Phytogenic Feed Additives Market Overview

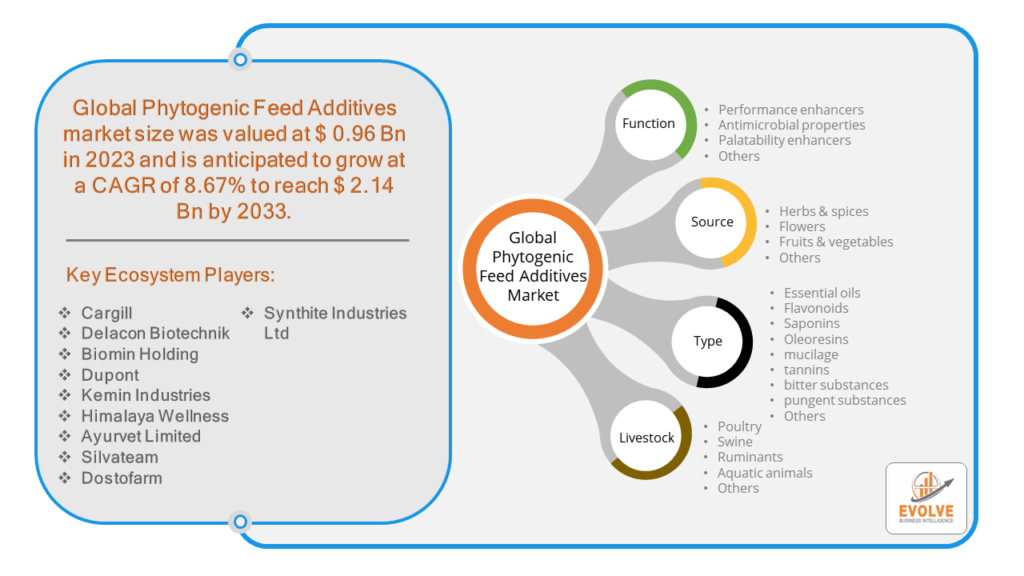

Phytogenic Feed Additives Market Size is expected to reach USD 2.14 Billion by 2033. The Phytogenic Feed Additives industry size accounted for USD 0.96 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.67% from 2023 to 2033. Phytogenic feed additives, also known as PFAs or botanicals, are plant-derived substances added to animal diets to enhance performance. These additives include essential oils, herbs, and spices rich in bioactive compounds like phenols and flavonoids. They offer various benefits such as antioxidative, anti-inflammatory, antimicrobial, and digestion-enhancing effects. Common sources of phytogenics include oregano, thyme, garlic, horseradish, chili, peppermint, cinnamon, and anise. While phytogenics show promise in improving animal health and growth, research is ongoing to fully substantiate their efficacy, especially as alternatives to traditional in-feed antibiotics

Global Phytogenic Feed Additives Market Synopsis

The Phytogenic Feed Additives market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic has caused supply chain hiccups that have resulted in shortages or decreased demand in the market for phytogenic feed additives. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. Due to the epidemic, end-user trends and tastes have altered, leading manufacturers, developers, and service providers to implement a variety of tactics aimed at stabilizing their businesses.

Global Phytogenic Feed Additives Market Dynamics

The major factors that have impacted the growth of Phytogenic Feed Additives are as follows:

Drivers:

⮚ Technological Advancements and Research

Advances in extraction techniques, formulation technologies, and scientific research have expanded the understanding of the bioactive compounds present in plants and their potential applications in animal nutrition. This has facilitated the development of innovative phytogenic feed additive products with improved efficacy and stability.

Restraint:

- Standardization and Quality Control

One of the primary challenges is ensuring consistency in the composition and quality of phytogenic feed additives. Variability in the composition of botanical extracts due to factors such as plant genetics, growing conditions, and extraction methods can make standardization difficult, leading to inconsistent efficacy and performance.

Opportunity:

⮚ Value-added Product Differentiation

Producers can differentiate their livestock products in the market by promoting the use of phytogenic feed additives as part of their animal production practices. By emphasizing the natural and sustainable attributes of these additives, producers can command premium prices and capture niche market segments seeking high-quality, ethically produced meat, dairy, and poultry products.

Phytogenic Feed Additives Market Segment Overview

By Function

Based on the Function, the market is segmented based on Performance enhancers, Antimicrobial properties, Palatability enhancers and Others. The palatibility enhancer segment is projected to exhibit the highest CAGR of 9.34% during the forecast period. Another name for hytogenic feed additives is natural performance enhancers. The market demand is anticipated to be driven by the growth-promoting qualities of feed phytogenics, such as oleoresins, essential oils, and herbs & spices.

By Source

By Type

Based on the Type, the market has been divided into Essential oils, Flavonoids, Saponins

Oleoresins, mucilage, tannins, bitter substances, pungent substances and Others.

By Livestock

Based on Livestock, the market has been divided into Healthcare Products, Consumer Goods, and Industrial Goods. The poultry segment accounted for the largest market share of 42.97% in 2020 and is expected to register a 9.37% CAGR during the review period. Consuming feed phytogenics improves intestinal health, growth performance, feed intake, feed conversion ratio, and the ability of chickens to withstand the particular impacts of heat stress when temperatures are high and humid.

Global Phytogenic Feed Additives Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Europe is anticipated to dominate the market for the usage of Phytogenic Feed Additives, followed by those in North America and Europe.

The Europe region holds a dominant position in the Phytogenic Feed Additives market. With a share of 33.23% in the global feed phytogenic market in 2020, Europe held a dominant position. The EU outlawed the use of AGPs in animal feed in 2006, and laws are now in place to minimize the use of therapeutic antibiotics. As a result, feed phytogenic makers found themselves in an advantageous market. In the past few years, the feed business in Europe has experienced substantial growth.

North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Phytogenic Feed Additives industry. For producers of phytogenic feed, North America is a desirable location. By 2028, it is expected that the region, which had 28.30% of the market in 2020, will have grown to USD 458.03 million. The US is the second-largest feed-producing nation in the world and is a major factor in the expansion of the feed phytogenic business in North America. The Food and Drug Administration (FDA) implemented new regulations in 2017 that severely limited the routine use of antibiotics on US farms. This raised the demand for phytogenic feed because it was thought to be an antibiotic substitute.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Cargill, Delacon Biotechnik, Biomin Holding, Dupont, and Kemin Industries are some of the leading players in the global Phytogenic Feed Additives Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Cargill

- Delacon Biotechnik

- Biomin Holding

- Dupont

- Kemin Industries

- Himalaya Wellness

- Ayurvet Limited

- Silvateam

- Dostofarm

- Synthite Industries Ltd

Key Development:

In August2020, Delacon announced the launch of Syrena Boost, a phytogenic solution specifically designed for gut performance and productivity of aquaculture practices. With this, the company enters into the aqua market.

In January 2020, Kemin Industries launched VANNIX C4, a novel phytogenic feed additive that joins the comprehensive lineup of poultry gut health solutions from Kemin Animal Nutrition and Health, North America.

Scope of the Report

Global Phytogenic Feed Additives Market, by Function

- Performance enhancers

- Antimicrobial properties

- Palatability enhancers

- Others

Global Phytogenic Feed Additives Market, by Source

- Herbs & spices

- Flowers

- Fruits & vegetables

- Others

Global Phytogenic Feed Additives Market, by Type

- Essential oils

- Flavonoids

- Saponins

- Oleoresins

- mucilage

- tannins

- bitter substances

- pungent substances

- Others

Global Phytogenic Feed Additives Market, by Livestock

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others

Global Phytogenic Feed Additives Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.14 Billion |

| CAGR | 8.67% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Function , Source, Type, Livestock |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Cargill, Delacon Biotechnik, Biomin Holding, Dupont, Kemin Industries, Himalaya Wellness, Ayurvet Limited, Silvateam, Dostofarm, Synthite Industries Ltd |

| Key Market Opportunities | Emergence Of New Technologies Such as Encapsulation |

| Key Market Drivers | Feed phytogenic are derived from natural sources for livestock feed. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Phytogenic Feed Additives Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Phytogenic Feed Additives market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Phytogenic Feed Additives market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Phytogenic Feed Additives Market.

Frequently Asked Questions (FAQ)

Phytogenic feed additives market size ?

The global phytogenic feed additives market size was valued at USD 710.88 million in 2021 and is projected to reach USD 1,170.63 million by 2027, exhibiting a CAGR of 8.67% during the forecast period. According to a report by Grand View Research, the global phytogenic feed additives market size was valued at USD million in 2020 and is expected to grow significantly in the forecast period of 2023 to 2030. Another report by Data Bridge Market Research states that the market is growing with a CAGR of 9.2% in the forecast period of 2023 to 2030, and it is expected to be worth USD 1,744.34 million by 2030. These figures indicate a substantial and consistent growth trend in the global phytogenic feed additives market.

What are Phytogenic feed additives products ?

Phytogenic feed additives are substances of plant origin added to animal diets at recommended levels with the aim of improving animal performance. These additives are also known as PFAs or botanicals and are derived from a wide range of plant materials, including essential oils, herbs, and spices. Phytogenic feed additives are standardized, specific, and science-based combinations of bioactive compounds derived from or inspired by the plant universe, offering benefits for animals, people, or the environment. They contain more than 100 natural ingredients that are part of many different active substance groups. Phytogenic feed additives using plant extracts show greater modes of action in animal nutrition compared to synthetic, nature-identical substances. The benefits of phytogenic feed additives include enhanced animal performance, improved feed efficiency, and reduced emissions. The market for phytogenic feed additives is projected to quadruple, reaching between US$1.7 billion and US$2 billion in global sales by 2030

Wholesale Phytogenic feed additives ?

- Feed Buyers Guide: Offers a wide range of phytogenic feed additives from various suppliers, including Biomin, Delacon, and Kemin Industries

- Alibaba: A global online marketplace that connects buyers with suppliers, including phytogenic feed additives suppliers and wholesalers

- TradeFord: A platform that connects buyers with suppliers, including phytogenic feed additives manufacturers and distributors

- Delacon: A leading manufacturer of phytogenic feed additives, offering standardized plant-based feed additives with proven efficacy, containing more than 100 natural ingredients

Phytogenic feed additives companies ?

Some of the leading phytogenic feed additives companies include:

- DSM N.V.: A global science-based company that acquired Biomin Holding GMBH in October 2020, strengthening its product portfolio and expertise in phytogenic feed additives

- Biomin Holding GMBH: A well-known company in the phytogenic feed additives industry, Biomin was acquired by DSM in October 2020

- DuPont: In August 2020, DuPont announced the opening of a new animal nutrition manufacturing facility in Wuxi, China, providing the local animal production industry with customized solutions

- Delacon: A leading expert in phytogenic feed additives, Delacon has been fully dedicated to phytogenics since its inception and is known for its double-digit growth rates

- Kemin Industries: Kemin is a global ingredient manufacturer that offers phytogenic feed additives for poultry

- Adisseo: Adisseo is a global leader in animal nutrition, offering a range of feed additives, including phytogenic feed additives