Construction 4.0 Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

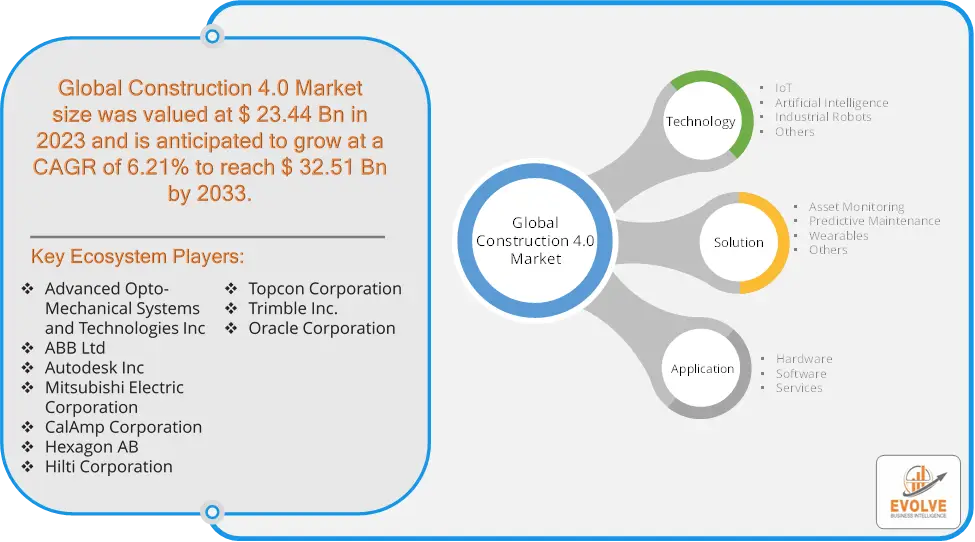

Construction 4.0 Market Research Report: Information By Technology (IoT, Artificial Intelligence, Industrial Robots, Others), By Application (Asset Monitoring, Predictive Maintenance, Wearables, Others), By Solution (Hardware, Software, Services), and by Region — Forecast till 2033

Page: 162

Construction 4.0 Market Overview

The Construction 4.0 Market Size is expected to reach USD 62.54 Billion by 2033. The Construction 4.0 Market industry size accounted for USD 11.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 17.24% from 2023 to 2033. The Construction 4.0 Market refers to the integration of advanced technologies and innovations within the construction industry, akin to the principles of Industry 4.0. This market encompasses the use of digital tools, automation, and smart technologies to enhance efficiency, productivity, and sustainability in construction processes.

The market is driven by the need for cost efficiency, improved safety, enhanced productivity, and reduced environmental impact in construction projects. Construction 4.0 also aligns with sustainable development goals by promoting energy efficiency and reducing waste.

Global Construction 4.0 Market Synopsis

The COVID-19 pandemic had a significant impact on the Construction 4.0 Market. The need to maintain social distancing and reduce on-site labour led to a surge in the use of automation and robotics in construction projects. The pandemic emphasized the importance of digital tools for remote collaboration, such as Building Information Modeling (BIM), which allowed teams to work together without being physically present on-site. The pandemic caused widespread delays and cancellations of construction projects, leading to reduced demand and slowed growth in the market. The shift to digital tools and automation required significant training and upskilling of the workforce, which was challenging to implement quickly during the pandemic. Rapid changes in regulations and compliance requirements related to health and safety during the pandemic created additional hurdles for the construction industry, slowing down the implementation of new technologies.

Construction 4.0 Market Dynamics

The major factors that have impacted the growth of Construction 4.0 Market are as follows:

Drivers:

Ø Advancements in Technology

Rapid advancements in digital technologies, such as IoT, AI, robotics, and 3D printing, have made Construction 4.0 solutions more accessible and practical. These technologies enhance project planning, execution, and management, driving their adoption across the industry. Worker safety is a top priority in construction, and Construction 4.0 technologies offer significant improvements in this area. Wearable devices, drones, and AI-driven safety monitoring systems help prevent accidents and ensure compliance with safety regulations. The global trend of rapid urbanization and the need for modern infrastructure drive demand for more efficient and scalable construction solutions. Construction 4.0 technologies enable faster and more precise construction, meeting the needs of growing urban populations.

Restraint:

- Perception of High Initial Costs and Lack of Skilled Workforce

Implementing Construction 4.0 technologies, such as advanced robotics, automation, and digital tools like BIM, often requires significant upfront investment. This includes the cost of hardware, software, and training, which can be prohibitive for small and medium-sized construction firms. The successful implementation of Construction 4.0 technologies requires a workforce skilled in digital tools, data analytics, and advanced machinery. However, there is a significant skills gap in the construction industry, making it challenging for companies to adopt and fully utilize these technologies.

Opportunity:

⮚ Sustainability and Green Building:

Construction 4.0 technologies can contribute to building energy-efficient structures by optimizing design, construction processes, and resource management, aligning with global sustainability goals. Advanced technologies can help reduce construction waste through better planning, materials management, and recycling processes. Automating repetitive tasks and using robotics can reduce labor costs and improve construction speed, offering significant cost savings and efficiency gains. IoT and AI can enable predictive maintenance of construction equipment and infrastructure, reducing downtime and extending asset lifespan.

Construction 4.0 Market Segment Overview

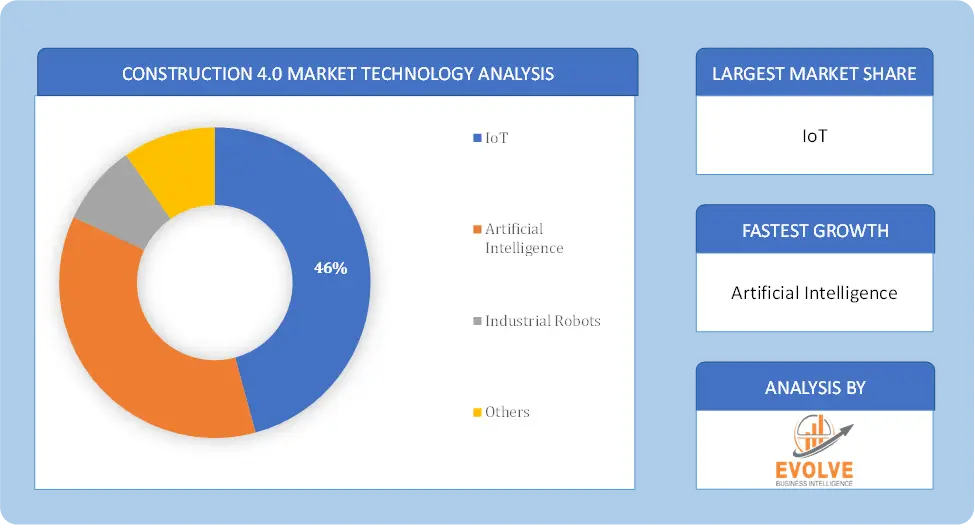

By Technology

Based on Technology, the market is segmented based on IoT, Artificial Intelligence, Industrial Robots and Others. The IoT category generated the most income. One benefit of loT expanding its application in Construction 4.0 is the most effective use of the available resources with strong technological planning, regulated costs, and reduced risks. Applications of the Internet of Things (IoT) are widespread in the construction industry.

Based on Technology, the market is segmented based on IoT, Artificial Intelligence, Industrial Robots and Others. The IoT category generated the most income. One benefit of loT expanding its application in Construction 4.0 is the most effective use of the available resources with strong technological planning, regulated costs, and reduced risks. Applications of the Internet of Things (IoT) are widespread in the construction industry.

By Application

Based on Application, the market segment has been divided into Asset Monitoring, Predictive Maintenance, Wearables and Others. The asset monitoring segment dominated the market. This can be linked to the growing use of asset management software by construction companies, who want to maximize the value of their assets and manage them effectively. The increasing use of AI algorithms, ML, and data analytics by asset managers to schedule maintenance, detect maintenance needs, and forecast possible failures will contribute to the segment’s growth.

By Solution

Based on Solution, the market segment has been divided into Hardware, Software and Services. The software segment dominated the market. Construction 4.0 techniques are enabled and supported in large part by software. The software component includes a variety of tools such as data analytics software, scheduling and planning tools, BIM software, collaboration platforms, and project management software.

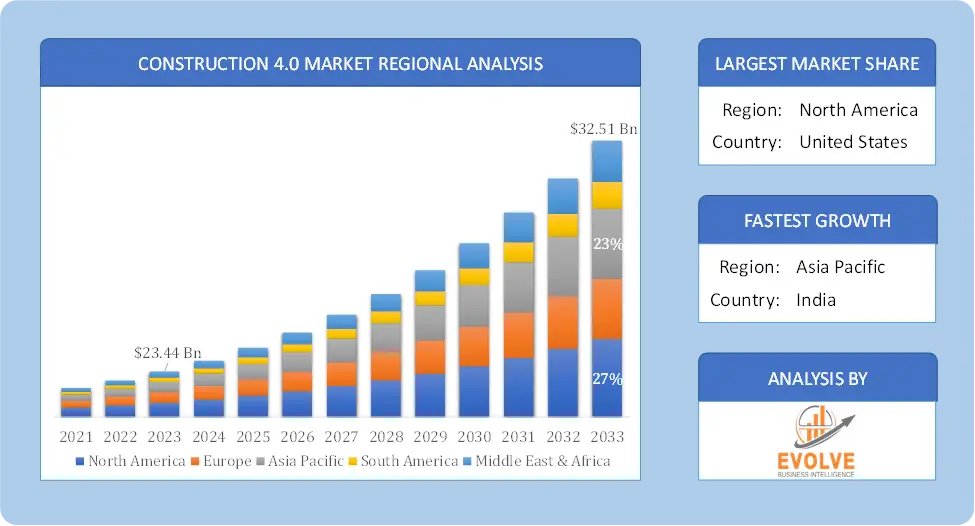

Global Construction 4.0 Market Regional Analysis

Based on region, the global Construction 4.0 Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Construction 4.0 Market followed by the Asia-Pacific and Europe regions.

Construction 4.0 North America Market

Construction 4.0 North America Market

North America holds a dominant position in the Construction 4.0 Market. North America is a leading adopter of Construction 4.0 technologies due to advanced infrastructure, high levels of investment in technology, and a focus on efficiency and sustainability. The market benefits from significant government and private sector investment in smart cities, green building initiatives, and advanced construction technologies and there is high demand for smart buildings, energy-efficient solutions, and advanced construction management systems. The U.S. and Canada are also focusing on integrating IoT, AI, and robotics into construction processes.

Construction 4.0 Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Construction 4.0 Market industry. China is a major player in the Construction 4.0 market due to its rapid urbanization, large-scale infrastructure projects, and significant investments in smart city development. The country is also a leader in the use of construction robotics and automation and India is witnessing increased adoption of Construction 4.0 technologies driven by urbanization, infrastructure development, and government initiatives aimed at improving construction efficiency and sustainability.

Competitive Landscape

The global Construction 4.0 Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Advanced Opto-Mechanical Systems and Technologies Inc

- ABB Ltd

- Autodesk Inc

- Mitsubishi Electric Corporation

- CalAmp Corporation

- Hexagon AB

- Hilti Corporation

- Topcon Corporation

- Trimble Inc.

- Oracle Corporation.

Key Development

In November 2022, Trimble and the Hilti Group, a global leader providing innovative tools, technology, software, and services to the commercial construction industry, announced that the Hilti ON!Track asset management system will integrate with Trimble Viewpoint Vista, an ERP solution within the Trimble Construction One suite. This will allow contractors to track and manage their tools and equipment.

In January 2023, Topcon Positioning Systems announced the expanding of compact solutions portfolio with 2D-MC automatic grade control solution for compact track loaders. 2D-MC is a low-cost 2D machine control system that is designed to be installed directly onto select grading attachments and provide simplified operational visibility.

Scope of the Report

Global Construction 4.0 Market, by Technology

- IoT

- Artificial Intelligence

- Industrial Robots

- Others

Global Construction 4.0 Market, by Application

- Asset Monitoring

- Predictive Maintenance

- Wearables

- Others

Global Construction 4.0 Market, by Solution

- Hardware

- Software

- Services

Global Construction 4.0 Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $62.54 Billion |

| CAGR | 17.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Application, Solution |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, Mitsubishi Electric Corporation, CalAmp Corporation, Hexagon AB, Hilti Corporation, Topcon Corporation, Trimble Inc. and Oracle Corporation. |

| Key Market Opportunities | • Sustainability and Green Building • Cost Reduction and Efficiency Gains |

| Key Market Drivers | • Advancements in Technology • Rising Focus on Safety |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Construction 4.0 Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Construction 4.0 Market historical market size for the year 2021, and forecast from 2023 to 2033

- Construction 4.0 Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Construction 4.0 Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Construction 4.0 Market is 2021- 2033

What is the growth rate of the global Construction 4.0 Market?

The global Construction 4.0 Market is growing at a CAGR of 17.24% over the next 10 years

Which region has the highest growth rate in the market of Construction 4.0 Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Construction 4.0 Market?

North America holds the largest share in 2022

Who are the key players in the global Construction 4.0 Market?

Advanced Opto-Mechanical Systems and Technologies Inc, ABB Ltd, Autodesk Inc, Mitsubishi Electric Corporation, CalAmp Corporation, Hexagon AB, Hilti Corporation, Topcon Corporation, Trimble Inc. and Oracle Corporation are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Construction 4.0 Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Construction 4.0 Market, By Technology 6.1. Introduction 6.2. IoT 6.3. Artificial Intelligence 6.4. Industrial Robots 6.5. Others Chapter 7. Global Construction 4.0 Market, By Application 7.1. Introduction 7.2. Asset Monitoring 7.3. Predictive Maintenance 7.4. Wearables 7.5. Others Chapter 8. Global Construction 4.0 Market, By Solution 8.1. Introduction 8.2. Hardware 8.3. Software 8.4. Services Chapter 9. Global Construction 4.0 Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Technology, 2020 - 2028 9.2.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.6. Market Size and Forecast, By Solution, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Technology, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Solution, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Technology, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Solution, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Technology, 2020 - 2028 9.3.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.6. Market Size and Forecast, By Solution, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Technology, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Solution, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Technology, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Solution, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Technology, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Solution, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Technology, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Solution, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Technology, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Solution, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Technology, 2020 - 2028 9.4.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.7. Market Size and Forecast, By Solution, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Technology, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Solution, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Technology, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Solution, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Technology, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Solution, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Technology, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Solution, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Technology, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Solution, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Technology, 2020 - 2028 9.5.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.5. Market Size and Forecast, By Solution, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Technology, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Solution, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Technology, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Solution, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Advanced Opto-Mechanical Systems and Technologies Inc 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. ABB Ltd 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Autodesk Inc 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Mitsubishi Electric Corporation 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. CalAmp Corporation 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Hexagon AB 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Hilti Corporation 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Topcon Corporation 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Trimble, Inc. 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Oracle Corporation. 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology