Water treatment systems (point-of-entry) market Overview

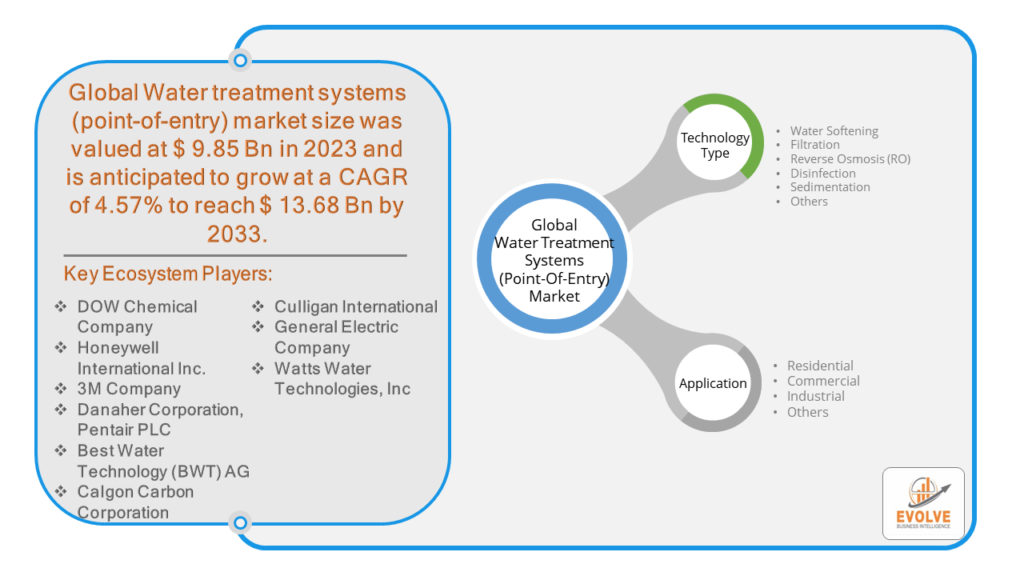

The Water treatment systems (point-of-entry) market Size is expected to reach USD 13.68 Billion by 2033. The Water treatment systems (point-of-entry) market industry size accounted for USD 9.85 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.57% from 2023 to 2033. The water treatment systems (point-of-entry) market refers to the industry involved in the production, distribution, and installation of water treatment systems designed to purify water at the point where it enters a residential or commercial property. Water treatment systems at the point of entry typically aim to address a variety of contaminants and issues commonly found in water supplies, including sediment, chlorine, heavy metals, pesticides, bacteria, viruses, and other impurities. The specific technologies and components employed in these systems can vary widely depending on the quality of the source water and the desired level of purification.

Factors driving growth in this market include increasing awareness of water quality issues, concerns about contaminants in drinking water, regulatory requirements, industrial development, population growth, and rising standards of living. Additionally, advancements in technology and the development of more efficient and cost-effective treatment solutions contribute to the expansion of the market for point-of-entry water treatment systems.

Global Water treatment systems (point-of-entry) market Synopsis

The COVID-19 pandemic had significant impacts on the water treatment systems (point-of-entry) market. The pandemic has heightened awareness about the importance of clean and safe water for hygiene and health. This increased awareness may lead to greater demand for point-of-entry water treatment systems as people seek to ensure the purity of their water supply. With more people spending time at home due to lockdowns and remote work arrangements, there has been a greater emphasis on home improvement projects, including water treatment system installations. Consumers are more likely to invest in point-of-entry water treatment systems to enhance the quality of water used for drinking, cooking, and bathing at home. The economic downturn resulting from the pandemic has affected consumer spending patterns. Some individuals and businesses may delay or cancel investments in non-essential products and services, including water treatment systems.

Water treatment systems (point-of-entry) market Dynamics

The major factors that have impacted the growth of Water treatment systems (point-of-entry) market are as follows:

Drivers:

Ø Increasing Awareness of Water Quality

Growing concerns about water contamination, pollution, and the presence of harmful chemicals and microorganisms have raised awareness about the importance of clean and safe water. This heightened awareness drives demand for point-of-entry water treatment systems as consumers seek solutions to improve the quality of their water supply. Health-conscious consumers are increasingly interested in protecting themselves and their families from exposure to contaminants in water. Additionally, there is a growing focus on environmental sustainability, driving demand for water treatment systems that reduce the environmental impact of water consumption and waste. Ongoing advancements in water treatment technologies lead to the development of more efficient, cost-effective, and environmentally friendly treatment solutions. Innovations such as advanced filtration membranes, UV disinfection systems, and smart monitoring technologies enhance the performance and reliability of point-of-entry water treatment systems, driving adoption among consumers and businesses.

Restraint:

- Perception of High Initial Cost

The upfront cost of purchasing and installing point-of-entry water treatment systems can be significant, especially for high-capacity or technologically advanced systems. This cost may deter some consumers and businesses from investing in these solutions, particularly in regions with limited financial resources or competing budget priorities. Point-of-entry water treatment systems often require professional installation and regular maintenance to ensure optimal performance and longevity. The complexity of installation and ongoing maintenance requirements can pose challenges for consumers and businesses, particularly those without access to qualified technicians or adequate resources for maintenance. Point-of-entry water treatment systems face competition from alternative water treatment solutions, including point-of-use filters, bottled water, and centralized water treatment facilities. Consumers and businesses may opt for these alternatives instead of investing in point-of-entry systems, depending on factors such as convenience, cost, and perceived effectiveness.

Opportunity:

⮚ Rising Demand for Clean and Safe Water

Increasing awareness of water quality issues and growing concerns about contaminants in drinking water drive demand for effective water treatment solutions. Point-of-entry water treatment systems offer consumers and businesses a comprehensive approach to improving water quality throughout their properties, presenting a significant market opportunity. The growing focus on health and wellness drives demand for products and services that support a healthy lifestyle, including access to clean and safe drinking water. Point-of-entry water treatment systems address consumers’ desire for better hydration, improved nutrition, and reduced exposure to harmful contaminants, positioning them as a valuable solution in the health and wellness market. The residential and commercial sectors represent significant market opportunities for point-of-entry water treatment systems. Homeowners, property managers, and businesses seek reliable and cost-effective solutions to ensure clean and safe water for drinking, cooking, bathing, and other household and commercial activities, driving demand for point-of-entry systems.

Water treatment systems (point-of-entry) market Segment Overview

By Technology Type

By Application

Based on Application, the market segment has been divided into Residential, Commercial, Industrial and Others. The industrial segment held the majority revenue share. This dominance is attributed to continuous expansion of various water-using industries such as chemicals, food & beverages, and textiles, as increasingly realizing the importance of treated water for their processes. Growing industrialization especially in developing nations that led to increased demand for clean water in several industrial processes, further contribute to the demand for reliable water treatment systems.

Global Water treatment systems (point-of-entry) market Regional Analysis

Based on region, the global Water treatment systems (point-of-entry) market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Water treatment systems (point-of-entry) market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Water treatment systems (point-of-entry) market. North America is a mature market for point-of-entry water treatment systems, driven by concerns about water quality, aging infrastructure, and regulatory compliance. The United States and Canada have well-established regulations governing drinking water quality, which drive demand for treatment solutions. Increasing awareness of health and wellness further stimulates market growth, particularly in residential and commercial sectors.

Water treatment systems (point-of-entry) Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Water treatment systems (point-of-entry) market industry. The Asia Pacific region presents significant growth opportunities for point-of-entry water treatment systems, driven by rapid urbanization, industrialization, and increasing awareness of water quality issues. Countries such as China, India, Japan, and Australia have growing markets for water treatment solutions, fueled by population growth, infrastructure development, and rising disposable incomes.

Competitive Landscape

The global Water treatment systems (point-of-entry) market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- DOW Chemical Company

- Honeywell International Inc.

- 3M Company

- Danaher Corporation

- Pentair PLC

- Best Water Technology (BWT) AG

- Calgon Carbon Corporation

- Culligan International

- General Electric Company

- Watts Water Technologies Inc

- Watts Water Technologies Inc.

Key Development

In June 2023, Culligan Water, a prominent worldwide leader and innovator in providing exceptional water treatment and services, officially introduced the first AI WaterBot, named Cullie. Cullie, the newest advancement from the water industry pioneer, leverages ChatGPT’s conversational capabilities to better the Culligan customer experience. It offers round-the-clock educational help and enhances online interactions.

In October 2023, Blupura introduced its first range of filter cartridges, named Blutron. The product range is attributed to Blupura’s dedication to delivering superior drinking water by making uncompromising decisions on materials and components.

Scope of the Report

Global Water treatment systems (point-of-entry) Market, by Technology Type

- Water Softening

- Filtration

- Reverse Osmosis (RO)

- Disinfection

- Sedimentation

- Others

Global Water treatment systems (point-of-entry) market, by Application

- Residential

- Commercial

- Industrial

- Others

Global Water treatment systems (point-of-entry) market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $13.68Billion |

| CAGR | 4.57% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | DOW Chemical Company, Honeywell International Inc., 3M Company, Danaher Corporation, Pentair PLC, Best Water Technology (BWT) AG, Calgon Carbon Corporation, Culligan International, General Electric Company, Watts Water Technologies Inc and Watts Water Technologies Inc. |

| Key Market Opportunities | • Rising Demand for Clean and Safe Water • Health and Wellness Trends |

| Key Market Drivers | • Increasing Awareness of Water Quality • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Water treatment systems (point-of-entry) market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Water treatment systems (point-of-entry) market historical market size for the year 2021, and forecast from 2023 to 2033

- Water treatment systems (point-of-entry) market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Water treatment systems (point-of-entry) market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Water treatment systems (point-of-entry) market?

The Water treatment systems (point-of-entry) market is expected to expand at a compound annual growth rate (CAGR) of 4.57% from 2023 to 2033.

Which region has the highest growth rate in the Water treatment systems (point-of-entry) market?

The Asia Pacific region is projected to exhibit the highest growth rate in the Water treatment systems (point-of-entry) market, driven by rapid urbanization, industrialization, and increasing awareness of water quality issues.

Which region has the largest share of the Water treatment systems (point-of-entry) market?

Currently, North America holds the largest share of the Water treatment systems (point-of-entry) market, driven by mature regulations governing drinking water quality and increasing awareness of health and wellness.

Who are the key players in the Water treatment systems (point-of-entry) market?

Key players in the Water treatment systems (point-of-entry) market include DOW Chemical Company, Honeywell International Inc., 3M Company, Danaher Corporation, Pentair PLC, Best Water Technology (BWT) AG, Calgon Carbon Corporation, Culligan International, General Electric Company, Watts Water Technologies Inc., and others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.