Blog

Consumer Finance Market Grows: 8.01% CAGR

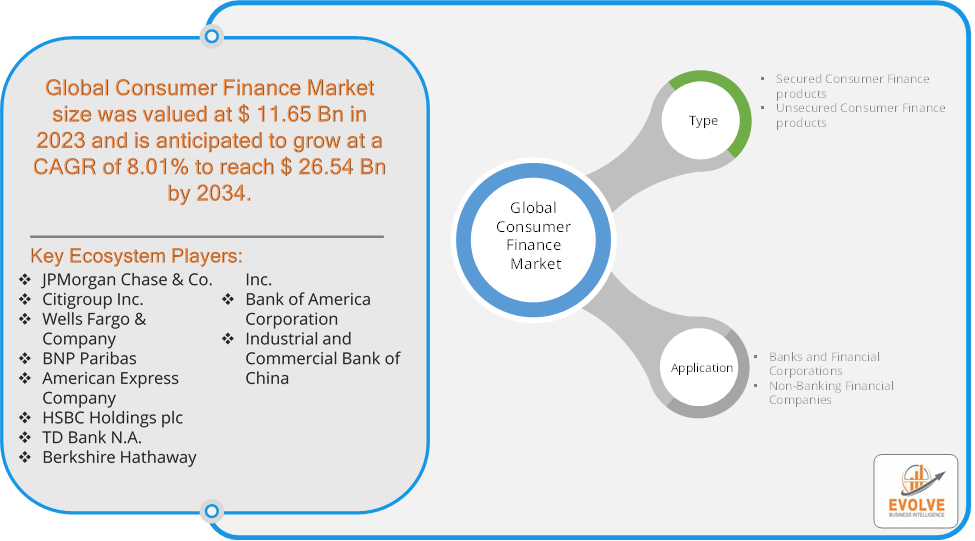

Evolve Business Intelligence has published a research report on the Global Consumer Finance Market, 2024–2034. The global Consumer Finance Market is projected to exhibit a CAGR of around 8.01% during the forecast period of 2024 to 2034.

Evolve Business Intelligence has recognized the following companies as the key players in the global Consumer Finance Market: JPMorgan Chase & Co., Citigroup, Inc., Wells Fargo & Company, BNP Paribas, American Express Company, HSBC Holdings plc, TD Bank, N.A., Berkshire Hathaway Inc., Bank of America Corporation and Industrial and Commercial Bank of China.

The Global Consumer Finance Market is projected to be valued at USD 26.54 Billion by 2034, recording a CAGR of around 8.01% during the forecast period. The Consumer Finance Market refers to the financial services and products offered to individuals (consumers) to help them manage personal expenses, purchase goods, or invest. It encompasses a broad range of products, including personal loans, credit cards, mortgages, auto loans, and lines of credit. The market primarily serves individual consumers rather than businesses, focusing on providing access to credit, financing options, and financial management tools to support everyday life and larger personal investments.

The consumer finance market plays a crucial role in the economy by providing individuals with the financial tools they need to achieve their financial goals. It helps people purchase homes, cars, and other assets, manage their expenses, and save for retirement.

Download the full report now to discover market trends, opportunities, and strategies for success.

Segmental Analysis

The global Consumer Finance Market has been segmented based on Type and Application.

Based on Type, the Consumer Finance Market is segmented into Secured Consumer Finance products and Unsecured Consumer Finance products. The Secured Consumer Finance products segment is anticipated to dominate the market.

Based on Application, the global Consumer Finance Market has been divided into Banks and Financial Corporations, and Non-Banking Financial Companies. The Banks and Financial Corporations segment is anticipated to dominate the market.

Regional Analysis

The Consumer Finance Market is divided into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East, & Africa. North America, particularly the U.S. and Canada, has a highly developed consumer finance market with widespread access to credit cards, loans, mortgages, and other financial services. The market is supported by a robust financial infrastructure and high consumer spending and the region is a global leader in fintech innovation, with widespread adoption of digital banking, mobile payments, and online lending platforms. Fintechs are competing with traditional financial institutions, offering more personalized and efficient services. Europe has a well-established consumer finance market, with significant regulatory oversight. The EU’s stringent financial regulations, such as GDPR and consumer protection laws, impact how financial institutions operate. The Asia-Pacific region, including major economies like China, India, Japan, and Southeast Asian countries, is experiencing rapid growth in the consumer finance market. Economic development, rising disposable incomes, and increasing urbanization are driving demand for consumer credit. Latin America is still developing its consumer finance market, with many consumers lacking access to formal financial services. However, the region is seeing rapid growth in fintech adoption, particularly in countries like Brazil, Mexico, and Argentina. Many countries in the Middle East and Africa have underdeveloped financial systems, with limited access to traditional banking services. However, mobile and digital financial solutions are rapidly emerging as alternatives, especially in Africa, where mobile money services like M-Pesa are widely used.