Adaptive Cruise Control Market Analysis and Global Forecast 2024-2034

$1,898.24 – $7,538.33Price range: $1,898.24 through $7,538.33

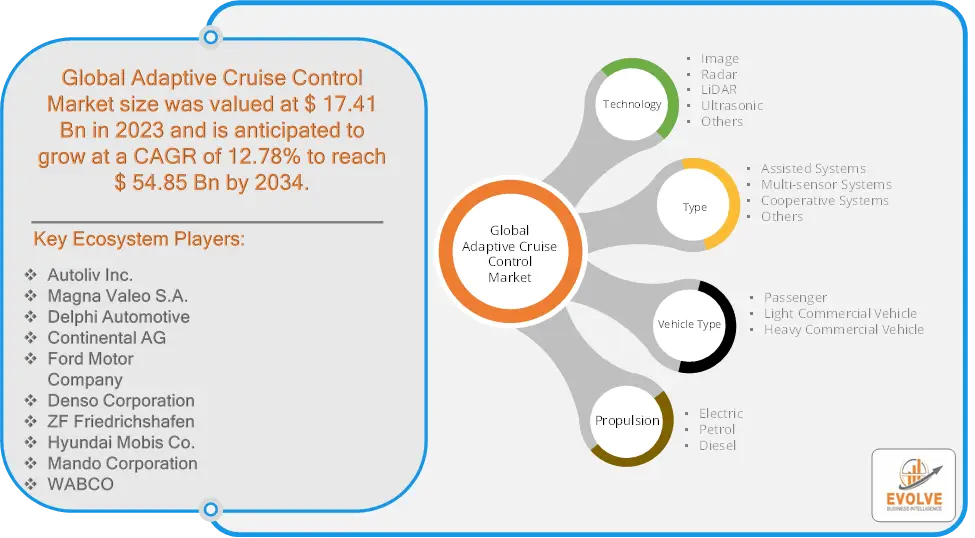

Adaptive Cruise Control Market Research Report: Information By Technology (Image, Radar, LiDAR, Ultrasonic, Others), By Type (Assisted Systems, Multi-sensor Systems, Cooperative Systems, Others), By Vehicle Type (Passenger, Light Commercial Vehicle, Heavy Commercial Vehicle), By Propulsion (Electric, Petrol, Diesel), and by Region — Forecast till 2034

Page: 138

Adaptive Cruise Control Market Overview

The Adaptive Cruise Control Market size accounted for USD 17.41 Billion in 2023 and is estimated to account for 18.33 Billion in 2024. The Market is expected to reach USD 54.85 Billion by 2034 growing at a compound annual growth rate (CAGR) of 12.78% from 2024 to 2034. The Adaptive Cruise Control (ACC) Market refers to the global market for adaptive cruise control systems, which are advanced driver assistance systems (ADAS) designed to automatically adjust a vehicle’s speed to maintain a safe distance from vehicles ahead. ACC systems use sensors such as radar, cameras, and LIDAR to detect traffic conditions and adjust vehicle speed accordingly, improving both safety and convenience for drivers.

The ACC market is growing due to increased demand for safety features in vehicles, advancements in autonomous driving technologies, and the integration of ACC with other ADAS systems. Regulatory mandates for safety features also drive market expansion. The automotive industry continues to prioritize safety and convenience, the demand for adaptive cruise control systems is expected to grow steadily.

Global Adaptive Cruise Control Market Synopsis

Adaptive Cruise Control Market Dynamics

Adaptive Cruise Control Market Dynamics

The major factors that have impacted the growth of Adaptive Cruise Control Market are as follows:

Drivers:

Ø Technological Advancements in Sensor Technology

Developments in radar, LIDAR, and camera sensors are making ACC systems more accurate and efficient, enhancing market growth. The reduction in the cost of these sensors is making ACC more accessible, even in mid-range and economy vehicles. Initiatives by organizations like the World Health Organization (WHO) and various road safety campaigns encourage the use of safety technologies like ACC to reduce accidents. Some insurers provide discounts for vehicles equipped with ACC, adding a financial incentive for consumers to adopt the technology.

