Packaging Market Overview

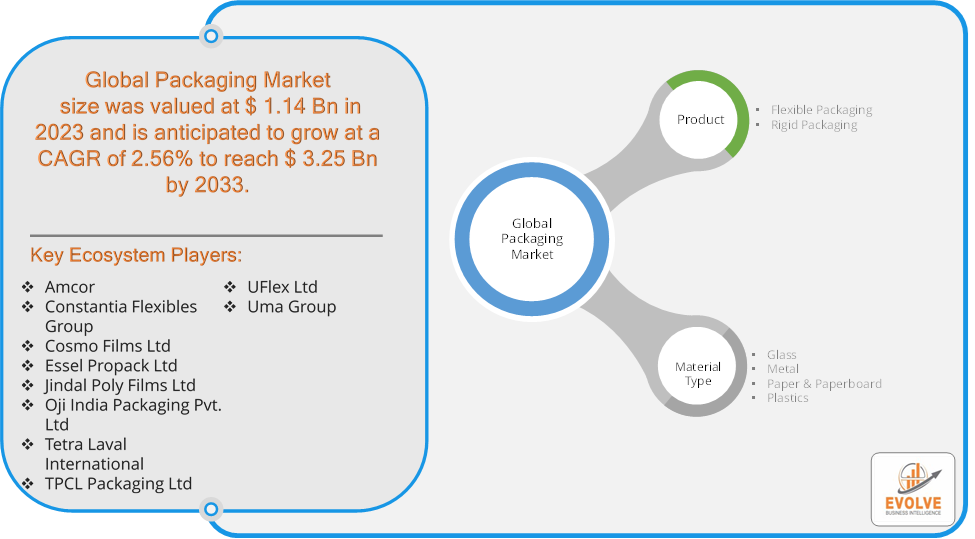

The Packaging Market Size is expected to reach USD 3.25 Billion by 2033. The Packaging Market industry size accounted for USD 1.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.56% from 2023 to 2033. The Packaging Market refers to the global industry involved in the design, production, and distribution of materials and containers used to protect, preserve, and transport goods. Packaging plays a crucial role in various industries, including food and beverages, pharmaceuticals, personal care, electronics, and industrial products.

The Packaging Market is driven by factors such as consumer demand, technological advancements, environmental regulations, and the need for innovation in packaging solutions.

Global Packaging Market Synopsis

The COVID-19 pandemic had a significant impact on the Packaging Market. With lockdowns and social distancing measures, online shopping and food delivery surged, leading to increased demand for packaging materials, especially for corrugated boxes, flexible packaging, and other shipping materials. The need for medical supplies, personal protective equipment (PPE), and pharmaceuticals rose sharply, driving demand for specialized packaging to ensure safe transport and storage of these critical items. Lockdowns and restrictions affected the production and transportation of raw materials, leading to shortages and delays in packaging production. The pandemic caused labor disruptions in manufacturing plants, which impacted production schedules and increased lead times for packaging orders. The pandemic raised awareness of environmental issues, leading to increased consumer demand for sustainable and eco-friendly packaging solutions. Companies began accelerating their efforts to develop biodegradable, recyclable, and reusable packaging. The pandemic accelerated the adoption of smart packaging solutions, including QR codes and RFID tags, to provide consumers with information about product origin, safety, and authenticity.

Packaging Market Dynamics

The major factors that have impacted the growth of Packaging Market are as follows:

Drivers:

Ø Rising E-commerce and Online Shopping

The rapid expansion of online shopping has significantly increased the demand for packaging materials, particularly for shipping and protective packaging. E-commerce platforms require durable and efficient packaging solutions to ensure products reach consumers safely and in good condition. The convenience of home delivery has made consumers more reliant on online shopping, boosting the need for packaging that is easy to handle, open, and dispose of. Innovations in smart packaging, such as QR codes, RFID tags, and temperature-sensitive materials, are driving market growth. These technologies enhance product tracking, improve safety, and provide consumers with additional information about the products they purchase. Advances in materials science are leading to the development of new packaging materials that are lighter, stronger, and more sustainable. These innovations reduce material costs and environmental impact, making them attractive to manufacturers.

Restraint:

- Perception of High Cost of Sustainable Packaging

Sustainable packaging materials, such as biodegradable plastics, recycled materials, and eco-friendly alternatives, often come with higher production costs compared to conventional materials. This can lead to higher prices for end consumers and reduced profit margins for manufacturers. Sustainable and eco-friendly materials may not be readily available or may require specialized production processes, leading to supply chain challenges and increased costs.

Opportunity:

⮚ Growing demand for Smart and Connected Packaging

The rise of smart packaging, which includes features like QR codes, NFC (Near Field Communication), RFID tags, and sensors, provides opportunities to enhance the functionality of packaging. Smart packaging can improve supply chain transparency, enhance product safety, and provide consumers with interactive experiences. Brands can use smart packaging to engage consumers directly, offering personalized experiences, product information, and promotional content through digital platforms linked to the packaging. Advances in materials science present opportunities to create innovative packaging materials that are lighter, stronger, and more sustainable. For example, companies can explore opportunities in plant-based plastics, edible packaging, and nanotechnology-enhanced materials. Innovations that enhance the barrier properties of packaging materials, such as improved moisture, oxygen, and light resistance, can extend the shelf life of perishable products and reduce food waste.

Packaging Market Segment Overview

Based on Product, the market is segmented based on Flexible Packaging and Rigid Packaging. The rigid packaging segment dominated the Packaging market. Rigid packaging refers to containers and packaging materials that possess a sturdy and inflexible structure, providing robust protection to the contents within. This type of packaging is commonly used for a wide range of products across various industries due to its durability, strength, and ability to safeguard goods during transportation and storage. Materials commonly employed in rigid packaging include plastics, metals, glass, and sometimes even wood.

By Material Type

Based on Material Type, the market segment has been divided into Glass, Metal, Paper & Paperboard and Plastics. The paper and paperboard segment dominant the market. Paper and paperboard are versatile materials widely employed in the packaging industry due to their numerous advantages, including sustainability, cost-effectiveness, and flexibility. These materials are derived from wood fibres, making them renewable and biodegradable, aligning with the growing emphasis on eco-friendly packaging solutions. Paper and paperboard primarily originate from wood pulp, obtained through the chemical or mechanical pulping of wood.

Global Packaging Market Regional Analysis

Based on region, the global Packaging Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Packaging Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Packaging Market. North America, particularly the United States and Canada, is a mature market with a strong emphasis on sustainability and innovation in packaging. The region has a high demand for packaging solutions driven by robust e-commerce growth, consumer goods, food and beverages, and pharmaceuticals. There is a strong focus on reducing plastic waste, leading to increased adoption of sustainable and eco-friendly packaging materials and companies in North America are investing heavily in developing recyclable and biodegradable packaging to meet consumer demand and regulatory requirements.

Packaging Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Packaging Market industry. Asia-Pacific is the fastest-growing region in the Packaging Market, driven by rapid industrialization, urbanization, and rising disposable incomes, particularly in China, India, and Southeast Asia. The region has a diverse market, with demand for packaging spanning across food and beverages, consumer electronics, pharmaceuticals, and personal care products and the booming e-commerce sector in Asia-Pacific is driving demand for durable and protective packaging solutions, particularly for shipping and logistics.

Competitive Landscape

The global Packaging Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Amcor

- Constantia Flexibles Group

- Cosmo Films Ltd

- Essel Propack Ltd

- Jindal Poly Films Ltd

- Oji India Packaging Pvt. Ltd

- Tetra Laval International

- TPCL Packaging Ltd

- UFlex Ltd

- Uma Group

Key Development

In October 2023, Berry Global has created a lightweight tube closure solution that blends modern style and material adaptability with greenhouse gas emission reduction. The new Slimline collection, which complements Berry’s vast range of tube closures, saves greenhouse gas emissions compared to standard caps due to a new lightweight and low-profile design.

Scope of the Report

Global Packaging Market, by Product

- Flexible Packaging

- Rigid Packaging

Global Packaging Market, by Material Type

- Glass

- Metal

- Paper & Paperboard

- Plastics

Global Packaging Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 3.25 Billion |

| CAGR (2023-2033) | 2.56% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Material Type |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Amcor, Constantia Flexibles Group, Cosmo Films Ltd, Essel Propack Ltd, Jindal Poly Films Ltd, Oji India Packaging Pvt. Ltd, Tetra Laval International, TPCL Packaging Ltd, UFlex Ltd and Uma Group. |

| Key Market Opportunities | · Smart and Connected Packaging

· Innovation in Packaging Materials |

| Key Market Drivers | · Rising E-commerce and Online Shopping

· Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Packaging Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Packaging Market historical market size for the year 2021, and forecast from 2023 to 2033

- Packaging Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Packaging Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Packaging Market?

The global Packaging Market is growing at a CAGR of 2.56% over the next 10 years

Which region has the highest growth rate in the market of Packaging Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Packaging Market?

North America holds the largest share in 2022

Who are the key players in the global Packaging Market?

Amcor, Constantia Flexibles Group, Cosmo Films Ltd, Essel Propack Ltd, Jindal Poly Films Ltd, Oji India Packaging Pvt. Ltd, Tetra Laval International, TPCL Packaging Ltd, UFlex Ltd and Uma Group are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.