Water and Wastewater Pipes Market Overview

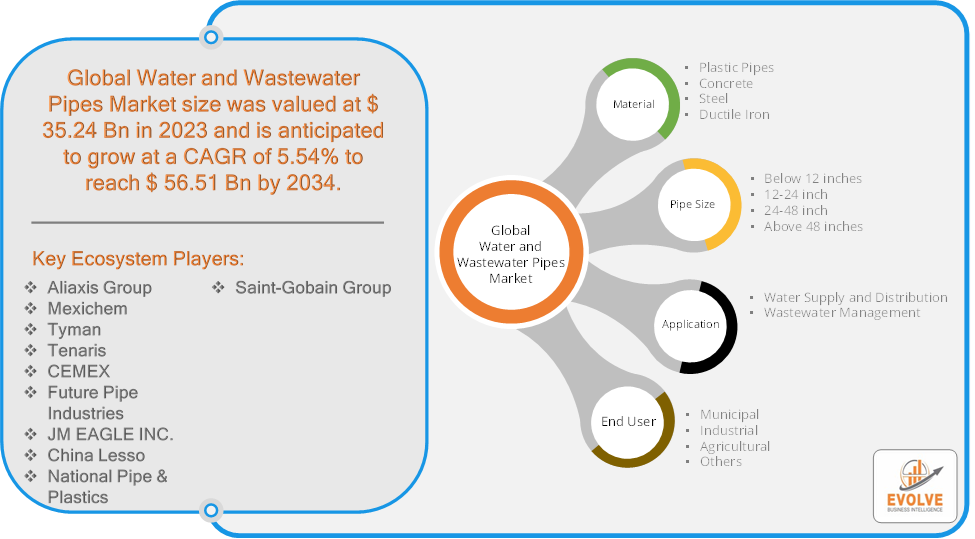

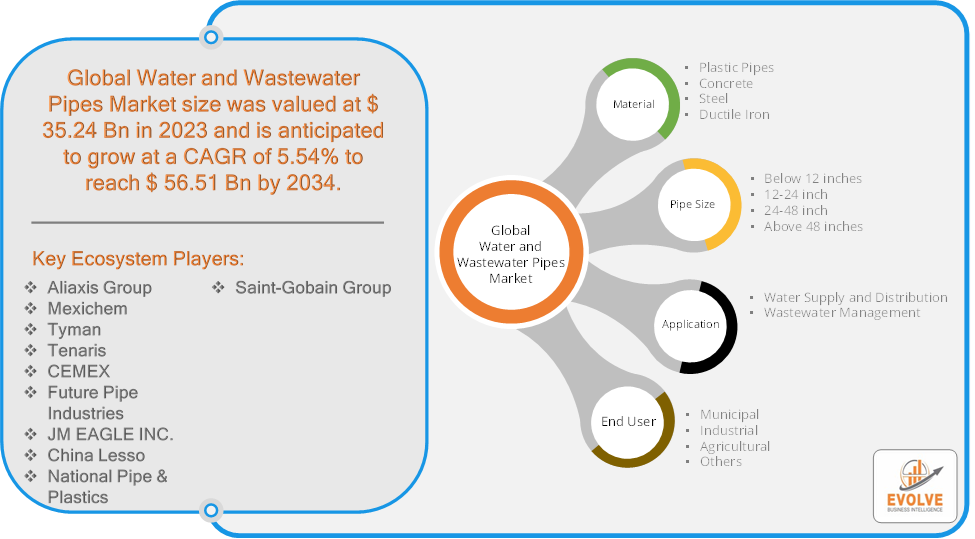

The Water and Wastewater Pipes Market Size is expected to reach USD 56.51 Billion by 2034. The Water and Wastewater Pipes Market industry size accounted for USD 35.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.54% from 2021 to 2034. The Water and Wastewater Pipes Market involves the production, distribution, and installation of pipes used for transporting water and treating wastewater. This market includes a range of pipe materials, such as PVC, ductile iron, concrete, and HDPE. Key drivers include urbanization, infrastructure development, and the need for water conservation and efficient wastewater management. Technological advancements focus on improving pipe durability, reducing leakage, and enhancing environmental sustainability. Regional demand is influenced by population growth, industrialization, and government regulations. The market also faces challenges such as high installation costs and aging infrastructure requiring replacement or upgrades.

Global Water and Wastewater Pipes Market Synopsis

The major factors that have impacted the growth of Water and Wastewater Pipes are as follows:

Drivers:

⮚ Infrastructure Development and Upgrades

Investment in infrastructure development and upgrades is crucial for modernizing aging water and wastewater systems. Many regions, especially in developed countries, are dealing with outdated infrastructure that requires replacement or significant rehabilitation. New projects and expansions in developing regions also contribute to market growth. Restraint:

- High Installation and Maintenance Costs

The initial costs associated with installing water and wastewater pipes can be substantial, particularly for advanced materials and technologies. Additionally, ongoing maintenance and repair expenses can strain budgets, especially for municipalities and utilities with limited financial resources.

Opportunity:

⮚ Technological Advancements

Innovations in pipe materials and technologies, such as the development of corrosion-resistant, high-strength, and flexible pipes, offer significant opportunities. Smart pipes integrated with sensors and monitoring systems can provide real-time data on flow, pressure, and potential leaks, enhancing system management and reducing maintenance costs.

Water and Wastewater Pipes Market Segment Overview

Based on the Application, the market is segmented based on Water Supply And Distribution, Wastewater Management. the Water Supply and Distribution segment typically dominates due to the extensive infrastructure required to deliver clean water to urban and rural areas.

By Material

Based on Material, the market has been divided into Plastic Pipes, Concrete, Steel, Ductile Iron. Plastic Pipes often dominate due to their corrosion resistance, lightweight, and cost-effectiveness, making them suitable for a wide range of applications.

By Pipe Size

Based on the Pipe Size, the market has been divided into Below 12 Inch, 12-24 Inch, 24-48 Inch, Above 48 Inch. the 12-24 Inch segment generally dominates, as it is widely used for various municipal and industrial applications that require a balance between capacity and manageability.

By End-User

Based on End-User, the market has been divided into Municipal, Industrial, Agricultural, Others. the Municipal segment typically dominates due to the high demand for infrastructure to manage urban water supply and sewage systems.

Global Water and Wastewater Pipes Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Water and Wastewater Pipes, followed by those in Asia-Pacific and Europe.

The North American region holds a dominant position in the Water and Wastewater Pipes market. In 2022, the North American Water and Wastewater Pipe Market held a 45.80% market share. The massive demand for clean water, greater awareness, and an increase in building and remodeling activities are all contributing to the market’s growth. The significant presence of well-known industry players offering efficient solutions and the early adoption of cutting-edge waste management technologies also have an impact on the market share for water and wastewater pipelines.In 2022, the North American Water and Wastewater Pipe Market held a 45.80% market share. The massive demand for clean water, greater awareness, and an increase in building and remodeling activities are all contributing to the market’s growth.

Water and Wastewater Pipes Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Water and Wastewater Pipes industry. From 2023 to 2032, the Asia Pacific market for water and wastewater pipes is anticipated to develop at a substantial rate. The construction of infrastructure is currently receiving a lot of attention in the area, which increases the demand for water and wastewater pipes. The building industry’s growth has propelled market expansion in the area due to the increasing economic conditions

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Aliaxis Group, Mexichem, Tyman, Tenaris, and CEMEX are some of the leading players in the global Water and Wastewater Pipes Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Aliaxis Group

- Mexichem

- Tyman

- Tenaris

- CEMEX

- Future Pipe Industries

- JM EAGLE INC.

- China Lesso

- National Pipe & Plastics

- Saint-Gobain Group

Key Development:

February 2020: Northwest Pipe Company, a leading engineered pipeline system water infrastructure provider, announced the acquisition of Geneva Pipe Company, Inc., a concrete pipe and precast concrete products manufacturer

Scope of the Report

Global Water and Wastewater Pipes Market, by Application

- Water Supply and Distribution

- Wastewater Management

Global Water and Wastewater Pipes Market, by Material

- Plastic Pipes

- Concrete

- Steel

- Ductile Iron

Global Water and Wastewater Pipes Market, by Pipe Size

- Below 12 inches

- 12-24 inch

- 24-48 inch

- Above 48 inches

Global Water and Wastewater Pipes Market, by End-User

- Municipal

- Industrial

- Agricultural

- Others

Global Water and Wastewater Pipes Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 56.51 Billion |

| CAGR (2021-2034) | 5.54% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Application, Material, Pipe Size, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa. |

| Key Vendors | Aliaxis Group, Mexichem, Tyman, Tenaris, CEMEX, Future Pipe Industries, JM EAGLE INC., China Lesso, National Pipe & Plastics, Saint-Gobain Group |

| Key Market Opportunities | Increasing awareness for clean & drinkable water |

| Key Market Drivers | Increase in population, urbanization, and industrialization, approval of high investment drainage projects, and increasing water consumption across multiple sectors |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Water and Wastewater Pipes market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Water and Wastewater Pipes market historical market size for the year 2022, and forecast from 2021 to 2034

- Water and Wastewater Pipes market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Water and Wastewater Pipes market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2021 to 2034) of the global Water and Wastewater Pipes market?

The global Water and Wastewater Pipes market is growing at a CAGR of ~5.54% over the next 10 years

Which region has the highest growth rate in the market of Water and Wastewater Pipes?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Water and Wastewater Pipes?

North America holds the largest share in 2023

Major Key Players in the Market of Water and Wastewater Pipes?

Aliaxis Group, Mexichem, Tyman, Tenaris, CEMEX, Future Pipe Industries, JM EAGLE INC., China Lesso, National Pipe & Plastics, and Saint-Gobain Group are the major companies operating in the Water and Wastewater Pipes Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.