Restraint:

- Perception of High Cost of ACC Systems and Data Privacy Concerns

The integration of advanced sensors such as radar, LIDAR, and cameras makes ACC systems expensive. This increases the overall cost of vehicles, particularly in mid-range and economy segments, limiting their adoption. Repair and maintenance of ACC systems can also be costly, further discouraging potential buyers, especially in price-sensitive markets. The collection and transmission of vehicle data by ACC systems can raise privacy concerns, which might slow down adoption in regions with strict data protection regulations.

Opportunity:

⮚ Technological Advancements in Sensor and AI Technology

The integration of artificial intelligence (AI) and machine learning can make ACC systems smarter and more adaptable to complex driving environments. This can improve performance in urban settings and reduce limitations in challenging driving conditions, opening new avenues for market growth. Advances in radar, LIDAR, and camera technologies are driving down the cost of sensors, making ACC systems more affordable. As costs decrease, ACC can be included in more mid-range and budget vehicles, expanding its market penetration. The rise of e-commerce and the expansion of logistics operations globally are driving demand for safe and efficient commercial vehicles. ACC-equipped trucks and delivery vehicles can offer enhanced safety and productivity, creating further market opportunities.

Adaptive Cruise Control Market Segment Overview

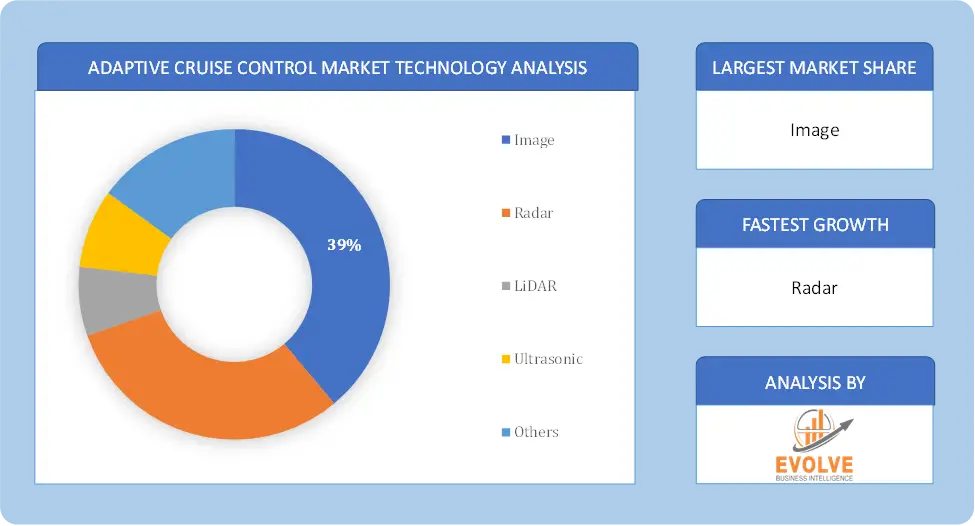

By Technology

Based on Technology, the market is segmented based on Image, Radar, LiDAR, Ultrasonic and Others. the radar sensors segment accounted for a moderate revenue share. Rising demand for vehicles that understand and complement human abilities within a vehicle is likely to fuel this segment’s revenue growth. Modern automobiles are integrated with a variety of sensors to help human drivers with their responsibilities. These sensors aid in data collection and send essential information to systems for processing.

Based on Technology, the market is segmented based on Image, Radar, LiDAR, Ultrasonic and Others. the radar sensors segment accounted for a moderate revenue share. Rising demand for vehicles that understand and complement human abilities within a vehicle is likely to fuel this segment’s revenue growth. Modern automobiles are integrated with a variety of sensors to help human drivers with their responsibilities. These sensors aid in data collection and send essential information to systems for processing.

By Type

Based on Type, the market segment has been divided into Assisted Systems, Multi-sensor Systems, Cooperative Systems and Others. The Assisted Systems segment dominant the market. There is a growing consumer preference for vehicles equipped with comprehensive safety and convenience features. The assisted systems segment benefits from this trend, as manufacturers increasingly offer ACC as part of their ADAS packages.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into Passenger, Light Commercial Vehicle and Heavy Commercial Vehicle. the passenger car segment accounted for a sizable revenue share. Increasing consumer awareness of the numerous benefits of having adaptive cruise control is likely to be a major factor driving market revenue development in this category. Adaptive cruise control helps drivers reduce stress when driving. This is due mostly to their capacity to automatically control vehicle speed while maintaining a specified minimum distance to the preceding vehicle.

By Propulsion

Based on Propulsion, the market segment has been divided into Electric, Petrol and Diesel. The Electric segment dominant the market. ACC systems enhance the driving experience by providing convenience and safety, allowing drivers to maintain a set speed and distance from the vehicle ahead without constant manual adjustments. This is particularly beneficial for electric vehicles, which are often marketed for their technological advancements.

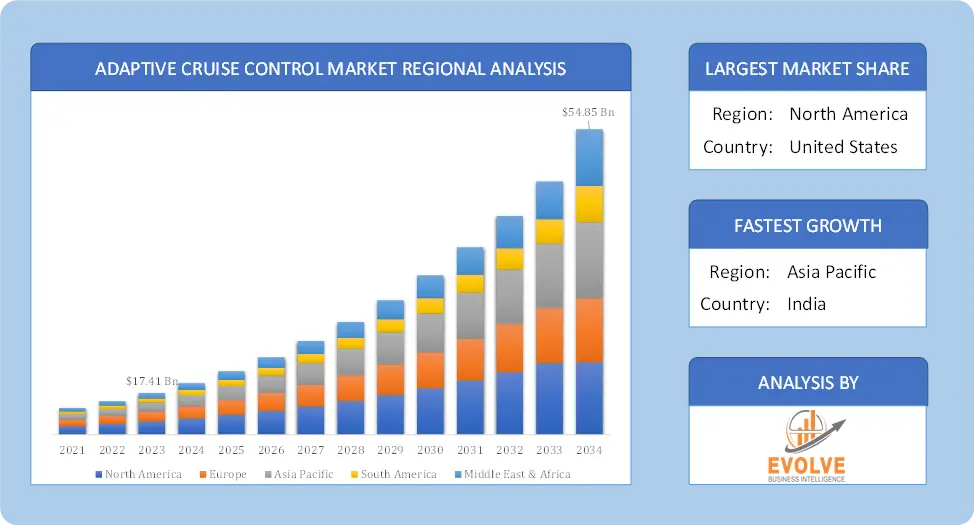

Global Adaptive Cruise Control Market Regional Analysis

Based on region, the global Adaptive Cruise Control Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Adaptive Cruise Control Market followed by the Asia-Pacific and Europe regions.

Adaptive Cruise Control North America Market

Adaptive Cruise Control North America Market

North America holds a dominant position in the Adaptive Cruise Control Market. North America, particularly the U.S., has been a leading market for ACC due to the strong presence of automotive manufacturers, high consumer demand for advanced safety features, and supportive government regulations regarding road safety and the region has a high adoption rate of advanced driver assistance systems (ADAS), including ACC, in both passenger and commercial vehicles. The growing development of autonomous vehicles further accelerates ACC adoption.

Adaptive Cruise Control Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Adaptive Cruise Control Market industry. Asia-Pacific, particularly China, Japan, and South Korea, represents the fastest-growing region for the ACC market. The rise in vehicle production, increasing disposable incomes, and growing urbanization contribute to higher demand for ACC systems and Japan and South Korea are leaders in automotive technology, with significant investments in autonomous driving and ADAS technologies, pushing ACC market expansion. China is also heavily investing in EVs, which helps drive ACC adoption.

Competitive Landscape

The global Adaptive Cruise Control Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Autoliv Inc.

- Magna Valeo S.A.

- Delphi Automotive

- Continental AG

- Ford Motor Company

- Denso Corporation

- ZF Friedrichshafen

- Hyundai Mobis Co.

- Mando Corporation

- WABCO

Key Development

In August 2023– ZF developed an innovative technology called ZF Eco Control 4 ACC, which is a predictive adaptive cruise control system. This advanced system allows vehicles to increase their driving range by an additional 8%.

