Advanced Driver Assistance Systems Market Overview

The Advanced Driver Assistance Systems Market Size is expected to reach USD 135.40 Billion by 2033. The Advanced Driver Assistance Systems Market industry size accounted for USD 30.64 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.45% from 2023 to 2033. The Advanced Driver Assistance Systems Market refers to the industry involved in developing, manufacturing, and implementing technologies designed to assist drivers in the driving process and enhance vehicle safety. These systems utilize various sensors, cameras, radar, Lidar, and other technologies to provide features such as adaptive cruise control, lane departure warning, automatic emergency braking, parking assistance, and more.

The ADAS market encompasses a wide range of players, including automotive OEMs (Original Equipment Manufacturers), technology suppliers, software developers, and research institutions. As safety regulations become more stringent globally and consumer demand for safer vehicles increases, the ADAS market continues to expand rapidly. It is closely tied to advancements in artificial intelligence, sensor technology, connectivity, and autonomous driving development.

Global Advanced Driver Assistance Systems Market Synopsis

The COVID-19 pandemic had significant impacts on the Advanced Driver Assistance Systems (ADAS) market. With automotive factories shutting down or operating at reduced capacity to comply with social distancing measures, the production of vehicles equipped with ADAS systems was significantly impacted. The pandemic highlighted the importance of safety and prompted a greater focus on technologies that can improve driver and passenger safety. As a result, there could be an accelerated adoption of ADAS features in vehicles as consumers prioritize safety features. The pandemic increased interest in autonomous driving technologies as people looked for solutions to minimize human contact and enhance hygiene. This could drive investment and development in more advanced ADAS systems with autonomous capabilities. The pandemic may spur innovation in ADAS technologies, such as contactless interfaces, health monitoring systems, and AI-driven safety features, to address new challenges and consumer needs arising from the pandemic.

Advanced Driver Assistance Systems Market Dynamics

The major factors that have impacted the growth of Advanced Driver Assistance Systems Market are as follows:

Drivers:

Growing Focus on Vehicle Safety

Increasing awareness among consumers about vehicle safety and the desire for safer driving experiences are driving the demand for ADAS-equipped vehicles. Features such as adaptive cruise control, automatic emergency braking, lane departure warning, and blind-spot detection systems are becoming standard or optional in many vehicle models. The alarming rise in road accidents globally has heightened the need for technologies that can mitigate the risk of collisions and improve road safety. ADAS systems, by providing real-time alerts, assistance, and intervention to drivers, can help prevent accidents or reduce their severity. Continuous advancements in sensor technologies, including radar, Lidar, cameras, ultrasonic sensors, and GPS, have enhanced the capabilities and reliability of ADAS systems. These sensors enable vehicles to perceive their surroundings accurately and respond effectively to dynamic driving conditions.

Restraint:

- Perception of High Cost of Implementation

The integration of ADAS technologies into vehicles often involves significant costs, including the expense of sensors, cameras, processors, software development, and testing. This can increase the overall cost of vehicles, making them less affordable for some consumers. ADAS systems comprise multiple components and technologies that need to work seamlessly together. Ensuring interoperability and integration with other vehicle systems without compromising performance or safety can be technically challenging. ADAS systems collect and process vast amounts of data, including sensitive information about vehicle performance, driver behavior, and surroundings. Ensuring the privacy and security of this data against cyber threats and unauthorized access is a significant concern for both consumers and regulators.

Opportunity:

⮚ Demand for Autonomous Vehicles

The growing interest in autonomous vehicles presents a significant opportunity for the ADAS market. ADAS technologies serve as the building blocks for autonomous driving systems, providing essential functionalities such as lane-keeping assistance, adaptive cruise control, and collision avoidance. As autonomous driving technology advances and gains acceptance, the demand for more sophisticated ADAS features will increase. The transition to electric vehicles presents opportunities for ADAS integration and innovation. EV manufacturers are increasingly incorporating advanced safety features to enhance the appeal and competitiveness of their vehicles. ADAS technologies can complement the unique characteristics of electric vehicles, such as regenerative braking systems and instant torque, to optimize performance and safety.

Advanced Driver Assistance Systems Market Segment Overview

By System Type

Based on System Type, the market is segmented based on Adaptive Cruise Control (ACC), Tire Pressure Monitoring System (TPMS), Drowsiness Monitor System (DMS), Adaptive Front Lights (AFL), Automatic Emergency Braking (AEB), Intelligent Parking Assist System (IPAS), Blind Spot Detection (BSD) and Other System Types. Adaptive Cruise Control (ACC) segment is dominant the market. Adaptive Cruise Control (ACC) is a driver assistance technology that uses sensors and cameras to adjust a vehicle’s speed to maintain a safe distance from the automobile in front. ACC is an extension of traditional cruise control in that it can slow down or speed up the vehicle based on the traffic flow. The two primary market drivers for ACC are safety and convenience.

By Sensor Type

Based on Sensor Type, the market segment has been divided into Ultrasonic Sensor, Lidar Sensor, Image Sensor, Radar Sensor and Others. The radar sensor based held the largest market share, as these Radar sensors are a vital component of Advanced Driver Assistance Systems (ADAS) Market that help improve driving safety and comfort. These sensors use radio frequency waves to detect objects around the vehicle and provide accurate distance and speed information to the Advanced Driver Assistance Systems Market.

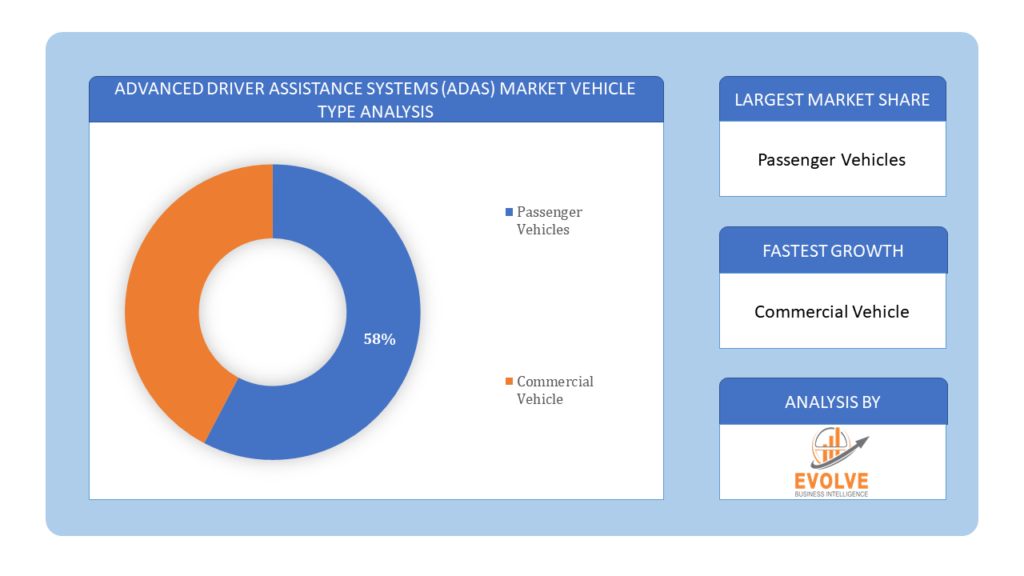

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into Passenger Vehicles and Commercial Vehicle. Passenger cars are dominating the market as they make up the largest segment of the automotive market globally. This prevalence inherently results in a higher demand for ADAS in passenger cars compared to other vehicle types. Furthermore, consumer demand for safety and comfort in personal transportation is driving manufacturers to integrate more ADAS features in passenger cars. Features such as parking assistance, automatic emergency braking, and blind-spot detection are becoming increasingly standard in new models, even in non-luxury passenger cars.

Global Advanced Driver Assistance Systems Market Regional Analysis

Based on region, the global Advanced Driver Assistance Systems (ADAS) Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Advanced Driver Assistance Systems (ADAS) Market followed by the Asia-Pacific and Europe regions.

Advanced Driver Assistance Systems North America Market

Advanced Driver Assistance Systems North America Market

North America holds a dominant position in the Advanced Driver Assistance Systems (ADAS) Market. North America is a leading market for ADAS technologies, driven by stringent safety regulations, high consumer awareness, and a strong automotive industry. The United States, in particular, has been at the forefront of ADAS adoption, with regulatory bodies like NHTSA (National Highway Traffic Safety Administration) emphasizing vehicle safety standards. The presence of key automotive OEMs, technology companies, and a supportive regulatory environment contribute to market growth.

Advanced Driver Assistance Systems Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Advanced Driver Assistance Systems (ADAS) Market industry. Asia-Pacific, particularly China, represents one of the fastest-growing ADAS markets globally. The region’s rapid urbanization, increasing vehicle sales, and government initiatives to improve road safety contribute to market expansion. China’s automotive industry is witnessing significant investments in ADAS technologies by both domestic and international manufacturers.

Competitive Landscape

The global Advanced Driver Assistance Systems (ADAS) Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Autoliv Inc.

- Continental AG

- DENSO Corporation

- ROBERT BOSCH GMBH

- Valeo

- Hyundai Mobis

- ZF Friedrichshafen

- Magna

- NXP Semiconductors

- Aisin Seiki Co. Ltd.

Key Development

In November 2021, Hyundai Mobis unveiled the world’s first urban Advanced Driver Assistance System (ADAS) to support the driver to mitigate the day-to-day challenge. Featured with Parking System (MPS), the technology integrates Narrow Space Assistance (NSA), Reverse Assistance (RA), and Remote Smart Parking Assistance (RSPA). With the MPS, the car can drive itself through a narrow street by avoiding obstructions, drive through the revolving gate of an underground parking lot or drive backwards at a dead-end where two cars are facing each other. Scope of the Report

Global Advanced Driver Assistance Systems (ADAS) Market, by System Type

- Adaptive Cruise Control (ACC)

- Tire Pressure Monitoring System (TPMS)

- Drowsiness Monitor System (DMS)

- Adaptive Front Lights (AFL)

- Automatic Emergency Braking (AEB)

- Intelligent Parking Assist System (IPAS)

- Blind Spot Detection (BSD)

- Other System Types

Global Advanced Driver Assistance Systems (ADAS) Market, by Sensor Type

- Ultrasonic Sensor

- Lidar Sensor

- Image Sensor

- Radar Sensor

- Others

Global Advanced Driver Assistance Systems (ADAS) Market, by Vehicle Type

- Passenger Vehicles

- Commercial Vehicle

Global Advanced Driver Assistance Systems (ADAS) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $135.40 Billion |

| CAGR | 6.45% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | System Type, Sensor Type, Vehicle Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Autoliv Inc., Continental AG, DENSO Corporation, ROBERT BOSCH GMBH, Valeo, Hyundai Mobis, ZF Friedrichshafen, Magna, NXP Semiconductors and Aisin Seiki Co. Ltd |

| Key Market Opportunities | • Demand for Autonomous Vehicles • Integration with Electric Vehicles (EVs) |

| Key Market Drivers | • Growing Focus on Vehicle Safety • Advancements in Sensor Technologies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Advanced Driver Assistance Systems (ADAS) Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Advanced Driver Assistance Systems (ADAS) Market historical market size for the year 2021, and forecast from 2023 to 2033

- Advanced Driver Assistance Systems (ADAS) Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Advanced Driver Assistance Systems (ADAS) Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.