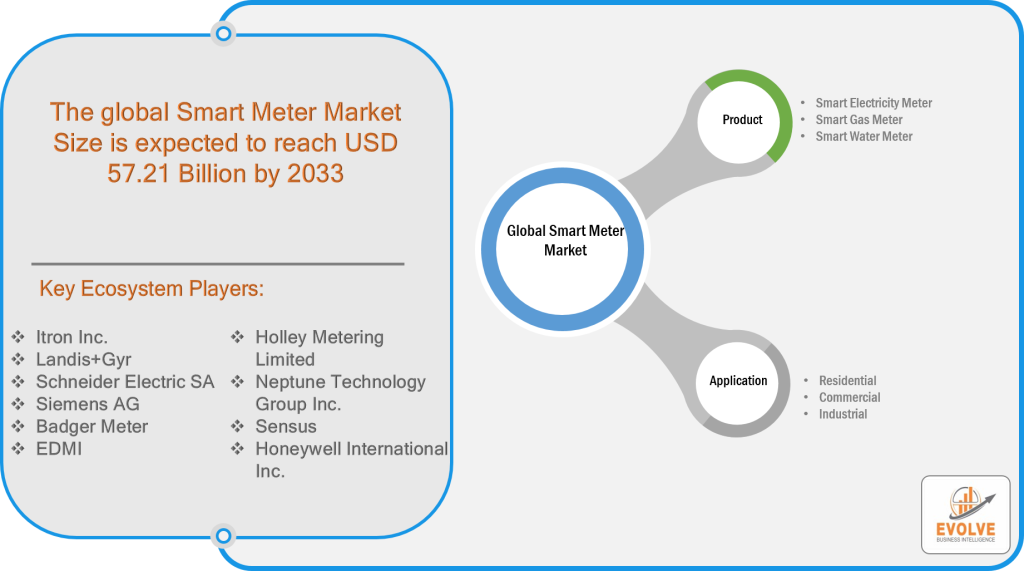

The global Smart Meter Market Size is expected to reach USD 57.21 Billion by 2033. The global Smart Meter industry size accounted for USD 22.75 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.66% from 2023 to 2033. The Smart Meter Market has witnessed significant growth in recent years, driven by the increasing need for efficient energy management and the integration of advanced technologies. Smart meters are digital devices that measure, record, and communicate energy consumption data to utility companies and consumers in real-time. They provide a range of benefits, including accurate billing, enhanced monitoring capabilities, and improved energy efficiency. With applications across electricity, gas, and water sectors, smart meters are transforming the way energy is consumed and managed.

Global Smart Meter Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a profound impact on various industries, and the smart meter market was no exception. During the lockdowns, the installation of smart meters faced delays due to restrictions on physical access to premises. Additionally, economic uncertainties and reduced consumer spending led to a temporary dcline in market growth. However, as the world transitions into a post-pandemic scenario, the smart meter market is expected to regain momentum. The increasing focus on digitalization and the need for remote monitoring solutions have accelerated the demand for smart meters.

Smart Meter Market Dynamics

The major factors that have impacted the growth of Smart Meter are as follows:

Drivers:

Growing Emphasis on Energy Conservation

One of the key driving factors for the smart meter market is the growing emphasis on energy conservation. As governments, organizations, and consumers become increasingly aware of the environmental impact of energy consumption, there is a rising demand for technologies that enable sustainable practices. Smart meters play a vital role in this regard by providing real-time insights into energy usage, allowing consumers to make informed decisions about their consumption patterns. By promoting energy conservation, smart meters contribute to reducing carbon footprints and fostering a greener future.

Restraint:

- High Initial Deployment Costs

Despite their numerous benefits, the high initial deployment costs associated with smart meters pose a significant challenge to market penetration. The installation and infrastructure expenses, including retrofitting existing systems and implementing communication networks, can be substantial. These costs are particularly burdensome for residential consumers and small-scale businesses. As a result, the adoption of smart meters may be limited in certain regions or demographics, hindering the overall market growth. However, ongoing advancements in technology and economies of scale are gradually reducing these barriers.

Opportunity:

⮚ Expanding End Uses and Product Innovation

An opportunity factor that holds immense potential for the smart meter market is the integration with the Internet of Things (IoT). Smart meters can be connected to IoT platforms, enabling seamless communication and data exchange between various devices. This integration opens up possibilities for innovative applications such as demand response systems, smart grids, and home automation. By harnessing the power of IoT, smart meters can optimize energy usage, improve grid stability, and enhance the overall efficiency of energy management systems.

Smart Meter Segment Overview

By Product

Based on the Product, the market is segmented based on Smart Electricity Meter, Smart Gas Meter, and Smart Water Meter. smart electricity meters currently hold the largest market share, owing to the increasing focus on electricity consumption monitoring and demand management. In terms of end-use, the market serves residential, commercial, and industrial sectors. The residential segment is anticipated to witness substantial growth due to the rising need for energy conservation and the implementation of smart home solutions.

By End Use

Global Smart Meter Market Regional Analysis

Based on region, the global Smart Meter market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America has emerged as a prominent market for smart meters, driven by favorable government initiatives and regulations promoting energy efficiency. The United States, in particular, has witnessed widespread deployment of smart meters across residential, commercial, and industrial sectors. Initiatives such as the Energy Policy Act of 2005 and the Smart Grid Investment Grant program have incentivized utility companies to invest in smart meter infrastructure. Furthermore, the region’s well-established energy infrastructure and advanced communication networks have facilitated the seamless integration of smart meters. As a result, North America is expected to continue experiencing substantial growth in the smart meter market.

Asia Pacific Market

Asia Pacific, with its rapidly growing economies and increasing energy demand, presents significant opportunities for the smart meter market. Countries such as China, Japan, South Korea, and India are witnessing a surge in infrastructure development and urbanization. Governments in the region are actively promoting energy conservation and the adoption of smart grid technologies. China, in particular, has witnessed widespread deployment of smart meters, driven by the government’s emphasis on energy efficiency and grid modernization. Additionally, the region’s large population and rising middle class contribute to the growing demand for smart meters in residential and commercial sectors. As the region continues to invest in smart grid infrastructure and urban development, the smart meter market in Asia Pacific is poised for robust growth.

Competitive Landscape

The global Smart Meter market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Itron Inc.

- Landis+Gyr

- Schneider Electric SA

- Siemens AG

- Badger Meter

- EDMI

- Holley Metering Limited

- Neptune Technology Group Inc.

- Sensus

- Honeywell International Inc.

Key Development:

June 2021: Itron Inc. has realized SAP certification for its interface software ISAIM 2.0 for Itron Enterprise Edition’s (IEE) Meter Data Management System (MDMS). The integration helps utilities to decrease the total cost of ownership and lower project implementation costs.

Scope of the Report

Global Smart Meter Market, by Product

- Smart Electricity Meter

- Smart Gas Meter

- Smart Water Meter

Global Smart Meter Market, by End Use

- Residential

- Commercial

- Industrial

Global Smart Meter Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $57.21 Billion |

| CAGR | 9.66% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Holley Metering Limited, Neptune Technology Group Inc., Sensus, and Honeywell International Inc. |

| Key Market Opportunities | Integration with Internet of Things (IoT) |

| Key Market Drivers | Growing Emphasis on Energy Conservation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Smart Meter market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Smart Meter market historical market size for the year 2021, and forecast from 2023 to 2033

- Smart Meter market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Commercial Use strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Smart Meter market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Commercial Use health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Smart Meter market?

The global Smart Meter market is growing at a CAGR of 11.5% over the next 10 years

Which region has the highest growth rate in the market of Smart Meter?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Smart Meter market?

Asia Pacific holds the largest share in 2022

Who are the key players in the global Smart Meter market?

Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Holley Metering Limited, Neptune Technology Group Inc., Sensus, and Honeywell International Inc. the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries