Automotive Fabric Market Overview

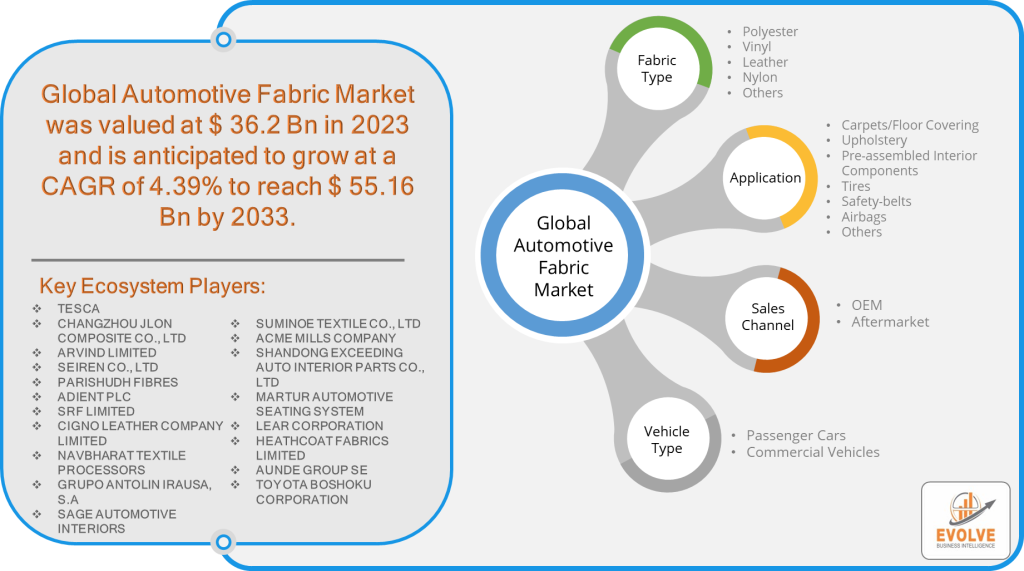

Automotive Fabric Market Size is expected to reach USD 55.16 Billion by 2033. The Automotive Fabric industry size accounted for USD 34.17 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.39% from 2023 to 2033. Automotive fabric is a type of fabric that is specifically designed for use in vehicles. It is typically made from synthetic fibers, such as polyester or nylon, and is often coated with a protective finish to make it resistant to wear, tear, and staining. Automotive fabrics are used in a variety of applications in vehicles, including: Upholstery, Airbags, and Safety belts, among other applications.

The automotive fabric market is growing due to a number of influencing factors such as, the increasing demand for lightweight and fuel-efficient vehicles, growing popularity of premium and luxury vehicles, increasing demand for safety features in vehicles, and increasing focus on sustainability in the automotive industry. In addition, the development of new synthetic fibers and coating technologies is also driving the growth of the automotive fabric market. These new materials offer improved performance properties, such as flame retardancy, stain resistance, and UV resistance. This is making them increasingly attractive to automakers, who are looking for ways to improve the safety, comfort, and durability of their vehicles.

Global Automotive Fabric Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the automotive fabric market, as it led to a decline in vehicle production and sales. However, the market is expected to recover in the post-COVID-19 period, as automakers resume production and sales. The pandemic had a number of specific impacts on the automotive fabric market, including:

A decline in vehicle production and sales: The COVID-19 pandemic led to a decline in vehicle production and sales, as automakers were forced to shut down plants and dealerships. This led to a decrease in demand for automotive fabrics.

Increased focus on safety: The COVID-19 pandemic also led to an increased focus on safety in vehicles. This led to an increased demand for automotive fabrics that are flame retardant, stain resistant, and UV resistant.

Shift in consumer preferences: The COVID-19 pandemic also led to a shift in consumer preferences. Consumers are now more interested in vehicles that are comfortable, durable, and easy to clean. This is leading to an increased demand for automotive fabrics that meet these needs.

