Interventional Cardiology Devices Market Overview

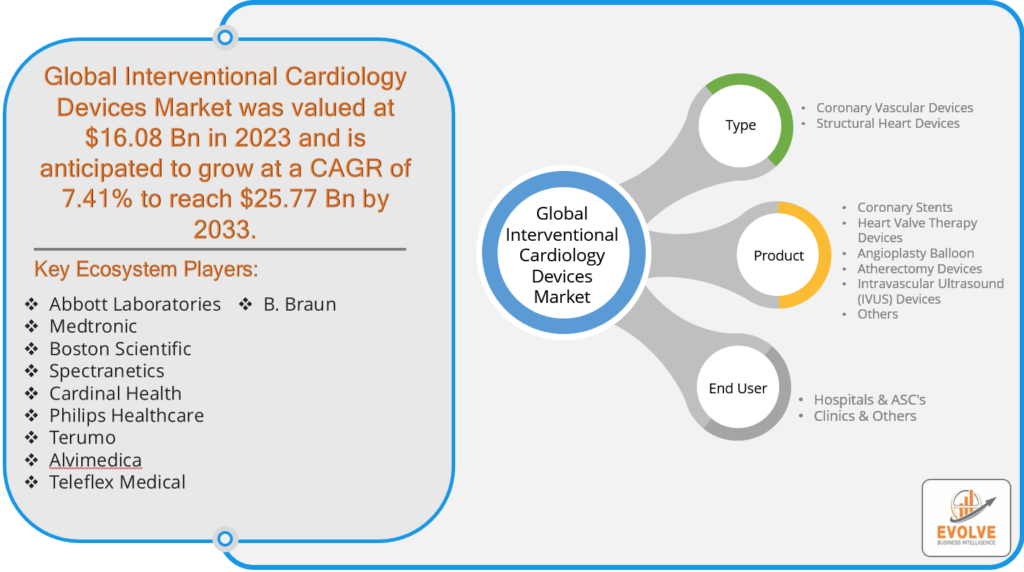

The Interventional Cardiology Devices Market Size is expected to reach USD 25.77 Billion by 2033. The Interventional Cardiology Devices industry size accounted for USD 16.08 Billion in 2023 and is expected to expand at a CAGR of 7.41% from 2023 to 2033. Interventional cardiology devices are specialized medical instruments and equipment designed for diagnosing and treating cardiovascular conditions using minimally invasive procedures. These devices are used by interventional cardiologists to access and navigate the cardiovascular system through small incisions or catheters, avoiding the need for traditional open surgery. Common interventional cardiology devices include stents, balloons, catheters, guidewires, and imaging technologies like angiography systems, all of which play a crucial role in procedures such as angioplasty, stent placement, and the treatment of coronary artery disease and other heart-related conditions, ultimately improving patient outcomes and reducing recovery times.

Global Interventional Cardiology Devices Market Synopsis

The Interventional Cardiology Devices market experienced a dual effect from the COVID-19 pandemic. Initially, there was a significant disruption as elective procedures were postponed or canceled to prioritize COVID-19 patients and reduce the risk of virus transmission in healthcare settings. This led to a temporary decline in the demand for interventional cardiology devices. However, as the pandemic progressed, there was a growing recognition of the importance of managing cardiovascular conditions, as COVID-19 was found to exacerbate heart issues. This realization, coupled with the backlog of postponed procedures, ultimately drove a rebound in the market. Moreover, the pandemic accelerated the adoption of telemedicine and remote monitoring solutions, further emphasizing the need for innovative interventional cardiology technologies to support remote patient care and diagnostics.

Global Interventional Cardiology Devices Market Dynamics

The major factors that have impacted the growth of Interventional Cardiology Devices are as follows:

Drivers:

⮚ Technological Advancements and Innovation

The interventional Cardiology Devices market is ongoing technological advancements and innovation in the field. The development of new and more effective devices, such as advanced stents, catheters, and imaging technologies, has significantly improved the outcomes of interventional cardiology procedures. These innovations enable cardiologists to perform procedures with greater precision and lower risk, leading to improved patient outcomes and shorter recovery times.

Restraint:

- High Cost of Interventional Procedures

A significant restraint in the Interventional Cardiology Devices market is the high cost associated with interventional procedures. These procedures often require expensive devices and equipment, and the overall cost can be a burden on healthcare systems and patients. Additionally, in some regions with limited access to healthcare and insurance coverage, the cost can be a barrier to patients seeking interventional cardiology treatments. Reducing the cost of these procedures and increasing accessibility is a challenge for market growth.

Opportunity:

⮚ Aging Population and Increasing Disease Burden

An opportunity in the Interventional Cardiology Devices market is the aging population and the associated increase in the burden of cardiovascular diseases. As the global population continues to age, there is a higher prevalence of cardiovascular conditions, such as coronary artery disease and heart failure. This demographic shift creates a growing patient pool in need of interventional cardiology procedures, presenting an opportunity for market expansion. Healthcare providers and device manufacturers can capitalize on this trend by offering innovative solutions and expanding their reach to meet the rising demand for cardiovascular care.

Interventional Cardiology Devices Market Segment Overview

By Type

By Product

Based on the Product, the market has been divided into Coronary Stents, Heart Valve Therapy Devices, Angioplasty Balloon, Atherectomy Devices, Intravascular Ultrasound (IVUS) Devices, and Others. The Coronary Stents segment is expected to hold the largest market share in the Interventional Cardiology Devices market due to the essential role stents play in treating coronary artery disease and maintaining vessel patency.

By End User

Based on End Users, the market has been divided into Hospitals & ASCs, Clinics and others. The Hospitals & ASC (Ambulatory Surgical Centers) segment is expected to hold the largest market share in the Interventional Cardiology Devices market due to its role as the primary setting for interventional cardiology procedures and patient care.

Global Interventional Cardiology Devices Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Interventional Cardiology devices, followed by those in Asia-Pacific and Europe.

North America asserts dominance in the Interventional Cardiology Devices market due to several key factors. The region boasts a robust healthcare infrastructure with advanced medical facilities and a high level of healthcare expenditure. Moreover, the prevalence of cardiovascular diseases, including coronary artery disease, remains high, primarily due to lifestyle factors such as diet and sedentary behavior, making the demand for interventional cardiology devices substantial. Additionally, the aging population in the United States and Canada is at an elevated risk of heart-related conditions, further driving the market. The presence of leading medical device manufacturers and ongoing investments in research and development contribute to technological advancements, positioning North America as a global leader in the interventional cardiology sector. Access to health insurance coverage ensures that a significant portion of the population can avail of these life-saving procedures, solidifying North America’s dominance in the market.

Asia Pacific Market

The Asia-Pacific region has been experiencing remarkable growth in the Interventional Cardiology Devices market due to a combination of factors. First, the region’s rapidly growing middle-class population, particularly in countries like China and India, has increased healthcare spending and access to advanced medical treatments, including interventional cardiology procedures. Second, the rising urbanization has led to lifestyle changes, contributing to a higher prevalence of cardiovascular diseases. Third, many Asian governments are actively investing in healthcare infrastructure development and promoting awareness campaigns about heart health, further driving the demand for interventional cardiology devices. Additionally, the adoption of innovative technologies and the expansion of healthcare services into rural areas have played a pivotal role in sustaining this growth, making the Asia-Pacific region a pivotal player in the global interventional cardiology market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Abbott Laboratories, Medtronic, Boston Scientific, Spectranetics, and Cardinal Health are some of the leading players in the global Interventional Cardiology Devices Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Abbott Laboratories

- Medtronic

- Boston Scientific

- Spectranetics

- Cardinal Health

- Philips Healthcare

- Terumo

- Alvimedica

- Teleflex Medical

- Braun

Key development:

In February 2023, IS Medical AG introduced the OPN NC percutaneous transluminal coronary angioplasty (PTCA) dilatation catheter featuring Twin-Wall technology. This unique design of the OPN NC device offers exceptional resistance to high pressure, boasting a rated burst pressure of 35 atm while maintaining low compliance.

Scope of the Report

Global Interventional Cardiology Devices Market, by Type

- Coronary Vascular Devices

- Structural Heart Devices

Global Interventional Cardiology Devices Market, by Product

- Coronary Stents

- Heart Valve Therapy Devices

- Angioplasty Balloon

- Atherectomy Devices

- Intravascular Ultrasound (IVUS) Devices

- Others

Global Interventional Cardiology Devices Market, by End User

- Hospitals & ASC’s

- Clinics & Others

Global Interventional Cardiology Devices Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $25.77 Billion |

| CAGR | 7.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Product, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Abbott Laboratories, Medtronic, Boston Scientific, Spectranetics, Cardinal Health, Philips Healthcare, Terumo, Alvimedica, Teleflex Medical, B. Braun |

| Key Market Opportunities | • Expanding patient pool due to the global burden of cardiovascular diseases. • Adoption of interventional cardiology in developing countries. • Emphasis on preventive cardiology and early intervention programs. |

| Key Market Drivers | • The aging population leads to higher cardiovascular disease prevalence. • Technological advancements and innovations in interventional cardiology devices. • Increasing awareness of minimally invasive procedures. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Interventional Cardiology Devices Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Interventional Cardiology Devices market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Interventional Cardiology Devices market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Interventional Cardiology Devices Market.

Frequently Asked Questions (FAQ)

What is the 10-year CAGR (2023 to 2033) of the global Interventional Cardiology Devices market?

The global Interventional Cardiology Devices market is growing at a CAGR of ~41% over the next 10 years

Which region has the highest growth rate in the market of Interventional Cardiology Devices?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Interventional Cardiology Devices?

North America holds the largest share in 2022

Major Key Players in the Market of Interventional Cardiology Devices Manufacturers?

Abbott Laboratories, Medtronic, Boston Scientific, Spectranetics, Cardinal Health, Philips Healthcare, Terumo, Alvimedica, Teleflex Medical, B. Braun.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.