Smart Grid Sensors Market Overview

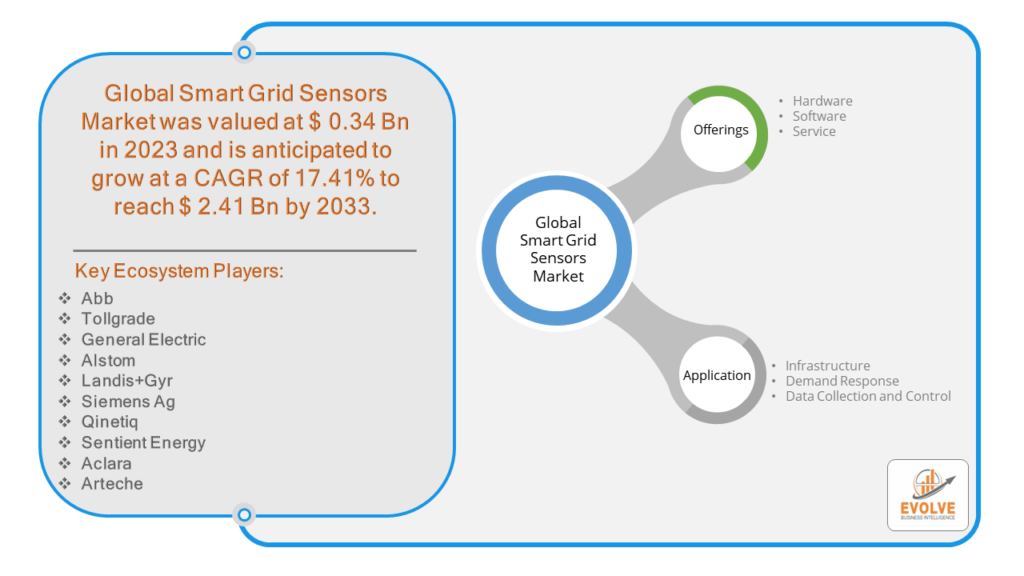

The Smart Grid Sensors Market Size is expected to reach USD 2.41 Billion by 2033. The Smart Grid Sensors industry size accounted for USD 0.34 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 17.41% from 2023 to 2033. The smart grid sensors market encompasses devices deployed within electrical grids to gather data crucial for grid optimization and management. These sensors monitor parameters like voltage, current, temperature, and power flow, enabling utilities to enhance efficiency, reliability, and resilience of the grid. They facilitate real-time monitoring, fault detection, and rapid response to disturbances, aiding in reducing downtime and improving outage management. Advancements in sensor technologies, such as IoT integration and AI analytics, are driving market growth, offering utilities greater insights for predictive maintenance and demand-side management. The market is witnessing expansion globally, propelled by increasing investments in modernizing aging grid infrastructure and integrating renewable energy sources.

Global Smart Grid Sensors Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Smart Grid Sensors market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Smart Grid Sensors Market Dynamics

The major factors that have impacted the growth of Smart Grid Sensors are as follows:

Drivers:

- Government’s supportive policies

Electric infrastructure has a nature of interconnection to other critical infrastructures such as Communication, Water, Transportation and others, any disturbance has the potential for cascading interruption of critical facilities and services, which can impact national public health and safety. To address these problems, government across countries are increasing funding and developing programs for smart grid technology. According to smartgrid.gov, the Office of Electricity is investing nearly $10 million in early-stage research in smart grid in the US. The U.S. Department of Energy (DOE) Office of Electricity (OE) Advanced Grid Research and Development Division is proposing a new Sensor Technologies and Data Analytics Program.

Restraint:

- Increase in adoption of smart technologies and rise in development of smart cities

According to OECD, smart cities are initiatives or approaches that effectively leverage digitalization to boost citizen well-being and deliver more efficient, sustainable and inclusive urban services and environments. Some of the leading smart cities around the globe are Singapore, Dubai, Oslo, Copenhagen, and others. Smart cities are developed when several subjects such as, Mobility, Healthcare, Security, and Energy, among others, combines to automate and digitize several public services while improving the citizen experience. Smart grid is one of the most essential part of smart city and distributed energy resources (DER) systems.

Opportunity:

⮚ Technological Innovations

Ongoing advancements in sensor technology, such as the development of low-cost, low-power sensors and wireless communication protocols, are expanding the potential applications of smart grid sensors. These innovations lower deployment costs and enable scalability, opening up new opportunities for utilities to enhance grid intelligence and efficiency.

Smart Grid Sensors Segment Overview

By Offerings

By Application

Based on Applications, the market has been divided into the Infrastructure, Demand Response, Data Collection and Control. In the smart grid sensors market, the infrastructure segment dominates, driven by the critical need for real-time monitoring and optimization of grid assets to enhance reliability and efficiency.

Global Smart Grid Sensors Market Regional Analysis

Based on region, the global Smart Grid Sensors market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Smart Grid Sensors market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Smart Grid Sensors Market. Due to their early adoption of smart grid projects and robust economies, North America will dominate the global market for smart grid sensors. The region will also invest heavily in smart infrastructure platforms.

Smart Grid Sensors Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Smart Grid Sensors industry. From 2023 to 2032, the Asia-Pacific smart grid sensors market is anticipated to expand at the highest rate due to factors such as increased disposable income, the quick expansion of the electrical infrastructure, and the need for additional monitoring tools to keep track of power Offeringsion, transmission, and distribution. Furthermore, the smart grid sensors market in China commanded the most market share, while the market in India grew at the fastest rate in the Asia-Pacific area.

Competitive Landscape

The global Smart Grid Sensors market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Offerings launches, and strategic alliances.

Prominent Players:

- Abb

- Tollgrade

- General Electric

- Alstom

- Landis+Gyr

- Siemens Ag

- Qinetiq

- Sentient Energy

- Aclara

Key Development

May 2023: Siemens is developing a new servo drive system intended for a wide range of common applications in battery, electronics, and other industries. It delivers high dynamic performance and comprises a precise drive, strong servo motors, and simple cables. The new servo drive technology is particularly advantageous for applications that need accuracy in speed and torque, including winding and unwinding machines used in battery manufacture and cell assembly.

Scope of the Report

Global Smart Grid Sensors Market, by Offerings

- Hardware

- Software

- Service

Global Smart Grid Sensors Market, by Application

- Infrastructure

- Demand Response

- Data Collection and Control

Global Smart Grid Sensors Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.41 Billion/strong> |

| CAGR | 17.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Offerings, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ABB, TOLLGRADE, GENERAL ELECTRIC, ALSTOM, LANDIS+GYR, SIEMENS AG, QINETIQ, SENTIENT ENERGY, ACLARA, ARTECHE |

| Key Market Opportunities | • Smart city development in the middle- and low-income nations |

| Key Market Drivers | • Rising levels of discretionary income Increasing investment in a scientific study |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Smart Grid Sensors market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Smart Grid Sensors market historical market size for the year 2021, and forecast from 2023 to 2033

- Smart Grid Sensors market share analysis at each Offerings level

- Competitor analysis with detailed insight into its Offerings segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Offerings launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Smart Grid Sensors market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Offerings offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

2. What is the growth rate of the global Smart Grid Sensors market?

- The global Smart Grid Sensors market is growing at a CAGR of 17.41% over the next 10 years

3. Which region has the highest growth rate in the market of Smart Grid Sensors?

Asia Pacific is expected to register the highest CAGR during 2023-2033

4. Which region has the largest share of the global Smart Grid Sensors market?

- North America holds the largest share in 2022

5. Who are the key players in the global Smart Grid Sensors market?

- ABB, TOLLGRADE, GENERAL ELECTRIC, ALSTOM, LANDIS+GYR, SIEMENS AG, QINETIQ, SENTIENT ENERGY, ACLARA, and ARTECHE. are the major companies operating in the market.