Price range: $ 1,390.00 through $ 5,520.00

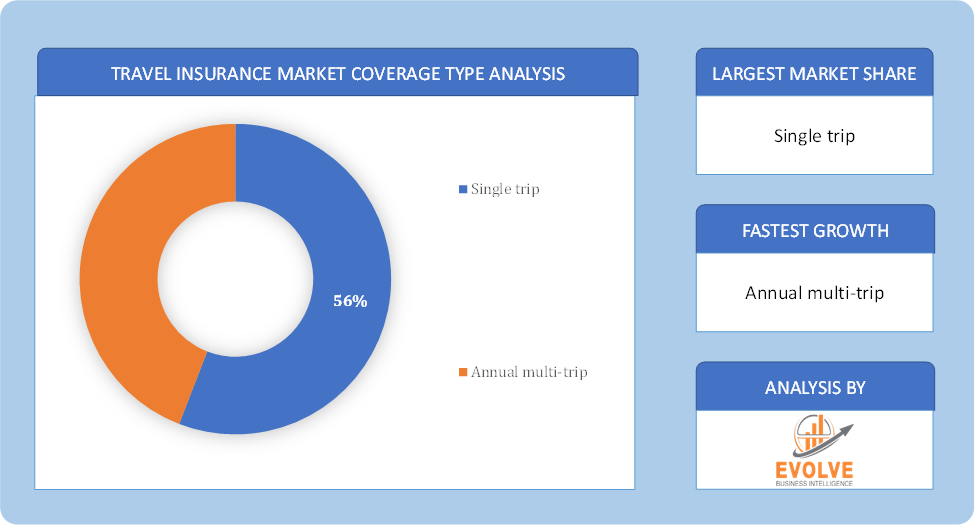

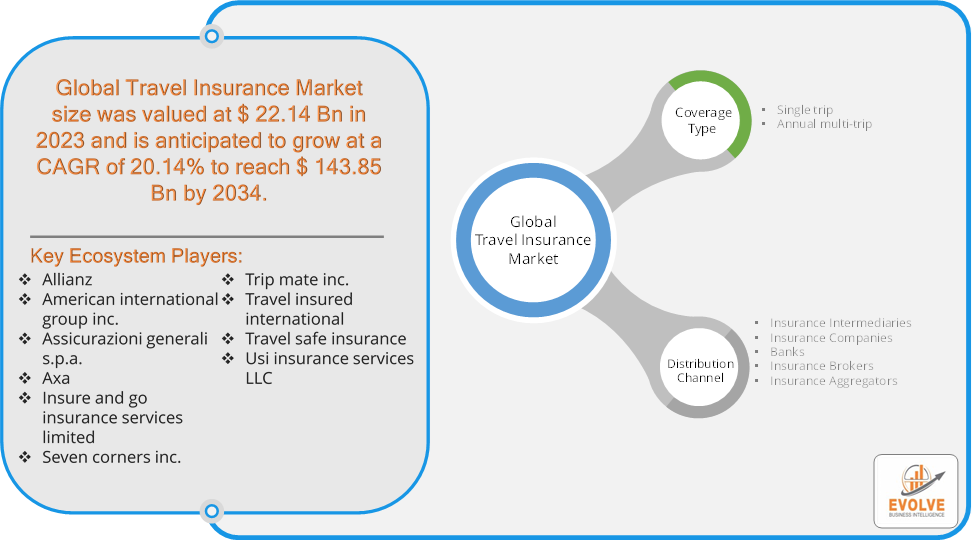

Travel Insurance Market Research Report: Information By Coverage Type (Single trip, Annual multi-trip), By Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), and by Region — Forecast till 2034

Page: 170

Description

Travel Insurance Market Overview

The Travel Insurance Market size accounted for USD 22.14 Billion in 2023 and is estimated to account for 23.68 Billion in 2024. The Market is expected to reach USD 143.85 Billion by 2034 growing at a compound annual growth rate (CAGR) of 20.14% from 2024 to 2034. The Travel Insurance Market refers to the industry that provides insurance policies to travelers to cover a range of potential risks and unforeseen events during domestic or international trips. These insurance plans typically offer protection against trip cancellations, medical emergencies, lost luggage, flight delays, accidents, and other travel-related disruptions.

The market is driven by factors such as the rising popularity of travel (for both leisure and business), an increase in the frequency of travel-related risks, and growing awareness of the need for travel protection. The travel insurance market plays a crucial role in protecting travelers and ensuring their peace of mind while on the road.

Global Travel Insurance Market Synopsis

Travel Insurance Market Dynamics

Travel Insurance Market Dynamics

The major factors that have impacted the growth of Travel Insurance Market are as follows:

Drivers:

Ø Rising Travel and Tourism Industry

Increasing global tourism, both for leisure and business, boosts the need for travel insurance. As more people travel domestically and internationally, the demand for protection against travel-related risks grows. Travelers are becoming more aware of potential risks such as flight cancellations, medical emergencies, lost baggage, and natural disasters. This awareness leads to a higher adoption rate of travel insurance to mitigate these risks.

Restraint:

- Perception of High Insurance Premiums and Increased Competition

Travel insurance can be costly, particularly for extended trips, older travelers, or those engaging in high-risk activities. High premiums can discourage travelers, especially budget-conscious individuals, from purchasing coverage. Intense competition among insurance providers can lead to price wars, impacting profitability. Smaller players may struggle to compete with larger, well-established companies offering more comprehensive packages at competitive rates. While pandemics like COVID-19 have driven awareness of travel risks, they have also introduced new challenges, such as insurers’ reluctance to cover pandemic-related cancellations or medical expenses. The unpredictability of global health crises can disrupt travel insurance coverage options.

Opportunity:

⮚ Growing demand for Customized Insurance Products

There is a rising demand for personalized travel insurance products that cater to specific needs and preferences. Insurers can create tailored policies for different traveler demographics, such as families, adventure seekers, seniors, or business travelers. The use of technology, such as mobile applications and AI-driven platforms, can enhance customer experience. Innovations like instant policy issuance, digital claims processing, and real-time assistance can attract tech-savvy travelers. The growing trend of wellness and health-focused travel creates opportunities for specialized insurance products. Coverage options that include wellness activities, telemedicine services, and health screenings can appeal to this market segment.

Travel Insurance Market Segment Overview

Based on Coverage Type, the market is segmented based on Single trip and Annual multi-trip. The Annual multi-trip segment dominant the market. Annual multi-trip insurance offers a cost-effective solution for frequent travelers who take multiple trips throughout the year. Instead of purchasing separate policies for each trip, travelers can save money with a single annual policy. This type of insurance allows travelers to purchase insurance once a year and eliminates the need to arrange coverage for each individual trip.

By Distribution Channel

Based on Distribution Channel, the market segment has been divided into Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators. The Insurance Intermediaries segment dominant the market. Insurance intermediaries such as travel agents and brokers provide personalized advice and recommendations based on the specific needs and preferences of travelers. They help individuals navigate the complexities of different travel insurance policies, ensuring they choose the most suitable coverage. Intermediaries often have extensive networks and partnerships with multiple insurance providers, giving them access to a wide range of products and options.

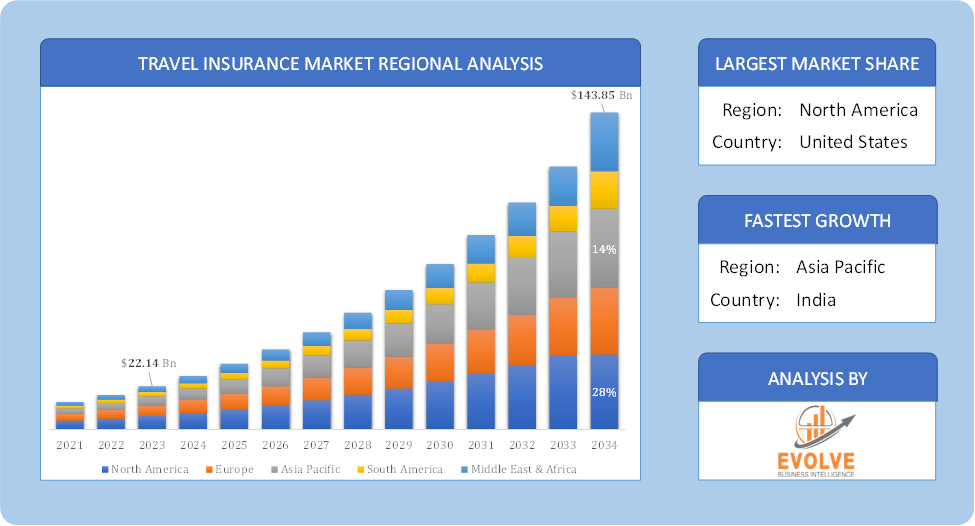

Global Travel Insurance Market Regional Analysis

Based on region, the global Travel Insurance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Travel Insurance Market followed by the Asia-Pacific and Europe regions.

Global Travel Insurance North America Market

Global Travel Insurance North America Market

North America holds a dominant position in the Travel Insurance Market. The North American market, particularly the United States and Canada, is one of the largest and most mature travel insurance markets globally. High travel frequency, awareness of travel risks, and increasing medical costs abroad drive demand and there is a growing trend towards comprehensive policies that include trip interruption, health coverage, and cancellation protection.

Global Travel Insurance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Travel Insurance Market industry. The Asia-Pacific region is witnessing rapid growth, driven by a rising middle class and increasing outbound tourism. Countries like China and India are seeing significant increases in travel, creating opportunities for insurance providers and there is a growing demand for customized insurance products and digital solutions to cater to tech-savvy travelers.

Competitive Landscape

The global Travel Insurance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Allianz

- American international group inc.

- Assicurazioni generali s.p.a.

- Axa

- Insure and go insurance services limited

- Seven corners inc.

- Trip mate inc.

- Travel insured international

- Travel safe insurance

- Usi insurance services LLC.

Scope of the Report

Global Travel Insurance Market, by Coverage Type

- Single trip

- Annual multi-trip

Global Travel Insurance Market, by Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators.

Global Travel Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 143.85 Billion |

| CAGR (2024-2034) | 20.14% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Coverage Type, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | ALLIANZ, AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., AXA, Insure and Go Insurance Services Limited, Seven Corners Inc., Trip Mate Inc., Travel Insured International, Travel Safe Insurance and USI INSURANCE SERVICES LLC. |

| Key Market Opportunities | · The growing demand for Customized Insurance Products

· Focus on Wellness Travel |

| Key Market Drivers | · Rising Travel and Tourism Industry

· Digitalization and Easy Access to Insurance |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Travel Insurance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Travel Insurance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Travel Insurance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Travel Insurance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Travel Insurance Market?

The global Travel Insurance Market is growing at a CAGR of 20.14% over the next 10 years

Which region has the highest growth rate in the market of Travel Insurance Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Travel Insurance Market?

North America holds the largest share in 2022

Who are the key players in the global Travel Insurance Market?

ALLIANZ, AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., AXA, Insure and Go Insurance Services Limited, Seven Corners Inc., Trip Mate Inc., Travel Insured International, Travel Safe Insurance and USI INSURANCE SERVICES LLC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Contents

[html_block id="9127"]

Connect to Analyst

[html_block id="6813"]