Vehicle Leasing Market Overview

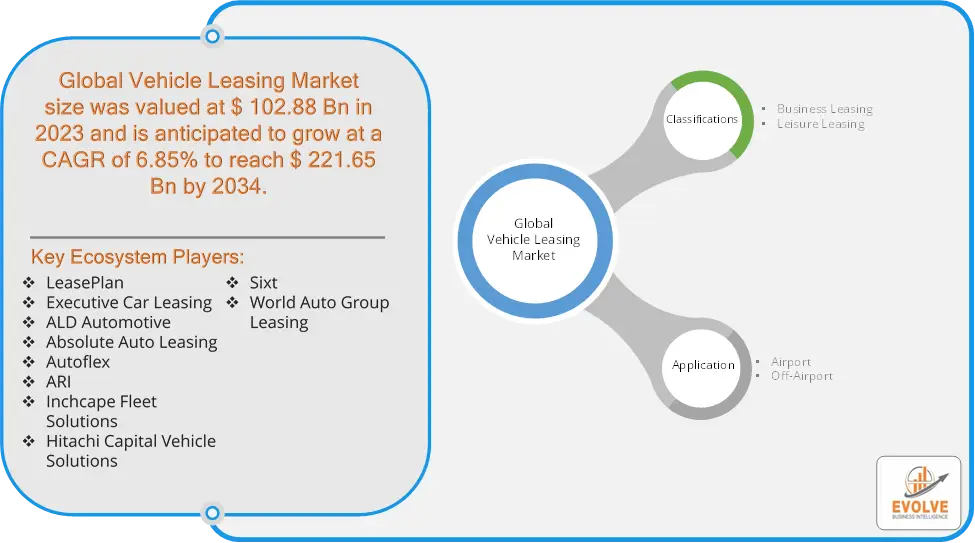

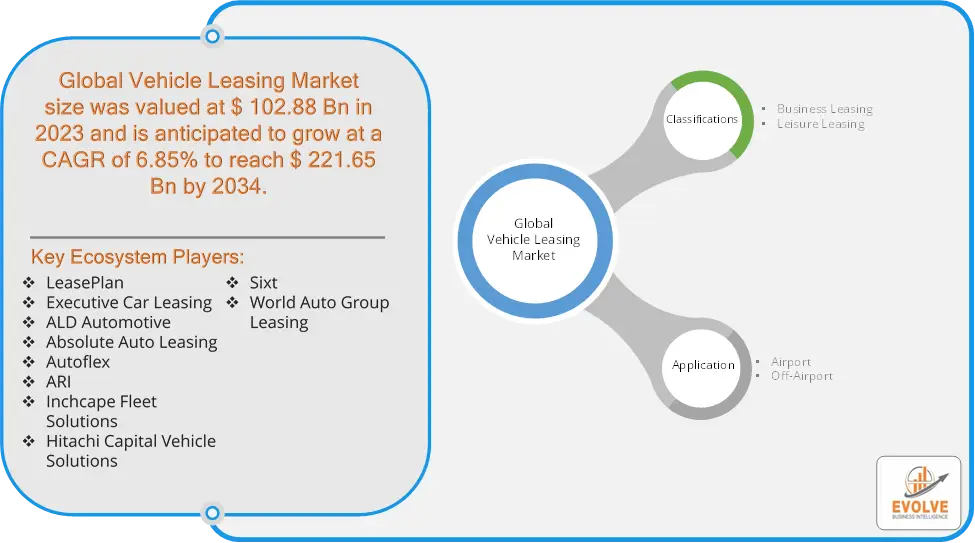

The Vehicle Leasing Market size accounted for USD 102.88 Billion in 2023 and is estimated to account for 132.54 Billion in 2024. The Market is expected to reach USD 221.65 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.85% from 2024 to 2034. The Vehicle Leasing Market refers to the industry that provides leasing services for various types of vehicles, including passenger cars, commercial vehicles, and specialty vehicles, to individuals, businesses, and organizations. Instead of purchasing a vehicle outright, customers in this market enter into an agreement to rent or lease vehicles for a set period, typically between 12 and 60 months, with fixed monthly payments.

Factors driving the Vehicle Leasing Market include rising vehicle costs, increasing demand for flexible mobility options, tax benefits, and the growing trend toward corporate fleet leasing. The vehicle leasing market is a dynamic industry that plays a significant role in the transportation sector. It provides individuals and businesses with a convenient and flexible way to access vehicles without the long-term commitment of ownership.

Global Vehicle Leasing Market Synopsis

The major factors that have impacted the growth of Vehicle Leasing Market are as follows:

Drivers:

Ø Technological Advancements

The inclusion of connected car technologies and telematics in leasing agreements helps businesses optimize vehicle usage, manage maintenance costs, and improve fleet efficiency, driving demand in the market. The increasing cost of new vehicles, driven by advanced technology and stricter emission regulations, has made leasing a more viable option for consumers and businesses, as it spreads the cost over a longer period with lower monthly payments. The shift from vehicle ownership to on-demand vehicle use is contributing to the popularity of leasing. Companies are integrating leasing into broader mobility services such as ride-sharing and car-sharing platforms.

Restraint:

- Perception of Lack of Ownership and High Long-Term Costs

At the end of a lease term, the customer does not own the vehicle, which may be a drawback for individuals or businesses who prefer to invest in assets rather than continuously pay for a leased vehicle. While leasing may have lower monthly payments compared to purchasing, over the long term, leasing can become more expensive due to continuous payments without asset ownership.

Opportunity

⮚ Integration with Mobility-as-a-Service (MaaS)

The rise of MaaS platforms, including ride-sharing and car-sharing services, provides opportunities for leasing companies to partner with these platforms and offer flexible vehicle access solutions. Offering more flexible leasing terms, such as shorter lease periods or customizable packages, can attract customers who need temporary vehicle access or who prefer less rigid contracts. As sustainability becomes a key focus for both individuals and businesses, leasing companies can offer green vehicles and sustainability-focused leasing options to attract environmentally conscious customers.

Vehicle Leasing Market Segment Overview

By Classifications

By Application

Based on Application, the market has been divided into Airport and Off-Airport. The Off-Airport segment dominant the market. Off-Airport vehicle leasing locations are typically situated in urban areas, near business districts, or in residential neighbourhoods, rather than at airports and these locations often cater to local residents, businesses, and tourists who do not require immediate airport access.

Global Vehicle Leasing Market Regional Analysis

Based on region, the global Vehicle Leasing Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Vehicle Leasing Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Vehicle Leasing Market. The North American market is one of the largest and most mature in the world, driven by factors such as a strong economy, a developed automotive industry, and a preference for leasing among consumers and businesses and vehicle leasing has a high penetration rate in the United States and Canada, with many consumers opting for leases to avoid upfront costs and drive newer models. The U.S. is one of the largest markets for vehicle leasing, driven by a strong preference for leasing among both consumers and businesses. Factors include a mature automotive market, high vehicle prices, tax advantages for businesses, and a well-established leasing infrastructure.

Global Vehicle Leasing Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Vehicle Leasing Market industry. The Asia-Pacific region is witnessing rapid growth in the vehicle leasing market, driven by factors such as increasing urbanization, rising disposable incomes, and a growing middle class and China and India are the largest markets in the region, with significant potential for growth. China is experiencing rapid growth in the vehicle leasing market due to rising urbanization, increasing vehicle costs, and a growing middle class. Government policies promoting electric vehicles and the expansion of ride-sharing services also drive demand.

Competitive Landscape

The global Vehicle Leasing Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- LeasePlan

- Executive Car Leasing

- ALD Automotive

- Absolute Auto Leasing

- Autoflex

- ARI

- Inchcape Fleet Solutions

- Hitachi Capital Vehicle Solutions

- Sixt

- World Auto Group Leasing

Scope of the Report

Global Vehicle Leasing Market, by Classifications

- Business Leasing

- Leisure Leasing

Global Vehicle Leasing Market, by Application

- Airport

- Off-Airport

Global Vehicle Leasing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $221.65 Billion |

| CAGR | 6.85% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Classifications, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | LeasePlan, Executive Car Leasing, ALD Automotive, Absolute Auto Leasing, Autoflex, ARI, Inchcape Fleet Solutions, Hitachi Capital Vehicle Solutions, Sixt and World Auto Group Leasing |

| Key Market Opportunities | • Integration with Mobility-as-a-Service (MaaS) • Increased Focus on Sustainability |

| Key Market Drivers | • Technological Advancements • Rising Vehicle Prices |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Vehicle Leasing Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Vehicle Leasing Market historical market size for the year 2021, and forecast from 2023 to 2033

- Vehicle Leasing Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Vehicle Leasing Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Vehicle Leasing Market?

The global Vehicle Leasing Market is growing at a CAGR of 6.85% over the next 10 years

Which region has the highest growth rate in the market of Vehicle Leasing Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Vehicle Leasing Market?

North America holds the largest share in 2022

Who are the key players in the global Vehicle Leasing Market?

LeasePlan, Executive Car Leasing, ALD Automotive, Absolute Auto Leasing, Autoflex, ARI, Inchcape Fleet Solutions, Hitachi Capital Vehicle Solutions, Sixt and World Auto Group Leasing. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.