Wheat Protein Market Overview

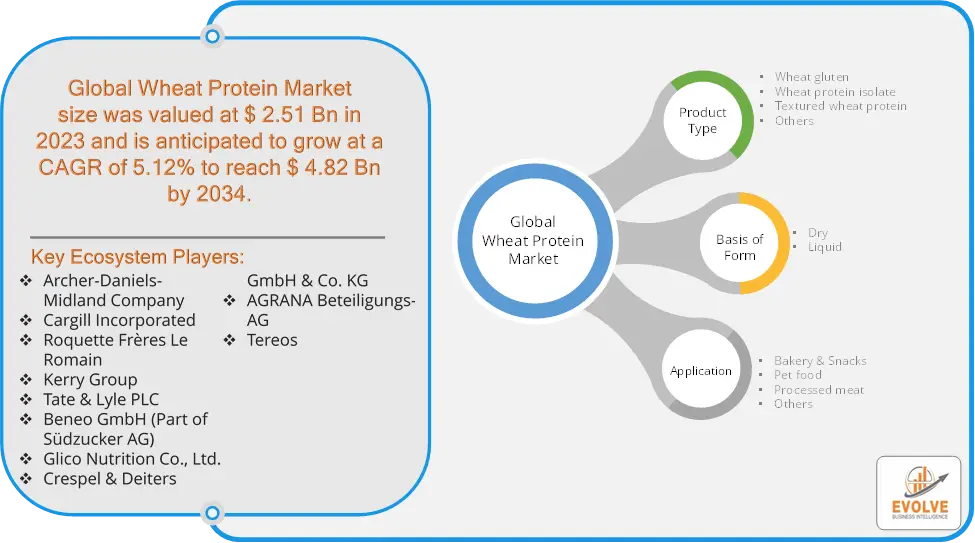

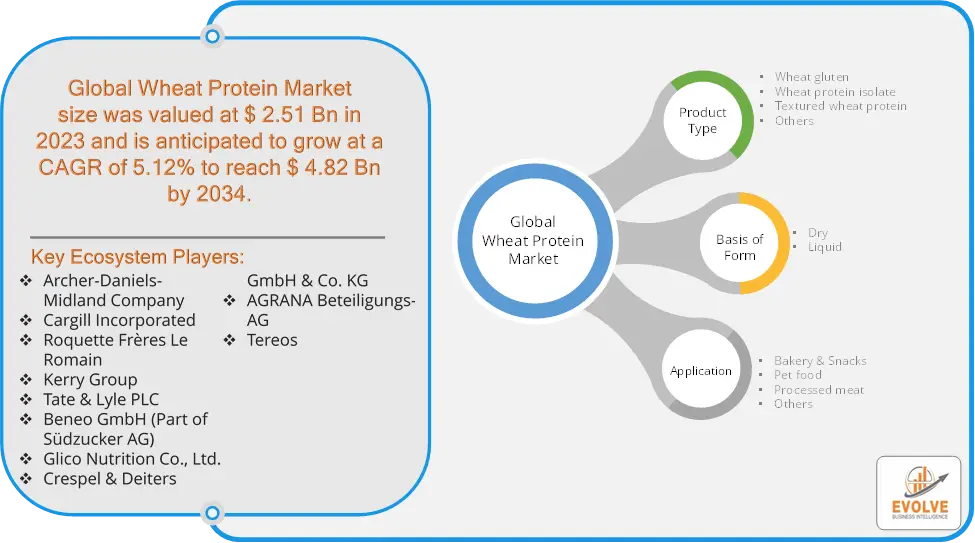

The Wheat Protein Market size accounted for USD 2.51 Billion in 2023 and is estimated to account for 3.14 Billion in 2024. The Market is expected to reach USD 4.82 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.12% from 2024 to 2034. The Wheat Protein Market refers to the sector involved in the production, distribution, and consumption of wheat protein, primarily derived from wheat grains. Wheat protein is a plant-based protein source, with gluten being the most well-known type, widely used in various food products due to its functional properties.

The wheat protein market is expected to continue growing steadily in the coming years, driven by these factors and the increasing demand for plant-based and functional ingredients.

Global Wheat Protein Market Synopsis

The major factors that have impacted the growth of Wheat Protein Market are as follows:

Drivers:

Ø Increasing Demand for Plant-Based Proteins

The rising popularity of vegan and vegetarian diets has led to a growing demand for plant-based protein sources, with wheat protein being a preferred choice for many consumers seeking alternatives to animal proteins. Consumers are becoming more health-conscious, seeking products high in protein for muscle building, weight management, and overall health. Wheat protein, being a good source of protein, fits well into this trend. There is a trend towards clean label products with recognizable and natural ingredients. Wheat protein is perceived as a clean and healthy ingredient, making it attractive to consumers looking for transparency in food sourcing.

Restraint:

- Perception of Wheat Protein and Variability in Wheat Supply

Some consumers perceive wheat protein as inferior to animal-based proteins in terms of amino acid profile and overall nutrition. This perception can impact the acceptance of wheat protein in various applications. The wheat protein market is influenced by fluctuations in wheat production due to climate conditions, agricultural practices, and geopolitical factors. Supply chain disruptions can lead to price volatility and affect availability.

Opportunity:

⮚ Innovation in Product Development

There is considerable scope for research and development in creating new products that utilize wheat protein, including functional foods, protein bars, snacks, and ready-to-eat meals. This innovation can cater to diverse consumer needs, such as high-protein, gluten-free, or organic options. Educating consumers about the health benefits of wheat protein, such as its role in muscle building and weight management, can drive demand. Marketing campaigns focused on health and nutrition can help enhance consumer awareness.

Wheat Protein Market Segment Overview

By Product Type

By Basis Of Form

Based on Basis of Form, the market segment has been divided into Dry and Liquid. The dry segment dominant the market. Dry wheat protein aligns with consumer preferences for clean label and natural ingredients. Many dry wheat protein products are minimally processed and free from additives, appealing to health-conscious consumers seeking wholesome and transparent food options. Dry wheat protein is easier to handle and process during manufacturing compared to liquid forms. Its powdered or granular form allows for precise measurement and uniform dispersion within formulations, contributing to consistent product quality and texture.

By Application

Based on Application, the market segment has been divided into Bakery & Snacks, Pet food, Processed meat and Others. The bakery & confectionery segment dominant the market. This dominance in the wheat protein market is due to the widespread use of plant protein ingredients in these product categories. Wheat protein, particularly wheat gluten, serves as a vital component in bakery formulations, contributing to dough elasticity, structure, and volume in bread, cakes, pastries, and other baked goods.

Global Wheat Protein Market Regional Analysis

Based on region, the global Wheat Protein Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Wheat Protein Market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Wheat Protein Market. North America, particularly the United States and Canada, is a significant market for wheat protein, driven by high consumption of plant-based foods and health supplements and Wheat protein is extensively used in baked goods, snacks, and sports nutrition products. North America holds the largest market share due to well-established food processing industries, a growing vegetarian population, and high consumer awareness of health and nutrition.

Global Wheat Protein Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Wheat Protein Market industry. The Asia-Pacific region is witnessing rapid growth in the wheat protein market due to urbanization, changing dietary preferences, and rising disposable incomes. The increasing popularity of Western diets and the growing awareness of health and fitness are contributing to the demand for wheat protein and countries like China and India present significant opportunities for market expansion, driven by a growing middle class and demand for high-protein foods.

Competitive Landscape

The global Wheat Protein Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Archer-Daniels-Midland Company

- Cargill Incorporated

- Roquette Frères Le Romain

- Kerry Group

- Tate & Lyle PLC

- Beneo GmbH (Part of Südzucker AG)

- Glico Nutrition Co., Ltd.

- Crespel & Deiters GmbH & Co. KG

- AGRANA Beteiligungs-AG

- Tereos

Key Development

In November 2023, Amber Wave, a leading U.S. supplier of premium wheat protein, proudly unveiled its latest milestone—the inauguration of North America’s largest wheat protein ingredients facility. This achievement follows substantial investment from Summit Agricultural Group, an esteemed agribusiness operator and investment manager.

In September 2023, British alternative meat brand Squeaky Bean made another step into diversification with the introduction of its latest offerings, the Teriyaki Duck Protein Pot and the Beef Ragu Protein Pot. These ready-to-eat meals cater to varied tastes and preferences, showcasing the brand’s commitment to providing innovative plant-based options.

Scope of the Report

Global Wheat Protein Market, by Product Type

- Wheat gluten

- Wheat protein isolate

- textured wheat protein

- Others

Global Wheat Protein Market, by Basis of Form

- Dry

- Liquid

Global Wheat Protein Market, by Application

- Bakery & Snacks

- Pet food

- Processed meat

- Others

Global Wheat Protein Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $4.82 Billion |

| CAGR | 5.12% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Basis of Form, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Archer-Daniels-Midland Company, Cargill Incorporated, Roquette Freres Le Romain, Kerry Group, Tate & Lyle PLC, Beneo GmbH (Part of Südzucker AG), Glico Nutrition Co. Ltd., Crespel & Deiters GmbH & Co. KG, AGRANA Beteiligungs-AG and Tereos |

| Key Market Opportunities | • Innovation in Product Development • Increased Awareness of Health Benefits |

| Key Market Drivers | • Increasing Demand for Plant-Based Proteins • Consumer Preferences for Clean Label Products |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Wheat Protein Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Wheat Protein Market historical market size for the year 2021, and forecast from 2023 to 2033

- Wheat Protein Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Wheat Protein Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Wheat Protein Market?

The global Wheat Protein Market is growing at a CAGR of 5.12% over the next 10 years

Which region has the highest growth rate in the market of Wheat Protein Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Wheat Protein Market?

North America holds the largest share in 2022

Who are the key players in the global Wheat Protein Market?

Archer-Daniels-Midland Company, Cargill Incorporated, Roquette Frères Le Romain, Kerry Group, Tate & Lyle PLC, Beneo GmbH (Part of Südzucker AG), Glico Nutrition Co., Ltd., Crespel & Deiters GmbH & Co. KG, AGRANA Beteiligungs-AG and Tereos. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives