IoT Insurance Market Overview

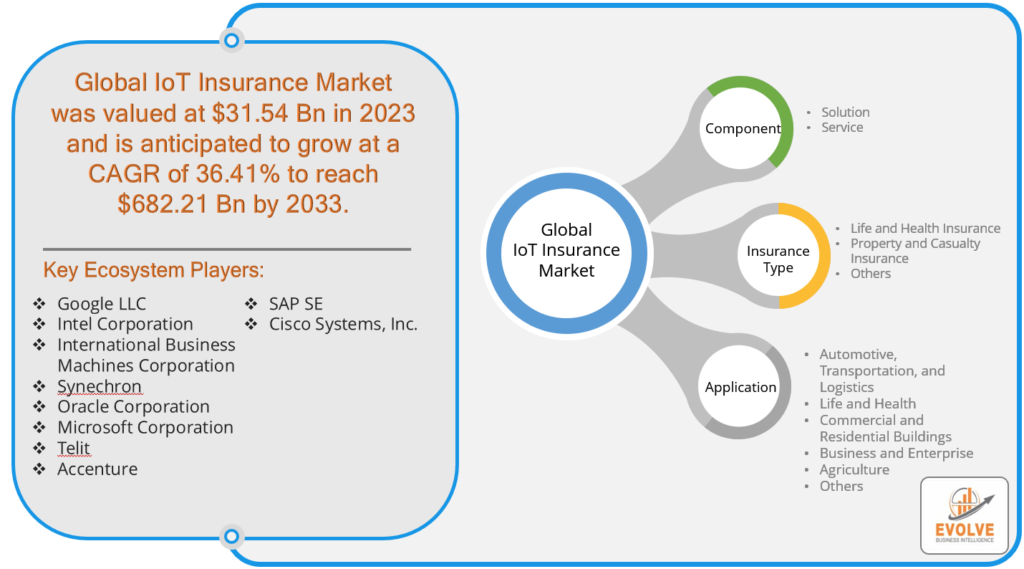

The IoT Insurance Market Size is expected to reach USD 682.21 Billion by 2033. The IoT Insurance industry size accounted for USD 31.54 Billion in 2023 and is expected to expand at a CAGR of 36.41% from 2023 to 2033. IoT insurance, or Internet of Things insurance, refers to a type of insurance that incorporates data from interconnected devices to assess, manage, and mitigate risks associated with insured assets or individuals. In this context, IoT devices, such as sensors, actuators, and other smart devices, collect and transmit real-time data to insurance companies. This data is utilized to make more informed underwriting decisions, tailor insurance policies to individual behaviors or usage patterns, and even prevent potential risks through proactive measures. For example, in the automotive sector, telematics devices may be used to monitor driving behavior, influencing premium rates based on actual usage and risk factors. The integration of IoT technologies in insurance aims to improve accuracy in risk assessment, enhance customer engagement, and optimize claims processes by leveraging the insights derived from continuous monitoring of relevant data sources.

Global IoT Insurance Market Synopsis

The IoT insurance market experienced a moderate impact during the COVID-19 pandemic. The global crisis led to a reassessment of risk models and business strategies within the insurance industry, affecting the pace of IoT adoption. While some challenges arose due to economic uncertainties and disruptions, the pandemic also highlighted the value of IoT in adapting to changing circumstances. Insurers recognized the importance of real-time data for remote monitoring, personalized coverage, and efficient claims processing, which accelerated the integration of IoT technologies. The shift towards digital transformation gained momentum as insurers sought innovative solutions to address emerging challenges. Overall, the IoT insurance market demonstrated resilience during the pandemic, with a trajectory that reflected a balance between challenges and opportunities in adapting to the new normal.

Global IoT Insurance Market Dynamics

The major factors that have impacted the growth of IoT Insurance are as follows:

Drivers:

⮚ Increased Demand for Personalized Insurance Solutions

The IoT insurance market is driven by the growing demand for personalized insurance solutions. The integration of IoT devices allows insurers to gather real-time data on individual behaviors and risks, enabling the customization of insurance policies based on specific usage patterns. This personalization not only meets the evolving preferences of policyholders but also enhances risk assessment accuracy, leading to more precise underwriting and pricing strategies.

Restraint:

- Data Security and Privacy Concerns

The IoT insurance market is the heightened concern around data security and privacy. As the use of IoT devices involves the constant collection and transmission of sensitive personal information, there is an increased risk of data breaches and unauthorized access. Addressing these concerns and ensuring robust cybersecurity measures are in place becomes crucial for the widespread adoption of IoT in insurance, as any compromise in data security could erode trust among policyholders and lead to regulatory challenges.

Opportunity:

⮚ Accelerated Digital Transformation Post-COVID-19

The COVID-19 pandemic has acted as a catalyst for digital transformation across industries, presenting an opportunity for the IoT insurance market. Insurers are increasingly recognizing the need for resilient and agile solutions, and the integration of IoT technologies provides a pathway for streamlining processes, offering remote monitoring capabilities, and enhancing customer experiences. The post-pandemic landscape offers an opportune moment for insurers to leverage IoT to drive innovation, improve operational efficiency, and stay competitive in an evolving market.

