LNG Bunkering Market Overview

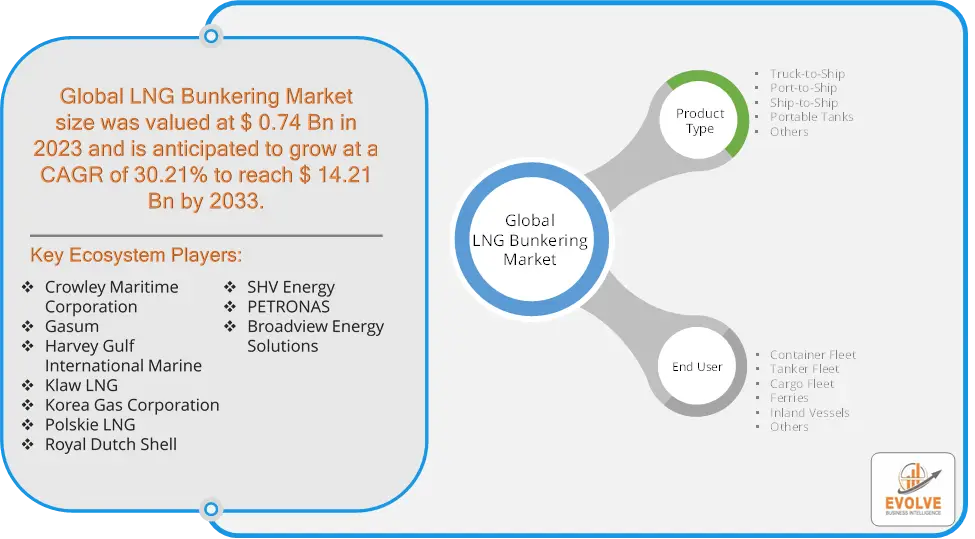

The LNG Bunkering Market Size is expected to reach USD 14.21 Billion by 2033. The LNG Bunkering Market industry size accounted for USD 0.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 30.21% from 2023 to 2033. The LNG Bunkering Market refers to the industry involved in the supply of liquefied natural gas (LNG) as a fuel for ships. LNG is considered a cleaner alternative to traditional marine fuels, such as heavy fuel oil, because it produces lower emissions of sulfur oxides (SOx), nitrogen oxides (NOx), and carbon dioxide (CO2).

The LNG Bunkering Market is positioned for growth as the shipping industry seeks to meet stricter environmental standards and reduce its carbon footprint. the LNG bunkering market is seen as a key driver in the transition towards cleaner and more sustainable maritime transportation.

Global LNG Bunkering Market Synopsis

The COVID-19 pandemic had a significant impact on the LNG Bunkering Market. The pandemic led to a global economic slowdown, which resulted in decreased shipping activity. This reduction in maritime trade affected the demand for LNG as a marine fuel. Many LNG bunkering infrastructure projects faced delays due to disruptions in supply chains, labor shortages, and restrictions on movement, impacting the growth of the market. Restrictions and lockdowns led to operational challenges in transporting and supplying LNG, affecting the consistency and reliability of LNG bunkering services. LNG production facilities also faced disruptions due to workforce limitations and safety protocols, influencing the availability of LNG for bunkering. The pandemic contributed to fluctuations in LNG prices, affecting the cost competitiveness of LNG compared to other marine fuels. This volatility made it challenging for shipping companies to plan long-term fuel strategies. Despite the challenges, the pandemic highlighted the importance of sustainability and the need to reduce emissions in the maritime sector. This continued focus on environmental goals-maintained interest in LNG as a cleaner fuel option.

LNG Bunkering Market Dynamics

The major factors that have impacted the growth of LNG Bunkering Market are as follows:

Drivers:

Growth of LNG-Powered Vessels

The increasing number of LNG-powered vessels in the global fleet drives the demand for LNG bunkering services. Shipowners are investing in LNG-capable ships to meet regulatory requirements and enhance sustainability. Improvements in LNG propulsion technology and ship designs make LNG an attractive option for new shipbuilding projects. As part of global energy transition efforts, many countries and companies are prioritizing the reduction of carbon emissions, making LNG an attractive intermediate solution. Supportive policies and incentives from governments to promote the use of LNG in shipping further drive market growth.

Restraint:

- Perception of High Initial Investment Costs and Price Volatility

Building LNG bunkering facilities and infrastructure, such as storage tanks, pipelines, and specialized vessels, requires significant capital investment. This can be a barrier for ports and companies considering LNG bunkering. The cost of LNG engines and retrofitting existing vessels to use LNG can be prohibitively high for some shipowners. The price of LNG can be volatile, influenced by global supply and demand dynamics, geopolitical factors, and competition from other energy sources. This volatility can affect the cost-competitiveness of LNG compared to traditional marine fuels.

