Global Pharmaceutical Packaging Market Overview

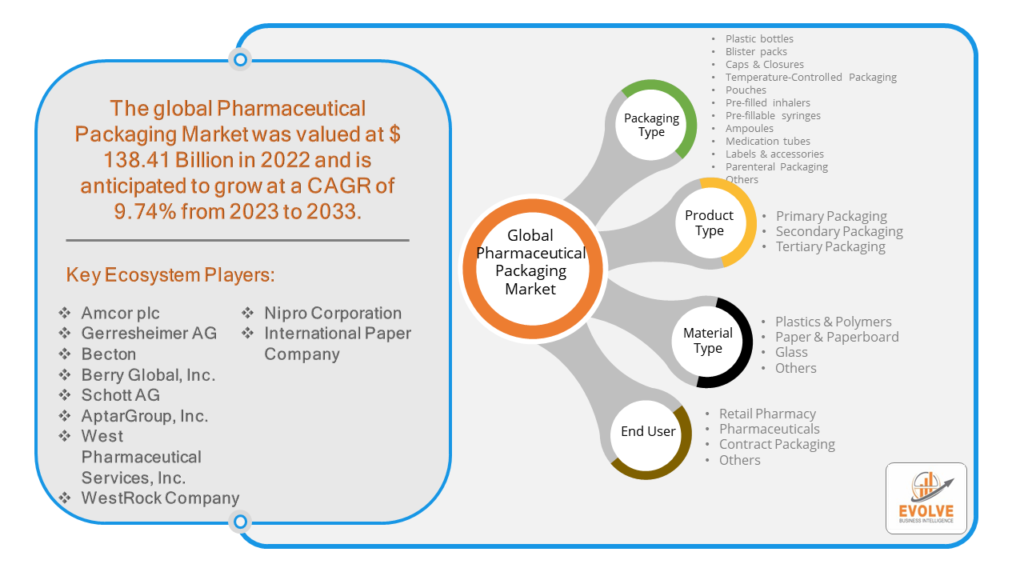

Global Pharmaceutical Packaging Market Size is expected to reach USD 174.35 Billion by 2033. The Global Pharmaceutical Packaging industry size accounted for USD 138.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.74% from 2023 to 2033. The pharmaceutical packaging market encompasses the design, production, and distribution of containers and materials used to protect and deliver pharmaceutical products. It includes various types of packaging such as bottles, blister packs, vials, and pouches, designed to maintain product integrity, safety, and efficacy throughout storage and transportation. Key factors driving this market include stringent regulatory requirements, the need for tamper-evident packaging, and the rise in demand for innovative and eco-friendly packaging solutions. The market is also influenced by advancements in technology, such as smart packaging and track-and-trace systems, to ensure product security and authenticity. With increasing pharmaceutical production and a growing focus on patient safety, the demand for specialized and customizable packaging solutions continues to expand, driving growth in the pharmaceutical packaging market.

Global Pharmaceutical Packaging Market Synopsis

The Pharmaceutical Packaging market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic has significantly impacted the pharmaceutical packaging market, with increased demand for packaging materials due to surging vaccine production and distribution efforts worldwide. Stringent hygiene and safety measures have propelled the adoption of single-dose packaging formats and tamper-evident seals. Additionally, supply chain disruptions and logistic challenges have underscored the importance of resilient and agile packaging solutions to ensure uninterrupted delivery of essential medicines and vaccines.

Global Pharmaceutical Packaging Market Dynamics

The major factors that have impacted the growth of Global Pharmaceutical Packaging are as follows:

Drivers:

⮚ Innovations in Materials and Technologies

Advances in packaging materials, such as polymers, films, and coatings, contribute to enhanced product stability, shelf life, and sustainability. Technologies like smart packaging, RFID (Radio Frequency Identification), and QR (Quick Response) codes enable tracking, authentication, and real-time monitoring of pharmaceutical products.

Restraint:

- Technological Complexity

Integrating advanced technologies, such as smart packaging features and track-and-trace systems, into pharmaceutical packaging requires substantial investments in infrastructure, software, and workforce training. Implementation challenges and interoperability issues may slow down adoption.

Opportunity:

⮚ E-commerce Packaging Solutions

The expansion of e-commerce channels for pharmaceutical sales creates demand for packaging solutions optimized for online retail distribution. Packaging designs that ensure product integrity during shipping, enhance user experience with easy-open features, and comply with regulatory requirements for online sales offer significant growth opportunities.

Global Pharmaceutical Packaging Market Segment Overview

By Packaging Type

Based on the Packaging Type, the market is segmented based on Plastic bottles, Blister packs, Caps & Closures, Temperature-Controlled Packaging, Pouches, Pre-filled inhalers, Pre-fillable syringes, Ampoules, Medication tubes, Labels & accessories, Parenteral Packaging and Others. Among these, the bottles category is the most significant product type. The lightweight, affordable, and easily moldable nature of this product is responsible for the segment’s rise. It is also preferred to package tablets, capsules, syrups, nose drops, eye drops, and other solid and liquid pharmaceuticals in plastic bottles.

By Product Type

Based on Product Type, the market has been divided into Primary Packaging, Secondary Packaging, and Tertiary Packaging. Primary packaging dominates the pharmaceutical packaging market as it directly encloses the pharmaceutical product, ensuring its integrity, safety, and stability. Primary packaging includes containers such as vials, bottles, blister packs, and ampoules, which come into direct contact with the medication, playing a critical role in preserving its efficacy and extending shelf life.

By Material Type

Based on the Material Type, the market has been divided into Plastics & Polymers, Paper & Paperboard, Glass, and Others. Plastics & Polymers dominate the pharmaceutical packaging market due to their versatility, lightweight nature, and compatibility with various drug formulations. They offer excellent barrier properties, ensuring product protection against moisture, oxygen, and light, while also facilitating cost-effective production and customization.

By End-Use

Global Pharmaceutical Packaging Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Pharmaceutical Packaging, followed by those in Asia-Pacific and Europe.

The North American region holds a dominant position in the Pharmaceutical Packaging market. With a value share of the market in 2022, North America assumed the lead. Mexico, the United States, and Canada are among the countries in the region that have a large representation of leading pharmaceutical businesses. Owing to its substantial investments in drug discovery, sophisticated healthcare system, and high per capita income, the United States has the largest pharmaceutical market in the world.

Pharmaceutical Packaging Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Pharmaceutical Packaging industry. From 2023 to 2032, the pharmaceutical packaging market in Asia-Pacific is anticipated to develop at the fastest rate. China’s pharmaceutical packaging market is expanding significantly, creating a plethora of business opportunities. Businesses are finding it more and more important to investigate package concepts that meet evolving demands in the pharmaceutical packaging sector. For a number of years, the pharmaceutical packaging industry in India has experienced substantial growth. Because of discoveries and innovative treatments, this sector of the pharmaceutical industry has room to grow.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Amcor plc, Gerresheimer AG, Becton, Berry Global, Inc., and Schott AG are some of the leading players in the global Pharmaceutical Packaging Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Amcor plc

- Gerresheimer AG

- Becton

- Berry Global, Inc.

- Schott AG

- AptarGroup, Inc.

- West Pharmaceutical Services, Inc.

- WestRock Company

- Nipro Corporation

- International Paper Company

Key Development:

January 2023: Amcor disclosed its plans to purchase Shanghai-based MDK. With roughly USD 50 million in annual sales, MDK is a leader in medical device packaging and a top priority growth area for Amcor. Amcor’s existing robust healthcare portfolio in the Asia-Pacific region will be strengthened by the inclusion of MDK as it maintains its concentration on higher growth priority categories.

April 2022: Amcor added new, more environmentally friendly High Shield laminates to its assortment of pharmaceutical packaging. This low-carbon, recyclable, and moisture-resistant packaging solution supports end-use companies’ recycling goals.

Scope of the Report

Global Pharmaceutical Packaging Market, by Packaging Type

- Plastic bottles

- Blister packs

- Caps & Closures

- Temperature-Controlled Packaging

- Pouches

- Pre-filled inhalers

- Pre-fillable syringes

- Ampoules

- Medication tubes

- Labels & accessories

- Parenteral Packaging

Global Pharmaceutical Packaging Market, by Product Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Global Pharmaceutical Packaging Market, by Material Type

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Others

Global Pharmaceutical Packaging Market, by End-Use

- Retail Pharmacy

- Pharmaceuticals

- Contract Packaging

- Others

Global Pharmaceutical Packaging Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $174.35 Billion |

| CAGR | 9.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Packaging Type, Product Type, Material Type, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Amcor plc, Gerresheimer AG, Becton, Berry Global, Inc., Schott AG, AptarGroup, Inc., West Pharmaceutical Services, Inc., WestRock Company, Nipro Corporation, International Paper Company |

| Key Market Opportunities | Growing R&D activities |

| Key Market Drivers | Increase technological advancementsGrowing need for medicines |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Pharmaceutical Packaging Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Pharmaceutical Packaging market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Pharmaceutical Packaging market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Pharmaceutical Packaging Market.

Frequently Asked Questions (FAQ)

What is the growth rate of the Pharmaceutical Packaging Market?

The Pharmaceutical Packaging Market is expected to grow at a CAGR of 9.74% from 2023 to 2033.

Which region has the highest growth rate in the Pharmaceutical Packaging Market?

The Asia-Pacific region has the highest growth rate in the Pharmaceutical Packaging Market.

Which region has the largest share of the Pharmaceutical Packaging Market?

North America holds the largest share of the Pharmaceutical Packaging Market.

Who are the key players in the Pharmaceutical Packaging Market?

Key players in the Pharmaceutical Packaging Market include Amcor plc, Gerresheimer AG, and Berry Global, Inc.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.