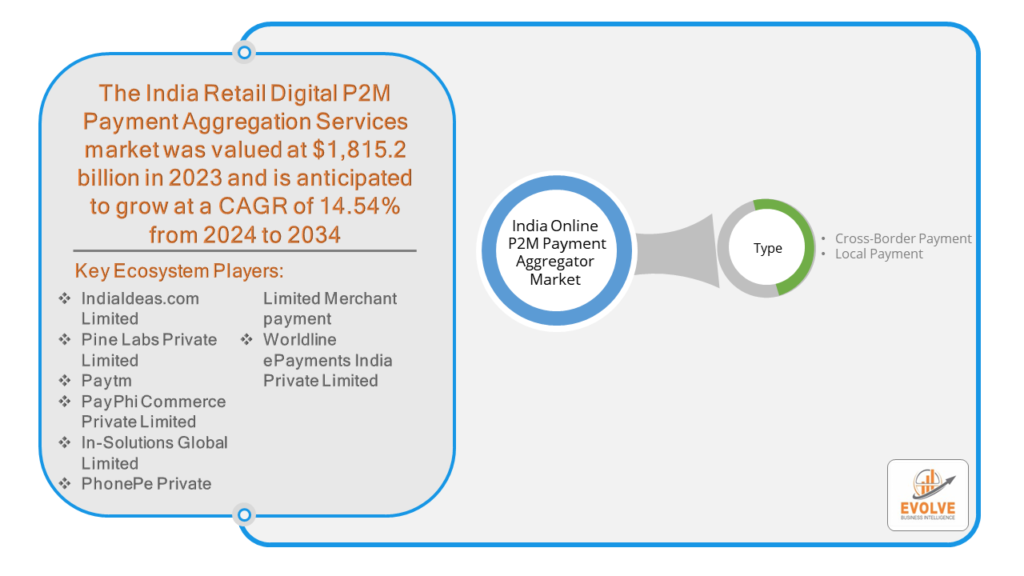

India Online P2M Payment Aggregator Market Overview

The India Retail Digital P2M Payment Aggregation Services market was valued at $1,815.2 billion in 2023 and is anticipated to grow at a CAGR of 14.54% from 2024 to 2034. The India Online P2M (Person-to-Merchant) Payment Aggregator Market refers to the ecosystem in which various digital payment services facilitate transactions between individuals (consumers) and merchants (businesses) in India. These payment aggregators act as intermediaries, enabling merchants to accept payments from customers through multiple payment methods such as credit/debit cards, digital wallets, UPI (Unified Payments Interface), and net banking.

The market is characterized by rapid innovation and adoption of new technologies to enhance the payment experience, improve security, and expand the range of services offered to both consumers and merchants.

Global India Online P2M Payment Aggregator Market Synopsis

The COVID-19 pandemic had a significant impact on the India Online P2M Payment Aggregator Market. With lockdowns and social distancing measures in place, consumers and businesses turned to online transactions more than ever. This led to a surge in the use of digital payment methods, including UPI, digital wallets, and online banking. The pandemic caused a dramatic increase in e-commerce activities as people preferred shopping online to avoid physical stores. This, in turn, boosted the demand for payment aggregation services to facilitate online transactions. UPI saw exponential growth during the pandemic. The convenience and security of UPI payments made it a preferred method for both small and large transactions, further driving the P2M payment aggregator market. Businesses that were slow to adopt digital payment solutions faced difficulties, while those that integrated digital payment options saw improved resilience and continued operations during lockdowns.

India Online P2M Payment Aggregator Market Dynamics

The major factors that have impacted the growth of India Online P2M Payment Aggregator Market are as follows:

Drivers:

Ø Increasing Smartphone Penetration

The widespread use of smartphones has made it easier for consumers to access digital payment solutions. Mobile payment apps and wallets have become increasingly popular, contributing to the growth of the P2M payment market. The rapid expansion of e-commerce platforms has increased the demand for secure and efficient payment solutions. Payment aggregators play a crucial role in facilitating transactions between consumers and online merchants. Innovations in payment technology, such as QR code payments, biometric authentication, and AI-driven fraud detection, have enhanced the security and convenience of digital transactions, encouraging more consumers and merchants to adopt these methods.

Restraint:

- Perception of Security Concerns and Digital Divide

The rise in digital transactions has also led to an increase in cyber frauds and data breaches. Concerns about the security of online payments can deter consumers and merchants from fully embracing digital payment solutions. Despite significant progress, there remains a considerable digital divide in India. Many rural and remote areas still lack reliable internet connectivity and digital literacy, limiting the reach of online payment services. The market is highly competitive with numerous players offering similar services. This intense competition can lead to thin profit margins and can make it difficult for new entrants to gain a foothold.

Opportunity:

⮚ Expansion into Rural Markets

There is a significant untapped market in rural areas where digital payment penetration is still low. By focusing on improving digital literacy and infrastructure, payment aggregators can capture this vast market. Advances in technology, such as AI and machine learning, can be leveraged to enhance fraud detection, personalize user experiences, and streamline payment processes. Blockchain technology also holds potential for improving transaction security and transparency. Payment aggregators can expand their offerings to include value-added services such as loans, insurance, investment products, and loyalty programs. Providing a comprehensive financial ecosystem can increase customer engagement and retention.

India Online P2M Payment Aggregator Market Segment Overview

By Type

Competitive Landscape

The India Online P2M Payment Aggregator Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- com Limited

- Pine Labs Private Limited

- Paytm

- PayPhi Commerce Private Limited

- In-Solutions Global Limited

- PhonePe Private Limited Merchant payment

- Worldline ePayments India Private Limited

Scope of the Report

India Online P2M Payment Aggregator Market, by Type

- Cross-Border Payment

- Local Payment

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8272.5 Billion |

| CAGR | 14.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | IndiaIdeas.com Limited, Pine Labs Private Limited, Paytm, PayPhi Commerce Private Limited, In-Solutions Global Limited, PhonePe Private Limited Merchant payment and Worldline ePayments India Private Limited |

| Key Market Opportunities | • Expansion into Rural Markets • Diversification of Services |

| Key Market Drivers | • Increasing Smartphone Penetration • Growth of E-commerce |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future India Online P2M Payment Aggregator Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- India Online P2M Payment Aggregator Market historical market size for the year 2021, and forecast from 2023 to 2034

- India Online P2M Payment Aggregator Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global India Online P2M Payment Aggregator Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the forecasted growth rate for the India Online P2M Payment Aggregator Market?

The market is anticipated to grow at a CAGR of 14.54% from 2024 to 2034

How did COVID-19 impact the India Online P2M Payment Aggregator Market?

The pandemic significantly boosted the market as consumers and businesses increased their use of digital payment methods

What are the main drivers of growth in the India Online P2M Payment Aggregator Market?

Key drivers include increasing smartphone penetration and the growth of e-commerce

What opportunities exist for expansion in the India Online P2M Payment Aggregator Market?

There are significant opportunities for expansion into rural markets and the diversification of services offered