Polylactic Acid Market Overview

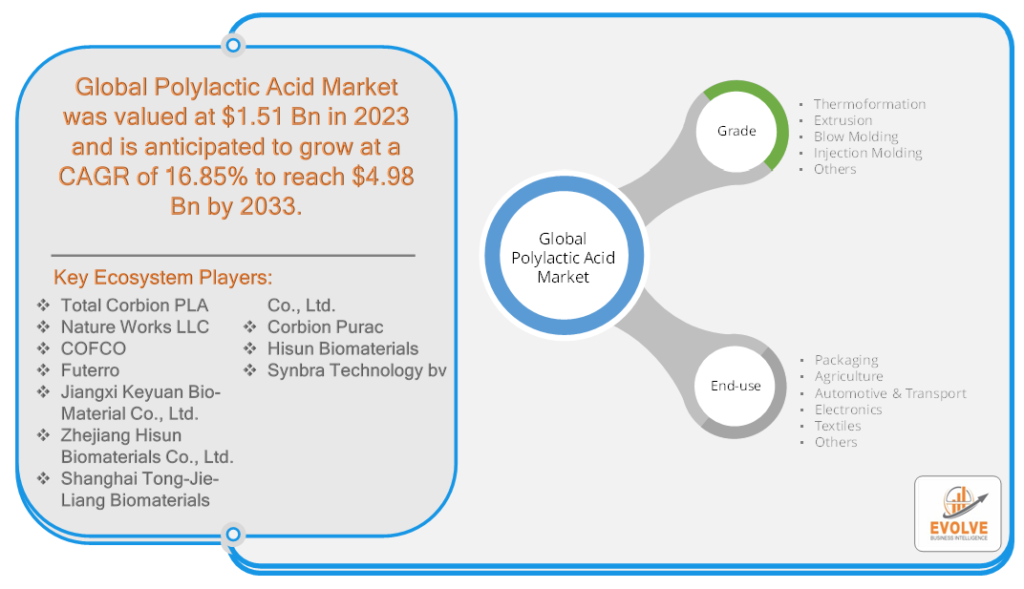

The Polylactic Acid Market Analysis Size is expected to reach USD 4.98 Billion by 2033. The Polylactic Acid industry size accounted for USD 1.51 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.85% from 2023 to 2033. Polylactic Acid (PLA) is a biodegradable and bio-based polymer that belongs to the family of thermoplastics. It is derived from renewable resources such as cornstarch, sugarcane, or other agricultural feedstocks. PLA exhibits properties similar to conventional petroleum-based plastics while offering distinct environmental advantages. It possesses good transparency, excellent moldability, and thermal stability. PLA can be processed using various manufacturing techniques, including injection molding, extrusion, and 3D printing. As a sustainable alternative to traditional plastics, PLA finds applications in various industries, including packaging, textiles, medical devices, disposable utensils, and agricultural films. It has gained popularity due to its biodegradability, reduced carbon footprint, and compatibility with circular economy principles.

Global Polylactic Acid Market Synopsis

The COVID-19 pandemic had a significant and transformative impact on the Polylactic Acid (PLA) market. With a growing emphasis on sustainability and environmental concerns, PLA had already been experiencing increasing demand as a bio-based and biodegradable alternative to traditional plastics. However, the pandemic further amplified the importance of sustainable solutions, as it highlighted the vulnerabilities and risks associated with single-use plastics. The need for safer and more environmentally friendly packaging materials, medical supplies, and hygiene products surged during the pandemic. This led to heightened demand for PLA in various applications, including food packaging, personal protective equipment, and medical devices. The pandemic catalyzed the adoption of PLA and accelerated the transition towards more sustainable materials, contributing to the overall growth and transformation of the PLA market.

Polylactic Acid Market Dynamics

The major factors that have impacted the growth of Polylactic Acid are as follows:

Drivers:

Growing environmental concerns and sustainability initiatives

One of the major drivers of the Polylactic Acid (PLA) market is the increasing environmental concerns and sustainability initiatives worldwide. PLA is derived from renewable resources, such as cornstarch or sugarcane, and is biodegradable, making it an attractive alternative to petroleum-based plastics. The demand for PLA is driven by the desire to reduce reliance on fossil fuels, minimize carbon footprint, and address plastic pollution issues.

Restraint:

- Higher production costs compared to traditional plastics

A significant restraint for the Polylactic Acid market is the relatively higher production costs of PLA compared to traditional plastics. The production process of PLA requires specialized equipment and technologies, as well as a consistent supply of raw materials. These factors contribute to the higher overall cost of PLA production, which can limit its widespread adoption, particularly in price-sensitive markets or industries.

Opportunity:

Expanding applications in various industries

An opportunity for the Polylactic Acid market lies in the expanding range of applications across various industries. PLA’s versatile properties, including its ability to be molded into different shapes and forms, make it suitable for packaging, textiles, medical devices, disposable utensils, and more. As sustainability becomes a priority for businesses and consumers, the demand for PLA in these industries is expected to increase. Additionally, advancements in PLA production technologies and increasing economies of scale have the potential to lower production costs, opening up new opportunities for market growth.

Polylactic Acid Segment Overview

By Grade

By End-use

Based on End-use, the market has been divided into Packaging, Agriculture, Automotive & Transport, Electronics, Textiles, and Others. The Packaging segment is anticipated to dominate the market. The increasing consumer demand for eco-friendly packaging solutions, coupled with stringent regulations on plastic waste and pollution, is driving the adoption of PLA in the packaging industry. PLA offers excellent clarity, barrier properties, and printability, making it suitable for various packaging applications, including bottles, containers, films, and bags.

Global Polylactic Acid Market Regional Analysis

Based on region, the global Polylactic Acid market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Polylactic Acid market followed by the Asia-Pacific and Europe regions.

North America has indeed consistently held a dominant position in the Polylactic Acid (PLA) market. The region’s dominance can be attributed to several factors. Firstly, North America has a strong focus on sustainability and environmental initiatives, which has driven the demand for PLA as a bio-based and biodegradable alternative to conventional plastics. The region’s advanced manufacturing capabilities, research and development infrastructure, and supportive regulatory frameworks have facilitated the growth of the PLA market. Additionally, North America boasts a robust packaging industry, where PLA finds extensive applications. Furthermore, the presence of major market players, technological advancements, and collaborations between industry participants in the region have contributed to North America’s dominant position in the Polylactic Acid market. However, as sustainability gains traction globally and demand for PLA rises in other regions, the market landscape is expected to become more competitive and geographically diversified in the coming years.

Asia-Pacific Market

The Asia-Pacific region has emerged as a rapidly growing market for the Polylactic Acid (PLA) industry. The region’s expanding population, rising disposable incomes, and increasing awareness of environmental sustainability have contributed to the growing demand for PLA. Countries such as China, Japan, South Korea, and India are witnessing significant growth in various industries, including packaging, textiles, and consumer goods, which are key application areas for PLA. Additionally, supportive government policies and regulations promoting the use of bio-based and biodegradable materials further drive the adoption of PLA in the region. Moreover, the Asia-Pacific region is home to several PLA manufacturers, fostering local production and supply chains. With its strong market potential, the Asia-Pacific region presents lucrative opportunities for both domestic and international players in the Polylactic Acid industry.

Competitive Landscape

The Global Polylactic Acid market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Total Corbion PLA

- Nature Works LLC

- COFCO

- Futerro

- Jiangxi Keyuan Bio-Material Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Shanghai Tong-Jie-Liang Biomaterials Co., Ltd.

- Corbion Purac

- Hisun Biomaterials

- Synbra Technology bv

Key Development

In June 2022, NatureWoks LLC initiated the construction of a new manufacturing facility in Thailand dedicated to producing PLA polymer. With an expected annual capacity of 75,000 tons, this facility aims to meet the growing demand for PLA in various industries.

In January 2021, Sulzer Chemtech secured a contract to supply lactide production equipment for a project at Zhejiang Depei New Material Co.’s latest plant located in Ningbo, Zhejiang Province, China. This collaboration highlights the increasing focus on PLA production and underscores the importance of advanced manufacturing equipment in meeting the rising demand for PLA materials.

Scope of the Report

Global Polylactic Acid Market, by Grade

- Thermoformation

- Extrusion

- Blow Molding

- Injection Molding

- Others

Global Polylactic Acid Market, by End-use

- Packaging

- Agriculture

- Automotive & Transport

- Electronics

- Textiles

- Others

Global Polylactic Acid Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $57.21 Billion |

| CAGR | 16.85% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Grade, End-use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Total Corbion PLA, Nature Works LLC, COFCO, Futerro, Jiangxi Keyuan Bio-Material Co Ltd, Zhejiang Hisun Biomaterials Co Ltd, Shanghai Tong-Jie-Liang Biomaterials Co Ltd, Corbion Purac, Hisun Biomaterials, Synbra Technology bv. |

| Key Market Opportunities | • Expanding applications and market penetration |

| Key Market Drivers | • Increasing environmental concerns and sustainability initiatives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Polylactic Acid market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Polylactic Acid market historical market size for the year 2021, and forecast from 2023 to 2033

- Polylactic Acid market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Polylactic Acid market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

The study period of the global Polylactic Acid market is 2021- 2033

The Global Polylactic Acid market is growing at a CAGR of 16.85% over the next 10 years

Asia Pacific is expected to register the highest CAGR during 2023-2033

North America holds the largest share in 2022

Total Corbion PLA, Nature Works LLC, COFCO, Futerro, Jiangxi Keyuan Bio-Material Co Ltd, Zhejiang Hisun Biomaterials Co Ltd, Shanghai Tong-Jie-Liang Biomaterials Co Ltd, Corbion Purac, Hisun Biomaterials, Synbra Technology bv are the major companies operating in the market.

Yes, we offer 16 hours of analyst support to solve the queries

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.