In June 2023, Plus selected Luminar as its long-range LiDAR provider for use in its PlusDrive-assisted commercial vehicle driving system; Luminar is involved in the manufacture of fully autonomous vehicles. Scope of the Report

Global Adaptive Cruise Control Market, by Technology

- Image

- Radar

- LiDAR

- Ultrasonic

- Others

Global Adaptive Cruise Control Market, by Type

- Assisted Systems

- Multi-sensor Systems

- Cooperative Systems

- Others

Global Adaptive Cruise Control Market, by Vehicle Type

- Passenger

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Adaptive Cruise Control Market, by Propulsion

- Electric

- Petrol

- Diesel

Global Adaptive Cruise Control Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $607.2 Billion |

| CAGR | 4.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Type, Vehicle Type, Propulsion |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Autoliv, Inc., Magna Valeo S.A., Delphi Automotive, Continental AG, Ford Motor Company, Denso Corporation, ZF Friedrichshafen, Hyundai Mobis Co., Mando Corporation and WABCO |

| Key Market Opportunities | • Technological Advancements in Sensor and AI Technology • Growing Logistics and E-Commerce Sectors |

| Key Market Drivers | • Technological Advancements in Sensor Technology • Focus on Road Safety Initiatives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Adaptive Cruise Control Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Adaptive Cruise Control Market historical market size for the year 2021, and forecast from 2023 to 2033

- Adaptive Cruise Control Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Adaptive Cruise Control Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Adaptive Cruise Control Market is 2021- 2033

What is the growth rate of the global Adaptive Cruise Control Market?

The global Adaptive Cruise Control Market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Adaptive Cruise Control Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Adaptive Cruise Control Market?

North America holds the largest share in 2022

Who are the key players in the global Adaptive Cruise Control Market?

Autoliv, Inc., Magna Valeo S.A., Delphi Automotive, Continental AG, Ford Motor Company, Denso Corporation, ZF Friedrichshafen, Hyundai Mobis Co., Mando Corporation and WABCO are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Adaptive Cruise Control Market 4.3.1. Impact on Market Size 4.3.2. Propulsion Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Adaptive Cruise Control Market, By Technology 6.1. Introduction 6.2. Image 6.3. Radar 6.4. LiDAR 6.5. Ultrasonic 6.6. Others Chapter 7. Global Adaptive Cruise Control Market, By Type 7.1. Introduction 7.2. Assisted Systems 7.3. Multi-sensor Systems 7.4. Cooperative Systems 7.5. Others Chapter 8. Global Adaptive Cruise Control Market, By Vehicle Type 8.1. Introduction 8.2. Passenger 8.3. Light Commercial Vehicle 8.4. Heavy Commercial Vehicle 8.5. Others Chapter 9. Global Adaptive Cruise Control Market, By Propulsion 9.1. Introduction 9.2. Electric 9.3. Petrol 9.4. Diesel Chapter 10. Global Adaptive Cruise Control Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Technology, 2020 - 2028 10.2.5. Market Size and Forecast, By Type, 2020 - 2028 10.2.6. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.2.7. Market Size and Forecast, By Propulsion, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Technology, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Type, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.2.8.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Technology, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Type, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.2.9.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Technology, 2020 - 2028 10.3.5. Market Size and Forecast, By Type, 2020 - 2028 10.3.6. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.7. Market Size and Forecast, By Propulsion, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Technology, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.8.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Technology, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.9.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Technology, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.10.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Technology, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.11.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.3.12. Rest of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Technology, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.3.12.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Technology, 2020 - 2028 10.4.5. Market Size and Forecast, By Type, 2020 - 2028 10.4.6. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.7. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Technology, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.8.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Technology, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.9.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Technology, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.10.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Technology, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.11.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.4.12. Rest of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Technology, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.4.12.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.5. Rest of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Technology, 2020 - 2028 10.5.4. Market Size and Forecast, By Type, 2020 - 2028 10.5.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.5.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Technology, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Type, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.5.8.6. Market Size and Forecast, By Propulsion, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Technology, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Type, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Vehicle Type, 2020 – 2028 10.5.9.6. Market Size and Forecast, By Propulsion, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Autoliv, Inc. 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Magna Valeo S.A. 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Delphi Automotive 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Continental AG 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. FORD MOTOR COMPANY 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Denso Corporation 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. ZF Friedrichshafen 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Hyundai Mobis Co. 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Mando Corporation 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. WABCO 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology