High-Performance Computing Chipset Market Overview

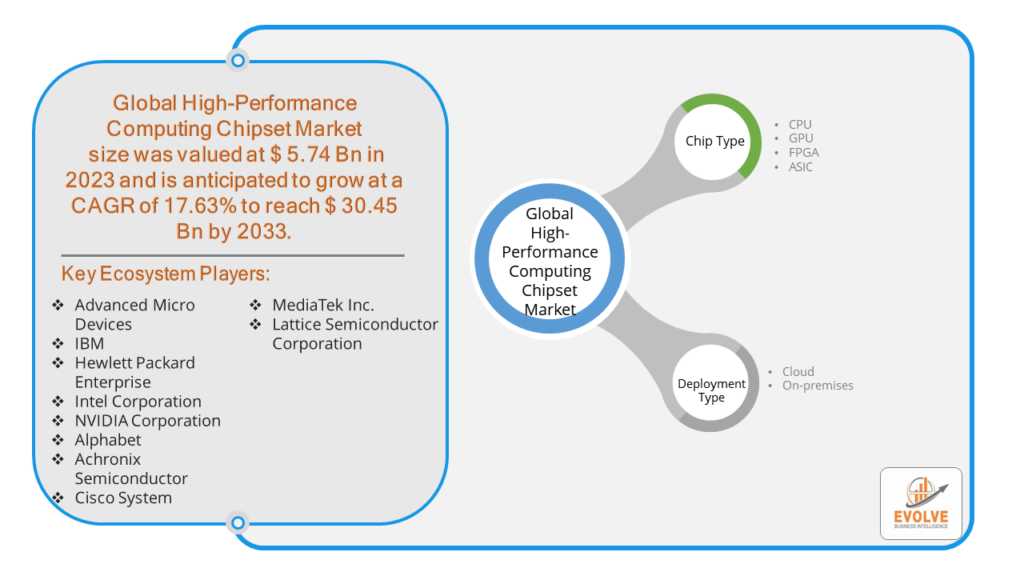

The High-Performance Computing Chipset Market Size is expected to reach USD 30.45 Billion by 2033. The High-Performance Computing Chipset Market industry size accounted for USD 5.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 17.63% from 2023 to 2033. The High-Performance Computing (HPC) Chipset Market refers to the sector involved in the development, production, and sale of chipsets used in high-performance computing systems. These chipsets are integral components in HPC systems, which are designed to deliver superior performance, processing speed, and computational power to handle complex and demanding tasks, such as scientific simulations, financial modeling, climate research, and large-scale data analysis.

The High-Performance Computing Chipset Market plays a crucial role in enabling advancements in various fields that require significant computational power and speed and It’s driven by Increasing demand for cloud-based HPC solutions and rising adoption of AI and big data analytics across industries.

Global High-Performance Computing Chipset Market Synopsis

The COVID-19 pandemic had a significant impact on the High-Performance Computing (HPC) Chipset Market. The pandemic led to a surge in demand for HPC systems. As research institutions, healthcare organizations, and pharmaceutical companies ramped up efforts to understand the virus, develop vaccines, and simulate potential treatment outcomes, the need for high-performance computing power grew. This increased demand for HPC chipsets to support these computational needs. With the shift to remote work and an accelerated digital transformation across industries, there was a heightened need for robust data processing and analysis capabilities. Organizations required more powerful computing systems to support virtual collaboration, data security, and business continuity, boosting the demand for HPC chipsets. The focus on COVID-19 research led to increased funding and investments in HPC capabilities. Governments and private sectors invested in HPC infrastructure to accelerate research efforts, driving growth in the HPC chipset market. The pandemic accelerated the adoption of emerging technologies such as artificial intelligence (AI) and machine learning (ML), which rely heavily on HPC capabilities. This further fueled the demand for advanced HPC chipsets designed to handle AI and ML workloads.

High-Performance Computing Chipset Market Dynamics

The major factors that have impacted the growth of High-Performance Computing Chipset Market are as follows:

Drivers:

Ø Advancements in Chipset Technologies

Continuous innovations in chipset design, such as increased processing speeds, improved energy efficiency, and enhanced parallel processing capabilities, contribute to the growth of the HPC chipset market. Technologies like GPUs, FPGAs, and specialized AI accelerators are particularly impactful. The growing complexity and scale of scientific research, engineering simulations, financial modeling, and big data analytics require advanced computational power. HPC systems, powered by high-performance chipsets, are essential for these demanding applications. The exponential growth of data generated by IoT devices, social media, and other digital sources requires robust analytics capabilities. HPC systems equipped with high-performance chipsets are essential for processing and extracting insights from massive datasets.

Restraint

- Perception of High Costs of Development and Implementation

Developing high-performance chipsets involves significant research and development (R&D) costs. Additionally, the implementation of HPC systems requires substantial investments in infrastructure, which can be a barrier for many organizations, especially small and medium-sized enterprises (SMEs). High-performance chipsets consume significant amounts of power and generate a lot of heat, leading to increased operational costs and the need for advanced cooling solutions. This can be a major restraint, particularly in environments where energy efficiency and cooling capacity are limited.

Opportunity:

⮚ Growing demand for Big Data and Analytics

The explosion of data from IoT devices, social media, and other sources creates opportunities for HPC chipsets that can efficiently process and analyze big data. Industries such as finance, retail, and manufacturing can benefit from enhanced data analytics capabilities powered by HPC systems. There is a growing emphasis on sustainability and energy efficiency in computing. Developing HPC chipsets that are more energy-efficient and environmentally friendly can attract organizations focused on reducing their carbon footprint and operational costs. With the increasing threat of cyberattacks, there is a demand for HPC chipsets with advanced security features. Developing secure HPC solutions can address concerns related to data protection and attract industries that handle sensitive information.

High-Performance Computing Chipset Market Segment Overview

By Product Type

By Deployment Type

Based on Deployment Type, the market segment has been divided into the Cloud and On-premises. On-premises segments dominant the market. One of the major advantages of on-premises deployment over cloud deployment is that it is highly secure against cyberattacks and security breaches. Although the cost of maintenance is very high in terms of on-premise deployment, several enterprises prefer using on-premise deployment.

Global High-Performance Computing Chipset Market Regional Analysis

Based on region, the global High-Performance Computing Chipset Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the High-Performance Computing Chipset Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the High-Performance Computing Chipset Market. North America, particularly the United States, is a leader in technological innovation, with significant investments in HPC infrastructure. Strong government support and substantial funding for defense and research initiatives drive demand for HPC systems. Presence of major tech companies, research institutions, and industries such as aerospace, healthcare, and finance that require advanced computational capabilities.

High-Performance Computing Chipset Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the High-Performance Computing Chipset Market industry. Rapid economic growth and industrialization in countries like China, Japan, South Korea, and India. Presence of major technology hubs and manufacturing centers. Growth of cloud computing and digital transformation initiatives. Adoption of HPC for smart city projects and IoT applications.

Competitive Landscape

The global High-Performance Computing Chipset Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Advanced Micro Devices

- IBM

- Hewlett Packard Enterprise

- Intel Corporation

- NVIDIA Corporation

- Alphabet

- Achronix Semiconductor

- Cisco System

- MediaTek Inc.

- Lattice Semiconductor Corporation

Key Development

In November 2023, Intel is gearing up to launch its refreshed Xeon W-2500 “Sapphire Rapids” CPU lineup for workstations, boasting up to 26 cores, clock speeds hitting 4.8 GHz, and a 250W TDP. These CPUs, built on the Golden Cove P-Core architecture, will support DDR5 memory and feature a range of SKUs offering increased core counts and higher TDPs compared to their predecessors. Expected to debut in early 2024, the lineup aims to rival AMD’s Threadripper 7000 series in the mainstream workstation market, offering improved performance and competitiveness.

Scope of the Report

Global High-Performance Computing Chipset Market, by Chip Type

- CPU

- GPU

- FPGA

- ASIC

Global High-Performance Computing Chipset Market, by Deployment Type

- Cloud

- On-premises

Global High-Performance Computing Chipset Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $30.45 Billion/strong> |

| CAGR | 17.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Chip Type, Deployment Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Advanced Micro Devices, IBM, Hewlett Packard Enterprise, Intel Corporation, NVIDIA Corporation, Alphabet, Achronix Semiconductor, Cisco System, MediaTek Inc and Lattice Semiconductor Corporation |

| Key Market Opportunities | • The growing demand for Big Data and Analytics • Energy-Efficient and Sustainable HPC Solutions |

| Key Market Drivers | • Advancements in Chipset Technologies • Increasing Demand for Advanced Computational Capabilities |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future High-Performance Computing Chipset Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- High-Performance Computing Chipset Market historical market size for the year 2021, and forecast from 2023 to 2033

- High-Performance Computing Chipset Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global High-Performance Computing Chipset Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

2. What is the growth rate of the global High-Performance Computing Chipset Market?

- The global High-Performance Computing Chipset Market is growing at a CAGR of 17.63% over the next 10 years

3. Which region has the highest growth rate in the market of High-Performance Computing Chipset Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4. Which region has the largest share of the global High-Performance Computing Chipset Market?

- North America holds the largest share in 2022

5. Who are the key players in the global High-Performance Computing Chipset Market?

Advanced Micro Devices, IBM, Hewlett Packard Enterprise, Intel Corporation, NVIDIA Corporation, Alphabet, Achronix Semiconductor, Cisco System, MediaTek Inc and Lattice Semiconductor Corporation. are the major companies operating in the market

6. Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7. Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives