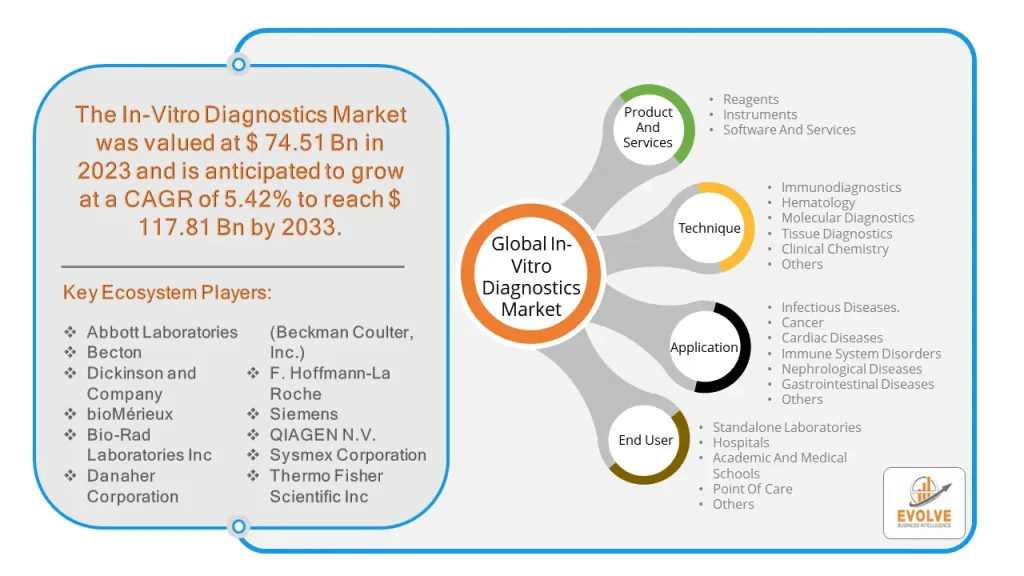

The Global In-Vitro Diagnostics Market size is projected to reach approximately $117.81 Billion by 2033, at a CAGR of 5.42% from 2023 to 2033. In-Vitro Diagnostics (IVD) refers to medical tests and procedures that are performed on biological samples such as blood, urine, or tissue outside of the body in a laboratory setting. These tests are used to detect and diagnose diseases, monitor treatment progress, and screen for potential health conditions. IVD tests can range from simple tests such as glucose monitoring to more complex tests like genetic testing, immunoassays, and molecular diagnostics. They can be used to diagnose a variety of medical conditions such as infectious diseases, cancer, diabetes, cardiovascular diseases, and autoimmune disorders. IVD plays an essential role in modern healthcare, providing healthcare professionals with critical information to aid in the diagnosis, treatment, and management of diseases.

The In-Vitro Diagnostics (IVD) sector has benefitted immensely from the COVID-19 pandemic. Diagnostic testing is crucial for identifying infected people, tracking disease development, and adopting efficient public health measures to stop the spread of the virus, which has caused a spike in demand as a result of the COVID-19 epidemic. As a result, there has been a significant increase in demand for IVD tests, including polymerase chain reaction (PCR) tests, serology tests, and antigen tests, among others. This led to a surge in IVD test production and sales, with many companies ramping up their manufacturing capacity to meet the demand.

In-Vitro Diagnostics Market Dynamics

The major factors that have impacted the growth of In-Vitro Diagnostics are as follows:

Drivers:

Rising numbers of Infectious Diseases

In-vitro diagnostics are laboratory tests that detect and diagnose diseases or conditions in a patient’s body fluids or tissues. In the case of infectious diseases, in-vitro diagnostics can be used to detect the presence of pathogens such as bacteria or viruses in a patient’s blood, urine, or other bodily fluids. With the rise of infectious diseases, there is an increased demand for accurate and timely diagnostic tests that can quickly identify the causative agent of the infection. This demand can drive the development and commercialization of new in-vitro diagnostic tests that are specifically designed to detect these pathogens, leading to growth in the in-vitro diagnostics market.

Restraint:

- Increasing Invasion of Counterfeit Drugs

Counterfeit drugs are fake medications that are deliberately produced and sold to deceive consumers. These counterfeit drugs can pose a significant risk to public health, as they may contain incorrect or harmful ingredients, or may not contain any active ingredients at all. While the use of counterfeit drugs can lead to misdiagnosis or delayed diagnosis, it is not clear how this would specifically impact the in-vitro diagnostics market. In-vitro diagnostics are laboratory tests that are used to detect and diagnose diseases and are typically not involved in the manufacture or distribution of drugs. However, it is worth noting that the use of counterfeit drugs can have a broader impact on the healthcare system, which in turn may indirectly affect the in-vitro diagnostics market.

Opportunity:

Availability of a plethora of products

The In Vitro Diagnostics (IVD) market refers to the use of medical devices and diagnostic kits for testing samples such as blood, urine, or tissue in a laboratory setting outside of the human body. This market has seen significant growth in recent years due to advancements in technology and an increase in demand for more accurate and reliable diagnostic testing. There are indeed numerous products under development in the IVD market, which may present opportunities for growth and profitability. These products include new diagnostic tests for a range of conditions such as infectious diseases, cancer, and genetic disorders, as advances in technology such as point-of-care testing and digital diagnostics. while the availability of a plethora of products under development may offer opportunities for the IVD market.

In-Vitro Diagnostics Segment Overview

By Product And Services

By Technique

Based on Technique, the global In-Vitro Diagnostics market has been divided into Immunodiagnostics, Hematology, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Others. The Molecular Diagnostics segment is expected to hold the largest market share. As this is a rapidly growing area of IVD. Molecular diagnostics involves the detection and measurement of nucleic acids, such as DNA or RNA, in biological samples to diagnose and monitor various diseases and conditions.

By Application

Based on Application, the global In-Vitro Diagnostics market has been divided into Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Others. The Infectious Diseases segment is expected to hold the largest market share. Especially in the wake of the COVID-19 pandemic. Infectious disease diagnostics involves the detection and measurement of infectious agents, such as bacteria, viruses, and fungi, in biological samples to diagnose and monitor various infectious diseases.

By End User

Based on End Users, the global In-Vitro Diagnostics market has been divided into Standalone Laboratories, Hospitals, Academic And Medical Schools, Point Of Care, and Others. The Hospitals segment holds the largest market share of In-Vitro Diagnostics. Hospitals rely on IVD tests to diagnose and monitor a wide range of diseases and conditions, and they are often equipped with advanced laboratory facilities to perform complex tests.

Global In-Vitro Diagnostics Market Share, by Segmentation

Based on region, the global In-Vitro Diagnostics market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to dominate the use of the In-Vitro Diagnostics market followed by the Asia-Pacific and Europe regions.

North America Market

North America is one of the dominant regions in the In-Vitro Diagnostics (IVD) market, with the United States being the largest market in the region. The growth of the North American IVD market is driven by several factors, including the increasing prevalence of chronic and infectious diseases, the growing demand for personalized medicine, and the presence of well-established healthcare infrastructure and advanced medical technologies. The IVD market in North America is also supported by favorable government initiatives and regulations, such as the Affordable Care Act in the United States, which has increased access to healthcare services and encouraged the adoption of advanced diagnostic technologies. In addition, the increasing adoption of point-of-care testing (POCT) and the development of new and advanced IVD tests are expected to drive the growth of the market in the region.

Europe Market

Europe is one of the major regions in the In-Vitro Diagnostics (IVD) market, and it holds the second-largest share after North America. The European IVD market is driven by factors such as the increasing prevalence of chronic and infectious diseases, the growing demand for advanced diagnostic technologies, and favorable government initiatives and regulations to promote healthcare access and quality. The European IVD market is also supported by the presence of leading market players, robust healthcare infrastructure, and a high level of awareness among patients regarding the benefits of early disease diagnosis and management. In addition, the increasing adoption of point-of-care testing (POCT) and the development of new and advanced IVD tests are expected to drive the growth of the market in the region.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Since of their strategic innovations and broad regional presence, companies such as Abbott Laboratories, Becton, Dickinson and Company, and bioMérieux lead the global In-Vitro Diagnostics business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- Abbott Laboratories

- Becton

- Dickinson and Company

- bioMérieux

- Bio-Rad Laboratories Inc

- Danaher Corporation (Beckman Coulter, Inc.)

- Hoffmann-La Roche

- Siemens

- QIAGEN N.V.

- Sysmex Corporation

- Thermo Fisher Scientific Inc

Scope of the Report

Global In-Vitro Diagnostics Market, by Product And Services

- Reagents

- Instruments

- Software And Services

Global In-Vitro Diagnostics Market, by Technique

- Immunodiagnostics

- Hematology

- Molecular Diagnostics

- Tissue Diagnostics

- Clinical Chemistry

- Others

Global In-Vitro Diagnostics Market, by Application

- Infectious Diseases

- Cancer

- Cardiac Diseases

- Immune System Disorders

- Nephrological Diseases

- Gastrointestinal Diseases

- Others

Global In-Vitro Diagnostics Market, by End User

- Standalone Laboratories

- Hospitals

- Academic And Medical Schools

- Point Of Care

- Others

Global In-Vitro Diagnostics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 117.81 Billion |

| CAGR | 5.42% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product And Services, Technique, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Product And Services, Technique, Application, End User |

| Key Market Opportunities | Availability of a plethora of products |

| Key Market Drivers | Rising numbers of Infectious Diseases |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future In-Vitro Diagnostics market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- In-Vitro Diagnostics market historical market size for the year 2021, and forecast from 2023 to 2033

- In-Vitro Diagnostics market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global In-Vitro Diagnostics market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the In-Vitro Diagnostics market?

The In-Vitro Diagnostics market is projected to grow at a CAGR of 5.42% from 2023 to 2033.

Which region has the highest growth rate in In-Vitro Diagnostics market?

North America is anticipated to have the highest growth rate in the In-Vitro Diagnostics market.

Which region has the largest share of In-Vitro Diagnostics market?

North America is projected to dominate the In-Vitro Diagnostics market.

Who are the key players in In-Vitro Diagnostics market?

Key players include Abbott Laboratories, Becton, Dickinson and Company, bioMérieux, Bio-Rad Laboratories Inc, and others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.