SME Insurance Market Overview

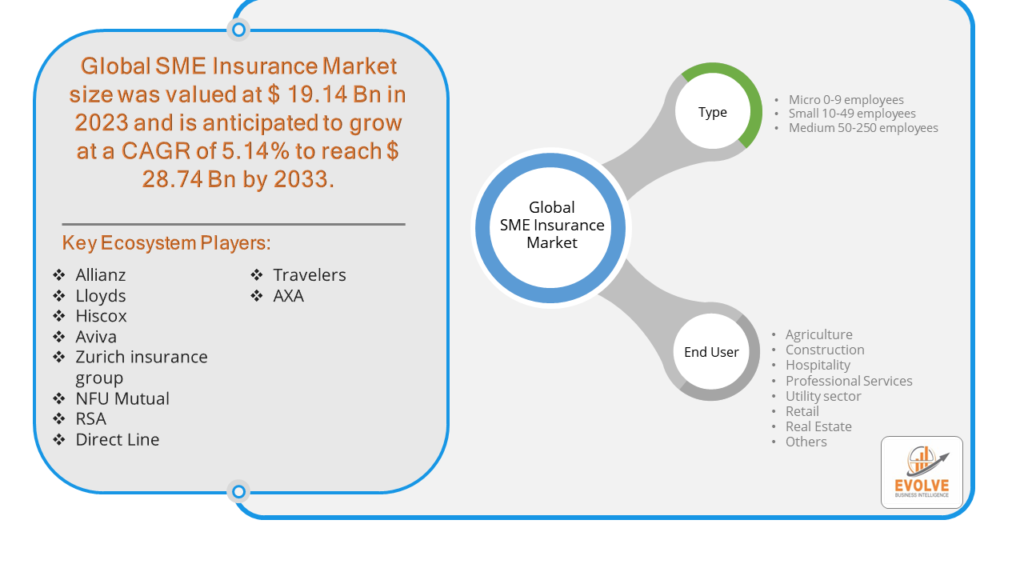

The SME Insurance Market Size is expected to reach USD 28.74 Billion by 2033. The SME Insurance Market industry size accounted for USD 19.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.14% from 2023 to 2033. The SME (Small and Medium-sized Enterprises) insurance market refers to the sector of the insurance industry that caters specifically to the needs of small and medium-sized businesses. These businesses typically have unique insurance requirements that differ from those of larger corporations, as they often operate on smaller scales with different risk profiles and financial capacities.

Insurance providers in the SME market tailor their products and services to meet the diverse needs of smaller businesses, offering flexible coverage options and often providing personalized assistance to help clients understand their risks and choose appropriate insurance solutions. As SMEs play a crucial role in the economy, the SME insurance market serves as a vital resource to support their growth and resilience by mitigating potential financial losses due to unforeseen events.

Global SME Insurance Market Synopsis

The COVID-19 pandemic had significant effects on the SME insurance market. Many SMEs faced business interruptions due to lockdowns, supply chain disruptions, and reduced consumer demand. This led to an increase in business interruption claims, putting financial pressure on insurance companies The economic downturn caused by the pandemic resulted in financial strains for many SMEs. Some struggled to afford insurance premiums, leading to potential lapses in coverage or cancellations. The nature of risks faced by SMEs changed during the pandemic. For example, businesses had to adapt to remote work environments, cybersecurity threats increased, and concerns about employee health and safety became more prominent. Insurers had to reassess risk profiles and adapt their coverage accordingly. The pandemic highlighted the importance of certain insurance coverages, such as business interruption insurance and cyber insurance. SMEs became more aware of their vulnerability to unforeseen events and sought out additional coverage to protect their businesses.

SME Insurance Market Dynamics

The major factors that have impacted the growth of SME Insurance Market are as follows:

Drivers:

Ø Technological Advancements

Technological innovations impact the insurance industry by enabling insurers to develop more sophisticated risk assessment models, streamline operations, and offer new digital solutions. These advancements make insurance products more accessible and tailored to the needs of SMEs. As SMEs become more aware of the risks they face, they seek insurance solutions to mitigate potential losses. Education initiatives and awareness campaigns about the importance of insurance coverage can drive demand among SMEs. Access to financing, including loans and credit facilities, often depends on SMEs having adequate insurance coverage. Lenders may require businesses to obtain insurance as a condition for providing financing, driving demand for insurance products in the SME market.

Restraint:

- Perception of Limited Awareness and Understanding

Some SME owners may lack awareness of the importance of insurance or may not fully understand the types of coverage they need. Limited access to information and resources about insurance options can hinder SMEs from making informed decisions about their risk management strategies. Insurance policies can be complex, with various terms, conditions, and exclusions. The complexity of insurance products may deter SMEs from purchasing coverage, especially if they find it difficult to navigate the intricacies of policy documents and understand the extent of their protection. Standard insurance products may not always meet the unique needs of SMEs, which often operate in diverse industries and face specific risks. Insufficient customization options can lead to mismatches between the coverage SMEs require and the coverage available, resulting in gaps in protection.

Opportunity:

⮚ Increased Awareness and Education

There is an opportunity to educate SME owners about the importance of insurance and the specific risks their businesses face. Investing in awareness campaigns and educational initiatives can help SMEs understand how insurance coverage can protect their assets, employees, and operations, driving increased demand for insurance products. Embracing digital technologies can enhance the accessibility, efficiency, and customer experience of insurance services for SMEs. Insurers can leverage digital platforms for policy issuance, claims processing, risk assessment, and customer support, making insurance more convenient and responsive to the needs of SMEs. As economies evolve and new SMEs emerge in developing regions, there is an opportunity for insurers to expand into underserved or untapped markets. Developing tailored insurance solutions that address the unique needs and challenges of SMEs in emerging markets can drive growth and profitability for insurers.

SME Insurance Market Segment Overview

By Type

By End User

Based on End User, the market segment has been divided into Agriculture, Construction, Hospitality, Professional Services, Utility sector, Retail, Real Estate and Others. Hospitality segment anticipated the market. Hospitality businesses typically have significant investments in property, including buildings, furnishings, equipment, and inventory. Property insurance is essential to protect against risks such as fire, theft, vandalism, and natural disasters.

Global SME Insurance Market Regional Analysis

Based on region, the global SME Insurance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the SME Insurance Market followed by the Asia-Pacific and Europe regions.

SME Insurance North America Market

North America holds a dominant position in the SME Insurance Market. In the United States and Canada, the SME insurance market is well-developed and highly competitive. Insurers offer a wide range of insurance products tailored to the needs of SMEs, including property, liability, workers’ compensation, and commercial auto insurance. The regulatory environment is relatively stable, with regulations varying by state or province. Insurers often leverage digital technologies to enhance customer experience and streamline operations.

SME Insurance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the SME Insurance Market industry. The SME insurance market in Asia-Pacific is diverse, with varying levels of insurance penetration and regulatory environments across countries. In emerging markets such as India, China, and Southeast Asia, insurance penetration among SMEs is lower, but there is significant growth potential driven by economic development and rising awareness of insurance. Insurers in the region are increasingly adopting digital distribution channels and innovative products to reach SMEs in underserved segments.

Competitive Landscape

The global SME Insurance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Allianz

- Lloyds

- Hiscox

- Aviva

- Zurich insurance group

- NFU Mutual

- RSA

- Direct Line

- Travelers

- AXA

Scope of the Report

Global SME Insurance Market, by Type

- Micro 0-9 employees

- Small 10-49 employees

- Medium 50-250 employees

Global SME Insurance Market, by End User

- Agriculture

- Construction

- Hospitality

- Professional Services

- Utility sector

- Retail

- Real Estate

- Others

Global SME Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $28.74 Billion |

| CAGR | 5.14% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Allianz, Lloyds, Hiscox, Aviva, Zurich insurance group, NFU Mutual, RSA, Direct Line, Travelers and AXA |

| Key Market Opportunities | • Increased Awareness and Education • Digital Transformation |

| Key Market Drivers | • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future SME Insurance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- SME Insurance Market historical market size for the year 2021, and forecast from 2023 to 2033

- SME Insurance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global SME Insurance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the SME Insurance Market?

The SME Insurance Market is anticipated to grow at a compound annual growth rate (CAGR) of 5.14% from 2023 to 2033, indicating steady expansion in the insurance sector catering to small and medium-sized enterprises.

Which region has the highest growth rate in the SME Insurance Market?

Asia-Pacific emerges as the region with the highest growth rate in the SME Insurance Market, fueled by economic development, rising awareness of insurance, and increasing adoption of digital distribution channels.

Which region has the largest share of the SME Insurance Market?

North America holds the largest share in the SME Insurance Market, with well-developed insurance markets in the United States and Canada, offering a wide range of insurance products tailored to the needs of small and medium-sized enterprises.

Who are the key players in the SME Insurance Market?

Key players in the SME Insurance Market include Allianz, Lloyds, Hiscox, Aviva, Zurich Insurance Group, NFU Mutual, RSA, Direct Line, Travelers, and AXA, contributing to the competitive landscape with diverse insurance offerings and innovative strategies.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.