Global Surface and Underground Mining In EV market Overview

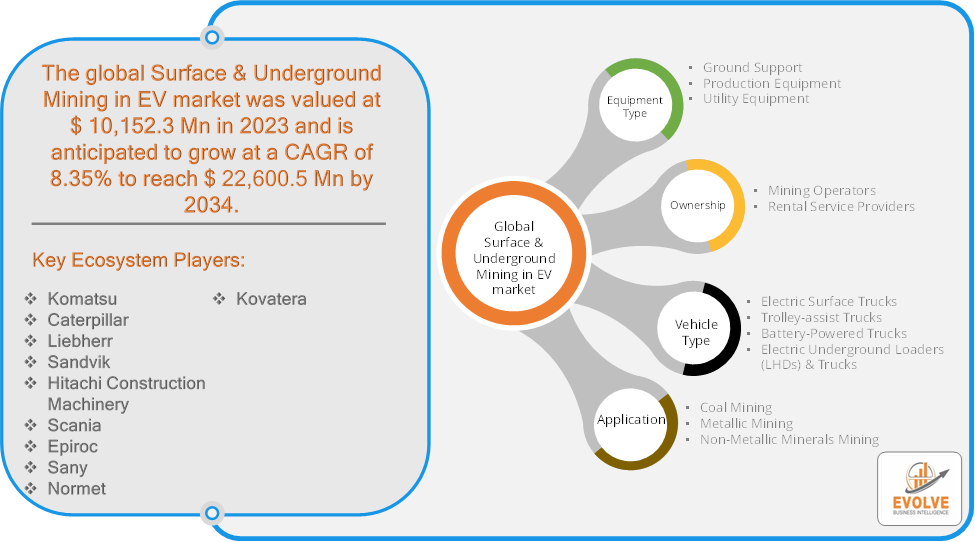

The Global Surface and Underground Mining In EV market Size is expected to reach USD 22600.5 Million by 2033. The Global Surface and Underground Mining In EV market Application size accounted for USD 397.3 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.34% from 2023 to 2033. The global Surface & Underground Mining Market in relation to Electric Vehicles (EVs) refers to the sector focused on extracting raw materials essential for the production of electric vehicles. This includes mining operations both on the surface (surface mining) and below ground (underground mining). The materials typically targeted include lithium, cobalt, nickel, and rare earth elements, all of which are critical for manufacturing EV batteries and other components.

As the demand for EVs increases globally, the mining industry is adapting to supply these necessary materials, often leading to innovations in mining practices and increased focus on sustainable and ethical extraction methods.

Global Surface and Underground Mining In EV market Synopsis

The COVID-19 pandemic had a significant impact on the global Surface & Underground Mining Market. The pandemic caused widespread disruptions in global supply chains, impacting the extraction, processing, and transportation of key raw materials like lithium, cobalt, and nickel. Lockdowns and restrictions in major mining regions delayed mining activities and reduced output, leading to shortages and increased prices for these critical materials. The pandemic caused delays in the development of new mining projects and the expansion of existing ones. Investments in new mining infrastructure were postponed, affecting the future supply of materials necessary for EV production. Initially, there was a decline in the demand for EVs as the global economy slowed down and consumer spending decreased. This, in turn, reduced the immediate demand for mined materials. However, as economies began to recover, the demand for EVs surged, leading to a renewed focus on securing a stable supply of critical minerals. The pandemic highlighted the vulnerabilities in global supply chains, leading to a stronger emphasis on sustainable and localized mining practices. There has been growing pressure on mining companies to ensure ethical sourcing and reduce environmental impacts, aligning with the broader sustainability goals of the EV industry.

Global Surface and Underground Mining In EV market Dynamics

The major factors that have impacted the growth of Global Surface and Underground Mining In EV market are as follows:

Drivers:

Ø Technological Advancements

Advances in battery technology, such as the development of lithium-ion and solid-state batteries, are increasing the need for high-purity raw materials. These advancements are driving the mining industry to enhance extraction techniques to meet the growing demand for these materials. Automakers are significantly expanding their EV production capabilities, often requiring large volumes of raw materials. This expansion is driving investments in both existing and new mining projects to secure a steady supply of necessary materials.

Restraint:

- Perception of Battery life and range limitations

In mining operations, equipment is often required to operate for long shifts, sometimes up to 24 hours a day. Current battery technology may not support such extended use without frequent recharging or battery swaps, limiting the effectiveness of electric mining equipment in continuous operations. The range of electric mining trucks and equipment is limited by the capacity of their batteries. In surface and underground mining, where equipment often needs to travel long distances within the mine, limited range can hinder the effectiveness of electric vehicles compared to traditional diesel-powered counterparts.

Opportunity:

⮚ Focus on battery recycling

Recycling can be more cost-effective than mining for new materials, especially as the costs of raw materials rise. Efficient recycling processes can reduce the costs associated with sourcing and processing new minerals. Standardized battery designs allow for greater interchangeability between different types of electric mining equipment and manufacturers. This simplifies maintenance and reduces inventory costs for spare parts. Standardization can lead to economies of scale as manufacturers produce batteries in larger quantities, reducing per-unit costs. This can make electric mining equipment more affordable.

