Online Trading Platform Market Analysis and Global Forecast 2023-2033

$1,390.00 – $5,520.00Price range: $1,390.00 through $5,520.00

Online Trading Platform Market Research Report: Information By Interface Type (Desktop, Web-based, and mobile-based), By End User (Banking and Financial Institutions, Brokers, and Others), and by Region — Forecast till 2033

Page: 129

[vc_row content_placement=”top”][vc_column css=”.vc_custom_1532433256788{margin-right: 15px !important;}” offset=”vc_col-md-8″][woodmart_responsive_text_block size=”custom” align=”left” woodmart_css_id=”67d6af05cb898″ content_width=”100″ inline=”no” text_font_size=”eyJwYXJhbV90eXBlIjoid29vZG1hcnRfcmVzcG9uc2l2ZV9zaXplIiwiY3NzX2FyZ3MiOnsiZm9udC1zaXplIjpbIiAud29vZG1hcnQtdGV4dC1ibG9jayJdfSwic2VsZWN0b3JfaWQiOiI2N2Q2YWYwNWNiODk4IiwiZGF0YSI6eyJkZXNrdG9wIjoiMTRweCJ9fQ==” responsive_spacing=”eyJwYXJhbV90eXBlIjoid29vZG1hcnRfcmVzcG9uc2l2ZV9zcGFjaW5nIiwic2VsZWN0b3JfaWQiOiI2N2Q2YWYwNWNiODk4Iiwic2hvcnRjb2RlIjoid29vZG1hcnRfcmVzcG9uc2l2ZV90ZXh0X2Jsb2NrIiwiZGF0YSI6eyJ0YWJsZXQiOnt9LCJtb2JpbGUiOnt9fX0=”]

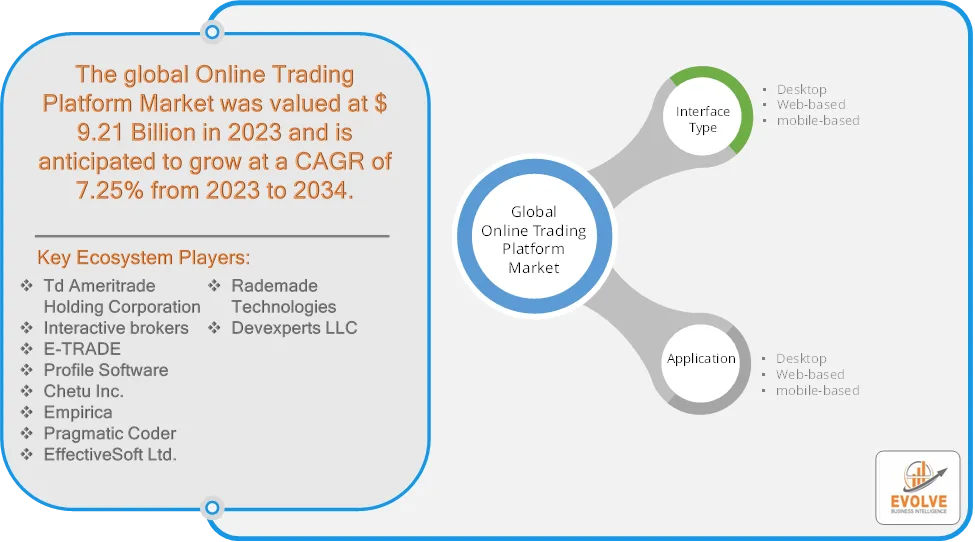

Online Trading Platform Market Overview

The Online Trading Platform Market size accounted for USD 9.21 Billion in 2023 and is estimated to account for 11.32 Billion in 2024. The Market is expected to reach USD 18.37 Billion by 2034 growing at a compound annual growth rate (CAGR) of 7.25% from 2024 to 2034. The online trading platform market has experienced significant growth and transformation over recent years, driven by technological advancements, increased retail investor participation, and the emergence of innovative financial technologies. The online trading platform market is dynamic and continually evolving, influenced by technological innovations, changing investor behaviors, and regulatory developments. As platforms strive to offer more sophisticated tools and access to diverse financial instruments, they play a crucial role in shaping the future landscape of global financial markets.

The online trading platform market is dynamic and evolving, driven by technological innovation and changing investor behavior.

Global Online Trading Platform Market Synopsis

Online Trading Platform Market Dynamics

Online Trading Platform Market Dynamics

The major factors that have impacted the growth of Online Trading Platform Market are as follows:

Drivers:

Ø Rising Technological Advancements

Continuous technological innovations, particularly the integration of artificial intelligence (AI) and machine learning, are enhancing user experiences on trading platforms. These technologies streamline processes, provide real-time data analysis, and improve risk management tools, simplifying decision-making and automating various trading strategies. The ongoing digital transformation in the financial services industry is driving the adoption of online trading platforms. Investors seek convenient and efficient ways to manage their investments, and online platforms play a crucial role in promoting financial inclusion by providing access to investment opportunities, education, and resources previously unavailable to many individuals.

Restraint:

- Smart Conflicts of Interest and Technological Vulnerabilities

Practices like Payment for Order Flow (PFOF), where brokers receive compensation for directing orders to specific market makers, can create conflicts of interest. This arrangement may result in orders being routed to venues that prioritize broker profits over optimal execution for clients, potentially undermining investor trust and leading to regulatory scrutiny and dependence on technology exposes trading platforms to risks like system outages, cyberattacks, and technical glitches. Such vulnerabilities can disrupt trading activities, lead to financial losses, and damage the platform’s reputation.

Opportunity:

⮚ Integration of Advanced Technologies

The accessibility of open-source artificial intelligence (AI) tools is transforming trading strategies. Platforms incorporating AI can offer enhanced data analysis, predictive modeling, and personalized user experiences. This technological integration can democratize sophisticated trading tools, making them available to a broader audience and potentially increasing user engagement and the rise of social trading platforms, such as ZuluTrade, enables users to replicate the strategies of experienced traders. This model appeals to novice investors seeking guidance and fosters a community-driven trading environment. Platforms offering social trading features can attract users interested in collaborative and educational trading experiences.

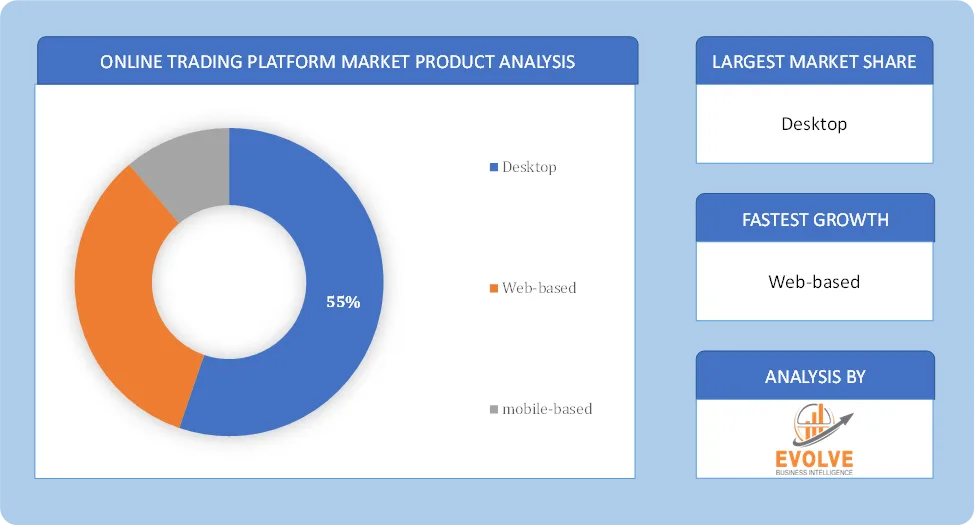

Online Trading Platform Market Segment Overview

Based on Interface Type, the market is segmented based on Desktop, Web-based, and mobile-based. Desktop segment dominant the market. The move is the result of a rise in demand for trading platforms, which traders may download and use to check and adjust their online trading positions using graphs and other indicators. It is anticipated that the mobile app-based market would grow significantly over the anticipated time frame. The growing use of smartphones, media devices, and social media platforms all contribute to the need for mobile app-based trading platforms.

By End User

Based on End User, the market segment has been divided into the Banking and Financial Institutions, Brokers, and Others. Banking and financial institutions segment dominated the Online Trading Platform Market. This is because stock market fluctuations are greatly influenced by the movement of huge blocks of shares. It is described as a group of knowledgeable, experienced investors who avoid making rash decisions and investments.

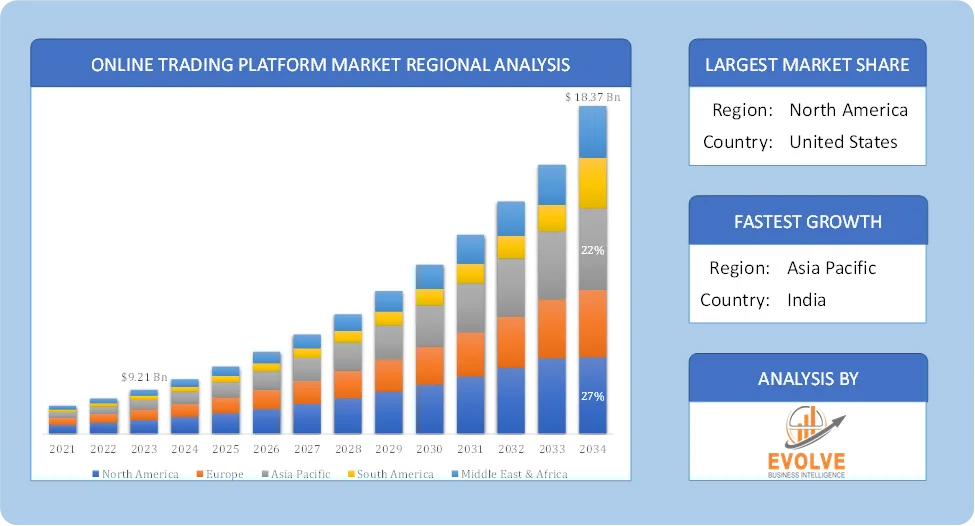

Global Online Trading Platform Market Regional Analysis

Based on region, the global Online Trading Platform Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Online Trading Platform Market followed by the Asia-Pacific and Europe regions.

North America Online Trading Platform Market

North America Online Trading Platform Market

North America holds a dominant position in the Online Trading Platform Market. North America holds a significant market share, driven by its well-established financial markets and advanced technological infrastructure. The region’s dominance is also attributed to the extensive and well-established financial industry, including major stock exchanges and institutional investors and a high adoption rate of online trading among retail investors is a key factor.

Asia-Pacific Online Trading Platform Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Online Trading Platform Market industry. The Asia-Pacific region is witnessing rapid growth in online trading, propelled by increasing smartphone penetration and financial literacy initiatives. Platforms like Zerodha in India and Tiger Brokers in China have capitalized on this trend. Government efforts to promote digital financial inclusion, such as India’s Unified Payments Interface (UPI) integration into trading platforms, have enhanced accessibility. The region’s young, tech-savvy population is driving demand for mobile-friendly trading solutions.

Competitive Landscape

The global Online Trading Platform Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Td Ameritrade Holding Corporation

- Interactive brokers

- E-TRADE

- Profile Software

- Chetu Inc.

- Empirica

- Pragmatic Coder

- EffectiveSoft Ltd.

- Rademade Technologies

- Devexperts LLC.

Scope of the Report

Global Online Trading Platform Market, by interface Type

- Desktop

- Web-based

- mobile-based

Global Online Trading Platform Market, by End User

- Banking and Financial Institutions

- Brokers

- Others

Global Online Trading Platform Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 18.37 Billion |

| CAGR (2023-2033) | 7.25% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Interface Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Td Ameritrade Holding Corporation, Interactive brokers, E-TRADE, Profile Software, Chetu Inc., Empirica, Pragmatic Coder, EffectiveSoft Ltd., Rademade Technologies and Devexperts LLC. |

| Key Market Opportunities | · Integration of Advanced Technologies

· Social and Copy Trading Platforms |

| Key Market Drivers | · Rising Technological Advancements

· Digital Transformation and Financial Inclusion |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Online Trading Platform Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Online Trading Platform Market historical market size for the year 2021, and forecast from 2023 to 2033

- Online Trading Platform Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Online Trading Platform Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

[/woodmart_responsive_text_block][vc_column_text css=”” woodmart_inline=”no” text_larger=”no”]

Frequently Asked Questions (FAQ)

[sp_easyaccordion id=”76753″][/vc_column_text][/vc_column][vc_column offset=”vc_col-md-4″][vc_column_text text_larger=”no” woodmart_inline=”no”]

[html_block id=”3961″][/vc_column_text][vc_wp_text]

Press Release

[rpwe limit=”10″ thumb=”true”][/vc_wp_text][/vc_column][/vc_row]