IoT Insurance Market Segment Overview

By Component

By Insurance Type

Based on the Insurance Type, the market has been divided into Life and Health Insurance, Property and Casualty Insurance, and Others. The Life and Health Insurance segment is expected to dominate the IoT insurance market, primarily driven by the growing demand for real-time health monitoring through wearable devices and IoT-enabled solutions, leading to improved risk assessment, personalized coverage, and enhanced overall wellness management for policyholders. The integration of IoT technologies in life and health insurance underscores a shift towards preventive healthcare and data-driven insights.

By Application

Based on Application, the market has been divided into Automotive, Transportation, and Logistics, Life and Health, Commercial and Residential Buildings, Business and Enterprise, Agriculture, and Others. The Automotive segment is positioned to capture the largest market share in the IoT insurance market, fueled by the widespread adoption of telematics devices and connected car technologies. This trend is driven by insurers leveraging real-time data from IoT devices to assess driving behavior, enhance risk modeling, and offer personalized auto insurance, thereby optimizing premium pricing and improving overall road safety.

Global IoT Insurance Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of IoT Insurance, followed by those in Asia-Pacific and Europe.

North America asserts dominance in the IoT insurance market as a technological hub, with the region exhibiting a robust ecosystem for innovation and early adoption of advanced technologies. The presence of numerous key players, coupled with a tech-savvy consumer base, has accelerated the integration of IoT devices in insurance practices. The region’s well-established insurance industry is actively leveraging IoT for personalized risk assessments, real-time monitoring, and efficient claims processing. Additionally, a favorable regulatory environment and a high level of awareness among both insurers and policyholders contribute to North America’s leadership in driving the growth of the IoT insurance market. The continuous investments in research and development, coupled with a strong focus on enhancing customer experiences, position North America at the forefront of shaping the future of IoT in the insurance sector.

IoT Insurance Asia Pacific Market

The Asia-Pacific region has witnessed remarkable growth in the IoT insurance market, fueled by rapid technological advancements, increasing connectivity, and a burgeoning awareness of the benefits of IoT in the insurance sector. Governments and businesses across the region are actively investing in digital transformation, creating an environment conducive to the integration of IoT devices for risk assessment, personalized coverage, and improved operational efficiency. The diverse and dynamic insurance landscape in countries like China, India, and Japan is adapting to the transformative impact of IoT technologies, with insurers embracing innovative solutions to meet evolving customer needs. The proliferation of smartphones, rising disposable incomes, and a growing middle class further contribute to the expansion of IoT insurance offerings, positioning the Asia-Pacific region as a key player in shaping the future of the global IoT insurance market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Oracle Corporation, Microsoft Corporation, Telit, Accenture, and SAP are some of the leading players in the global IoT Insurance Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Google LLC

- Intel Corporation

- International Business Machines Corporation

- Synechron

- Oracle Corporation

- Microsoft Corporation

- Telit

- Accenture

- SAP SE

- Cisco Systems, Inc.

Key development:

In November 2022, IBM Corporation disclosed a collaboration with Ablera and Bulgaria to advance ABACUS, an AI-powered solution for insurance companies, enhancing pricing and rating processes. This partnership aims to elevate the speed and precision of these operations, reducing error-prone manual efforts and enabling a broader user base to engage with sophisticated mathematical applications.

In August 2022, Telit, a global IoT leader, revealed the acquisition of group assets from Mobilogix. This strategic move expands Telit’s capabilities with comprehensive device engineering expertise, focusing on optimizing specifications for a seamless transition to electronic manufacturing services. The acquired resources also contribute to original device manufacturing, regulatory approvals, and obtaining carrier certifications, strengthening Telit’s position in the IoT domain.

Scope of the Report

Global IoT Insurance Market, by Component

- Solution

- Services

Global IoT Insurance Market, by Insurance Type

- Life and Health Insurance

- Property and Casualty Insurance

- Others

Global IoT Insurance Market, by Application

- Automotive, Transportation, and Logistics

- Life and Health

- Commercial and Residential Buildings

- Business and Enterprise

- Agriculture

- Others

Global IoT Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $682.21 Billion |

| CAGR | 36.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Insurance Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Google LLC, Intel Corporation, International Business Machines Corporation, Synechron, Oracle Corporation, Microsoft Corporation, Telit, Accenture, SAP SE, Cisco Systems, Inc. |

| Key Market Opportunities | • Improved Risk Management and Prevention |

| Key Market Drivers | • Increased Connectivity and Adoption of IoT Devices |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future IoT Insurance Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- IoT Insurance market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global IoT Insurance market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global IoT Insurance Market.

Frequently Asked Questions (FAQ)

What is the growth rate of the IoT Insurance Market?

The IoT Insurance market is expected to expand at a remarkable compound annual growth rate (CAGR) of 36.41% from 2023 to 2033.

Which region has the highest growth rate in the IoT Insurance Market?

The Asia-Pacific region is anticipated to experience the highest growth rate in the IoT Insurance market, driven by rapid technological advancements and increasing connectivity.

Which region has the largest share of the IoT Insurance Market?

Currently, North America holds the largest share in the IoT Insurance market, benefiting from its robust ecosystem for innovation and early adoption of advanced technologies.

Who are the key players in the IoT Insurance Market?

Key players in the IoT Insurance market include Google LLC, Intel Corporation, International Business Machines Corporation (IBM), Synechron, Oracle Corporation, Microsoft Corporation, Telit, Accenture, SAP SE, and Cisco Systems, Inc., among others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.