Blog

Debt Collection Software Market Grows: 9.61% CAGR

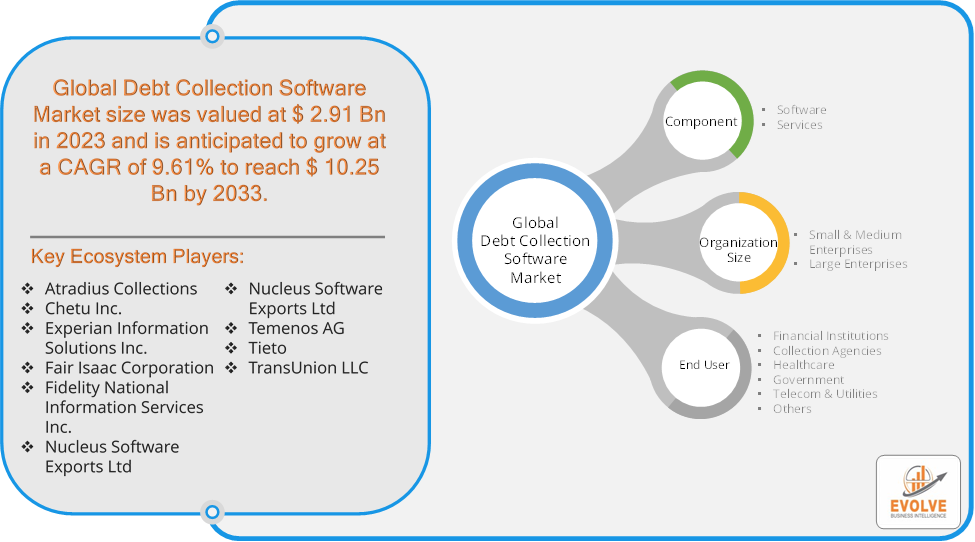

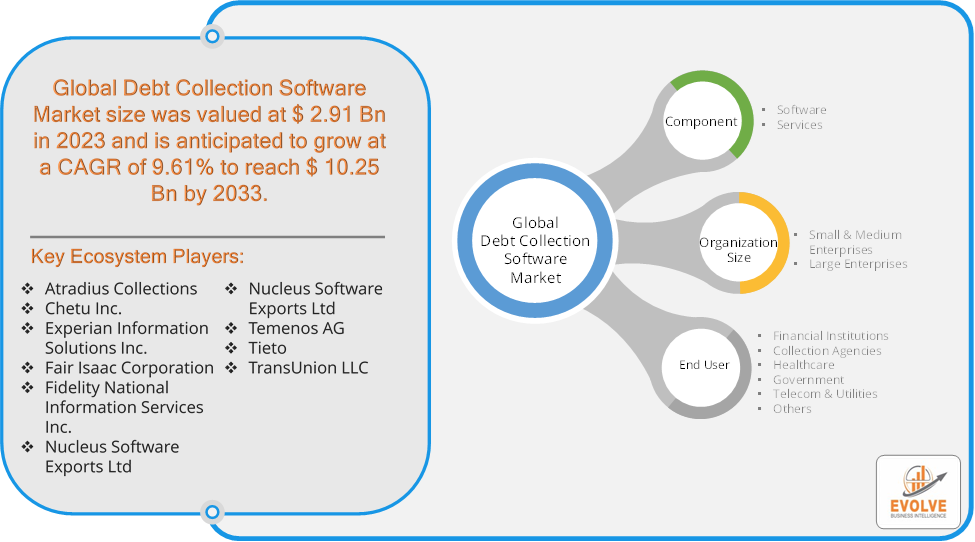

Evolve Business Intelligence has published a research report on the Global Debt Collection Software Market, 2023–2033. The global Debt Collection Software Market is projected to exhibit a CAGR of around 9.61% during the forecast period of 2023 to 2033.

Evolve Business Intelligence has recognized the following companies as the key players in the global Debt Collection Software Market: Atradius Collections, Chetu Inc., Experian Information Solutions Inc., Fair Isaac Corporation, Fidelity National Information Services Inc., Nucleus Software Exports Ltd, Nucleus Software Exports Ltd, Temenos AG, Tieto and TransUnion LLC.

More Information: https://evolvebi.com/report/debt-collection-software-market-analysis/

More Information: https://evolvebi.com/report/debt-collection-software-market-analysis/

Market Highlights

The Global Debt Collection Software Market is projected to be valued at USD 10.25 Billion by 2033, recording a CAGR of around 9.61% during the forecast period. The Debt Collection Software Market involves software solutions designed to assist businesses and organizations in managing and automating the process of collecting overdue debts from customers. These software applications help organizations, such as financial institutions, collection agencies, and healthcare providers, to efficiently manage their debt portfolios and increase their collection rates.

The market for debt collection software is driven by the need for efficient debt recovery processes, improved cash flow management, and reduced administrative costs. It serves various industries, including financial services, healthcare, utilities, and retail.

The COVID-19 pandemic had a significant impact on the Debt Collection Software Market. With physical offices closed and remote work becoming the norm, businesses needed digital solutions to manage debt collection processes. This led to a surge in demand for debt collection software that supports remote operations and automation. The pandemic introduced new regulations and guidelines for debt collection, such as temporary bans on debt collections and requirements for more transparent communication with debtors. Software vendors had to ensure their solutions complied with these evolving regulations. The need for better analytics and reporting tools grew as businesses sought to understand the impact of the pandemic on their debt portfolios. Debt collection software with advanced reporting capabilities became more valuable for tracking performance and making data-driven decisions.

Segmental Analysis

The global Debt Collection Software Market has been segmented based on Component, Organization Size and End User.

Based on Component, the Debt Collection Software Market is segmented into Software and Services. The Software Systems segment is anticipated to dominate the market.

Based on Organization Size, the global Debt Collection Software Market has been divided into By Organization Size Small & Medium Enterprises and Large Enterprises. The Large Enterprises segment is anticipated to dominate the market.

Based on End Users, the global Debt Collection Software Market has been divided into Financial Institutions, Collection Agencies, Healthcare, Government, Telecom & Utilities and Others. The Healthcare segment is anticipated to dominate the market.

More Information: https://evolvebi.com/report/debt-collection-software-market-analysis/

Regional Analysis

The Debt Collection Software Market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, & Africa. North America, particularly the United States, is the largest and most mature market for debt collection software. The General Data Protection Regulation (GDPR) impacts data handling and privacy considerations in debt collection. A strong economy, a well-developed financial sector, and a high adoption rate of technology have contributed to the market’s growth. The European debt collection software market is experiencing steady growth, driven by factors such as increasing digitization and the need for efficient debt recovery processes. The increasing adoption of cloud-based solutions and the growing focus on data analytics present significant opportunities for market growth. The Asia-Pacific region is one of the fastest-growing markets for debt collection software, driven by economic growth, rising consumer debt, and the increasing adoption of technology. Growing adoption of cloud-based and mobile solutions, increasing focus on automation and AI, and rising demand in emerging markets. The Latin American debt collection software market is still in its early stages of development, but it is showing signs of growth, particularly in countries with strong economies and increasing financial services. The Middle East and Africa region is a developing market for debt collection software, with growth driven by factors such as increasing urbanization and the expansion of financial services.