Price range: $ 1,390.00 through $ 5,520.00

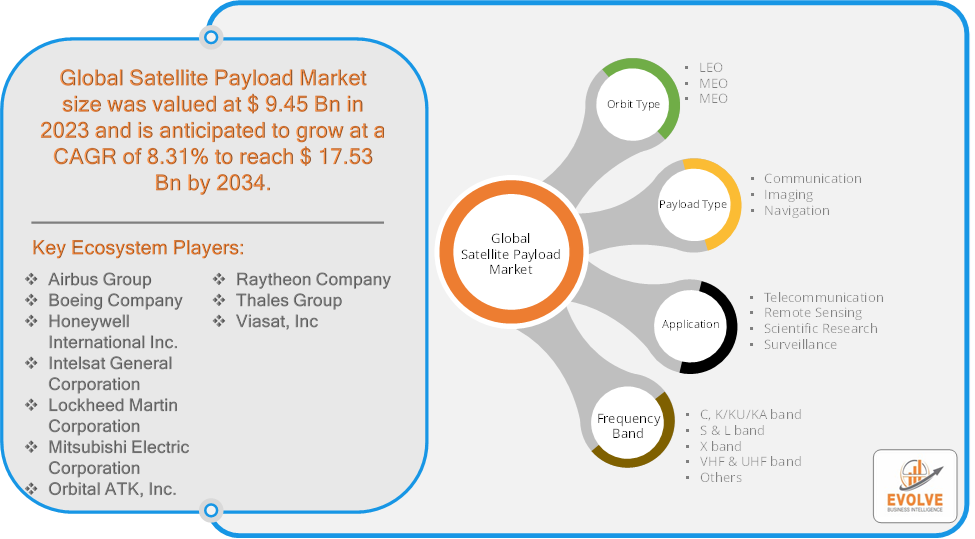

Satellite Payload Market Research Report: By Orbit Type (LEO, MEO, MEO), By Payload Type (Communication, Imaging, Navigation), By Application (Telecommunication, Remote Sensing, Scientific Research, Surveillance), By Frequency Band (C, K/KU/KA band, S & L band, X band, VHF & UHF band, Others, ), and by Region — Forecast till 2034

Page: 118

Description

Satellite Payload Market Overview

The Satellite Payload Market Size is expected to reach USD 17.53 Billion by 2034. The Satellite Payload Market industry size accounted for USD 9.45 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.31% from 2021 to 2034. The Satellite Payload Market encompasses the components and equipment onboard satellites that are responsible for carrying out specific functions such as communication, imaging, sensing, and data collection. Payloads can include transponders, antennas, sensors, cameras, and scientific instruments tailored for various applications, including Earth observation, telecommunications, navigation, and meteorology. This market is driven by increasing demand for satellite-based services across sectors like broadcasting, defense, and space exploration. Technological advancements, such as the development of high-throughput and multi-mission payloads, are enhancing capabilities and efficiency. Growth in satellite constellations and private space ventures also contributes to the expanding market for satellite payloads.

Global Satellite Payload Market Synopsis

Global Satellite Payload Market Dynamics

Global Satellite Payload Market Dynamics

The major factors that have impacted the growth of Satellite Payload are as follows:

Drivers:

⮚ Advancements in Satellite Technology

Technological innovations in satellite payloads, such as high-throughput satellites (HTS), low Earth orbit (LEO) constellations, and multi-mission payloads, are expanding their capabilities and efficiency. HTS, for example, offers higher data rates and greater bandwidth, making it suitable for a wide range of applications. These advancements enhance satellite performance and stimulate market growth by meeting the evolving needs of various sectors.

Restraint:

- Technological Obsolescence

The rapid pace of technological advancements in the space industry can lead to concerns about technological obsolescence. Newer technologies and innovations may quickly render existing payloads outdated, impacting their competitiveness and value. This requires continuous investment in research and development to keep up with technological trends and maintain relevance in the market.

