Price range: $ 1,390.00 through $ 5,520.00

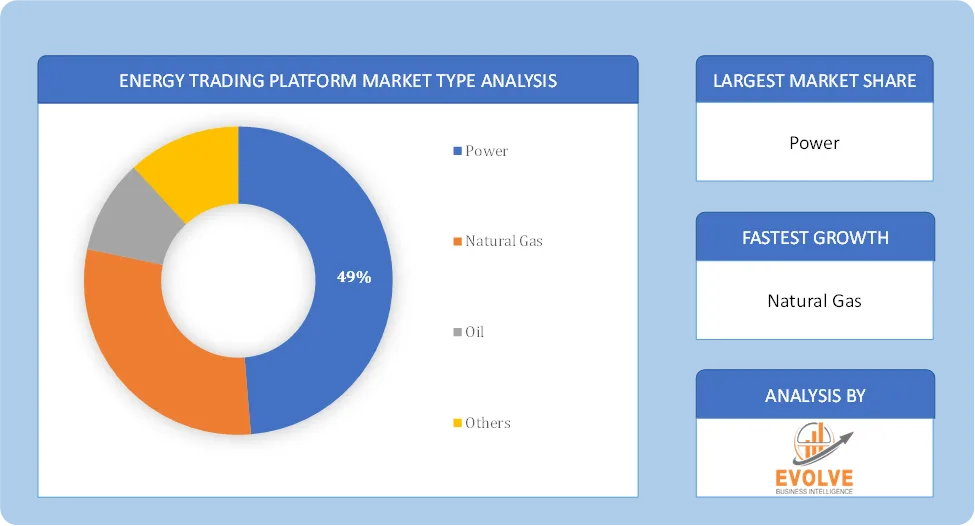

Energy Trading Platform Market Research Report: Information By Type (Power, Natural Gas, Oil, Others), by Trading Type (Intraday, Day-Ahead, Long-Term), by End-User (Utilities, Industrial, Retail, Others), and by Region — Forecast till 2034

Page: 165

Description

Energy Trading Platform Market Overview

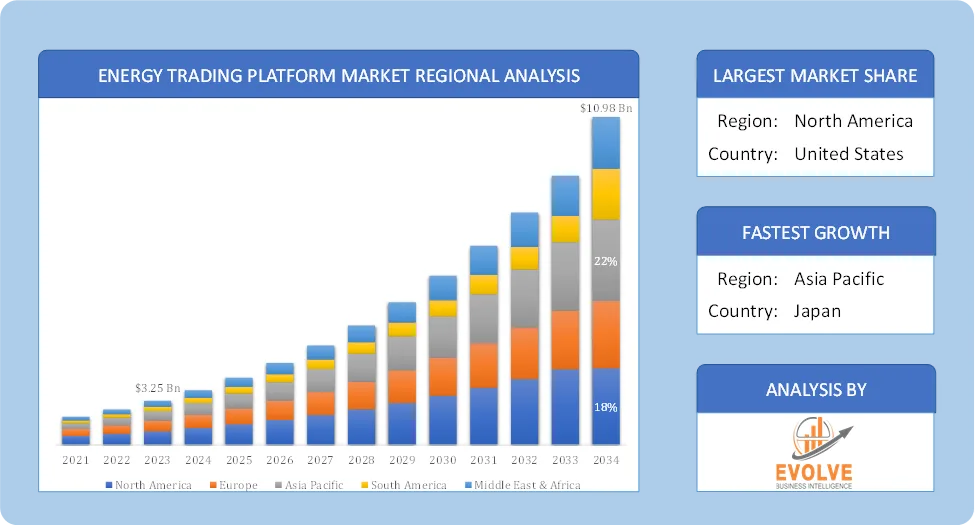

The Energy Trading Platform Market size accounted for USD 3.25 Billion in 2023 and is estimated to account for 4.20 Billion in 2024. The Market is expected to reach USD 10.98 Billion by 2034 growing at a compound annual growth rate (CAGR) of 14.28% from 2024 to 2034. The Energy Trading Platform Market is experiencing significant growth and transformation, driven by technological advancements, the increasing integration of renewable energy sources, and evolving energy market dynamics. These platforms facilitate the trading of energy commodities such as electricity, oil, gas, and renewable energy certificates, enabling stakeholders to optimize their trading strategies, enhance market liquidity, and streamline the execution of energy contracts.

The energy trading platform market is a dynamic and rapidly evolving sector. It is crucial for modern energy markets, enabling efficient trading, better integration of renewables, and enhanced grid stability.

Global Energy Trading Platform Market Synopsis

Energy Trading Platform Market Dynamics

Energy Trading Platform Market Dynamics

The major factors that have impacted the growth of Energy Trading Platform Market are as follows:

Drivers:

Ø Growing Adoption of Renewable Energy

The increasing penetration of solar, wind, and hydro power has led to a more decentralized and volatile energy market. Energy trading platforms help balance supply and demand by enabling real-time trading of renewable energy. Governments are introducing renewable energy certificates (RECs), which require efficient trading mechanisms. AI-driven predictive analytics enhance decision-making by analyzing price trends and optimizing trading strategies. Blockchain technology improves transparency, security, and efficiency in energy transactions and Cloud-based trading platforms offer scalability, flexibility, and real-time access to market data.

Restraint:

- High Initial Investment & Implementation Costs

Deploying an advanced energy trading platform requires significant capital investment in software, infrastructure, and personnel training. Small and medium-sized enterprises (SMEs) may find it cost-prohibitive to implement sophisticated trading solutions. Energy trading platforms handle sensitive financial and operational data, making them prime targets for cyberattacks and Blockchain-based energy trading solutions are still evolving and face security concerns related to fraud and hacking.

Opportunity:

⮚ Rise of Renewable Energy & Carbon Credit Trading

The increasing adoption of solar, wind, and hydro energy creates demand for efficient energy trading platforms to manage decentralized power generation. The expansion of carbon credit markets and cap-and-trade programs presents opportunities for platforms that facilitate carbon credit trading and emissions reduction compliance. AI-driven platforms can optimize energy trading strategies through predictive analytics, demand forecasting, and automated trading and Machine learning algorithms enhance risk management by identifying market trends and price fluctuations in real time.

Energy Trading Platform Market Segment Overview

Based on Type, the market is segmented based on Power, Natural Gas, Oil, Others. The Oil segment dominant the market. Crude oil continues to be one of the most traded commodities globally, driven by its crucial role in the global energy mix. The significant demand for crude oil in various sectors like transportation, industrial production, and power generation, coupled with its influence on global economic activity, contributes to its dominant position in the market.

By Trading Type

Based on Trading Type, the market segment has been divided into Intraday, Day-Ahead, Long-Term. Long-Term trading segment dominant the market. Long-term trading is particularly popular due to its stability and predictability, making it a preferred choice for large-scale energy producers, utilities, and institutional investors. The long-term contracts, often spanning months or years, allow market participants to lock in prices and secure energy supply with minimal risk, which is crucial for both buyers and sellers in volatile energy markets.

By End User

Based on Application, the market segment has been divided into Utilities, Industrial, Retail, Others. Utilities held a dominant the market. Utilities are the backbone of the energy sector, responsible for the production, transmission, and distribution of electricity, gas, and other energy resources. As major players in the energy trading market, utilities use trading platforms to manage supply and demand, balance energy costs, and ensure grid stability.

Global Energy Trading Platform Market Regional Analysis

Based on region, the global Energy Trading Platform Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Energy Trading Platform Market followed by the Asia-Pacific and Europe regions.

North America Energy Trading Platform Market

North America Energy Trading Platform Market

North America holds a dominant position in the Energy Trading Platform Market. This dominance is primarily attributed to the region’s mature and well-established energy markets, high adoption rates of advanced technologies, and stringent environmental regulations. The U.S. leads with a well-established power market structure and advanced energy trading software adoption and renewable energy trading is growing, with increasing investments in carbon credits and green energy certificates.

Asia-Pacific Energy Trading Platform Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Energy Trading Platform Market industry. Rapid Industrialization and Urbanization: Growing energy demand from rapidly industrializing and urbanizing economies like China and India is a major driver. The deployment of smart grids to improve grid efficiency and integrate renewable energy sources drives the need for advanced trading platforms. Peer-to-peer (P2P) energy trading is gaining traction, especially in Japan and Australia.

Competitive Landscape

The global Energy Trading Platform Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ABB Ltd.

- BP Plc

- Chevron Corporation

- Citigroup Inc.

- Glencore International AG

- Royal Dutch Shell Plc

- Siemens AG

- TotalEnergies SE

- Trafigura Group Pte Ltd

- Vitol Group.

Scope of the Report

Global Energy Trading Platform Market, by Type

- Power

- Natural Gas

- Oil

- Others

Global Energy Trading Platform Market, by Trading Type

- Intraday

- Day-Ahead

- Long-Term

Global Energy Trading Platform Market, by End User

- Utilities

- Industrial

- Retail

- Others

Global Energy Trading Platform Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 10.98 Billion |

| CAGR (2024-2034) | 14.28% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Trading Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | ABB Ltd., BP Plc, Chevron Corporation, Citigroup Inc., Glencore International AG, Royal Dutch Shell Plc, Siemens AG, TotalEnergies SE, Trafigura Group Pte Ltd and Vitol Group. |

| Key Market Opportunities | · Rise of Renewable Energy & Carbon Credit Trading

· AI & Predictive Analytics for Smarter Trading |

| Key Market Drivers | · Growing Adoption of Renewable Energy

· Advancements in Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Energy Trading Platform Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Energy Trading Platform Market historical market size for the year 2021, and forecast from 2023 to 2033

- Energy Trading Platform Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Energy Trading Platform Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Energy Trading Platform Market?

The global Energy Trading Platform Market is growing at a CAGR of 14.28% over the next 10 years

Which region has the highest growth rate in the market of Energy Trading Platform Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Energy Trading Platform Market?

North America holds the largest share in 2022

Who are the key players in the global Energy Trading Platform Market?

ABB Ltd., BP Plc, Chevron Corporation, Citigroup Inc., Glencore International AG, Royal Dutch Shell Plc, Siemens AG, TotalEnergies SE, Trafigura Group Pte Ltd and Vitol Group. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|