High-Throughput Screening Market Overview

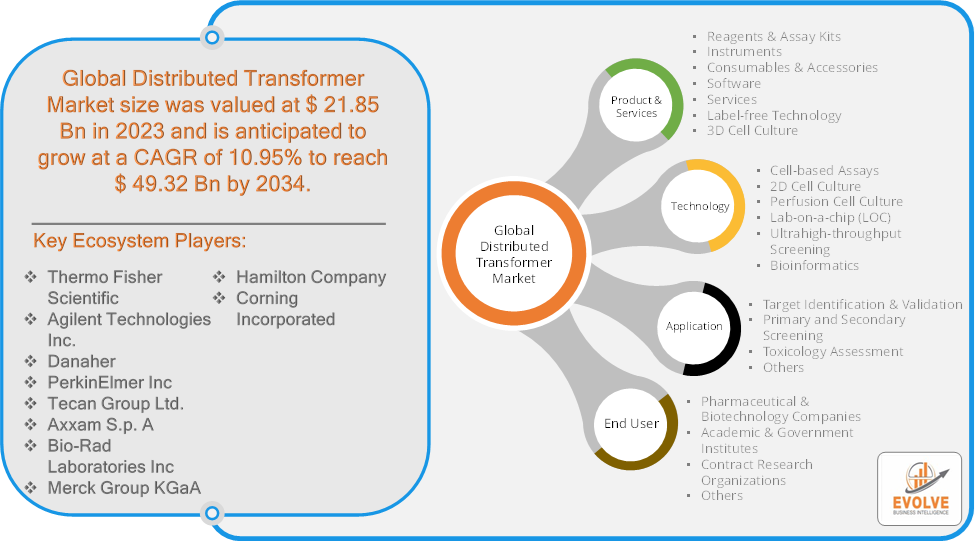

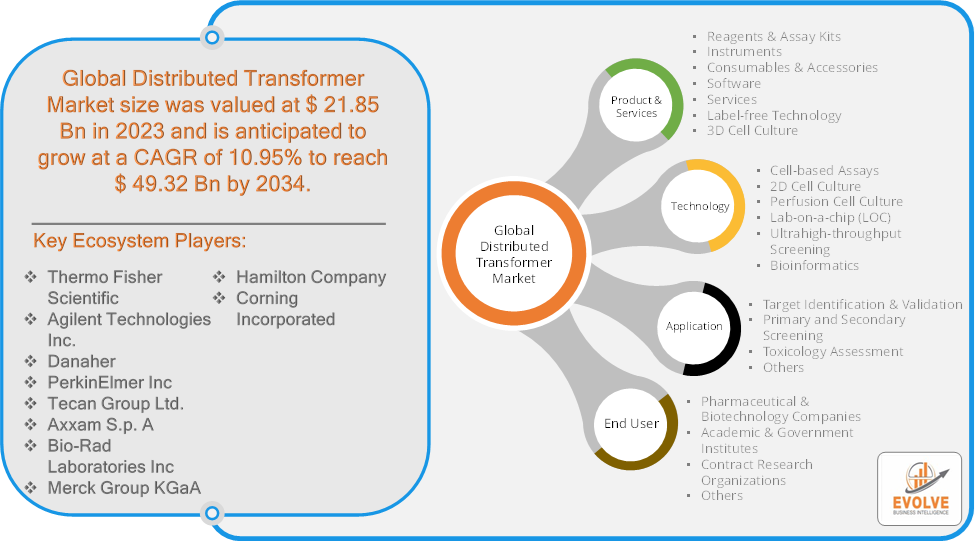

The High-Throughput Screening Market size accounted for USD 21.85 Billion in 2023 and is estimated to account for 22.99 Billion in 2024. The Market is expected to reach USD 49.32 Billion by 2034 growing at a compound annual growth rate (CAGR) of 10.95% from 2024 to 2034. The High-Throughput Screening (HTS) market is a rapidly growing industry that encompasses the development and application of technologies and methods for rapidly and efficiently testing large numbers of biological or chemical compounds. HTS is primarily used in drug discovery to identify potential drug candidates by screening vast libraries of compounds against specific biological targets.

The HTS market is a dynamic and rapidly evolving field with significant potential to accelerate drug discovery and development. As technology continues to advance and the benefits of HTS become more widely recognized. The High-Throughput Screening Market plays a critical role in modern biological research and drug development, contributing to innovations in health care and medicine.

Global High-Throughput Screening Market Synopsis

The major factors that have impacted the growth of High-Throughput Screening Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in automation, robotics, and data analysis tools enhance the efficiency and accuracy of HTS processes, making them more accessible and attractive to research institutions and companies. Increased funding and investment in biotechnology research and development drive the need for high-throughput screening methods to support drug discovery and development processes. The shift toward personalized medicine necessitates the identification of specific biomarkers and drug responses, which can be efficiently evaluated through HTS techniques.

Restraint:

- Perception of High Costs of Equipment and Technology and Complex Data Management

The initial investment required for HTS technologies, including automated systems, sophisticated assays, and data management software, can be significant. This cost barrier may restrict access for smaller research institutions and companies. HTS generates vast amounts of data, which can be challenging to manage and analyze effectively. The need for specialized software and skilled personnel to interpret this data can create bottlenecks in the research process. Integrating HTS data with existing systems and ensuring compatibility with other technologies can be difficult, potentially leading to inefficiencies in the research workflow.

Opportunity:

⮚ Increasing Focus on Rare Diseases

HTS can be instrumental in accelerating the discovery of treatments for rare diseases, which often lack adequate research. This focus can attract funding and investment from various stakeholders. The expanding biotechnology industry, particularly in drug development and therapeutics, provides a robust market for HTS technologies and services as companies seek faster and more efficient research methodologies. Continued advancements in automation and robotics can improve the efficiency and throughput of HTS processes, making them more appealing to research organizations and pharmaceutical companies.

High-Throughput Screening Market Segment Overview

Based on Product & Services, the market is segmented based on Reagents & Assay Kits, Instruments, Consumables & Accessories, Software, Services, Label-free Technology and 3D Cell Culture. The consumables segment dominant the high throughput screening market, primarily due to the widespread use of HTS reagents and assay kits essential throughout the screening process. These consumables require frequent replacement, driving recurring revenue for manufacturers.

By Technology

Based on Technology, the market segment has been divided into Cell-based Assays, 2D Cell Culture, Perfusion Cell Culture, Lab-on-a-chip (LOC), Ultrahigh-throughput Screening and Bioinformatics. The Ultrahigh-throughput Screening segment dominant the market. The high-throughput screening market overview indicates that cell-based assays are increasingly being used by various pharmaceutical and biotech companies. Cell-based assays in high-throughput screening utilize live cells as the biological readout for compound testing, enabling the evaluation of drug candidates’ effects on cellular function, viability, and phenotype in a high-throughput manner, often employed in drug discovery and toxicity screening.

By Application

Based on Application, the market segment has been divided into Target Identification & Validation, Primary and Secondary Screening, Toxicology Assessment and Others. Target identification and validation involves identifying and validating molecular targets (such as proteins, genes, or cellular pathways) that are implicated in a disease or biological process. Through various methods, including genomics, proteomics, and bioinformatics, potential targets are identified and then validated to ensure their relevance and draggability for further investigation.

By End User

Based on End User, the market segment has been divided into Pharmaceutical & Biotechnology Companies, Academic & Government Institutes, Contract Research Organizations and Others. The Pharmaceutical & Biotechnology Companies segment dominant the market.

Global High-Throughput Screening Market Regional Analysis

Based on region, the global High-Throughput Screening Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the High-Throughput Screening Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the High-Throughput Screening Market. North America remains the dominant region in the HTS market, accounting for a substantial share of global revenue. This dominance is attributed to the presence of numerous pharmaceutical and biotechnology companies, strong research and development infrastructure, and significant investments in healthcare. The United States, in particular, is a major hub for HTS activities, with a large number of research institutions, pharmaceutical companies, and contract research organizations (CROs) involved in HTS research and development.

Global High-Throughput Screening Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the High-Throughput Screening Market industry. Asia Pacific is emerging as a key growth market for HTS, driven by factors such as increasing healthcare spending, growing pharmaceutical industry, and rising R&D investments. China, India, and Japan are among the leading countries in the region, with a growing number of pharmaceutical companies and research institutions adopting HTS technologies. The Asia Pacific market is expected to experience significant growth in the coming years, fueled by the increasing demand for new drugs and the expansion of the pharmaceutical industry.

Competitive Landscape

The global High-Throughput Screening Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Thermo Fisher Scientific

- Agilent Technologies Inc.

- Danaher

- PerkinElmer Inc

- Tecan Group Ltd.

- Axxam S.p. A

- Bio-Rad Laboratories Inc

- Merck Group KGaA

- Hamilton Company

- Corning Incorporated

Key Development

In May 2024, Twist Bioscience launched Twist Multiplexed Gene Fragments (MGFs), enabling high-throughput screening applications with pools of directly synthesized DNA fragments up to 500 base pairs in length.

In December 2023, Piramal Pharma expanded its drug discovery capabilities with a new high-throughput screening facility in Ahmedabad, India, enhancing in-vitro biology services for comprehensive client support across research and development.

Scope of the Report

Global High-Throughput Screening Market, by Product & Services

- Reagents & Assay Kits

- Instruments

- Consumables & Accessories

- Software

- Services

- Label-free Technology

- 3D Cell Culture

Global High-Throughput Screening Market, by Technology

- Cell-based Assays

- 2D Cell Culture

- Perfusion Cell Culture

- Lab-on-a-chip (LOC)

- Ultrahigh-throughput Screening

- Bioinformatics

Global High-Throughput Screening Market, by Application

- Target Identification & Validation

- Primary and Secondary Screening

- Toxicology Assessment

- Others

Global High-Throughput Screening Market, by End User

- Pharmaceutical & Biotechnology Companies

- Academic & Government Institutes

- Contract Research Organizations

- Others

Global High-Throughput Screening Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 49.32 Billion |

| CAGR (2024-2034) | 10.95% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product & Services, Technology, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Thermo Fisher Scientific, Agilent Technologies Inc., Danaher, PerkinElmer, Inc, Tecan Group Ltd., Axxam S.p. A, Bio-Rad Laboratories Inc, Merck Group KGaA, Hamilton Company and Corning Incorporated. |

| Key Market Opportunities | · Increasing Focus on Rare Diseases

· Automation and Robotics Advancements |

| Key Market Drivers | · Technological Advancements

· Growing Focus on Personalized Medicine |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future High-Throughput Screening Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- High-Throughput Screening Market historical market size for the year 2021, and forecast from 2023 to 2033

- High-Throughput Screening Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global High-Throughput Screening Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global High-Throughput Screening Market?

The global High-Throughput Screening Market is growing at a CAGR of 10.95% over the next 10 years

Which region has the highest growth rate in the market of High-Throughput Screening Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global High-Throughput Screening Market?

North America holds the largest share in 2022

Who are the key players in the global High-Throughput Screening Market?

Thermo Fisher Scientific, Agilent Technologies, Inc., Danaher, PerkinElmer, Inc, Tecan Group Ltd., Axxam S.p. A, Bio-Rad Laboratories Inc, Merck Group KGaA, Hamilton Company and Corning Incorporated. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.