Software Defined Networking Market Overview

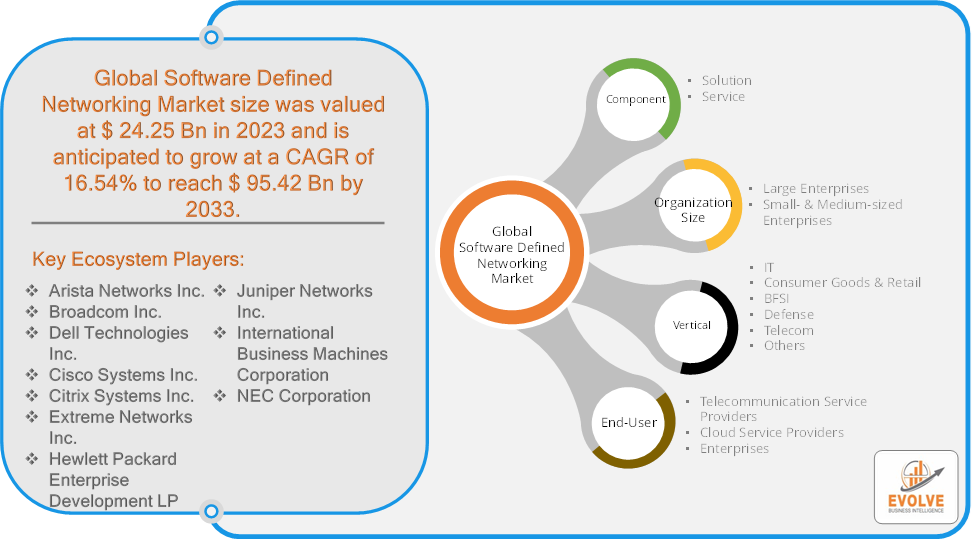

The Software Defined Networking Market Size is expected to reach USD 95.42 Billion by 2033. The Software Defined Networking Market industry size accounted for USD 24.25 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 17% from 2023 to 2033. The Software-Defined Networking (SDN) Market involves the segment of the technology industry focused on SDN solutions and services. SDN is a network architecture approach that allows network administrators to manage network services through abstraction of lower-level functionality. This separation of the network control plane from the data plane allows for more flexible and efficient network management and operation.

The SDN Market is influenced by advancements in networking technology, the increasing complexity of network environments, and the growing demand for more agile and scalable networking solutions.

Global Software Defined Networking Market Synopsis

The COVID-19 pandemic had significant impacts on the Software-Defined Networking (SDN) market. The pandemic forced many organizations to rapidly adopt digital solutions to support remote work and online operations. This shift increased the demand for flexible, scalable network solutions like SDN to manage the growing complexity of remote and cloud-based environments. With more people working from home and using online services, network traffic surged. SDN solutions helped manage this increased traffic more efficiently by providing better network visibility, control, and optimization. The pandemic accelerated the migration to cloud-based services, as businesses needed to ensure continuity and scalability. SDN played a crucial role in optimizing cloud network performance and managing resources effectively. With the increase in remote work, cybersecurity became a heightened concern. SDN provided improved network security through centralized control and better traffic management, helping organizations address new security challenges.

Software Defined Networking Market Dynamics

The major factors that have impacted the growth of Software Defined Networking Market are as follows:

Drivers:

Ø Rise in Network Traffic

The growing volume of data and increasing number of connected devices drive the need for better network management. SDN enables efficient traffic management, load balancing, and improved performance. The proliferation of Internet of Things (IoT) devices and machine-to-machine (M2M) communications creates a need for scalable and flexible network solutions. SDN supports the efficient management of these complex and dynamic networks. The push towards automating network management tasks and processes drives the adoption of SDN, which enables automation through programmable network management and control.

Restraint:

- Perception of High Initial Investment and Complexity of Implementation

The deployment of SDN solutions can involve significant upfront costs, including investments in new hardware, software, and training. This can be a barrier for smaller organizations or those with limited budgets. Transitioning from traditional network architectures to SDN can be complex and time-consuming. Organizations may face challenges related to integration, configuration, and compatibility with existing systems.

Opportunity:

⮚ 5G Network Deployment

The rollout of 5G networks requires advanced network management solutions to handle the increased complexity and scale. SDN is well-positioned to support the dynamic and high-performance requirements of 5G networks. The modernization of data centers to support higher performance and efficiency drives the need for SDN. SDN solutions can help optimize data center operations, improve resource utilization, and enhance overall network management.

Software Defined Networking Market Segment Overview

Based on Component, the market is segmented based on Solutions and Service. The solutions segment dominant the market. Solutions include the key technologies and products required to implement SDN, such as SDN controllers, network virtualization software, and related hardware. These technologies enable centralized control and management of network resources, resulting in more flexibility and efficiency. Their prevalence stems from the crucial role they play in changing traditional network topologies into programmable, flexible networks.