Global Surface and Underground Mining In EV market Segment Overview

Based on Equipment Type, the market is segmented based on Ground Support, Production Equipment and Utility Equipment. The Utility Equipment segment dominant the market. Utility equipment in mining also includes power generation and distribution systems that provide electricity for mining operations. This can range from diesel generators to renewable energy sources like solar or wind power, which are increasingly being integrated into remote mining sites to reduce reliance on traditional fuel sources and Utility equipment includes vehicles and machinery designed to transport materials, personnel, and equipment across mining sites. This includes electric trucks, conveyor systems, and rail solutions adapted for both surface and underground environment

By Ownership

Based on Ownership, the market segment has been divided into Mining Operators and Rental Service Providers. The Mining Operators segment dominant the market. Mining operators are responsible for identifying and exploring new mineral deposits, particularly those rich in materials necessary for EV production. This involves geological surveys, drilling, and sampling to assess the viability of mining projects. With the growing demand for EVs, operators are increasingly focusing on regions with untapped or under-explored reserves, aiming to secure long-term supply contracts with battery and EV manufacturers.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into Electric Surface Trucks, Trolley-assist Trucks, Battery-Powered Trucks and Electric Underground Loaders (LHDs) & Trucks. The Electric Surface Trucks segment dominant the market. Electric surface trucks offer a substantial reduction in greenhouse gas emissions compared to their diesel counterparts. This aligns with the global push for sustainability and the mining industry’s efforts to reduce its carbon footprint and Electric surface trucks often provide superior torque and power delivery, which can result in better performance in demanding mining conditions. This includes improved hauling capabilities and the ability to operate more efficiently on steep grades and in rugged terrains.

By Application

Based on Application, the market segment has been divided into Coal Mining, Metallic Mining and Non-Metallic Minerals Mining. The coal mining application segment dominant the market. Mining equipment is predicted to develop significantly in coal mining applications. The rise is related to increased demand for power generation. As the extraction of coal has increased, so has the use of coal mining equipment. Therefore, it is anticipated that the coal mining category will continue to dominate the market during the projection period.

Global Surface and Underground Mining In EV market Regional Analysis

Based on region, the Global Surface and Underground Mining In EV market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Surface and Underground Mining In EV market followed by the Asia-Pacific and Europe regions.

North America holds a dominant position in the Global Surface and Underground Mining In EV market. North America is a key player in the global mining sector, particularly for materials like lithium, cobalt, and nickel. The U.S. and Canada have substantial reserves of these critical minerals, and there is a growing focus on securing domestic supply chains to reduce dependence on foreign sources. The region is also investing in sustainable mining practices and advanced technologies, supported by favorable government policies and incentives aimed at boosting EV production.

Global Surface and Underground Mining In EV Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Surface and Underground Mining In EV market Application. The Asia-Pacific region is a dominant force in the global mining market. China is a major producer and processor of rare earth elements and has significant influence over the global supply chain for EV materials. Australia is a leading producer of lithium and has extensive reserves of other critical minerals like nickel and cobalt. Indonesia is a key player in nickel production, which is vital for EV battery manufacturing.

Competitive Landscape

The Global Surface and Underground Mining In EV market is highly competitive, with numerous players Equipment Type a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Komatsu

- Caterpillar

- Liebherr

- Sandvik

- Hitachi Construction Machinery

- Scania

- Epiroc

- Sany

- Normet

- Kovatera

Key Development

In March 2023, In March 2023, The South Cotabato campaign against open-pit mining suffered a setback at the hands of the Court of Appeals (CA). Activists are unfazed and determined to oppose this mining technique because they believe it harms the environment.

Scope of the Report

Global Surface and Underground Mining In EV market, by Equipment Type

- Ground Support

- Production Equipment

- Utility Equipment

Global Surface and Underground Mining In EV market, by Ownership

- Mining Operators

- Rental Service Providers

Global Surface and Underground Mining In EV market, by Vehicle Type

- Electric Surface Trucks

- Trolley-assist Trucks

- Battery-Powered Trucks

- Electric Underground Loaders (LHDs) & Trucks

Global Surface and Underground Mining In EV market, by Application

- Coal Mining

- Metallic Mining

- Non-Metallic Minerals Mining

Global Surface and Underground Mining In EV market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 22600.5 Billion |

| CAGR (2023 – 2034) | 8.34% |

| Base year | 2022 |

| Forecast Period | 2023 – 2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Equipment Type, Ownership, Vehicle Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Komatsu, Caterpillar, Liebherr, Sandvik, Hitachi Construction Machinery, Scania, Epiroc, Sany, Normet and Kovatera. |

| Key Market Opportunities | · Focus on battery recycling

· Standardization of battery technology |

| Key Market Drivers | · Technological Advancements

· Rising mineral mining activity |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Surface and Underground Mining In EV market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Surface and Underground Mining In EV market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Surface and Underground Mining In EV market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global Surface and Underground Mining In EV market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product Equipment Type, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Global Surface and Underground Mining In EV market?

The Global Surface and Underground Mining In EV market is growing at a CAGR of 8.34% over the next 10 years

Which region has the highest growth rate in the market of Global Surface and Underground Mining In EV market?

Asia Pacific is expected to register the highest CAGR during 2023 – 2034

Which region has the largest share of the Global Surface and Underground Mining In EV market?

North America holds the largest share in 2023

Who are the key players in the Global Surface and Underground Mining In EV market?

Komatsu, Caterpillar, Liebherr, Sandvik, Hitachi Construction Machinery, Scania, Epiroc, Sany, Normet and Kovatera are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.