Opportunity:

⮚ Expansion of LNG Bunkering Infrastructure

There is significant potential for developing new LNG bunkering facilities and infrastructure in emerging and underserved regions, including key maritime hubs and ports. Existing bunkering facilities can be upgraded or expanded to accommodate increasing demand for LNG as a marine fuel, improving service availability and efficiency. The increasing order of LNG-powered ships, including container ships, tankers, and cruise liners, drives demand for LNG bunkering services. Opportunities exist in retrofitting existing vessels to operate on LNG, providing a pathway for older ships to comply with new environmental regulations. Advances in LNG storage, handling, and propulsion technologies can enhance the efficiency and safety of LNG bunkering operations, creating opportunities for technology providers.

LNG Bunkering Market Segment Overview

By Product Type

By Application

Based on Application, the market segment has been divided into Container Fleet, Tanker Fleet, Cargo Fleet, Ferries, Inland Vessels and Others. the Tankers segment dominant the market. The tankers category is the fastest growing in the market. Depending on tanker capacity, there are several tanker fleets such as small tankers, intermediate tankers, medium-range 1 (MR1), medium-range 2 (MR2), large range 1 (LR1), large range 2 (LR2), very large crude carriers (VLCC), and ultra-large crude carriers (ULCC). Bulk quantities of gases and liquids are stored or transported using tanker fleets. They are used to store and transport substances including vegetable oil, freshwater, wine, molasses, and chemicals as well as other goods.

Global LNG Bunkering Market Regional Analysis

Based on region, the global LNG Bunkering Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the LNG Bunkering Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the LNG Bunkering Market. The United States and Canada are the primary markets in North America. The U.S. has several key ports, including Houston and Los Angeles, that are investing in LNG bunkering infrastructure. Canada is also exploring LNG bunkering opportunities, particularly in the Pacific Northwest. Expansion of LNG bunkering services in major U.S. and Canadian ports, along with potential growth in LNG-powered vessels, presents opportunities for market players.

LNG Bunkering Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the LNG Bunkering Market industry. The region is a major maritime hub with significant shipping activity, driving demand for LNG bunkering. Ports like Singapore and Shanghai are expanding their LNG bunkering infrastructure to accommodate the growing fleet of LNG-powered vessels. There is potential for further infrastructure development, including new LNG bunkering terminals and facilities in emerging markets such as India and Southeast Asia. China, Japan, South Korea, and Singapore are key players in the Asia-Pacific LNG bunkering market.

Competitive Landscape

The global LNG Bunkering Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Crowley Maritime Corporation

- Gasum

- Harvey Gulf International Marine

- Klaw LNG

- Korea Gas Corporation

- Polskie LNG

- Royal Dutch Shell

- SHV Energy

- PETRONAS

- Broadview Energy Solutions

Key Development

In February 2023, A new agreement about cooperation in the delivery of liquefied natural gas (LNG) to Rosmorport’s new boats has been signed between FSUE Rosmorport and Gazpromneft Marine Bunker PJSC (operator of Gazprom Neft’s marine bunkering business). According to the deal, Rosmorport’s ferries operating on the Ust-Luga-Kaliningrad line will continue to receive environmentally friendly fuel from Gazpromneft Marine Bunker. According to Rosmorport, Gazpromneft Marine Bunker would provide 10,000 tonnes of fuel for more than 15 bunkering operations in 2023

Scope of the Report

Global LNG Bunkering Market, by Product Type

- Truck-to-Ship

- Port-to-Ship

- Ship-to-Ship

- Portable Tanks

- Others

Global LNG Bunkering Market, by Application

- Container Fleet

- Tanker Fleet

- Cargo Fleet

- Ferries

- Inland Vessels

- Others

Global LNG Bunkering Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $14.21 Billion |

| CAGR | 30.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Crowley Maritime Corporation, Gasum, Harvey Gulf International Marine, Klaw LNG, Korea Gas Corporation, Polskie LNG, Royal Dutch Shell, SHV Energy, PETRONAS and Broadview Energy Solutions |

| Key Market Opportunities | • Expansion of LNG Bunkering Infrastructure • Growing Fleet of LNG-Powered Vessels |

| Key Market Drivers | • Growth of LNG-Powered Vessels • Energy Transition Initiatives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future LNG Bunkering Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- LNG Bunkering Market historical market size for the year 2021, and forecast from 2023 to 2033

- LNG Bunkering Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global LNG Bunkering Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global LNG Bunkering Market?

- The global LNG Bunkering Market is growing at a CAGR of 30.21% over the next 10 years

Which region has the highest growth rate in the market of LNG Bunkering Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global LNG Bunkering Market?

- North America holds the largest share in 2022

Who are the key players in the global LNG Bunkering Market?

Crowley Maritime Corporation, Gasum, Harvey Gulf International Marine, Klaw LNG, Korea Gas Corporation, Polskie LNG, Royal Dutch Shell, SHV Energy, PETRONAS and Broadview Energy Solutions are the major companies operating in the market

Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives