perception of High Premium Costs and Limited Access to Data and Technology

The cost of crop insurance premiums can be prohibitively high for small and marginal farmers, especially in developing countries. Many farmers find it difficult to afford insurance coverage without significant subsidies, limiting the overall market penetration. The effectiveness of crop insurance relies heavily on accurate data and monitoring systems, such as satellite imaging and weather tracking. In many regions, particularly in underdeveloped areas, there is limited access to such technologies, making it difficult for insurers to assess risks accurately or offer competitive premiums.

Opportunity:

⮚ Microinsurance and Parametric Insurance Models

Developing innovative insurance models like microinsurance and parametric insurance can help address the affordability challenge for small-scale farmers. Microinsurance provides low-cost coverage tailored to small farmers, while parametric insurance pays out based on pre-defined triggers (e.g., rainfall levels or temperature thresholds), enabling faster payouts and reducing the complexity of the claims process. With the rise of digital agriculture and precision farming technologies, insurance providers can explore new opportunities by developing products that protect high-tech investments in agriculture, such as IoT-enabled sensors, automated machinery, and smart irrigation systems. These insurance products can cover the risks associated with technology failures or unforeseen disruptions in precision farming operations.

Global Agriculture Crop Insurance Market Segment Overview

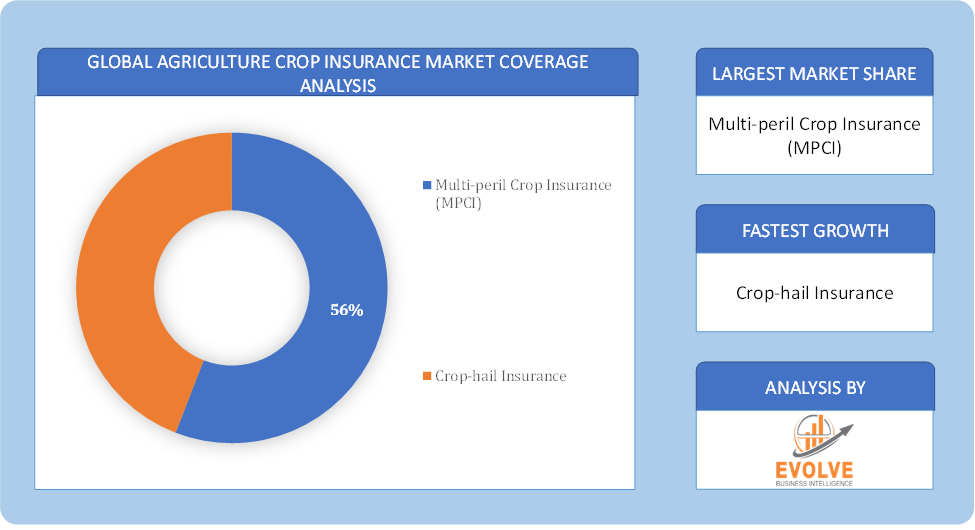

Based on Coverage, the market is segmented based on Multi-peril Crop Insurance (MPCI) and Crop-hail Insurance. The multi-peril crop insurance segment dominant the market. It is due to the benefits gained and the fact that many farmers employ crop diversification and seasonal rotation strategies to increase yield and income. Farmers buy crop insurance to hedge against financial losses resulting from natural disasters or sharp drops in commodity prices (floods, hail, pests, diseases, drought, etc.). Before planting a crop, farmers must purchase MPCI policies under federal regulations. The policy may include incentives to replant or penalties for failing to replant if the damage is discovered early enough in the growing season.

By Distribution Channel

Based on Distribution Channel, the market segment has been divided into Banks, Insurance Companies, Brokers/Agents and Others. The Insurance Companies segment dominant the market. Direct interaction with insurance companies allows farmers to customize coverage based on their specific needs. Insurance companies offer a range of policies catering to different crop types and risks. Additionally, insurance companies empower farmers to choose tailored solutions and ensure their protection aligns closely with their farming practices and risk exposure.

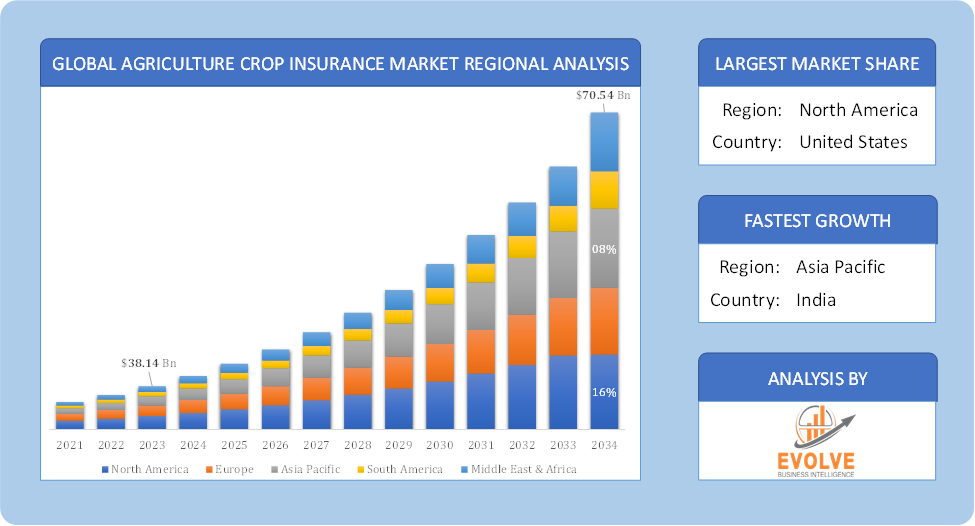

Global Agriculture Crop Insurance Market Regional Analysis

Based on region, the Global Agriculture Crop Insurance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Agriculture Crop Insurance Market followed by the Asia-Pacific and Europe regions.

Global Agriculture Crop Insurance North America Market

Global Agriculture Crop Insurance North America Market

North America holds a dominant position in the Global Agriculture Crop Insurance Market. North America, particularly the U.S., is one of the largest markets for agricultural crop insurance, primarily driven by strong government support programs like the Federal Crop Insurance Program (FCIP). This program provides extensive subsidies, making insurance affordable for farmers and the region has a well-established infrastructure for insurance, with advanced technologies like satellite monitoring and weather data integrated into risk assessment and claims processing.

Global Agriculture Crop Insurance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Agriculture Crop Insurance Market industry. The Asia-Pacific region is experiencing rapid growth in agricultural crop insurance, driven by large agricultural economies like India and China. In India, government initiatives like the Pradhan Mantri Fasal Bima Yojana (PMFBY) are crucial for expanding crop insurance coverage among small and marginal farmers and China has one of the largest crop insurance markets, with government subsidies playing a key role in increasing insurance adoption.

Competitive Landscape

The Global Agriculture Crop Insurance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Diversified Crop Insurance Services

- Agriculture Insurance Company of India Limited (AIC)

- Farmers Mutual Hail

- American Financial Group Inc

- Chubb

- Fairfax Financial Holdings Limited

- Everest Re Group

- ICICI Lombard General Insurance Company Limited

- PICC

- QBE Insurance Group Limited

Scope of the Report

Global Agriculture Crop Insurance Market, by Coverage

- Multi-peril Crop Insurance (MPCI)

- Crop-hail Insurance

Global Agriculture Crop Insurance Market, by Distribution Channel

- Banks

- Insurance Companies

- Brokers/Agents

- Others

Global Agriculture Crop Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 70.54 Billion |

| CAGR (2024-2034) | 6.03% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Coverage, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Diversified Crop Insurance Services, Agriculture Insurance Company of India Limited (AIC), Farmers Mutual Hail, American Financial Group Inc, Chubb, Fairfax Financial Holdings Limited, Everest Re Group, ICICI Lombard General Insurance Company Limited, PICC and QBE Insurance Group Limited. |

| Key Market Opportunities | · Microinsurance and Parametric Insurance Models · Insurance for Digital Agriculture and Precision Farming |

| Key Market Drivers | · Technological Advancements · Global Food Security Concerns |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Agriculture Crop Insurance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Agriculture Crop Insurance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Agriculture Crop Insurance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global Agriculture Crop Insurance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the Global Agriculture Crop Insurance Market is 2021- 2033

What is the growth rate of the Global Agriculture Crop Insurance Market?

The Global Agriculture Crop Insurance Market is growing at a CAGR of 6.03% over the next 10 years

Which region has the highest growth rate in the market of Global Agriculture Crop Insurance Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the Global Agriculture Crop Insurance Market?

North America holds the largest share in 2022

Who are the key players in the Global Agriculture Crop Insurance Market?

Diversified Crop Insurance Services, Agriculture Insurance Company of India Limited (AIC), Farmers Mutual Hail, American Financial Group Inc, Chubb, Fairfax Financial Holdings Limited, Everest Re Group, ICICI Lombard General Insurance Company Limited, PICC and QBE Insurance Group Limited. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Global Agriculture Crop Insurance Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Global Agriculture Crop Insurance Market 4.8. Import Analysis of the Global Agriculture Crop Insurance Market 4.9. Export Analysis of the Global Agriculture Crop Insurance Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Agriculture Crop Insurance Market, By Coverage 6.1. Introduction 6.2. Multi-peril Crop Insurance (MPCI) 6.3. Crop-hail Insurance Chapter 7. Global Agriculture Crop Insurance Market, By Distribution Channel 7.1. Introduction 7.2. Banks 7.3. Insurance Companies 7.4. Brokers/Agents 7.5. Others Chapter 8. Global Agriculture Crop Insurance Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Diversified Crop Insurance Services 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Agriculture Insurance Company of India Limited (AIC) 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Farmers Mutual Hail 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. American Financial Group Inc 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Chubb 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Fairfax Financial Holdings Limited 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Everest Re Group 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 ICICI Lombard General Insurance Company Limited 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 PICC 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. QBE Insurance Group Limited 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology