Amphibious Vehicles Market Analysis and Global Forecast 2023-2033

$1,390.00 – $5,520.00Price range: $1,390.00 through $5,520.00

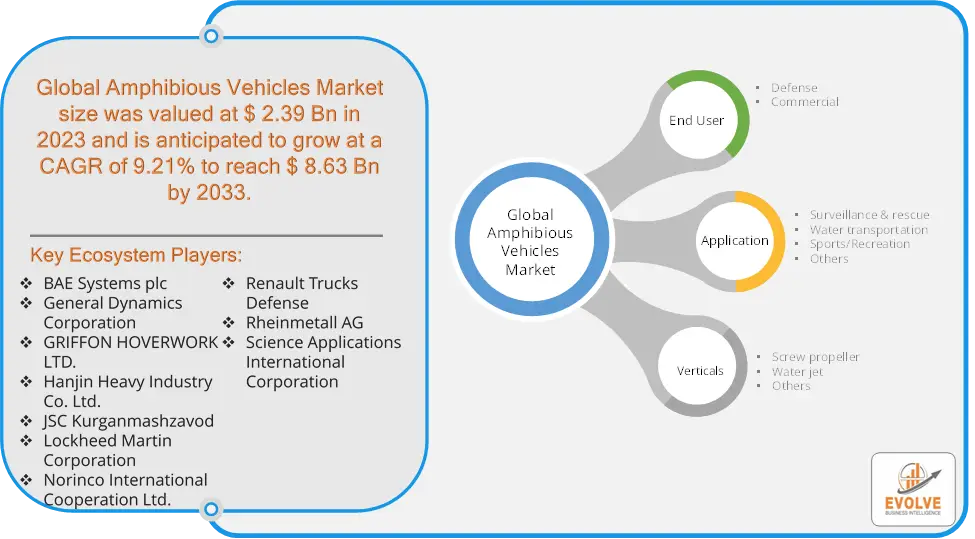

Amphibious Vehicles Market Research Report: By End User (Defense, Commercial), By Application (Surveillance & rescue, Water transportation, Sports/Recreation, Others), By propulsion (Screw propeller, Water jet, Others), and by Region — Forecast till 2033

Page: 160

[vc_row][vc_column width=”2/3″][vc_column_text css=”” text_larger=”no” woodmart_inline=”no”]

Amphibious Vehicles Market Overview

The Amphibious Vehicles Market Size is expected to reach USD 8.63 Billion by 2033. The Amphibious Vehicles industry size accounted for USD 2.39 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.21% from 2023 to 2033. The amphibious vehicles market refers to the segment of the automotive and defense industries that produce vehicles capable of operating both on land and water. These vehicles are designed for versatility and are utilized in a variety of applications including military operations, emergency rescue missions, and commercial activities like tourism and transport. Key features include watertight hulls, specialized propulsion systems, and often advanced navigation equipment. The market is driven by the need for efficient all-terrain mobility and enhanced tactical advantages in defense scenarios. Innovations in technology and increasing demand from emerging markets also contribute to the growth of this sector.

Global Amphibious Vehicles Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Amphibious Vehicles market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Global Amphibious Vehicles Market Dynamics

The major factors that have impacted the growth of Amphibious Vehicles are as follows:

Drivers:

⮚ Technological Advancements

Continuous advancements in vehicle technology, including improved propulsion systems, better materials, and enhanced design, are driving the market. Innovations such as hybrid propulsion, autonomous navigation systems, and improved safety features are making amphibious vehicles more efficient, reliable, and appealing to a broader range of customers.

Restraint:

- Technological Limitations

Despite advancements, amphibious vehicles still face technological challenges, such as ensuring reliable performance in diverse environments. Issues like water resistance, hull integrity, and propulsion system efficiency can affect operational reliability and safety. Continuous development is required to address these limitations, which can be resource-intensive.

Opportunity:

⮚ Increased Military and Defense Investments

The growing defense budgets of various countries, particularly in emerging markets, create significant opportunities for amphibious vehicle manufacturers. As militaries seek to enhance their operational capabilities and readiness, there is increased demand for advanced amphibious vehicles for various applications, including amphibious assaults, reconnaissance, and logistical support.

Amphibious Vehicles Market Segment Overview

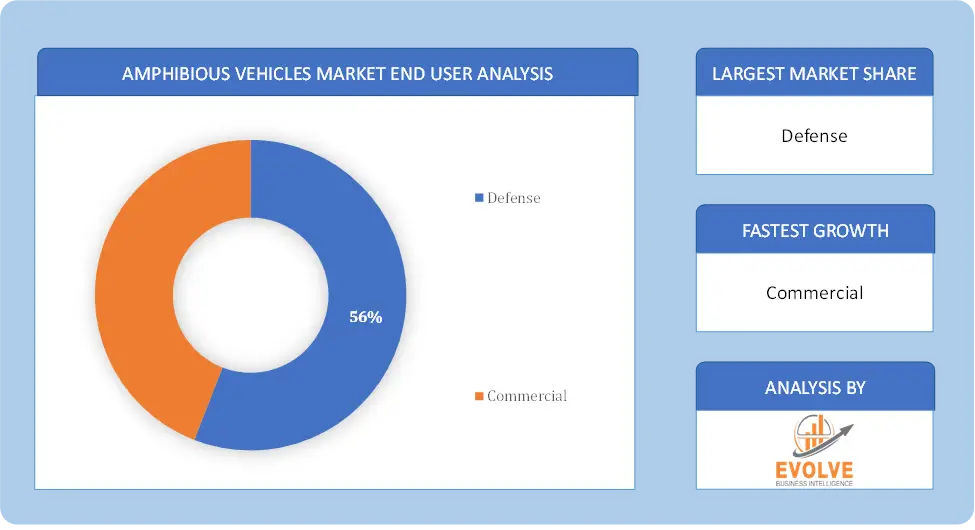

By End User

Based on the End User, the market is segmented based on Defense, Commercial. the defense segment generally dominates due to the high demand for advanced, multi-environment vehicles for military applications. However, the commercial segment is growing, driven by increasing use in tourism and other commercial activities.

By Application

Based on the Application, the market has been divided into Surveillance & rescue, Water transportation, Sports/Recreation, Others. the surveillance and rescue segment often dominates due to its critical role in emergency response and disaster management. However, water transportation is also significant, driven by the need for versatile transport solutions in challenging environments.

Based on the Application, the market has been divided into Surveillance & rescue, Water transportation, Sports/Recreation, Others. the surveillance and rescue segment often dominates due to its critical role in emergency response and disaster management. However, water transportation is also significant, driven by the need for versatile transport solutions in challenging environments.

By Verticals

Based on Verticals, the market has been divided into Screw propeller, Water jet, Others. the screw propeller segment typically dominates due to its proven efficiency and reliability in both land and water propulsion. However, water jet systems are gaining traction for their higher maneuverability and reduced maintenance requirements.

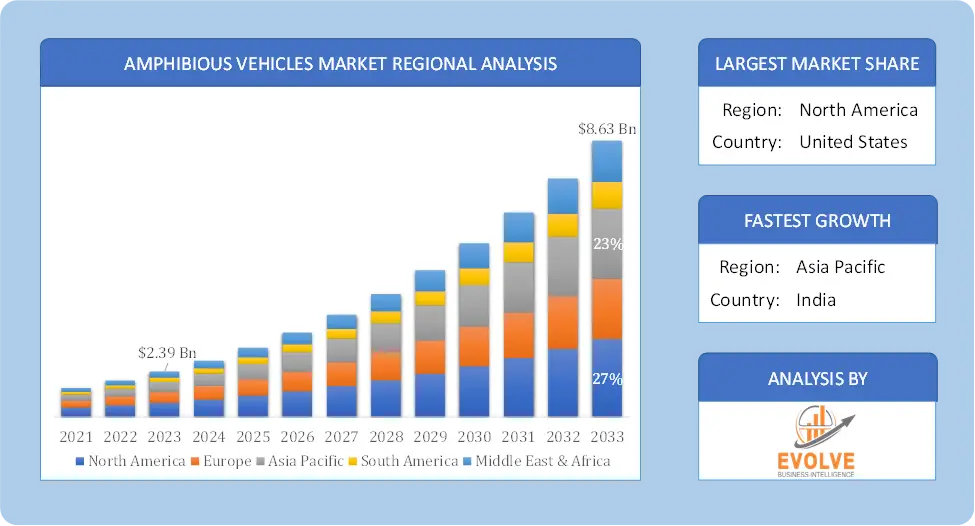

Global Amphibious Vehicles Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Amphibious Vehicles, followed by those in Asia-Pacific and Europe.

Amphibious Vehicles North America Market

Amphibious Vehicles North America Market

North America dominates the Amphibious Vehicles market due to several factors. North America held the largest amphibious vehicle market share in 2023 and is expected to be the fastest-growing region during the forecast period. In recent years, the U.S. has significantly increased spending on modernizing its marine fleets. In addition, key manufacturers such as Kawasaki Robotics and Electroimpact Inc. are driving market growth in the U.S. Moreover, government authorities are focusing on investing in advanced technology propulsion systems in the upcoming years.

Amphibious Vehicles Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. Asia Pacific held the second-largest region by market share in 2023 and is also expected to be the second fastest-growing region during the forecast period. The robust growth is due to a significant rise in demand for advanced ACVs from various countries. Besides, China, Saudi Arabia, and India are strengthening their defense budgets, which is likely to impel the market growth. The region is expected to witness long-term growth in this market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BAE Systems plc, General Dynamics Corporation, GRIFFON HOVERWORK LTD., Hanjin Heavy Industry Co. Ltd., and JSC Kurganmashzavod are some of the leading players in the global Amphibious Vehicles Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BAE Systems plc

- General Dynamics Corporation

- GRIFFON HOVERWORK LTD.

- Hanjin Heavy Industry Co. Ltd.

- JSC Kurganmashzavod

- Lockheed Martin Corporation

- Norinco International Cooperation Ltd.

- Renault Trucks Defense

- Rheinmetall AG

- Science Applications International Corporation

Key development:

In September 2022, Norinco International Cooperation Ltd. showcased its advanced amphibious vehicle technologies, highlighting enhancements in both military and civilian applications, including improved operational capabilities and integrated advanced systems.

Scope of the Report

Global Amphibious Vehicles Market, by End User

- Defense

- Commercial

Global Amphibious Vehicles Market, by Application

- Surveillance & rescue

- Water transportation

- Sports/Recreation

- Others

Global Amphibious Vehicles Market, by Verticals

- Screw propeller

- Water jet

- Others

Global Amphibious Vehicles Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.63 Billion |

| CAGR | 9.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | End User, Application, Verticals |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BAE Systems plc, General Dynamics Corporation, GRIFFON HOVERWORK LTD., Hanjin Heavy Industry Co. Ltd., JSC Kurganmashzavod, Lockheed Martin Corporation, Norinco International Cooperation Ltd., Renault Trucks Defense, Rheinmetall AG, Science Applications International Corporation |

| Key Market Opportunities | • Creative Content Generation and Personalization • Expanding applications in industries like media & entertainment, gaming, healthcare, design |

| Key Market Drivers | • Advancements in AI research and technology • Growing demand for personalized and creative content. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Amphibious Vehicles Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Amphibious Vehicles market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Amphibious Vehicles market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Amphibious Vehicles Market.

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text text_larger=”no” woodmart_inline=”no”]

[html_block id=”3961″][/vc_column_text][vc_wp_text]

Press Release

[rpwe limit=”10″ thumb=”true”][/vc_wp_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text woodmart_inline=”no” text_larger=”no”]

Frequently Asked Questions (FAQ)

[/vc_column_text][vc_column_text woodmart_inline=”no” text_larger=”no”][sp_easyaccordion id=”74093″][/vc_column_text][/vc_column][/vc_row]