By Organization Size

Based on Organization Size, the market segment has been divided into Large Enterprises and Small- & Medium-sized Enterprises. The large enterprises segment dominant the market. Large enterprises typically have more complex and extensive network infrastructures, requiring advanced solutions to manage their scale and diversity efficiently. They have the financial resources to invest in SDN technologies, which provide significant benefits such as reduced operational costs, improved network flexibility, and enhanced security. These organizations are also more likely to adopt innovative technologies to maintain a competitive edge, driving higher adoption rates of SDN solutions among large enterprises compared to SMEs.

By End User

Based on End Users, the market segment has been divided into Telecommunication Service Providers, Cloud Service Providers and Enterprises. The enterprises segment dominant the software defined networking (SDN) market due to their substantial need for scalable, flexible, and cost-effective network solutions. Unlike traditional networking, SDN allows enterprises to manage and optimize their networks dynamically, leading to improved efficiency and reduced operational costs. The growing adoption of cloud services, big data, and IoT technologies further drives enterprises to integrate SDN to handle complex and data-intensive applications seamlessly.

By End Use

Based on End Use, the market segment has been divided into IT & Telecom Consumer Goods & Retail, BFSI, Defense and Others. The IT & telecom segment dominant the market. This dominance stems from the intrinsic necessity for a strong and adaptable network infrastructure to accommodate massive data traffic, continuous communication, and quick technological advances. Network scalability, effective management, and reduced latency are all priorities for IT and telecom organizations, and SDN capabilities help them achieve these goals. The transition to 5G, growing cloud computing adoption, and the rise of IoT applications all drive SDN integration in this vertical.

Global Software Defined Networking Market Regional Analysis

Based on region, the global Software Defined Networking Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Software Defined Networking Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Software Defined Networking Market. This region has been a pioneer in SDN adoption, with a strong presence of technology giants and a well-established IT infrastructure. The market is driven by the increasing demand for network virtualization and cloud computing services. High adoption of advanced technologies, significant investment in data centers, strong presence of major SDN vendors, and a mature IT infrastructure and rapid growth in cloud computing, 5G deployment, and increased focus on network security and automation.

Software Defined Networking Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Software Defined Networking Market industry. The Asia Pacific region is experiencing rapid growth in the SDN market, driven by the increasing adoption of digital technologies and the need for network modernization. Countries like China, India, and Japan are emerging as key markets for SDN solutions. Rapid economic growth, increasing internet penetration, and significant investments in telecommunications infrastructure and expansion in emerging markets, substantial cloud adoption, and growing demand for network modernization and IoT applications.

Competitive Landscape

The global Software Defined Networking Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Arista Networks Inc.

- Broadcom Inc.

- Dell Technologies Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Extreme Networks Inc.

- Hewlett Packard Enterprise Development LP

- Juniper Networks Inc.

- International Business Machines Corporation

- NEC Corporation

Key Development

In November 2023, VMware, Inc. announced new technologies and expanded collaborations aimed at accelerating customers’ digital transformation at the edge. These innovations and additional integrations, which build on the recently announced VMware Software-Defined Edge, are designed to help customers streamline, improve security, and update their edge environments for increased efficiency.

In March 2023, OpenSync, a prominent provider of sophisticated and intelligent smart home devices and services, launched Linux SDN to expand its reach to newer smart home devices. SDN capabilities have been expanded to include support for the Linux network stack. According to the company, OpenSync is the first cloud-controlled open-source software defined networking (SDN) solution.

Scope of the Report

Global Software Defined Networking Market, by Component

- Solutions

- Service

Global Software Defined Networking Market, by Organization Size

- Large Enterprises

- Small- & Medium-sized Enterprises.

Global Software Defined Networking Market, by End User

- Telecommunication Service Providers

- Cloud Service Providers

- Enterprises

Global Software Defined Networking Market, by Vertical

- IT

- Consumer Goods & Retail

- BFSI

- Defense

- Telecom

- Others

Global Software Defined Networking Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 95.42 Billion |

| CAGR (2023-2033) | 17% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Organization Size, End User, End Use. |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Arista Networks Inc., Broadcom Inc., Dell Technologies, Inc., Cisco Systems Inc., Citrix Systems Inc., Extreme Networks Inc., Hewlett Packard Enterprise Development LP, Juniper Networks Inc., International Business Machines Corporation, NEC Corporation |

| Key Market Opportunities | · 5G Network Deployment

· Data Center Modernization |

| Key Market Drivers | · Rise in Network Traffic

· Growth of IoT and M2M Communications |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Software Defined Networking Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Software Defined Networking Market historical market size for the year 2021, and forecast from 2023 to 2033

- Software Defined Networking Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Software Defined Networking Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Software Defined Networking Market?

The global Software Defined Networking Market is growing at a CAGR of 17% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Software Defined Networking Market?

North America holds the largest share in 2022

Who are the key players in the global Software Defined Networking Market?

Arista Networks Inc., Broadcom Inc., Dell Technologies, Inc., Cisco Systems, Inc., Citrix Systems, Inc., Extreme Networks, Inc., Hewlett Packard Enterprise Development LP, Juniper Networks, Inc., International Business Machines Corporation, NEC Corporation are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.