What Does This Global Sugar and Confectionery Market Report Include?

| Parameters | Values |

|---|---|

| Market Size and Forecast Years | 2021 to 2023 |

| Compounded Average Growth Rate (CAGR) |

|

| Year-over-Year Growth Depiction | Included |

| Market Opportunity Score | Included |

| Market Dynamics or Impacting Factors | Included |

| Market Dynamics Impact Analysis | Included |

| PORTER’s Five Forces Analysis (in Brief) | Included (Detailed Analysis Can be included on Demand) |

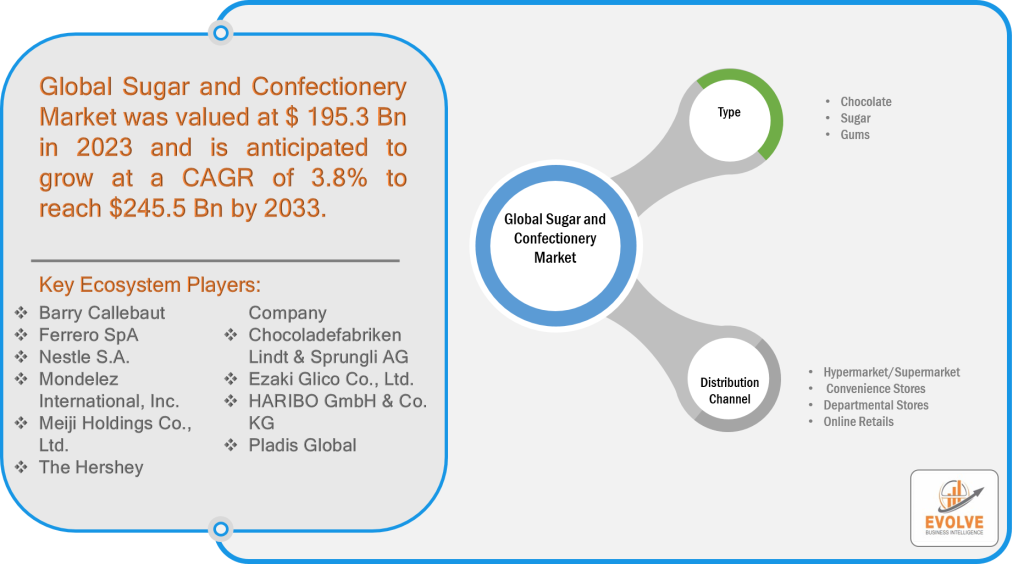

| Segments Included | By Type Chocolate Sugar GumsBy Distribution Channel Hypermarket/Supermarket Convenience Stores Departmental Stores Online Retails |

| Regions Included | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Countries Included | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, BeNeLux, Russia, China, Japan, India, South Korea, Thailand, Indonesia, Malaysia, Australia, Brazil, Argentina, Saudi Arabia, UAE, Egypt, and South Africa |

| Competitor Benchmarking | Included |

| Company/Vendor Market Share Analysis | Included |

| Key Development Analysis for top 5 Companies | Included |

| Market Share Acquisition Key Strategies | Included |

| Key Market Players | Barry Callebaut, Ferrero SpA, Nestle S.A., Mondelez International, Inc., Meiji Holdings Co., Ltd., The Hershey Company, Chocoladefabriken Lindt & Sprungli AG, Ezaki Glico Co., Ltd., HARIBO GmbH & Co. KG, and Pladis Global

* This section is completely customizable upto 15 companies; you can share the list of companies you want us to profile and we will include them in the final report for you |

Sugar and Confectionery Market Overview

The global Sugar and Confectionery Market Size is expected to reach USD 245.5 Billion by 2033. The global Sugar and Confectionery industry size accounted for USD 195.3 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2033. The sugar and confectionery market is a delightful industry that encompasses the production, processing, and distribution of various sugar-based products and confectioneries. This market caters to our sweet tooth cravings and offers a wide range of treats, including chocolates, candies, chewing gums, cakes, pastries, cookies, and much more. These products are beloved by people of all ages and are consumed for various purposes, such as indulgence, celebrations, gifting, and even as comfort food. The sugar and confectionery market plays a significant role in the global food industry, adding sweetness and joy to our lives.

Global Sugar and Confectionery Market Synopsis

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has had a profound impact on various industries, and the sugar and confectionery market is no exception. The pandemic brought about several challenges and changes in consumer behavior that affected the market dynamics. Initially, the market witnessed disruptions in the supply chain due to travel restrictions and lockdown measures, which led to difficulties in sourcing raw materials and ingredients for confectionery production. Moreover, the closure of foodservice outlets, such as restaurants and cafes, resulted in a decline in the demand for confectionery products. With people spending more time at home and adopting healthier eating habits during lockdowns, the demand for certain confectionery items experienced a temporary slowdown.

However, as the world gradually emerges from the pandemic and restrictions are lifted, the sugar and confectionery market is expected to rebound. The industry has shown resilience and adaptability by introducing new product lines, focusing on e-commerce channels, and leveraging digital marketing strategies to reach consumers. Furthermore, with the resumption of social gatherings and celebrations, there will likely be an increase in the demand for confectionery products, contributing to the market’s recovery and growth.

Sugar and Confectionery Market Dynamics

The major factors that have impacted the growth of Sugar and Confectionery are as follows:

Drivers:

- Growing Health and Wellness Trend

One of the significant driving factors in the post-COVID scenario for the sugar and confectionery market is the increasing focus on health and wellness. The pandemic has made people more conscious of their overall well-being, leading to a shift in consumer preferences towards healthier options, even within the confectionery segment. Consumers are seeking products that offer functional benefits, natural ingredients, reduced sugar content, and cleaner labeling.

Confectionery manufacturers have responded to this trend by introducing healthier alternatives and innovative product offerings. They are incorporating organic ingredients, reducing artificial additives, and experimenting with sugar substitutes to cater to health-conscious consumers. The development of sugar-free and low-sugar confectionery products has gained traction, providing consumers with guilt-free indulgence options. Additionally, there has been a rise in demand for confectionery products enriched with functional ingredients like vitamins, minerals, and plant-based extracts, which offer health benefits beyond their sweet taste.

Restraint:

- Economic Uncertainty: A Sweet Squeeze on Consumer Spending

While the sugar and confectionery market is poised for growth, it also faces restraining factors in the post-COVID scenario. Economic uncertainty resulting from the pandemic has impacted consumer spending patterns, leading to a cautious approach towards discretionary purchases. With the pandemic’s lingering effects on job security, income stability, and overall financial well-being, consumers are more inclined to prioritize essential purchases over indulgent items like confectionery products.

The uncertain economic landscape has created challenges for the sugar and confectionery market, as it relies heavily on discretionary spending and impulse purchases. Consumers are being cautious with their budgets, opting for more affordable alternatives or reducing their overall consumption of confectionery items. This restraint in spending poses a significant challenge for confectionery manufacturers and retailers, as they need to find innovative strategies to attract consumers and maintain sales volumes..

Opportunity:

- Rising Demand for Premium and Artisanal Confectionery

While economic uncertainty poses challenges, it also presents opportunities for the sugar and confectionery market. One such opportunity lies in the rising demand for premium and artisanal confectionery products. Despite cautious spending, consumers are willing to splurge on higher-end, high-quality confectionery items that provide a unique and indulgent experience.

Premium and artisanal confectionery offerings cater to consumers seeking novelty, craftsmanship, and exceptional flavor profiles. These products often use high-quality ingredients, innovative techniques, and intricate designs to create a luxurious and differentiated experience. The demand for premium chocolates, handcrafted candies, specialty cakes, and gourmet cookies has been steadily increasing, driven by consumers’ desire for a heightened indulgence.

Sugar and Confectionery Segment Overview

By Type

Based on the Type, the market is segmented based on Chocolate, Sugar, and Gums. the chocolate segment holds the largest share in the market. Chocolates have always been a popular choice among consumers, offering a wide range of flavors, textures, and formats. The market for chocolate products is expected to continue its growth trajectory due to its universal appeal and constant product innovations, such as new flavors, fillings, and packaging designs.

By Distribution Channel

Based on Distribution Channel, the market has been divided into Hypermarket/Supermarket, Convenience Stores, Departmental Stores, and Online Retails. the hypermarket/supermarket segment holds the largest share. These retail formats provide a convenient and one-stop shopping experience for consumers, offering a wide range of confectionery products. The hypermarket/supermarket segment is expected to maintain its dominance in the market due to its extensive reach, competitive pricing, and the ability to cater to diverse consumer preferences.

Global Sugar and Confectionery Market Regional Analysis

Based on region, the global Sugar and Confectionery market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America boasts a well-established sugar and confectionery market, with the United States leading the way. Chocolates, candies, and gums are widely consumed in this region. The market is characterized by a diverse range of products, from mass-produced commercial brands to artisanal and premium offerings.

In recent years, there has been a growing demand for high-quality and premium confectionery products in North America. Consumers are seeking unique flavors, organic ingredients, and innovative packaging. Artisanal chocolatiers have gained popularity, offering handcrafted chocolates with exotic flavors and ethically sourced ingredients. Additionally, health-conscious trends have influenced the market, leading to an increased demand for sugar-free and healthier confectionery alternatives.

Asia-Pacific Market

The Asia-Pacific region presents immense opportunities for the sugar and confectionery market. Countries like Japan, China, and South Korea have a rich tradition of indulging in sweets and confectioneries. The market is characterized by a diverse range of flavors, textures, and formats, catering to the unique tastes of each country.

In Japan, chocolates and traditional Japanese confections like wagashi hold a prominent place in the market. Wagashi, which includes mochi, dorayaki, and yokan, are made with ingredients like sweet bean paste, matcha, and seasonal fruits. These traditional sweets are not only popular among locals but also attract tourists seeking an authentic culinary experience.

Competitive Landscape

The global Sugar and Confectionery market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Barry Callebaut

- Ferrero SpA

- Nestle S.A.

- Mondelez International, Inc.

- Meiji Holdings Co., Ltd.

- The Hershey Company

- Chocoladefabriken Lindt & Sprungli AG

- Ezaki Glico Co., Ltd.

- HARIBO GmbH & Co. KG

- Pladis Global

Key Development:

January 2021: Mondelez International, Inc. declared the launch of Cadbury Dairy Milk Silk Mousse in India under its premium chocolate segment.

Scope of the Report

Global Sugar and Confectionery Market, by Type

- Chocolate

- Sugar

- Gums

Global Sugar and Confectionery Market, by Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Departmental Stores

- Online Retails

Global Sugar and Confectionery Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 245.5 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 3.8% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Distribution Channel |

| Key Market Opportunities | Rising Demand for Premium and Artisanal Confectionery |

| Key Market Drivers | Embracing Health and Wellness |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Barry Callebaut, Ferrero SpA, Nestle S.A., Mondelez International, Inc., Meiji Holdings Co., Ltd., The Hershey Company, Chocoladefabriken Lindt & Sprungli AG, Ezaki Glico Co., Ltd., HARIBO GmbH & Co. KG, and Pladis Global |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Sugar and Confectionery market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Sugar and Confectionery market historical market size for the year 2021, and forecast from 2023 to 2033

- Sugar and Confectionery market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Commercial Use strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Sugar and Confectionery market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Commercial Use health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Sugar and Confectionery market?

The global Sugar and Confectionery market is growing at a CAGR of 3.8% over the next 10 years

Which region has the highest growth rate in the market of Sugar and Confectionery?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Sugar and Confectionery market?

Asia Pacific holds the largest share in 2022

Who are the key players in the global Sugar and Confectionery market?

Barry Callebaut, Ferrero SpA, Nestle S.A., Mondelez International, Inc., Meiji Holdings Co., Ltd., The Hershey Company, Chocoladefabriken Lindt & Sprungli AG, Ezaki Glico Co., Ltd., HARIBO GmbH & Co. KG, and Pladis Global the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.