The post-COVID-19 scenario for the automotive fabric market is expected to be positive. This is because the market is expected to recover as automakers resume production and sales. In addition, the market is expected to benefit from the increasing focus on safety and the shift in consumer preferences. As a result, the automotive fabric market is expected to grow in the coming years.

Global Automotive Fabric Market Dynamics

The major factors that have impacted the growth of Automotive Fabric are as follows:

Drivers:

- Increasing demand for lightweight and fuel-efficient vehicles

The increasing demand for lightweight and fuel-efficient vehicles is a major driving factor for the growth of the automotive fabric market. Automakers are using lightweight automotive fabrics to make their vehicles lighter, improve fuel efficiency, and improve the comfort and appearance of their vehicles. For instance, Ford recently announced that it will be using lightweight automotive fabrics in its new Mustang Mach-E electric vehicle. This will help to make the vehicle lighter and more fuel-efficient, while also improving the comfort and appearance of the interior. As the demand for these vehicles continues to grow, the demand for lightweight automotive fabrics is expected to continue to grow as well.

Restraint:

- Government regulations

The automotive fabric market is facing increasing competition from substitute materials, such as leather and synthetic leather. These materials offer a number of advantages over automotive fabrics, including a more luxurious and premium look, durability, and the ability to be made to look like a variety of different materials. As the demand for these substitute materials continues to grow, the demand for automotive fabrics is expected to decline. For instance, BMW recently announced that it will be using synthetic leather in its new 7 Series sedan. This is because synthetic leather offers a number of advantages over traditional automotive fabrics, including durability, appearance, and luxury. The increasing competition from substitute materials is a major restraint for the growth of the automotive fabric market.

Opportunity:

- Increasing demand for sustainable fabrics

Consumers are increasingly demanding products that are made from sustainable materials, and this is driving demand for sustainable automotive fabrics. Automakers are responding to this demand by developing new automotive fabrics that are made from sustainable materials, such as recycled plastics and natural fibers. For instance, Ford recently announced that it will be using recycled plastic in the seats of its new Mustang Mach-E electric vehicle. This is a major step forward for the automotive industry, as it shows that automakers are committed to using sustainable materials in their vehicles. As the demand for sustainable fabrics continues to grow, the automotive fabric market is expected to see significant growth in the coming years. Automakers that are able to develop innovative and sustainable automotive fabrics will be well-positioned to succeed in this growing market.

Automotive Fabric Market Segment Overview

By Fabric Type

Based on the Fabric Type, the market is segmented based on Polyester, Vinyl, Leather, and Nylon, among others. The Polyester segment holds the largest market share in the global Automotive Fabric market. This is due to its many advantages, such as its durability, strength, and resistance to wear and tear. Vinyl is also a popular choice for automotive fabrics, as it is water-resistant, durable, and easy to clean. Leather is a more luxurious option, but it is also more expensive. Nylon is often used in safety-critical applications, such as safety belts and airbags.

By Application

Based on Application, the market has been divided into carpets/floor covering, upholstery, pre-assembled interior components, tires, safety-belts, and airbags, among others. The upholstery segment is expected to hold the largest market share in the Automotive Fabric market as it is used in a variety of areas in a vehicle, such as seats, door panels, and dashboards. Carpets/Floor Covering is the second most popular application, as it is used to cover the floors of vehicles.

By Sales Channel

Based on Sales Channel, the market has been divided into OEM, and Aftermarket. The Automotive Fabric market is projected to see significant share in the OEM segment. The market share of the OEM segment is expected to decline in the future as more and more consumers opt for aftermarket automotive fabrics. This is because aftermarket automotive fabrics are often more affordable and offer a wider range of options than OEM automotive fabrics.

By Vehicle Type

Based on the Vehicle Type, the market is segmented into Passenger Cars, and Commercial Vehicles. This is because passenger cars are more numerous than commercial vehicles, and they also tend to use more automotive fabrics in their interiors. Commercial vehicles, on the other hand, often use more durable and heavy-duty automotive fabrics, such as vinyl and nylon.

Global Automotive Fabric Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Automotive Fabric, followed by those in North America and Europe.

Asia Pacific Market

Asia Pacific is the fastest growing segment in Automotive Fabric market. The growth of the automotive fabrics market in Asia-Pacific is being driven by the increasing demand for automotive vehicles, premium and luxury vehicles, and the development of new technologies. The top 5 countries in Asia-Pacific with the largest automotive fabrics market share in 2022 are China, Japan, India, South Korea, and Thailand.

North America Market

North America is the second largest region in Automotive Fabric market in 2022. The growth of the automotive fabrics market in North America is being driven by the increasing demand for automotive vehicles, premium and luxury vehicles, and the development of new technologies.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Lear Corporation, ACME Mills, Toyota Boshoku Corporation, Suminoe Textile Co., Ltd., and Sage Automotive Interiors, Inc. are some of the leading players in the global Automotive Fabric Industry. These players holds around 50% of the global automotive fabric market.

Key Market Players:

- TESCA

- CHANGZHOU JLON COMPOSITE CO., LTD

- ARVIND LIMITED

- SEIREN CO., LTD

- PARISHUDH FIBRES

- ADIENT PLC

- SRF LIMITED

- CIGNO LEATHER COMPANY LIMITED

- NAVBHARAT TEXTILE PROCESSORS

- GRUPO ANTOLIN IRAUSA, S.A

- SAGE AUTOMOTIVE INTERIORS (SUBSIDIARY OF ASAHI KASEI CORPORATION)

- SUMINOE TEXTILE CO., LTD

- ACME MILLS COMPANY

- SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD

- MARTUR AUTOMOTIVE SEATING SYSTEM

- LEAR CORPORATION

- HEATHCOAT FABRICS LIMITED

- AUNDE GROUP SE

- TOYOTA BOSHOKU CORPORATION

Key Development:

- In February 2023, Lear Corporation announced a new partnership with BASF to develop sustainable automotive fabrics. The partnership will focus on developing fabrics made from recycled materials, such as PET bottles and nylon waste.

- In March 2023, ACME Mills announced the launch of its new antimicrobial fabric. The fabric is designed to help prevent the growth of bacteria and mold, which can be a problem in automotive interiors.

Scope of the Report

Global Automotive Fabric Market, by Fabric Type

- Polyester

- Vinyl

- Leather

- Nylon

- Others

Global Automotive Fabric Market, by Application

- Carpets/Floor Covering

- Upholstery

- Pre-assembled Interior Components

- Tires

- Safety-belts

- Airbags

- Others

Global Automotive Fabric Market, by Sales Channel

- OEM

- Aftermarket

Global Automotive Fabric Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Fabric Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 55.16 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 4.39% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Fabric Type, Application, Sales Channel, Vehicle Type |

| Key Market Opportunities | Rise in demand for environment-friendly fabric material Rise in demand for low-weight automotive fabric to reduce vehicle pollution |

| Key Market Drivers | Rise in sale of vehicles Surging demand for Advanced Airbag Fabrics Increase in demand for Non-Woven Fabrics Implementation of stringent government safety standards for usage of airbags, safety-belts, and others |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | TESCA, CHANGZHOU JLON COMPOSITE CO., LTD, ARVIND LIMITED, SEIREN CO., LTD., PARISHUDH FIBRES, ADIENT PLC, SRF LIMITED, CIGNO LEATHER COMPANY LIMITED, NAVBHARAT TEXTILE PROCESSORS, GRUPO ANTOLIN IRAUSA, S.A., SAGE AUTOMOTIVE INTERIORS (SUBSIDIARY OF ASAHI KASEI CORPORATION), SUMINOE TEXTILE CO., LTD., ACME MILLS COMPANY, SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD, MARTUR AUTOMOTIVE SEATING SYSTEM, LEAR CORPORATION, HEATHCOAT FABRICS LIMITED, AUNDE GROUP SE, TOYOTA BOSHOKU CORPORATION |

Report Content Brief:

- High-level analysis of the current and future Automotive Fabric Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Fabric market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Fabric market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Fabric Market.