Blood Product Market Overview

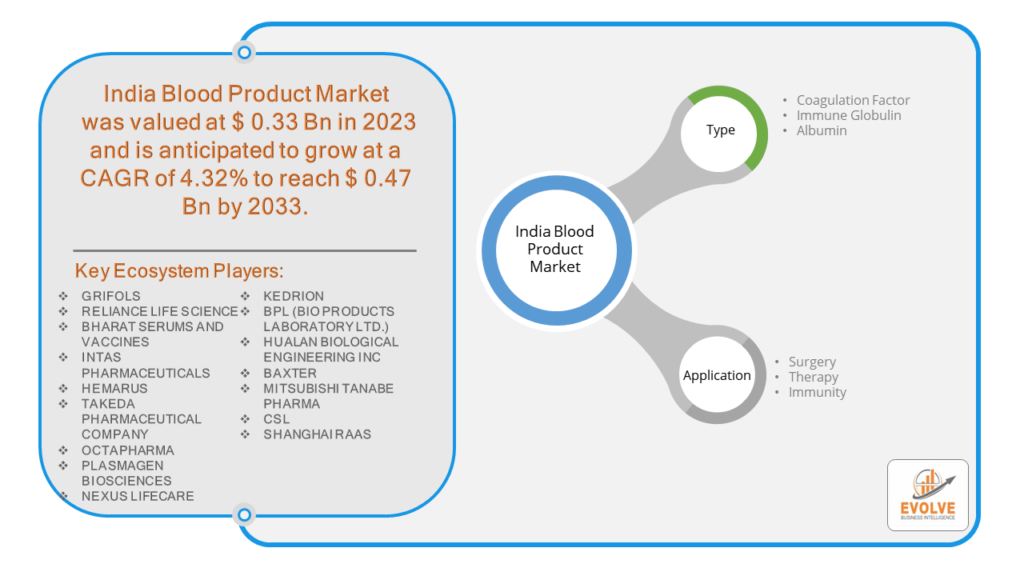

The Blood Product Market Size is expected to reach USD 0.47 Billion by 2033. The Blood Product Market industry size accounted for USD 0.33 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.32% from 2023 to 2033. A blood product is a medical substance derived from human blood that is used for therapeutic purposes. These include whole blood, blood components such as red blood cells, white blood cells, platelets, and plasma, as well as plasma-derived products like clotting factors and immunoglobulins. Blood products are essential in treating various medical conditions, including anemia, clotting disorders, immune deficiencies, and are crucial in surgical and trauma care. They are carefully collected, processed, and tested to ensure safety and compatibility for transfusions and other medical uses.

India Blood Product Market Synopsis

The COVID-19 pandemic has significantly impacted the Blood Product market, causing widespread disruptions in blood donations due to lockdowns and social distancing measures, leading to critical shortages. The increased need for treatments such as convalescent plasma for COVID-19 patients further strained supplies. Healthcare systems faced challenges in maintaining safe donation practices and managing inventory amidst fluctuating demand. Additionally, the postponement of elective surgeries initially reduced demand, but subsequent rescheduling created surges, complicating supply chain logistics and inventory management.

Blood Product Market Dynamics

The major factors that have impacted the growth of Blood Product Market are as follows:

Drivers:

Ø Growing Healthcare Infrastructure and Awareness

The expansion of healthcare facilities and increased public awareness about the importance of blood donation and the benefits of blood products are major drivers in the Indian Blood Product market. Government initiatives and non-profit organizations have been instrumental in promoting regular blood donation campaigns, which have improved the availability of blood products for medical use.

Restraint:

- Lack of Standardized Blood Collection and Storage Facilities

the Indian Blood Product market is the inconsistent quality and capacity of blood collection and storage facilities across different regions. Many rural and underdeveloped areas lack adequate infrastructure, leading to potential shortages and inefficiencies in blood product distribution and safety.

Opportunity:

⮚ Technological Advancements and Innovations

There is a significant opportunity in the Indian Blood Product market with the adoption of advanced technologies for blood screening, collection, and storage. Innovations such as automated blood collection devices, enhanced blood testing methods, and improved storage solutions can increase the efficiency and safety of blood products, expanding their availability and reliability for medical use.

Blood Product Market Segment Overview

By Type

By Application

Based on Application, the market segment has been divided into the Surgery, Therapy, Immunity. Surgeries dominate the Blood Product market due to the high demand for blood components to manage blood loss and ensure patient stability during and after surgical procedures. The increasing number of complex and elective surgeries further drives the need for a reliable supply of various blood products.

Competitive Landscape

The India Blood Product Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- GRIFOLS

- RELIANCE LIFE SCIENCE

- BHARAT SERUMS AND VACCINES

- INTAS PHARMACEUTICALS

- HEMARUS

- TAKEDA PHARMACEUTICAL COMPANY

- OCTAPHARMA

- PLASMAGEN BIOSCIENCES

- NEXUS LIFECARE

- KEDRION

- BPL (BIO PRODUCTS LABORATORY LTD.)

- HUALAN BIOLOGICAL ENGINEERING INC

- BAXTER

- MITSUBISHI TANABE PHARMA

- CSL

- SHANGHAI RAAS

Scope of the Report

India Blood Product Market, by Type

- Coagulation Factor

- Immune Globulin

- Albumin

India Blood Product Market, by Application

- Surgery

- Therapy

- Immunity

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.47 Billion |

| CAGR | 4.32% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | GRIFOLS, RELIANCE LIFE SCIENCE, BHARAT SERUMS AND VACCINES, INTAS PHARMACEUTICALS, HEMARUS, TAKEDA PHARMACEUTICAL COMPANY, OCTAPHARMA, PLASMAGEN BIOSCIENCES, NEXUS LIFECARE, KEDRION, BPL (BIO PRODUCTS LABORATORY LTD.), HUALAN BIOLOGICAL ENGINEERING INC, BAXTER, MITSUBISHI TANABE PHARMA, CSL, SHANGHAI RAAS |

| Key Market Opportunities | • Technological advancements in blood screening, collection, and storage. • Adoption of automated blood collection devices. • Enhanced blood testing methods |

| Key Market Drivers | • Growing healthcare infrastructure and awareness. • Government initiatives promoting blood donation. • Increased public awareness about the importance of blood donation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Blood Product Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Blood Product Market historical market size for the year 2021, and forecast from 2023 to 2033

- Blood Product Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the India Blood Product Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Blood Product Market?

The Blood Product Market is expected to grow at a CAGR of 4.32% from 2023 to 2033.

Which region has the highest growth rate in the Blood Product Market?

The India Blood Product Market report does not specify a single highest growth rate region but focuses on the Indian market dynamics.

Which region has the largest share of the Blood Product Market?

The report primarily discusses the Indian Blood Product Market, without specifying a comparative regional share.

Who are the key players in the Blood Product Market?

Key players in the Blood Product Market include Grifols, Reliance Life Science, Bharat Serums and Vaccines, Intas Pharmaceuticals, Hemarus, Takeda Pharmaceutical Company, Octapharma, Plasmagen Biosciences, Nexus Lifecare, Kedrion, BPL, Hualan Biological Engineering Inc, Baxter, Mitsubishi Tanabe Pharma, CSL, and Shanghai RAAS.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.