Specialty Fertilizers Market Overview

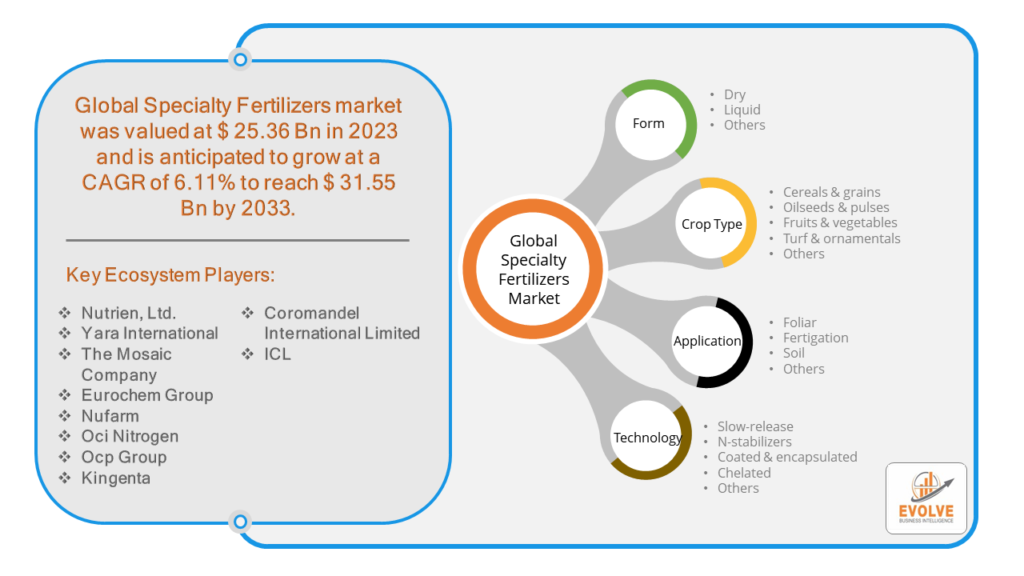

Specialty Fertilizers Market Size is expected to reach USD 15.66 Billion by 2033. The Specialty Fertilizers industry size accounted for USD 25.36 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.11% from 2023 to 2033. Specialty fertilizers are a category of agricultural inputs comprising formulations tailored to provide targeted and precise nutrient supplementation to specific crops, soils, or growth stages. Distinguished from conventional fertilizers by their customized nutrient compositions and enhanced efficiency characteristics, specialty fertilizers are designed to optimize plant growth, yield, and quality while minimizing environmental impacts. These fertilizers often incorporate slow-release mechanisms, micronutrient enrichment, or biostimulant additives to enhance nutrient uptake, improve soil health, and promote sustainable agricultural practices. Specialty fertilizers play a pivotal role in modern agriculture by addressing the diverse nutrient requirements of crops, maximizing resource utilization, and supporting the attainment of sustainable production goals.

Global Specialty Fertilizers Market Synopsis

The Specialty Fertilizers market experienced a detrimental effect due to the Covid-19 pandemic, as disruptions in supply chains and logistical challenges hindered the production and distribution of fertilizers. Decreased demand from farmers, coupled with uncertainties in global markets, led to reduced investments in agricultural inputs, impacting the overall market growth. However, the sector is gradually recovering as economies reopen and agricultural activities resume, albeit with lingering challenges such as fluctuating input costs and shifting consumer preferences.

Global Specialty Fertilizers Market Dynamics

The major factors that have impacted the growth of Specialty Fertilizers are as follows:

Drivers:

⮚ Increasing Demand for High-Quality Crops

The growing consumer preference for high-quality, nutrient-rich produce is driving the demand for specialty fertilizers, as they enable growers to optimize crop yields, quality, and nutritional content. With rising health consciousness among consumers, there is a greater emphasis on enhancing the nutritional value and taste of crops, driving the adoption of specialty fertilizers to meet these demands.

Restraint:

- Regulatory Hurdles and Compliance Costs

Regulatory requirements and compliance costs pose significant challenges for manufacturers and distributors of specialty fertilizers. Stringent regulations governing product formulations, labeling, and environmental impact assessments can increase production costs and time-to-market for specialty fertilizers, thereby hindering market growth. Moreover, the complexity of navigating regulatory frameworks across different regions adds further barriers to market entry and expansion.

Opportunity:

⮚ Sustainable Agriculture Initiatives

The growing focus on sustainable agriculture practices presents a significant opportunity for the specialty fertilizers market. With increasing concerns about environmental degradation and climate change, there is a rising demand for fertilizers that promote soil health, minimize nutrient runoff, and reduce greenhouse gas emissions. Specialty fertilizers, particularly those incorporating slow-release formulations, bio-based ingredients, and micronutrient-enriched blends, offer sustainable solutions to improve crop productivity while minimizing environmental impacts. Moreover, initiatives promoting organic farming and soil conservation provide a conducive environment for the adoption of specialty fertilizers, driving market growth in the long term.

Specialty Fertilizers Market Segment Overview

By Form

By Crop Type

Based on Crop Type, the market has been divided into Cereals & grains, Oilseeds & pulses, Fruits & vegetables, Turf & ornamentals, Others. The Cereals & grains segment dominates the Specialty Fertilizers Market due to the extensive cultivation of staple crops worldwide and the increasing demand for high-yield, nutrient-rich grains. Additionally, specialty fertilizers tailored to the specific nutritional needs of cereal and grain crops help optimize yields, improve crop quality, and enhance resistance to environmental stressors, driving their widespread adoption among farmers.

By Application

Based on the Application, the market has been divided into Foliar, Fertigation, Soil, Others. The Foliar segment dominates the Specialty Fertilizers Market due to its effectiveness in providing rapid nutrient uptake by crops, resulting in quick responses and visible improvements in plant health and productivity. Additionally, foliar application offers flexibility in nutrient delivery, allowing farmers to address specific deficiencies and optimize crop nutrition during critical growth stages, thereby driving its preference among growers.

By Technology

Based on Technology, the market has been divided into Slow-release, N-stabilizers, Coated & encapsulated, Chelated, Others. The Slow-release segment dominates the Specialty Fertilizers Market due to its ability to provide a consistent and prolonged nutrient supply to crops, promoting balanced growth and minimizing nutrient leaching. Additionally, slow-release fertilizers offer convenience and cost-effectiveness, reducing the need for frequent applications and minimizing environmental impacts, thus driving their widespread adoption among farmers and horticulturists.

Global Specialty Fertilizers Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market, followed by those in Asia-Pacific and Europe.

The North American region holds a dominant position in the Specialty Fertilizers market, buoyed by its advanced agricultural practices, technological innovations, and robust demand for high-quality crops. With a strong focus on maximizing yields, improving soil health, and meeting stringent regulatory standards, North American farmers increasingly rely on specialty fertilizers to optimize crop production and enhance profitability. Moreover, the region’s favorable economic conditions, supportive government policies, and growing consumer preference for sustainably sourced produce further bolster the demand for specialty fertilizers. Additionally, investments in research and development, coupled with strategic collaborations between key industry players, continue to drive innovation and market growth in North America’s Specialty Fertilizers sector.

Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Specialty Fertilizers industry due to several key factors. These include the region’s expanding population, rising food demand, and increasing adoption of modern agricultural practices to boost productivity. Additionally, governments in countries like China, India, and Southeast Asian nations are implementing initiatives to promote sustainable farming and enhance agricultural efficiency, driving the demand for specialty fertilizers. Moreover, the growing awareness among farmers about the benefits of specialty fertilizers in improving crop yield, quality, and profitability is fueling market expansion across the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Nutrien, Ltd., Yara International, The Mosaic Company, Eurochem Group, Nufarm are some of the leading players in the global Specialty Fertilizers Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Nutrien, Ltd.

- Yara International

- The Mosaic Company

- Eurochem Group

- Nufarm

- Oci Nitrogen

- Ocp Group

- Kingenta

- Coromandel International Limited

- ICL

Key Development:

In March 2022, EuroChem Group disclosed the finalization of its acquisition of a majority stake (51.48%) in the Brazilian distributor Fertilizantes Heringer SA, bolstering its production and distribution capabilities in Brazil.

In February 2022, EuroChem Group concluded its mergers and acquisitions endeavors by assuming control of the Serra do Salitre phosphate project, valued at US$ 452 million. EuroChem plans to invest a comparable sum to complete the project’s full implementation.

Scope of the Report

Global Specialty Fertilizers Market, by Form

- Dry

- Liquid

- Others

Global Specialty Fertilizers Market, by Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Turf & ornamentals

- Others

Global Specialty Fertilizers Market, by Application

- Foliar

- Fertigation

- Soil

- Others

Global Specialty Fertilizers Market, by Technology

- Slow-release

- N-stabilizers

- Coated & encapsulated

- Chelated

- Others

Global Specialty Fertilizers Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $25.36 Billion |

| CAGR | 6.11% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Form, Crop Type, Application, Technology |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Nutrien, Ltd., Yara International, The Mosaic Company, Eurochem Group, Nufarm, Oci Nitrogen, Ocp Group Kingenta, Coromandel International Limited, ICL |

| Key Market Opportunities | • Expansion into emerging markets with rising agricultural activities. • Development of innovative formulations catering to specific crop and soil requirements. |

| Key Market Drivers | • Increasing demand for high-quality, nutrient-rich crops. • Growing awareness about the benefits of specialty fertilizers in optimizing crop yield and quality. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Specialty Fertilizers Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Specialty Fertilizers market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Specialty Fertilizers market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Specialty Fertilizers Market.

Frequently Asked Questions (FAQ)

Specialty fertilizers market size ?

The global Specialty Fertilizers market size was valued at $38.12 Billion in 2020 and is expected to reach $65.81 Billion by 2028 growing at the CAGR of 6.93% from 2021 to 2028.

What are Specialty fertilizers products ?

Specialty fertilizers, such as controlled-release, water-soluble, micronutrient, slow-release, and customized fertilizers, are tailored to address specific nutrient deficiencies and enhance crop yields sustainably. They are utilized across various applications like row crops, fruits, vegetables, and turf, applied through soil, foliar, or fertigation methods, aligning with the increasing demand for sustainable agriculture.

Wholesale Specialty fertilizers ?

Some companies offering wholesale specialty fertilizers are:

1. Liquid Products: Providing specialty fertilizers for specialty crops in bulk or bags directly from supplier's warehouses with multiple terminals across the Northeast.

2. COMPO EXPERT: Offering a wide range of specialty fertilizers, including controlled-release, water-soluble, and micronutrient fertilizers to enhance crop yields and reduce environmental impact.

3. EuroChem Group: Providing specialty fertilizers such as bulk, fortified, and micronutrient fertilizers to improve soil nutrition and increase agricultural productivity.

4. ICL Specialty Fertilizers: Supplying products and services to various markets, focusing on providing specialized nutrition for plants to enhance crop yields.

Specialty fertilizers companies ?

Leading companies in the specialty fertilizers market include Terramera PlantHealth, focusing on biopesticides; Israel Chemicals Ltd (ICL), providing minerals and chemicals for various growers; Space AG, offering drone-based crop management solutions; and Soiltech, delivering real-time wireless monitoring for crop production improvement. Other key players include Kingenta, Agrium, AGLUKON Spezialduenger, EuroChem Group, Coromandel International Ltd., and The Mosaic Co., providing a wide array of specialty fertilizers to address specific nutrient deficiencies and boost crop yields.