Heavy construction equipment Market Overview

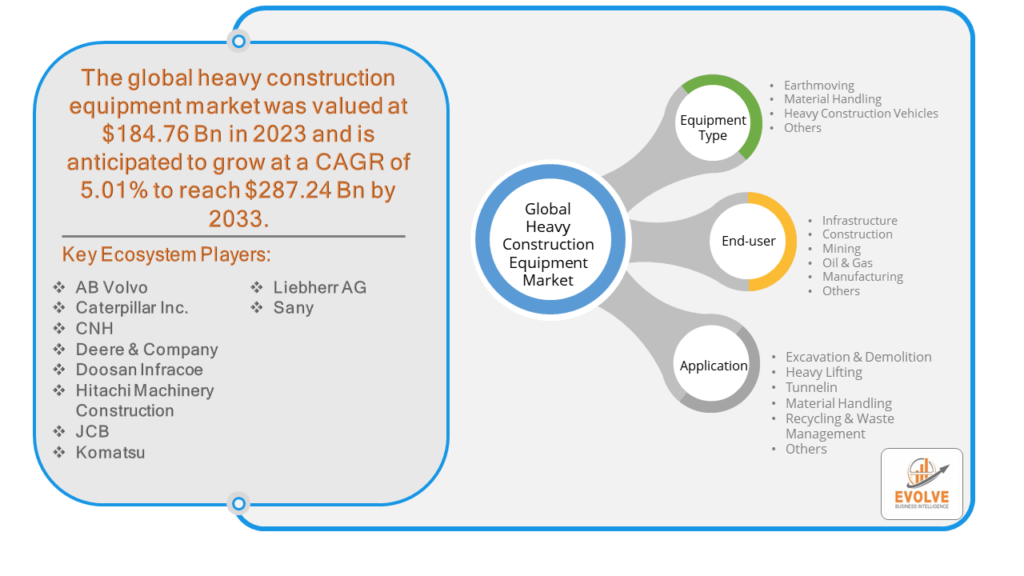

The Heavy construction equipment market Size is expected to reach USD 287.24 Billion by 2033. The Heavy construction equipment market industry size accounted for USD 184.76 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2033. The heavy construction equipment market refers to the industry segment involved in the manufacturing, distribution, and utilization of large machinery and equipment specifically designed for construction tasks requiring significant power and capabilities. This market encompasses a wide range of equipment such as excavators, bulldozers, cranes, loaders, dump trucks, and others, used in various construction projects including infrastructure development, residential and commercial building construction, mining, and other heavy-duty applications.

The market is influenced by factors such as economic conditions, infrastructure investment, technological advancements, regulatory policies, and environmental concerns. Key players in the heavy construction equipment market include manufacturers who design and produce these machines, as well as rental companies, dealerships, and service providers who facilitate their distribution, maintenance, and repair.

Global Heavy construction equipment market Synopsis

The COVID-19 pandemic had a significant impact on the heavy construction equipment market. Lockdowns, travel restrictions, and shutdowns of manufacturing facilities in various parts of the world disrupted the supply chain for heavy construction equipment. This led to delays in production, shortages of components, and logistical challenges in delivering equipment to customers. The rental market for heavy construction equipment was affected as construction activity slowed down. Rental companies experienced decreased demand and had to adjust their fleets and pricing strategies to adapt to changing market conditions. The pandemic accelerated the adoption of technology in the heavy construction equipment industry. Remote monitoring and telematics solutions became more important for equipment management and maintenance, as companies sought to minimize on-site personnel and optimize equipment utilization. The long-term impact of the pandemic on the heavy construction equipment market will depend on factors such as the pace of economic recovery, government infrastructure spending, and trends in construction activity. While the pandemic caused significant disruptions, it also highlighted the importance of resilient supply chains, digitalization, and innovation in the industry’s future resilience.

Heavy construction equipment Market Dynamics

The major factors that have impacted the growth of Heavy construction equipment market are as follows:

Drivers:

Ø Technological Advancements

Innovation in heavy construction equipment, including advancements in automation, electrification, and connectivity, improves efficiency, productivity, and safety on construction sites. Technologies such as GPS, telematics, and remote monitoring enable better fleet management and equipment utilization. Aging equipment fleets in many markets create opportunities for equipment replacement and upgrades. Construction companies and rental firms may invest in new machinery to improve efficiency, reliability, and safety or to comply with regulatory requirements. Overall economic growth and stability, as well as business confidence and investment sentiment, influence demand for construction equipment. Strong economic conditions, low interest rates, and favorable business environments encourage companies to invest in construction projects and equipment acquisition.

Restraint:

- Perception of High Initial Cost

Heavy construction equipment typically requires substantial upfront investment, which can be a barrier for small and medium-sized construction companies or those operating in regions with limited access to financing. The high initial cost can also deter companies from upgrading their fleets or investing in new technologies. The heavy construction equipment market is cyclical and susceptible to fluctuations in economic conditions, construction activity levels, and commodity prices. During economic downturns or periods of reduced construction activity, demand for equipment may decline, leading to excess capacity, pricing pressure, and decreased profitability for equipment manufacturers and rental companies.

Opportunity:

⮚ Technological Innovation

Advancements in technology such as automation, electrification, and digitalization offer opportunities to improve the efficiency, productivity, and safety of heavy construction equipment. Manufacturers can differentiate themselves by developing innovative solutions that enhance equipment performance, reduce operating costs, and minimize environmental impact. Digital technologies such as IoT, AI, and cloud computing are transforming the heavy construction equipment industry by enabling real-time monitoring, predictive maintenance, and remote equipment management. Manufacturers can leverage digitalization to improve equipment performance, optimize operations, and offer value-added services that enhance customer experience and loyalty.

Heavy construction equipment market Segment Overview

By Equipment Type

By Application

Based on Product Type, the market is segmented based on Excavation & Demolition, Material Handling, Heavy Lifting, Recycling & Waste Management and Tunneling. Excavation & demolition dominated the market. Excavation and demolition activities have emerged as major drivers, dominating the heavy construction equipment market. This trend is symptomatic of the dynamic terrain in the construction industry, where the need for efficient and robust excavation and demolition machinery has increased dramatically Heavy excavators, bulldozers and hydraulic fracturing is a must for reconstructing landscapes, cleaning areas, and preparing foundations for new structures Specialized equipment capable of handling complex construction projects and dominating the heavy construction equipment market.

By End User

Based on End Users, the market has been divided into Metals, Minerals, Coal, Real Estate, Oil & Gas and Others. Real Estate segment dominates the market. The real estate sector has emerged as a major driving force for the heavy construction equipment market. As urbanization and infrastructure boom across the globe, the demand for heavy machinery in the real estate industry has risen. Excavators, cranes, bulldozers and concrete mixers have become essential equipment in the residential, commercial and industrial sectors. These heavy-duty construction equipment not only speeds up the construction process but also ensures accuracy and safety during construction activities

Global Heavy construction equipment market Regional Analysis

Based on region, the global Heavy construction equipment market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Heavy construction equipment market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Heavy construction equipment market. North America particularly, the U.S. heavy construction equipment market is driven by infrastructure renewal projects, especially in transportation and energy sectors. Demand for equipment like excavators, loaders, and cranes remains strong. Technological advancements, including the adoption of telematics and autonomous machinery, are shaping the market.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Heavy construction equipment market industry. In Asia-Pacific, generally India’s heavy construction equipment market is growing rapidly due to urbanization, industrialization, and infrastructure development projects. The government’s focus on initiatives like “Make in India” and “Smart Cities Mission” boosts demand for machinery such as excavators, cranes, and concrete equipment.

Competitive Landscape

The global Heavy construction equipment market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Volvo Group

- Sany Heavy Industry Co. Ltd.

- CNH Industrial N.V

- Caterpillar Inc

- Terex Corporation

- Wacker Neuson SE

- Hitachi Construction Machinery Co. Ltd.

- Deere & Company

- Doosan Bobcat

- Komatsu Ltd

Key Development

In March 2023, In October 2022, JCB India launched three new excavators for the infrastructure and mining and quarrying applications at Udaipur in Rajasthan recently. These machines will be built at JCB India’s factory in Pune, Maharashtra, and will be sold not only in India but also in global markets.

In October 2022, John Deere expanded its line-up of large wheel loaders with the introduction of the all-new 744, 824 and 844 P-tier model under its Performance Tiering Strategy.

Scope of the Report

Global Heavy construction equipment Market, by Equipment

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

Global Heavy construction equipment market, by Application

- Excavation & Demolition

- Material Handling

- Heavy Lifting

- Recycling & Waste Management

- Tunneling

Global Heavy construction equipment Market, by Equipment

- Metals

- Minerals

- Coal

- Real Estate

- Oil & Gas and Others

- Others

Global Heavy construction equipment market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $287.24 Billion |

| CAGR | 5.01% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Equipment Type, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Volvo Group, Sany Heavy Industry Co. Ltd., CNH Industrial N.V, Caterpillar Inc, Terex Corporation, Wacker Neuson SE, Hitachi Construction Machinery Co. Ltd., Deere & Company, Doosan Bobcat and Komatsu Ltd.. |

| Key Market Opportunities | • Technological Innovation • Digital Transformation |

| Key Market Drivers | • Technological Advancements • Replacement Cycle |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Heavy construction equipment market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Heavy construction equipment market historical market size for the year 2021, and forecast from 2023 to 2033

- Heavy construction equipment market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Heavy construction equipment market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Heavy construction equipment market?

The Heavy construction equipment market is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2033.

Which region has the highest growth rate in the Heavy construction equipment market?

The Asia-Pacific region exhibits the highest growth rate in the Heavy construction equipment market.

Which region has the largest share of the Heavy construction equipment market?

North America holds the largest share of the Heavy construction equipment market.

Who are the key players in the Heavy construction equipment market?

Key players in the Heavy construction equipment market include Volvo Group, Sany Heavy Industry Co. Ltd., CNH Industrial N.V, Caterpillar Inc, Terex Corporation, Wacker Neuson SE, Hitachi Construction Machinery Co. Ltd., Deere & Company, Doosan Bobcat, and Komatsu Ltd.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.