Opportunity:

⮚ Expansion of Space Exploration and Science Missions

The increasing interest in space exploration and scientific research provides opportunities for specialized satellite payloads. Missions focused on exploring other planets, studying cosmic phenomena, and conducting space-based experiments require advanced payloads, such as scientific instruments and imaging systems. This trend is supported by both government space agencies and private space ventures, fueling demand for cutting-edge payload technologies.

Satellite Payload Market Segment Overview

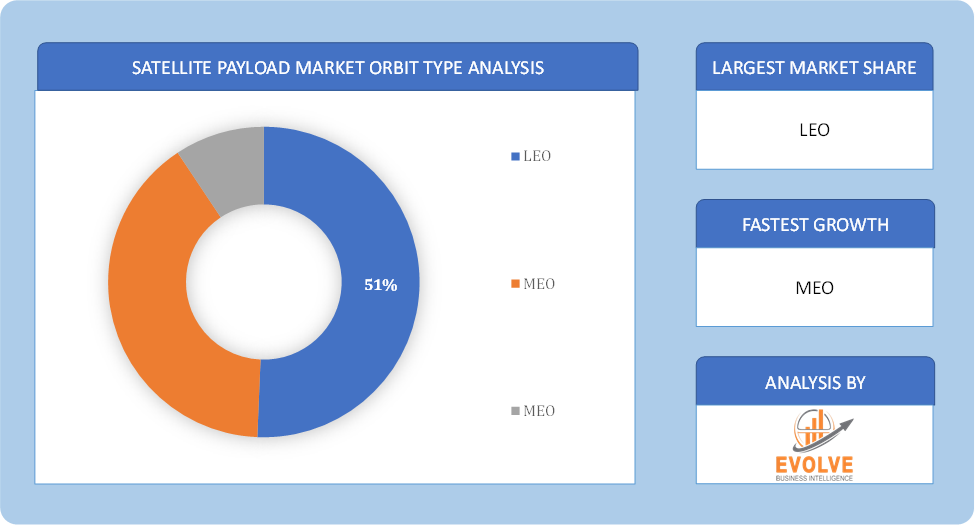

Based on the Orbit Type, the market is segmented based on LEO, MEO, MEO. the LEO (Low Earth Orbit) segment dominates due to its advantages in providing low-latency, high-speed communication and Earth observation capabilities, which are crucial for applications like broadband internet and real-time imaging.

By Payload Type

Based on Payload Type, the market has been divided into Communication, Imaging, Navigation. the Communication segment dominates due to the widespread need for satellite communication services across various applications, including broadcasting, internet connectivity, and telecommunication, which drive high demand for advanced communication payloads.

By Application

Based on the Application, the market has been divided into Telecommunication, Remote Sensing, Scientific Research, Surveillance. the Telecommunication segment dominates due to the high demand for satellite communication services, including broadcasting, internet, and data transmission, which require advanced payloads for reliable and high-capacity connectivity.

By Frequency Band

Based on Frequency Band, the market has been divided into C, K/KU/KA band, S & L band, X band, VHF & UHF band, Others. the C band dominates due to its long-standing use in communication and broadcasting, providing reliable performance and extensive coverage with relatively lower susceptibility to rain fade compared to higher frequency bands.

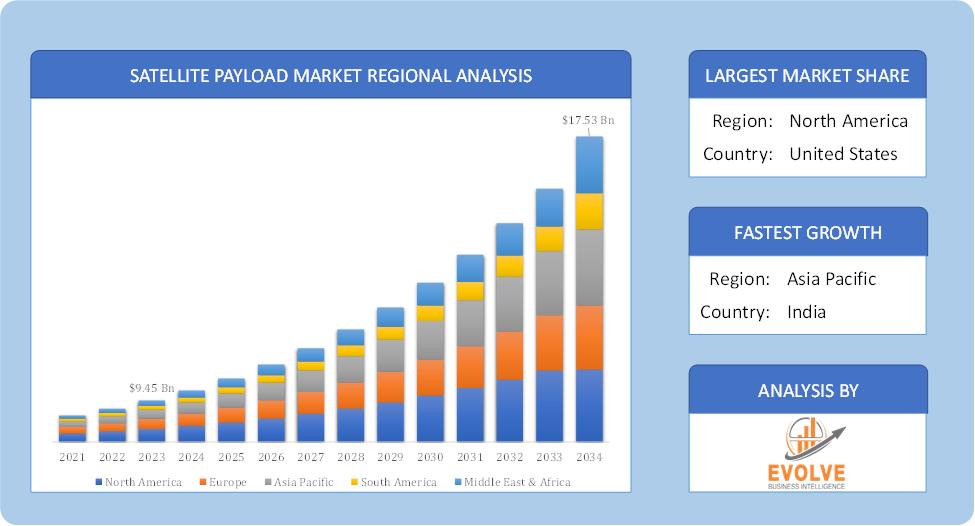

Global Satellite Payload Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Satellite Payload, followed by those in Asia-Pacific and Europe.

Satellite Payload North America Market

Satellite Payload North America Market

The North American region holds a dominant position in the Satellite Payload market. The market for satellite payloads in North America will be the largest due to increased government funding for space technology. One important tactic for increasing efficiency is for the manufacturers in the area to use satellite communication technologies.

Satellite Payload Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Satellite Payload industry. Between 2023 and 2030, the Asia Pacific Satellite Payloads Market is anticipated to expand at the quickest rate. The rising investments in earth observation and communications satellites by China and India are expected to drive up demand for the product. Furthermore, the China Satellite Payloads market was the fastest-growing market in the Asia Pacific region, while the India Satellite Payloads market held the biggest market share.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Airbus Group, Boeing Company, Honeywell International Inc., Intelsat General Corporation, and Lockheed Martin Corporation are some of the leading players in the global Satellite Payload Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Airbus Group

- Boeing Company

- Honeywell International Inc.

- Intelsat General Corporation

- Lockheed Martin Corporation

- Mitsubishi Electric Corporation

- Orbital ATK, Inc.

- Raytheon Company

- Thales Group

- Viasat, Inc

Key Development:

In September 2022, Honeywell International Inc. advanced its position in the Satellite Payload Market by unveiling new satellite payload technologies focused on enhancing communication and navigation capabilities, as part of their broader strategy to innovate in space and aerospace systems.

Scope of the Report

Global Satellite Payload Market, by Orbit Type

- LEO

- MEO

- MEO

Global Satellite Payload Market, by Payload Type

- Communication

- Imaging

- Navigation

Global Satellite Payload Market, by Application

- Telecommunication

- Remote Sensing

- Scientific Research

- Surveillance

Global Satellite Payload Market, by Frequency Band

- C, K/KU/KA band

- S & L band

- X band

- VHF & UHF band

- Others

Global Satellite Payload Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 17.53 Billion |

| CAGR (2021-2034) | 8.31% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Orbit Type, Payload Type, Application, Frequency Band |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa. |

| Key Vendors | Airbus Group, Boeing Company, Honeywell International Inc., Intelsat General Corporation, Lockheed Martin Corporation, Mitsubishi Electric Corporation, Orbital ATK, Inc., Raytheon Company, Thales Group, Viasat, Inc |

| Key Market Opportunities | Rising demand for small satellites for communications |

| Key Market Drivers | Flexible Payloads are becoming more popular on the market. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Satellite Payload market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Satellite Payload market historical market size for the year 2022, and forecast from 2021 to 2034

- Satellite Payload market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Satellite Payload market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What are the 10 Years CAGR (2021 to 2034) of the global Satellite Payload market?

The global Satellite Payload market is growing at a CAGR of ~8.31% over the next 10 years

Which region has the highest growth rate in the market of Satellite Payload?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Satellite Payload?

North America holds the largest share in 2023

Major Key Players in the Market of Satellite Payload?

Airbus Group, Boeing Company, Honeywell International Inc., Intelsat General Corporation, Lockheed Martin Corporation, Mitsubishi Electric Corporation, Orbital ATK, Inc., Raytheon Company, Thales Group, and Viasat, Inc are the major companies operating in the Satellite Payload Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Content

[html_block id="8272"]