OSS & BSS Market Overview

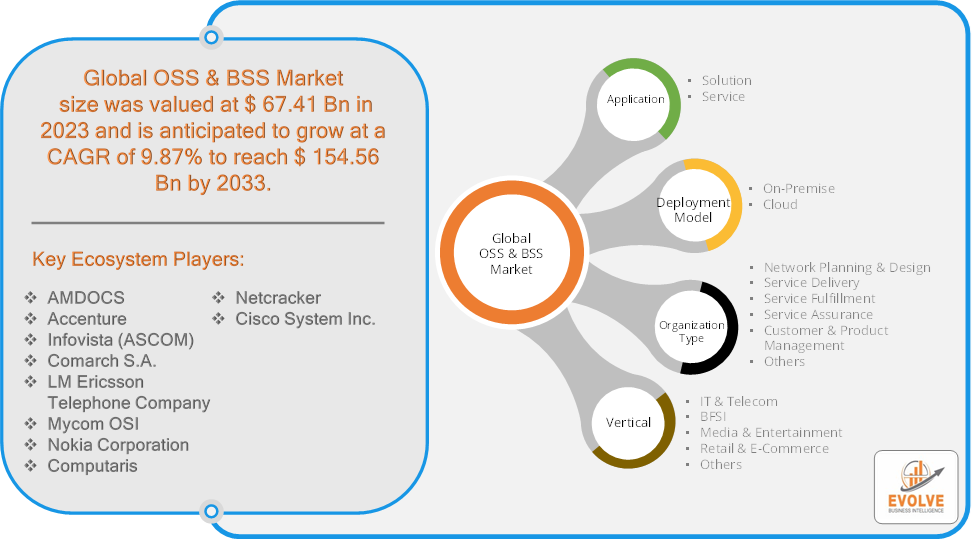

The OSS & BSS Market Size is expected to reach USD 154.56 Billion by 2033. The OSS & BSS Market industry size accounted for USD 67.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.87% from 2023 to 2033. The OSS (Operational Support Systems) and BSS (Business Support Systems) are essential components of telecommunications networks. They provide the software infrastructure needed to manage and optimize network operations and customer interactions.

This market is crucial for telecom operators as they manage both the technical and commercial aspects of their services, ensuring smooth operations and effective customer management.

Global OSS & BSS Market Synopsis

The COVID-19 pandemic significantly impacted the OSS & BSS Market. The pandemic accelerated the adoption of remote work, increasing the reliance on digital communication services. This, in turn, drove demand for robust OSS and BSS solutions to manage the surge in data traffic and ensure network reliability. The push for 5G deployment was amplified during the pandemic as operators sought to improve network capacity and speed to accommodate the growing demand for high-speed internet and digital services. This required enhanced OSS and BSS solutions to manage the complexity of 5G networks. The shift to remote working environments posed challenges for the deployment and integration of OSS and BSS systems, especially those requiring on-site installation or complex configurations. The pandemic-induced shift towards digital and remote services is expected to have a lasting impact, driving ongoing investments in OSS and BSS solutions to support these services. The pandemic highlighted the need for telecom operators to diversify their revenue streams, leading to the development of new business models that require innovative OSS and BSS capabilities to support services like IoT, cloud computing, and digital content delivery.

OSS & BSS Market Dynamics

The major factors that have impacted the growth of OSS & BSS Market are as follows:

Drivers:

Ø Adoption of 5G and Advanced Network Technologies

The deployment of 5G networks introduces more complex infrastructure, requiring advanced OSS and BSS solutions to manage, monitor, and optimize network performance. 5G enables new services like IoT, edge computing, and enhanced mobile broadband, necessitating robust OSS and BSS platforms to support service delivery, billing, and customer management. Telecom operators are increasingly adopting digital transformation strategies to improve efficiency, reduce costs, and enhance customer experiences, driving demand for modernized OSS and BSS systems.

Restraint:

- Perception of High Implementation Costs and Cybersecurity Risks

The implementation of advanced OSS and BSS solutions, especially those involving cloud-based platforms, AI, and automation, requires significant capital investment. This can be a barrier, particularly for smaller operators or those in emerging markets. Beyond the initial setup costs, maintaining and upgrading OSS and BSS systems can also be expensive, adding to the financial burden on operators. As OSS and BSS systems become more interconnected and data-driven, they are increasingly vulnerable to cyberattacks. The need to protect sensitive customer and network data adds complexity and cost to these systems, potentially deterring investment.

Opportunity:

⮚ Increasing Adoption of Cloud-Based Solutions

The growing preference for cloud-based OSS and BSS platforms offers opportunities for vendors to provide scalable, flexible, and cost-effective solutions. Cloud-native architectures enable operators to quickly deploy and update their systems, offering greater agility in responding to market changes. There is an increasing demand for SaaS-based OSS and BSS solutions, which allow operators to adopt new technologies with lower upfront costs and greater operational efficiency. The explosion of data in telecommunications, driven by 5G, IoT, and other digital services, creates an opportunity for advanced analytics and big data integration within OSS and BSS systems. These capabilities enable operators to derive actionable insights, optimize network performance, and enhance service delivery.

OSS & BSS Market Segment Overview

Based on Industry Vertical, the market is segmented based on IT & Telecom, BFSI, Media & Entertainment, Retail & E-Commerce and Others. The IT and telecom segment dominant the market. The IT and telecom sector is driven by extensive reliance on OSS & BSS solutions to manage and streamline operations effectively. Within the IT sector, businesses use OSS & BSS tools to enhance network performance, automate processes, and ensure seamless customer experiences. Moreover, OSS & BSS solutions managie billing, customer service, network provisioning, and service assurance. As a result, the market is witnessing significant contribution from the IT sector.

By Organization Type

Based on Organization Type, the market segment has been divided into Network Planning & Design, Service Delivery, Service Fulfillment, Service Assurance, Customer & Product Management and Others. The network planning and design segment dominant the market. Network design and planning are the most prevalent categories in this group. It allows providers to effectively plan and design their network infrastructure, which guarantees peak performance and scalability.

By Application

Based on Application, the market segment has been divided into Services and Solution. The solution segment dominant the market. The solution category comprises various platforms and software for business and operations support systems that provide network and customer data for back-office operations. With features including service provisioning, network setup, inventory management, order management, and fault management, these systems assist telecom service providers in managing networks and the service order experience for customers.

By Deployment Model

Based on Deployment Model, the market segment has been divided into On-premise and Cloud. The on-premises segment dominant the market. On-premises refers to the traditional model where software is installed and operated from the premises of the organization using it, rather than being hosted on cloud servers. It is primarily driven by factors such as data security concerns, regulatory compliance requirements, and the need for greater control over systems and processes.

Global OSS & BSS Market Regional Analysis

Based on region, the global OSS & BSS Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the OSS & BSS Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the OSS & BSS Market. North America holds a significant share of the OSS & BSS market, driven by early adoption of advanced technologies like 5G, IoT, and cloud computing. The region is characterized by strong innovation, with telecom operators heavily investing in digital transformation and the deployment of next-generation networks and North America’s regulatory environment is relatively supportive, with a focus on ensuring competition and consumer protection, which drives the demand for advanced OSS and BSS solutions to meet compliance requirements.

OSS & BSS Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the OSS & BSS Market industry. The Asia-Pacific region is experiencing rapid growth in telecom infrastructure, particularly in emerging markets like India, China, and Southeast Asia, leading to increased demand for OSS and BSS systems and the high rate of mobile penetration and the expansion of mobile services in rural and remote areas are driving the adoption of OSS and BSS solutions tailored to support large-scale, diverse networks.

Competitive Landscape

The global OSS & BSS Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- AMDOCS

- Accenture

- Infovista (ASCOM)

- Comarch S.A.

- LM Ericsson Telephone Company

- Mycom OSI

- Nokia Corporation

- Computaris

- Netcracker

- Cisco System Inc.

Key Development

In November 2022, Amdocs, a top supplier of software and services to media and communications industries, declared that it would assist AT&T Mexico in moving its Amdocs database and application workloads to the public cloud. As part of this strategy, Amdocs Customer Experience Suite (CES) will move from AT&T Mexico’s on-premise to the cloud. Enabling flexibility and capacity development will improve their readiness for future 5G initiatives and the busiest shopping season, ultimately improving the consumer experience.

Scope of the Report

Global OSS & BSS Market, by Industry Vertical

- IT & Telecom

- BFSI

- Media & Entertainment

- Retail & E-Commerce

Global OSS & BSS Market, by Organization Type

- Network Planning & Design

- Service Delivery

- Service Fulfillment

- Service Assurance

- Customer & Product Management

- Others

Global OSS & BSS Market, by Application

- Services

- Solution

Global OSS & BSS Market, by Deployment Model

- On-premise

- Cloud

Global OSS & BSS Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 154.56 Billion |

| CAGR (2023-2033) | 9.87% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Industry Vertical, Organization Type, Application, Deployment Model |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | AMDOCS, Accenture, Infovista (ASCOM), Comarch S.A., LM Ericsson Telephone Company, Mycom OSI, Nokia Corporation, Computaris, Netcracker and Cisco System Inc. |

| Key Market Opportunities | · Increasing Adoption of Cloud-Based Solutions

· Demand for Advanced Analytics and Big Data |

| Key Market Drivers | · Adoption of 5G and Advanced Network Technologies

· Digital Transformation Initiatives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future OSS & BSS Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- OSS & BSS Market historical market size for the year 2021, and forecast from 2023 to 2033

- OSS & BSS Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global OSS & BSS Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global OSS & BSS Market?

The global OSS & BSS Market is growing at a CAGR of 9.87% over the next 10 years

Which region has the highest growth rate in the market of OSS & BSS Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global OSS & BSS Market?

North America holds the largest share in 2022

Who are the key players in the global OSS & BSS Market?

AMDOCS, Accenture, Infovista (ASCOM), Comarch S.A., LM Ericsson Telephone Company, Mycom OSI, Nokia Corporation, Computaris, Netcracker and Cisco System Inc. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.